简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Vantage Markets Review 2025 – Is Vantage Safe & Legit for Forex Trading?

Abstract:Read our 2025 Vantage Markets review covering regulation, safety, trading platforms, instruments, account types, fees, and user feedback. Find out if Vantage is safe for forex traders.

Vantage Markets is a multi-regulated broker offering forex (FX), commodities, indices, precious metals, ETFs, bonds, and share CFDs to traders worldwide. With support for MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, ProTrader, and its proprietary Vantage App, the broker combines flexibility with a broad market offering.

Founded to provide professional-grade trading tools to retail and institutional clients, Vantage operates under multiple licenses, including ASIC (Australia) and FCA (UK), along with offshore registrations in the Cayman Islands, Vanuatu, and general registration with South Africas FSCA.

Pros and Cons of Vantage Markets

Pros

- Regulated in Australia (ASIC) and the UK (FCA)

- Multiple trading platforms, including MT4, MT5, TradingView, and Vantage App

- Wide range of instruments covering forex, commodities, indices, metals, ETFs, bonds, and shares

- Copy Trading and Demo Trading available

- Competitive spreads starting from 0.0 pips on certain accounts

- Multi-lingual customer support and educational resources

Cons

- Offshore regulation in some jurisdictions (CIMA, VFSC) may offer weaker investor protection

- No services to residents of certain jurisdictions such as Canada, China, Singapore, the United States and to jurisdictions on the FATF and EU/UN sanctions lists

- Fees for specific funding methods and inactivity may apply

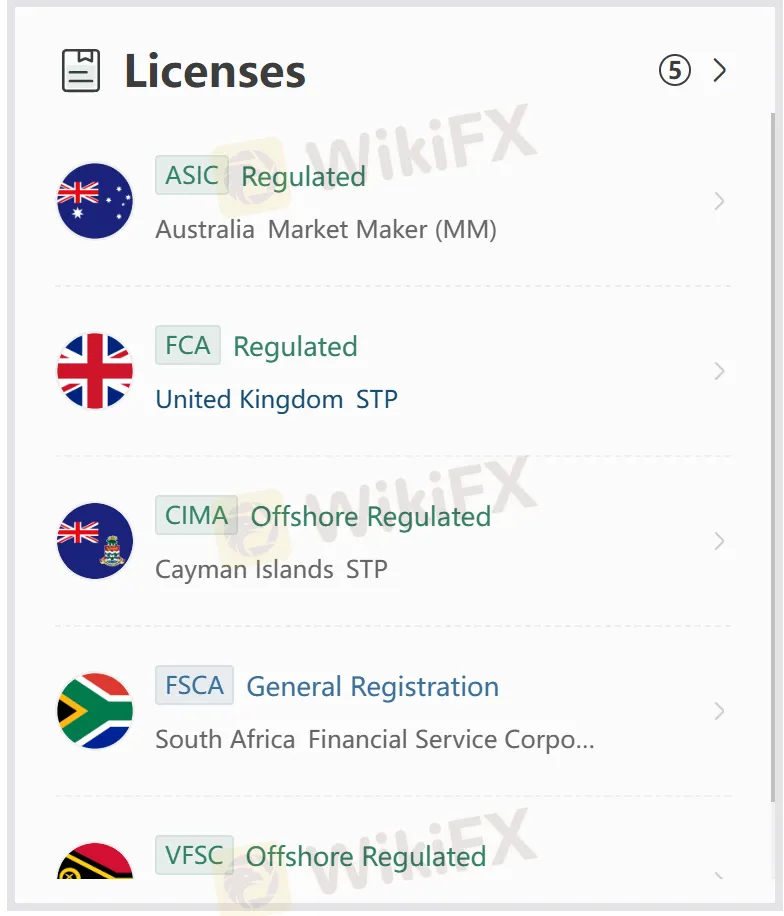

Regulation and Safety

Vantage Markets holds multiple licenses:

- Australia: ASIC – Vantage Global Prime Pty Ltd – Market Maker (MM) – License No. 428901 – Regulated

- United Kingdom: FCA – Vantage Global Prime LLP – STP – License No. 590299 – Regulated

- Cayman Islands: CIMA – Vantage International Group Limited – STP – License No. 1383491 – Offshore Regulated

- South Africa: FSCA – Vantage Markets (Pty) Ltd – General Registration – License No. 51268

- Vanuatu: VFSC – Vantage Global Limited – Retail Forex License – License No. 700271 – Offshore Regulated

Being regulated by ASIC and FCA gives Vantage credibility in major financial markets, though its offshore licenses require extra caution from traders concerned with investor protection standards.

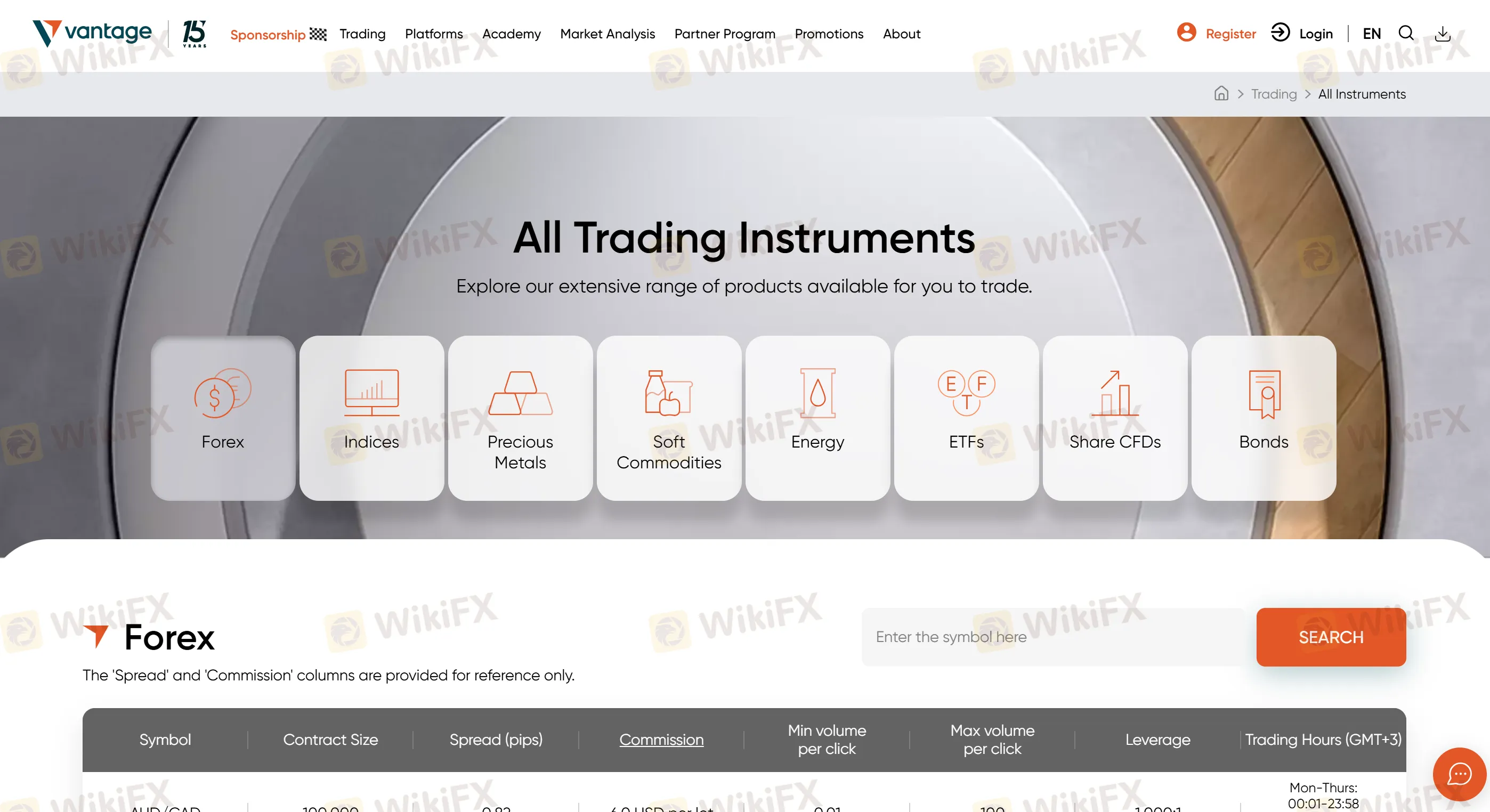

Trading Instruments

Vantage offers a full spectrum of tradable markets:

- Forex (FX) – Major, minor, and exotic currency pairs

- Indices – Global equity benchmarks

- Precious Metals – Gold, silver, and other metals

- Soft Commodities – Agricultural products

- Energy – Oil, natural gas

- ETFs – Exchange-traded funds

- Share CFDs – Global company stocks

- Bonds – Government and corporate debt instruments

Trading Platforms

Vantage supports a wide choice of platforms:

- Vantage App – Mobile trading with full account management

- MetaTrader 4 (MT4) – Industry-standard for forex traders

- MetaTrader 5 (MT5) – Multi-asset platform with advanced features

- TradingView – Browser-based professional charting

- ProTrader – Customisable, user-friendly charting tools

- Copy Trading – Social trading for beginners and pros

- Demo Trading – Risk-free practice environment

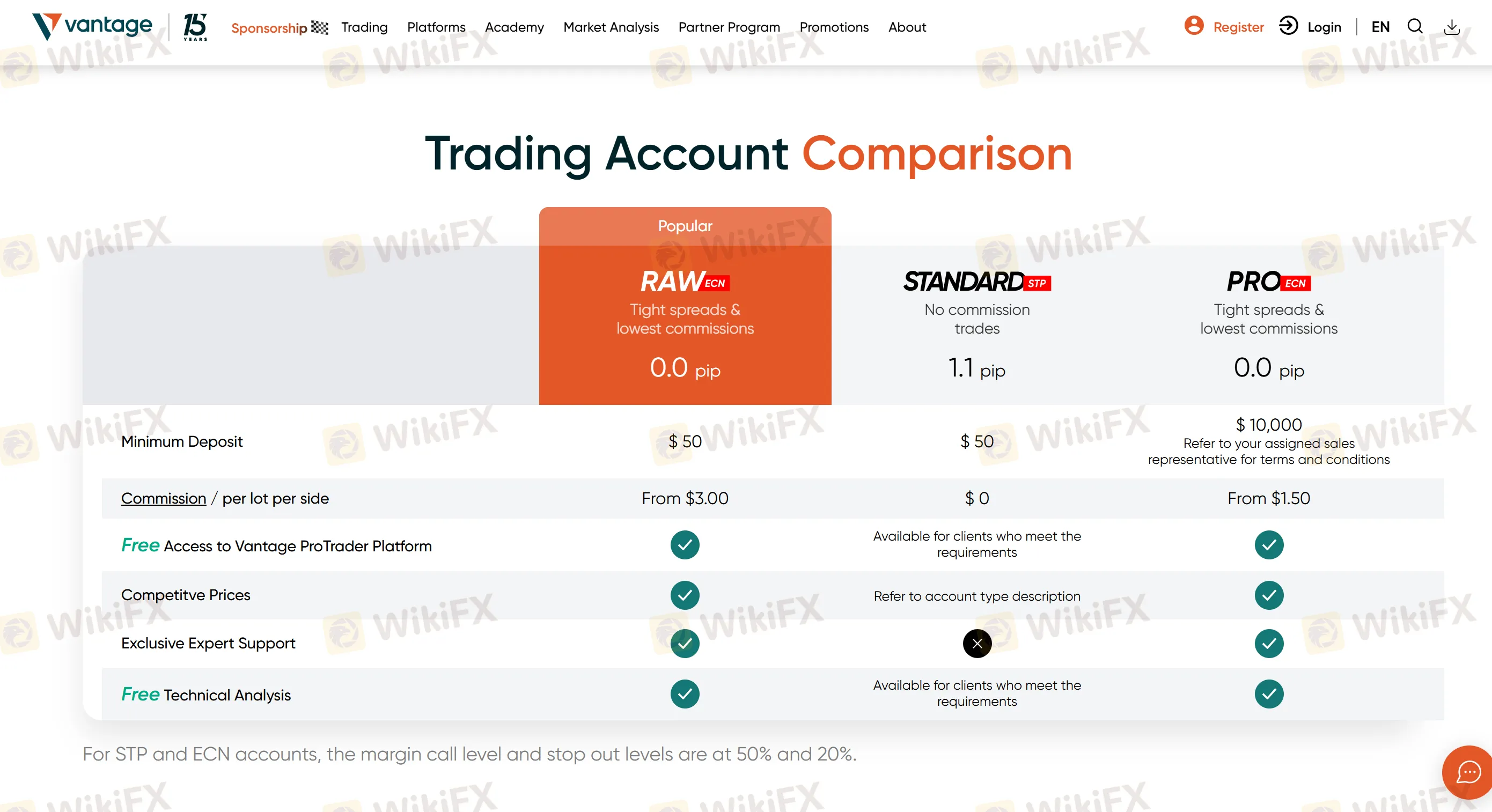

Account Types and Fees

Vantage provides multiple account options to suit different trading styles:

- Standard STP Account – Commission-free trading with spreads from 1.0 pips

- RAW ECN Account – Spreads from 0.0 pips with commissions

- Pro ECN Account – Designed for high-volume traders with lower commissions

Fees

- Spreads: From 0.0 pips (RAW ECN)

- Commissions: Applicable for ECN accounts

- Swap/Overnight fees: Charged on leveraged positions held overnight

- Possible fees for certain funding and withdrawal methods

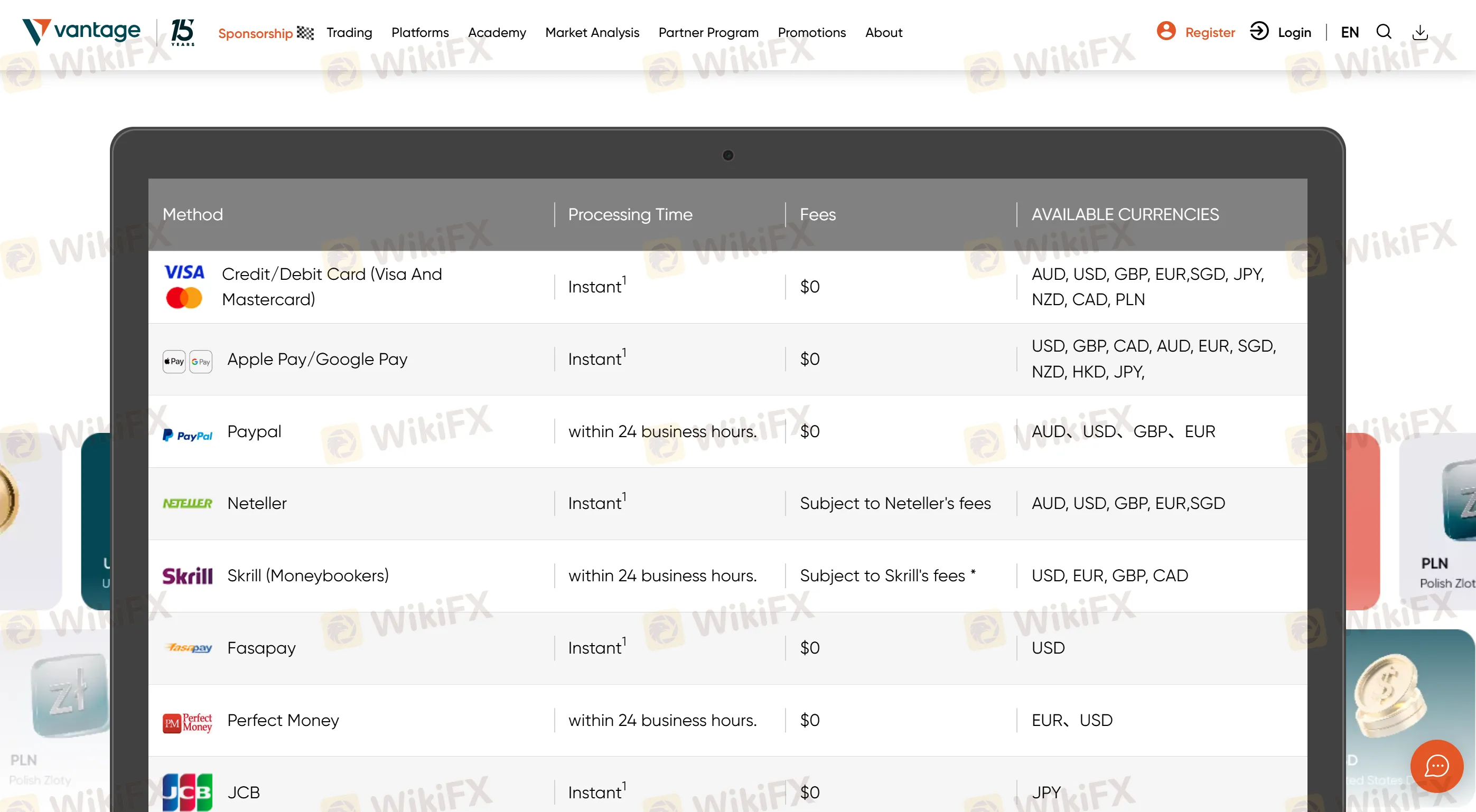

Deposit and Withdrawal

Vantage supports multiple funding methods, including:

- Bank wire transfer

- Credit/Debit cards

- E-wallets (Skrill, Neteller)

- Crypto payments (in supported regions)

Processing times vary depending on the method, with most deposits being instant and withdrawals processed within 1–3 business days. No deposit fees are generally charged, but third-party payment fees may apply.

User Reviews and Conclusion

Many traders praise Vantage for its fast execution, platform variety, and competitive pricing. The regulated status in Australia and the UK adds a layer of trust, although the offshore entities mean that protection levels differ by jurisdiction.

Overall, Vantage Markets stands out as a versatile broker for forex and CFD traders who value platform choice and access to global markets. Still, traders should match their chosen Vantage entity with the regulation they trust most.

Vantage Markets Review – FAQs

- Is Vantage Markets safe?

Yes, it is regulated by top-tier authorities (ASIC and FCA) but also operates offshore entities. Safety depends on which entity you register with.

- Does Vantage offer crypto trading?

Yes, cryptocurrency CFDs are available.

- What is the minimum deposit?

The minimum deposit varies by account type and region, starting from around $50.

- Can I use Copy Trading as a beginner?

Yes, the feature allows you to follow and copy professional traders.

- Are there any inactivity fees?

Yes, an inactivity fee may apply after prolonged account dormancy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Dollar Under Siege: Fiscal Gridlock and Foreign Divestment Weigh on Greenback

Commodities Brief: Gold Pierces $5,000 as 'Debasement Trade' Accelerates

Currency Calculator