Abstract:For Malaysian traders still using Bold Prime, here is what you need to know about this broker. Since 2023, the broker has been flagged by the Securities Commission Malaysia (SC) for engaging in unlicensed capital market activities. This disclosure signifies a serious regulatory gap and raises concerns about the safety of clients’ funds.

For Malaysian traders still using Bold Prime, here is what you need to know about this broker. Since 2023, the broker has been flagged by the Securities Commission Malaysia (SC) for engaging in unlicensed capital market activities. This disclosure signifies a serious regulatory gap and raises concerns about the safety of clients funds.

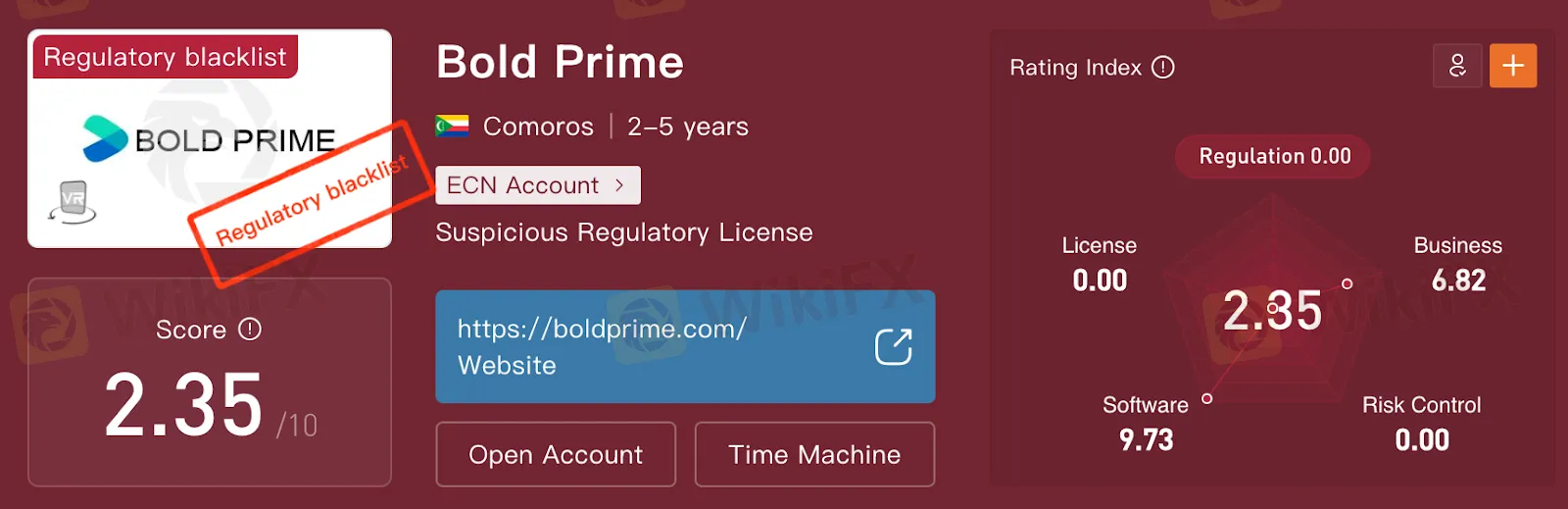

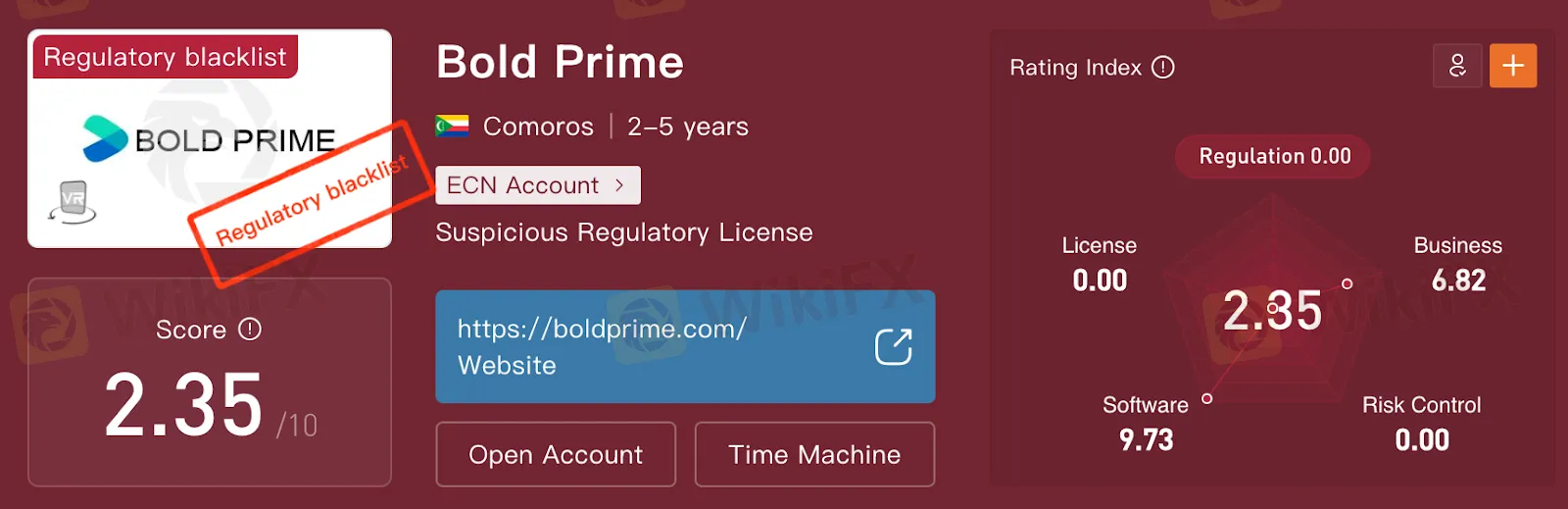

At first glance, Bold Prime presents itself as a professional and long-established global broker. Its polished website, wide selection of trading instruments, and claims of international regulatory oversight are designed to reassure. The firm has also showcased several industry awards, giving an appearance of legitimacy. Yet, a detailed review by WikiFX, the global broker verification platform, reveals that beneath the sleek marketing lies a worrying lack of genuine regulatory standing.

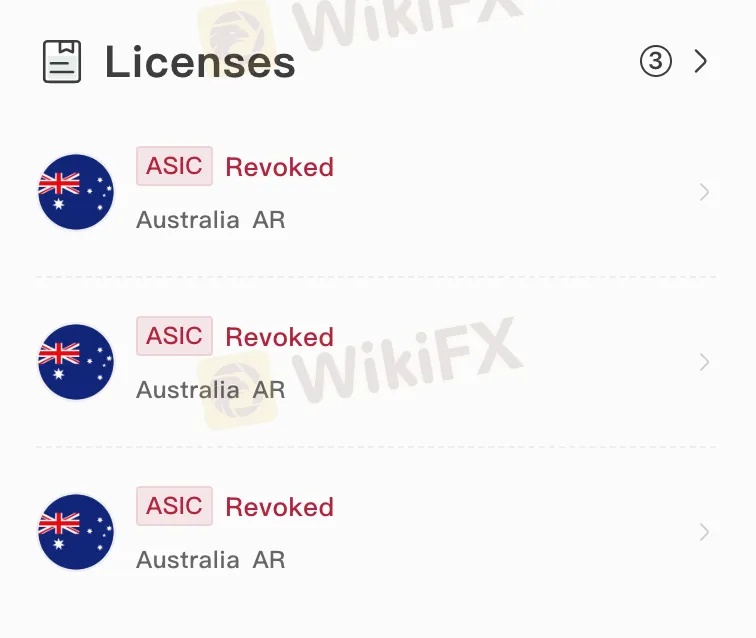

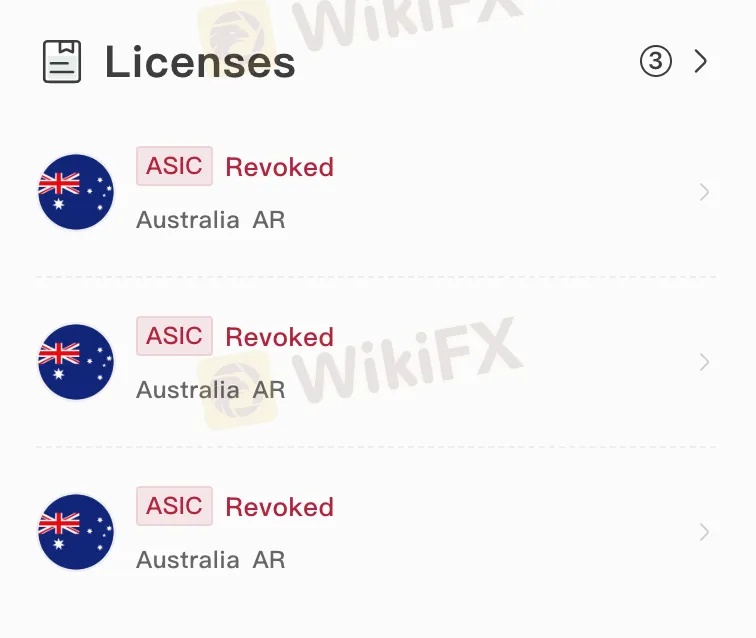

Revoked ASIC licences

Bold Prime has publicly claimed to be regulated in Australia under the Australian Securities and Investments Commission (ASIC). However, WikiFX‘s investigation found that the company’s cited licences tell a very different story. Three ASIC licence numbers (001305306, 001300520, and 001298510) are all listed as revoked. In regulatory terms, this means they are no longer valid, and any entity operating under these revoked numbers is unauthorised to provide financial services in Australia.

This revelation places Bold Prime in a troubling position: while it continues to project an image of being regulated, in reality, it holds no valid regulatory authorisation. For traders, this translates to a heightened risk of loss, as clients may have little to no recourse in the event of disputes or fund recovery issues.

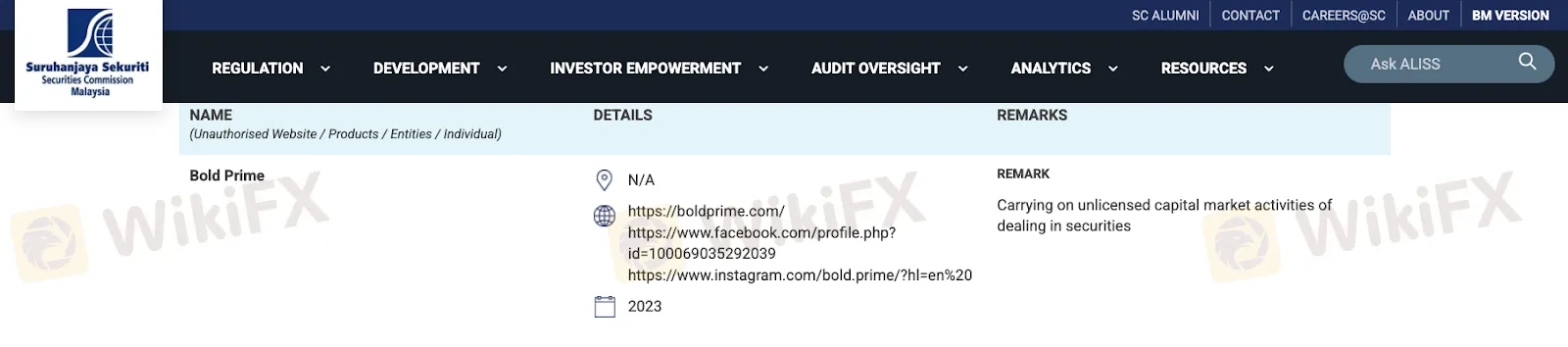

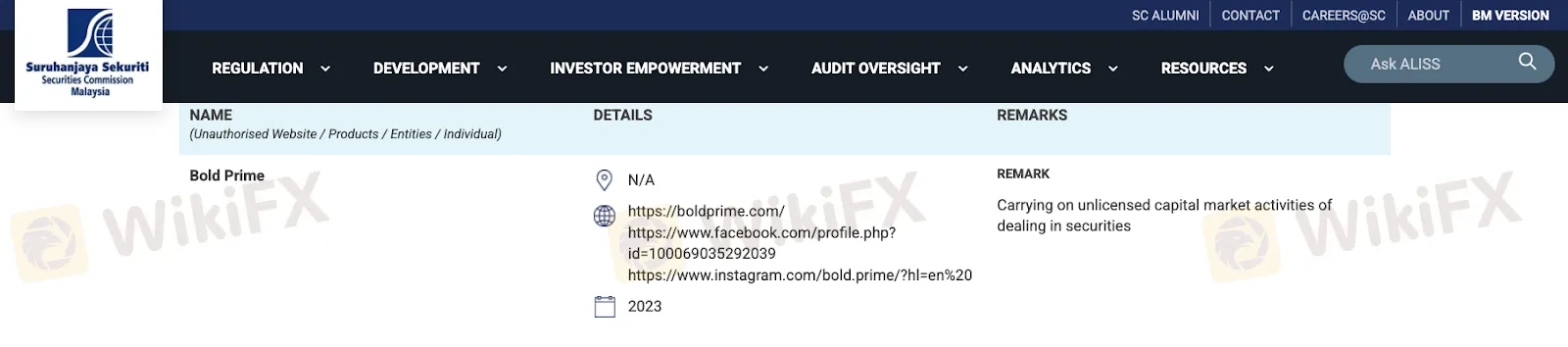

Malaysia‘s official warning

Perhaps most significantly for Malaysian traders, Bold Prime has been disclosed by the Securities Commission Malaysia. The SC’s Investor Alert List highlights firms that are operating without the necessary approvals under the Capital Markets and Services Act 2007. Malaysian investors dealing with unlicensed entities face significant risks: they are not protected under local investor protection frameworks and cannot rely on the SC to mediate disputes.

What Malaysian Traders Should Do Now

Malaysian clients who currently hold accounts with Bold Prime are strongly advised to review their exposure immediately. Where possible, withdrawals should be requested, and all transaction records and communications carefully documented in case future complaints must be filed.

Moving forward, traders should place funds only with brokers that are explicitly licensed by the SC or otherwise authorised to operate in Malaysia. Reliance on foreign licences, especially offshore or revoked ones, offers little security to Malaysian investors. It is also critical to be cautious of brokers who make “passporting” claims, suggesting that licences in one jurisdiction automatically allow them to operate elsewhere. This is not the case in Malaysia, where local authorisation is mandatory.

See WikiFXs full review on Bold Prime here: https://www.wikifx.com/en/dealer/1568170713.html

As an additional safeguard, traders can utilise tools such as the WikiFX mobile application, which provides independent ratings, regulatory checks, and user complaint tracking. By verifying the legitimacy of a broker before committing funds, investors can minimise their exposure to scams and better protect their savings.

The bottom line

Despite its professional façade, Bold Prime is not a licensed broker and has been flagged by the Securities Commission Malaysia. Its revoked Australian licences, absence of valid regulation, and mounting complaints make it a high-risk choice for Malaysian traders. Until proper authorisation is secured, investors are best advised to avoid Bold Prime and instead work only with firms that are demonstrably regulated by the SC or other reputable authorities.