Abstract:Recently, U.S. FX TV has been airing a hit drama—Alien: Earth—a prequel to the horror classic Alien, rivaling the cultural frenzy once sparked by Prison Break, Season 1.

In the film, deep inside a starship’s wreckage, leathery eggs pulse with a cold glow. When a human hand brushes the shell, a facehugger bursts out—eight fingers latch on, a tube pierces the throat, and an embryo slips down into the warm chest cavity. The host appears to recover, unaware that a fanged creature is gnawing at his heart from within.

In reality, a similar parasite stalks the forex world. Its name: MultiBank Group. With its golden “regulatory licenses” serving as camouflage eggs, it quietly deposits them into unsuspecting Chinese communities. Three years ago, it drained countless investors in China, then slithered into Malaysia—its new host—where it opened its sinister eyes.

Recently, U.S. FX TV has been airing a hit drama—Alien: Earth—a prequel to the horror classic Alien, rivaling the cultural frenzy once sparked by Prison Break, Season 1.

In the film, deep inside a starships wreckage, leathery eggs pulse with a cold glow. When a human hand brushes the shell, a facehugger bursts out—eight fingers latch on, a tube pierces the throat, and an embryo slips down into the warm chest cavity. The host appears to recover, unaware that a fanged creature is gnawing at his heart from within.

In reality, a similar parasite stalks the forex world. Its name: MultiBank Group. With its golden “regulatory licenses” serving as camouflage eggs, it quietly deposits them into unsuspecting Chinese communities. Three years ago, it drained countless investors in China, then slithered into Malaysia—its new host—where it opened its sinister eyes.

Fleeing China: The “Forex Colonization” of Southeast Asia

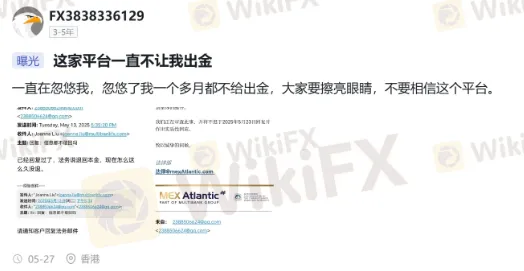

In early 2022, MultiBank abruptly exited China after leaving a trail of ruined investors. Client funds were frozen without explanation. No compensation, no official notice—just a cold abandonment: “Were gone. Pick up the pieces yourselves.”

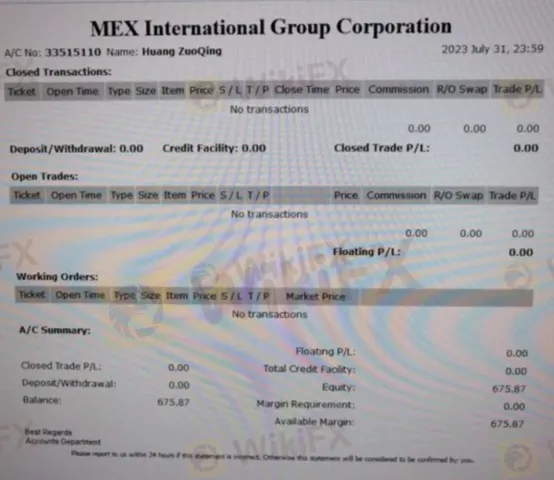

On the surface, Tahers shell companies in Beijing, Tianjin, and Shenzhen disappeared overnight. But in truth, MultiBank continued operations from Hong Kong and Southeast Asia under brands like Mex International Corp, Mex Atlantic Corp, and MEX Global Markets.

From 2022–2023, negative press about MultiBank flooded the Chinese internet. Business collapsed, forcing its leadership to retreat south. With China no longer safe, the vast Indochina peninsula became Naser Tahers new hunting ground.

Having perfected its techniques of “harvesting” Chinese investors, MultiBank quickly shifted its “war headquarters” to Malaysia and Singapore—home to the worlds second-largest Chinese diaspora. From there, its fraudulent reach extended into Indonesia, Thailand, Taiwan, Pakistan, the UAE, and anywhere Chinese investors could be found.

To verify the groups true operations, WikiFX investigators conducted on-site inspections across the region. Their findings in Malaysia (2022) and Singapore (2024) shocked the community.

· Kuala Lumpur, October 2022: At the “Third Oil Tower,” investigators located MultiBanks local headquarters. The office bore a Mex Atlantic Corp logo and advertising materials—but was eerily deserted, covered in dust, with no staff in sight.

· Singapore, April 2024: At 3 Church Street, Samsung Hub, Suite 13-03, investigators found MEX Global Financial Services LLC. Its office displayed the MEX Global Markets logo, with lights and traces of activity—but remained locked, inaccessible to outsiders.

Legitimate brokers usually welcome verification teams. In stark contrast, MultiBanks Malaysian and Singaporean offices were either empty or sealed—raising suspicions they were mere shells, remotely controlled from Dubai, just as in China.

The Fireworks of Fraud Across Southeast Asia

Time dulled China‘s memory of MultiBank’s devastation, but its DNA of deception remained unchanged.

From 2023–2025, complaints against MultiBank exploded again—this time from Hong Kong, Taiwan, Malaysia, Singapore, Thailand, Indonesia, and the Philippines.

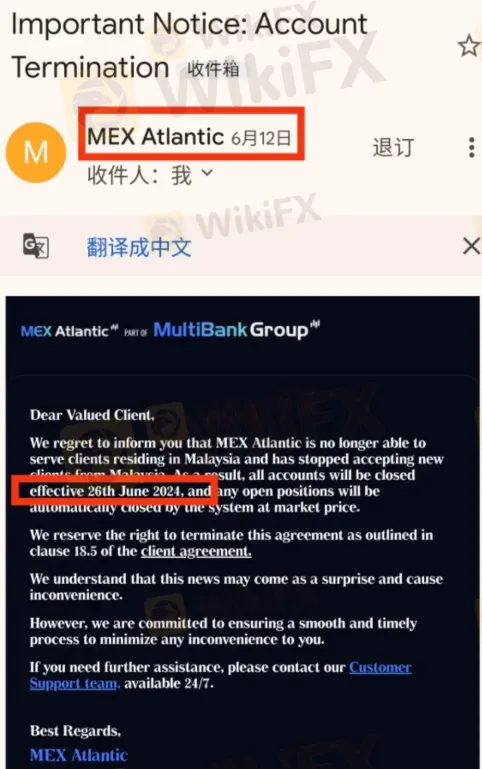

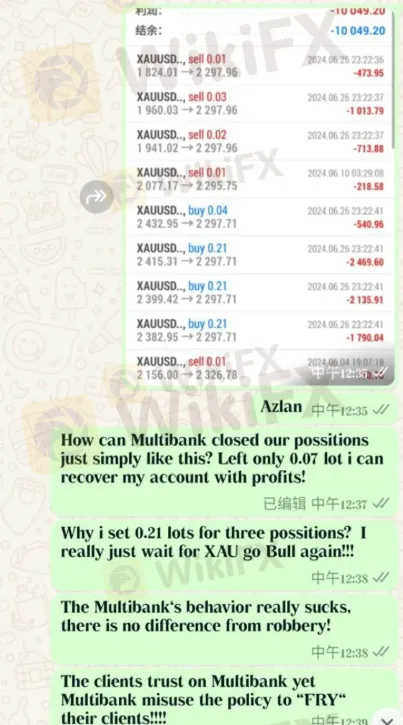

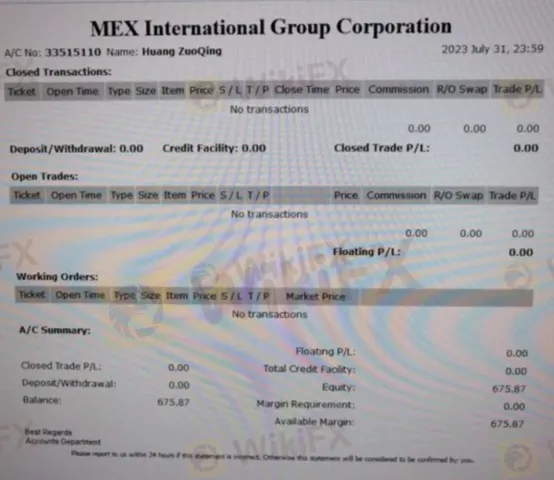

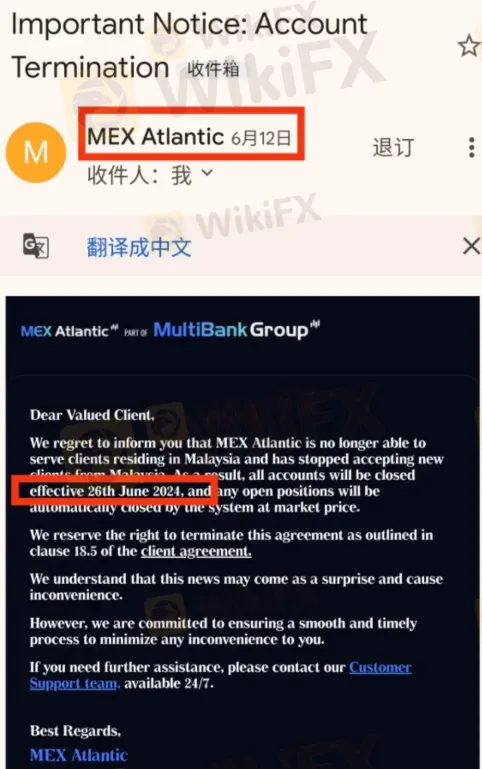

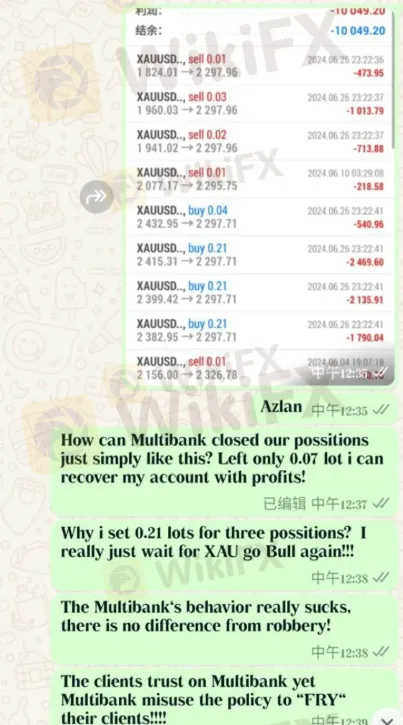

Malaysia (2024): Forced Account Closures

On July 6, 2024, a Malaysian investor named Ronald reported that MultiBank forcibly closed his $150,000 account, claiming it was “exiting the Malaysian market.” Customers were given 14 days to close positions. Ronald updated his KYC address to Singapore as instructed, yet his account was liquidated anyway. He lost $75,000; his friend lost $80,000.

Victims denounced the move as a pretext to confiscate funds—far worse than other brokers, who at least offered six months notice when leaving a market.

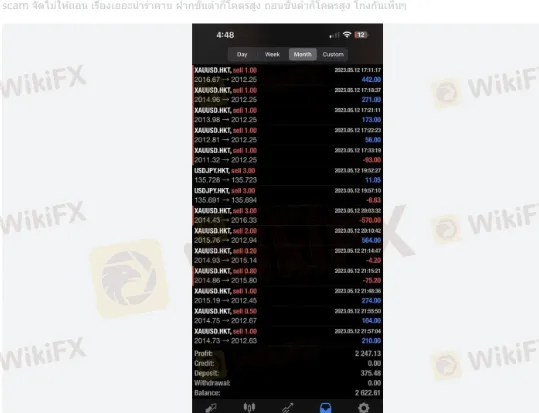

Thailand (2025): Classic “No Withdrawals”

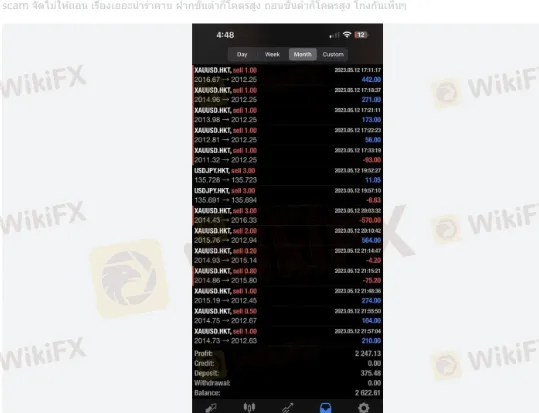

· Investor Lily 02 deposited $375, grew it to $2,600, but was blocked from withdrawing. “The same trick they used in China years ago—they let you lose, but never let you win,” she said.

· Another Thai user reported sudden hikes in minimum deposit/withdrawal thresholds, alongside withdrawal bans. The scheme relied on fake social media profiles of attractive men and women to lure victims.

Such moves are widely recognized as the “last gasp” before a broker vanishes with client funds.

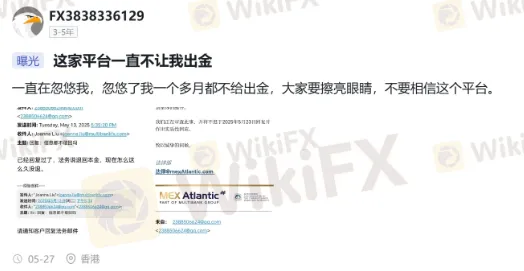

Hong Kong (2025): Vanishing Websites

· On July 29, 2025, Hong Kong user “Quanli” reported that MultiBanks local site multibank.link had gone dark. Deposit and withdrawal portals disappeared overnight without warning.

· On June 17, 2025, another user exposed how MultiBank had resurfaced in China under new brands, manipulating CPA rules to deny rebates—even after processing 700+ trades.

Beyond Asia

Reports also surfaced from Indonesia, Pakistan (IB commissions blocked), the UAE (repeated inducements into margin calls), Taiwan (so-called “IQ tax”), and even Spain—showing MultiBanks fraud was truly global.

A Decade-Long Scam Disguised as “Forex”

For most, forex is a chance to profit from hard work and market insight. For Naser Taher and his MultiBank empire, it is simply a vehicle to steal principal.

Behind its “11 licenses” façade, there is:

· No fair trading environment.

· No transparent rules.

· No genuine market quotes.

· Often, no real trading at all.

What exists instead is a global scam factory—a parasite that strips entire communities bare before moving on.

China was first. Then Malaysia. Now Thailand, Hong Kong, and beyond. Wherever there are Chinese investors, the cold flash of MultiBanks sickle follows.

The Alien Metaphor

Alien rewrote humanity‘s fear with blood-soaked imagery. In today’s financial world, Naser Taher—the self-styled “captain” of MultiBank—steers a pirate ship across oceans, planting leather-coated eggs plated with the gold dust of “11 global licenses” into Chinese communities worldwide.

Listen closely: that sticky, suffocating sound in investors‘ ears is not fiction. It is the sound of MultiBank’s parasitic fangs boring into their chests.

Once, it erupted from the bodies of countless Chinese victims, escaping into Malaysia, drenched in blood debt. After another feast, it burst forth again. Now, it is preparing to implant its monstrous eggs into yet another Chinese community.