WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Forex trading is one of the most popular financial markets in the world. It offers opportunities to earn profits by buying and selling currencies. However, success in forex trading depends on having the right strategies. Using effective forex trading strategies can help you make better decisions and reduce risks.

Forex trading is one of the most popular financial markets in the world. It offers opportunities to earn profits by buying and selling currencies. However, success in forex trading depends on having the right strategies. Using effective forex trading strategies can help you make better decisions and reduce risks.

9 Best Forex Trading strategies

1. Trend Following Strategy

This is one of the simplest and most popular forex trading strategies. It involves identifying the overall direction of the market—uptrend or downtrend—and trading in that direction. Traders use tools like moving averages to spot trends. When the market is trending upward, buy; when its trending downward, sell. This strategy works well in markets with strong, sustained trends.

2. Range Trading Strategy

Range trading is suitable for markets that are not trending but moving sideways within a specific price range. Traders identify support and resistance levels and buy near support and sell near resistance. This strategy requires patience and careful analysis of price movements to avoid false signals.

3. Breakout Trading Strategy

Breakout trading involves entering the market when the price breaks through support or resistance levels. This indicates a potential start of a new trend. Traders set entry points just above resistance or below support. This strategy can be very profitable if timed correctly, but false breakouts can lead to losses.

4. Swing Trading Strategy

Swing trading focuses on capturing short- to medium-term price movements. Traders hold positions for several days or weeks, trying to profit from price swings. Technical analysis tools like Fibonacci retracements and candlestick patterns are useful here. Patience and good market analysis are key.

5. Scalping Strategy

Scalping involves making many small trades throughout the day to profit from tiny price movements. Scalpers look for very short-term opportunities and need to act quickly. This strategy requires a lot of focus and discipline, as well as a good understanding of market volatility.

6. Moving Average Crossover Strategy

This strategy uses two moving averages of different periods (like 50-day and 200-day). When the short-term moving average crosses above the long-term, it signals a buy; when it crosses below, it indicates a sell. It helps traders identify trend reversals early.

7. News Trading Strategy

This strategy involves trading based on economic news and events. Major news releases can cause rapid price changes. Traders monitor economic calendars and make quick trades before or after news releases. It requires staying updated and quick decision-making.

8. Fibonacci Retracement Strategy

Fibonacci retracement levels are used to identify potential reversal points in the market. Traders look for prices to retrace to key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%) and then continue in the original direction. This helps in placing entries and stop-loss orders.

9. Day Trading Strategy

Day trading is a short-term trading strategy where traders buy and sell financial instruments—such as stocks, forex, or cryptocurrencies—within the same trading day. The goal is to capitalize on small price movements by entering and exiting positions quickly, often within minutes or hours. Successful day traders rely on technical analysis, real-time charts, indicators, and news updates to make quick decisions.

Conclusion

The key to success in forex trading is understanding and applying the right forex trading strategies. Whether you prefer trend following, range trading, or scalping, practicing and refining your strategies is essential. Remember, no strategy guarantees profits, but disciplined trading and good risk management can significantly improve your chances of success. Start with one or two strategies, learn them well, and gradually expand your trading skills for better results.

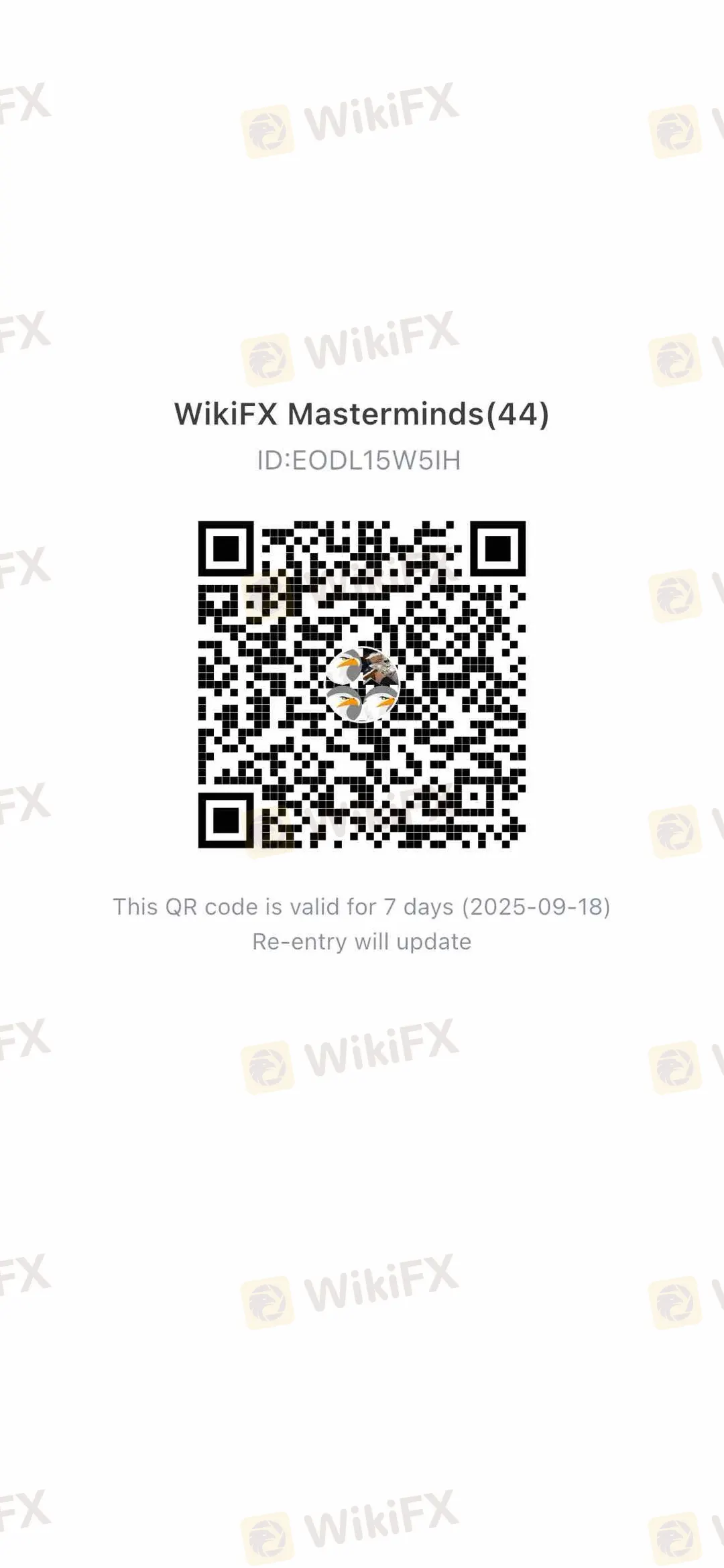

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.