简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Extends Seven-Day Rally, Sets New Record High

Abstract:Amid weakening macroeconomic data, markets are once again gripped by rate-cut fever. Expectations for three cuts this year have pushed gold and risk assets higher in tandem. Yet we remain skeptical of

Amid weakening macroeconomic data, markets are once again gripped by rate-cut fever. Expectations for three cuts this year have pushed gold and risk assets higher in tandem. Yet we remain skeptical of this speculative chase for returns. Investors are ignoring looming liquidity risks and assuming markets will never pull back—a potential storm is quietly brewing.

Playing at the peak—who can truly win?

(Figure 1. Market expectations for three rate cuts this year rise from 37% → 43.4%; Source: FedWatch Tool)

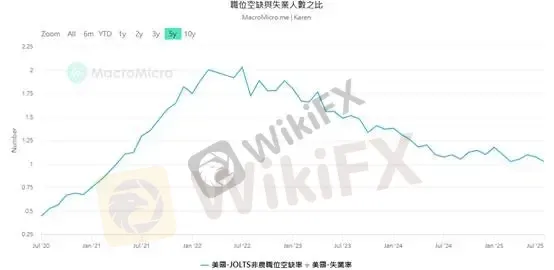

The July JOLTs job openings report showed 7.181 million openings, revised down from the previous 7.357 million. Based on the ratio of job openings to unemployed persons, there are now only 1.02 jobs available per job seeker—half the level seen in July 2022, when one person could find two jobs.

This indicates inflation risk is limited, but risks of end-demand deflation and price deflation are mounting. End-demand deflation stems from declining disposable income: consumers are cutting back on elastic demand goods (luxury items) and shifting toward essentials.

(Figure 2. Ratio of job openings to unemployed persons; Source: MacroMicro)

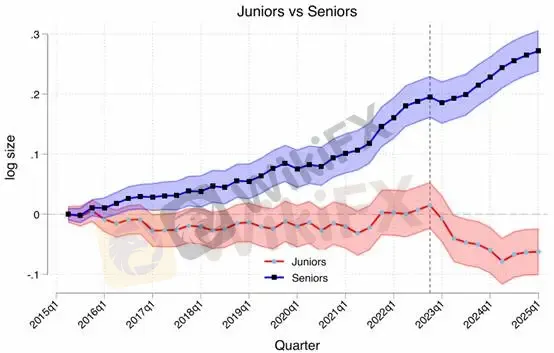

At the same time, we are witnessing a structural rise in permanent unemployment. The number of people unemployed for more than 27 weeks has climbed to 1.826 million—the highest since February 2022. A recent paper, Generative AI as Seniority-Biased Technological Change: Evidence from U.S. Résumé and Job Posting Data, finds that since Q1 2023, firms adopting AI have sharply reduced junior roles compared to non-AI firms, while senior positions continued to increase. The decline in junior roles is driven mainly by slower hiring, not higher attrition, with wholesale and retail trade most affected. Education-based heterogeneity shows a U-shaped pattern: mid-tier graduates face the steepest declines, while elites and low-tier graduates are less affected.

(Figure 3. Long-term unemployment reflects structural job loss; Source: MacroMicro)

(Figure 4. Sharp decline in junior positions since 2023; Source: Generative AI as Seniority-Biased Technological Change: Evidence from U.S. Résumé and Job Posting Data)

In short, workers lacking skills are forced either into lower-paying jobs or into reskilling for higher-level roles. The decline in job openings is not primarily due to a weak economy; rather, certain positions have simply disappeared.

Turning back to prices: the July ISM Manufacturing PMI report noted that most firms have raised product prices, largely due to tariffs driving up raw material costs. As consumer purchasing power fades, higher prices will eventually weigh on corporate sales and earnings. These real-economy impacts have yet to be priced into risk assets.

The current wave of FOMO has yet to recognize that risks are building. A poor risk-reward ratio is the ultimate pitfall for investors. For seasoned traders, patience and readiness for a trend reversal are now critical disciplines.

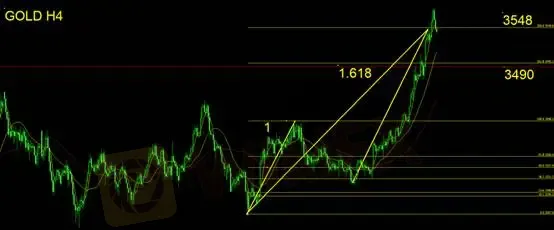

Gold Technical Analysis

Following yesterday‘s technical observations, investors should either stay flat or exit longs and consider short positions. We maintain our view that above 3,548 is an overextended move, as the rally has already satisfied the 1:1.618 extension target. Gold’s seven-day surge to fresh highs comes with heightened risk of chasing momentum. For shorts, stops can be set at 3,580, given excessive short-term deviation. Downside targets include a retracement toward the 5-day MA near 3,512. A break below 3,490 would signal a potential trend reversal.

Support: 3,490

Resistance: 3,548

Risk Disclaimer: The above views, analyses, research, prices, or other information are provided as general market commentary and do not constitute investment advice. All viewers bear sole responsibility for their trading decisions. Please exercise caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

WikiFX Elites Club Committee Concludes Voting! Inaugural Lineup Officially Announced

eToro CopyTrader Expands to U.S. Investors

Is MH Markets Safe or a Scam? Regulation and Fund Security Explained

Ponzi Scheme Operator Sentenced to 14 Years in Western Australia

Chicago PMI Beats But Remains In 'Contraction' For Second Straught Year

How to Add and Take Out Money from Amillex Broker: A Complete Guide

T4Trade broker Review 2025: Is T4Trade Regulated?

FCA warning: These Firms are on the list

Don’t Get Scammed: A Roundup of Common Online Fraud Tactics in Forex

Currency Calculator