WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Robo trading, also known as automated trading or algorithmic trading, is changing the way people invest in the stock and forex markets. It uses computers and software programs to buy and sell assets automatically based on pre-set rules. If you want to learn about Robo trading and how it works, this simple guide will help you understand everything you need to know.

Robo trading, also known as automated trading or algorithmic trading, is changing the way people invest in the stock and forex markets. It uses computers and software programs to buy and sell assets automatically based on pre-set rules. If you want to learn about robo trading and how it works, this simple guide will help you understand everything you need to know.

Robo trading is a method where computer programs, called trading robots or bots, handle your trades without needing constant human input. These robots follow specific strategies, analyze market data, and make decisions faster than a human trader. Many traders and investors use robo trading because it can work 24/7, take emotion out of trading, and execute trades more quickly.

Robo trading works through a few basic steps:

1. Setting the Strategy: Investors or traders choose or create a trading strategy. This could be based on technical analysis, such as moving averages or trend patterns, or fundamental analysis like economic news.

2. Programming or Selecting Bot: Once the strategy is ready, it is programmed into a trading robot. Many trading platforms offer pre-built bots that you can customize, or you can hire developers to create a personalized robot.

3. Connecting to the Market: The robo trading software connects to your trading account through an API (Application Programming Interface). This connection allows the robot to place trades automatically based on your settings.

4. Execution & Monitoring: The robot continuously monitors the market, analyzes data, and executes trades when the conditions match the strategy. You can also set limits like stop-loss or take-profit levels to manage risks.

1. Faster Trade Execution

Robo trading can analyze data and execute trades instantly, helping traders capitalize on market opportunities quickly.

2. Eliminates Emotional Bias

Automated systems follow predefined rules, removing emotional decisions that can lead to mistakes in trading.

3. 24/7 Trading

Robots can operate around the clock, allowing traders to take advantage of global market movements at any time.

4. Consistent Strategy Implementation

Robo trading ensures that trading strategies are followed precisely, leading to more disciplined trading.

5. Saves Time and Effort

Once set up, robo trading handles all trades automatically, freeing traders from constant market monitoring.

1. Market Volatility

Robo trading operates based on predefined rules and algorithms. During sudden market changes or unexpected events, the bots may not adapt quickly enough, leading to potential losses. Rapid price swings can catch even the most advanced algorithms off guard.

2. Technical Failures

Since robo trading relies on technology, technical issues such as server outages, connectivity problems, or software bugs can disrupt trading. These failures might cause missed opportunities or unintended trades.

3. Strategy Errors

If the programmed strategy is flawed or not well-tested, it can result in poor trading decisions. An incorrect or outdated strategy can lead to significant losses over time.

4. Over-Reliance on Automation

While automation saves time, traders must monitor their bots regularly. Ignoring updates or not supervising the system can increase risks, especially during unpredictable market conditions.

5. Lack of Human Judgment

Robots lack human intuition and judgment, which are sometimes necessary to interpret complex market signals or news events. Relying solely on robo trading can be risky without human oversight.

Robo trading is a powerful tool that automates the trading process using computers and algorithms. It helps traders execute faster, follow strict rules, and remove emotional biases. However, it's essential to understand the risks and manage your trading robot carefully. By learning how robo trading works, you can decide if it's the right approach for your investment goals.

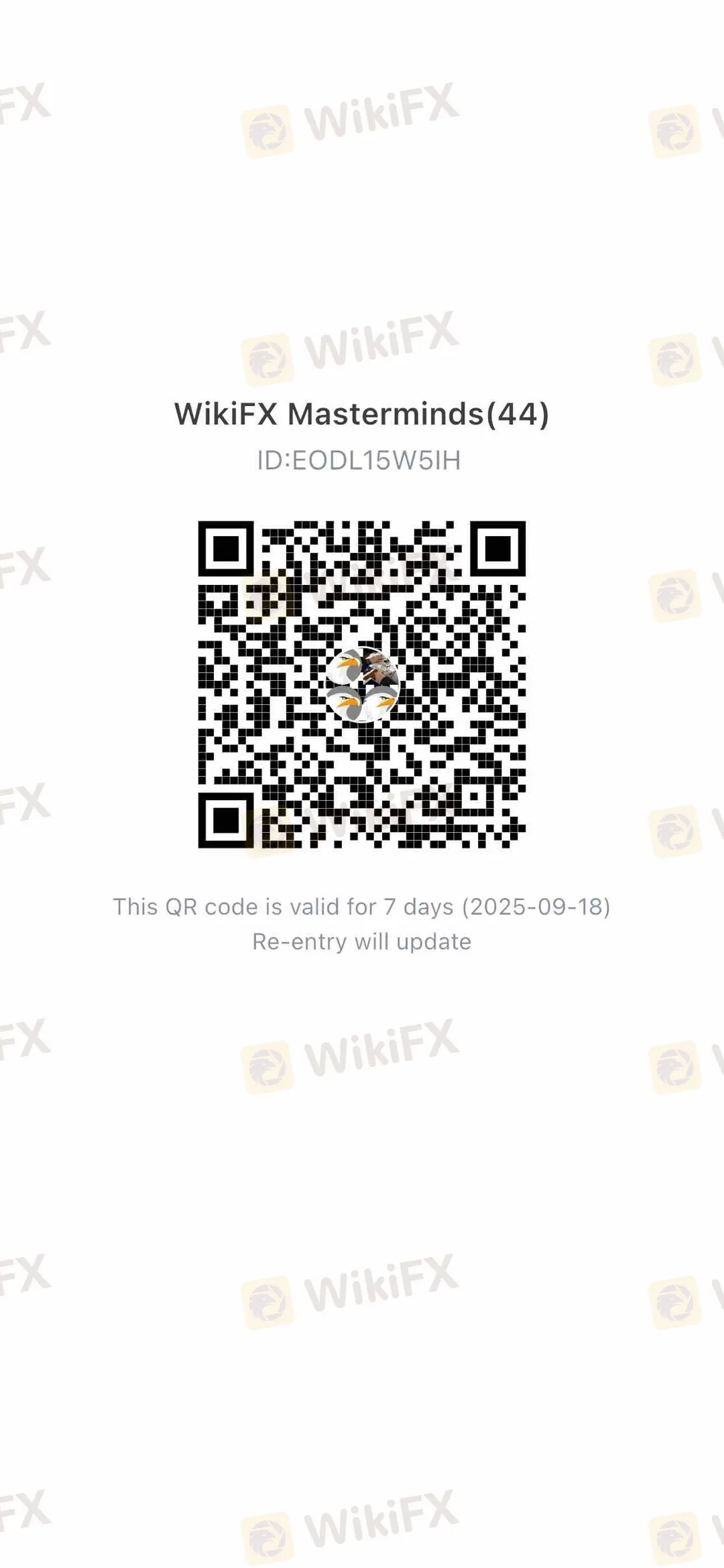

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.