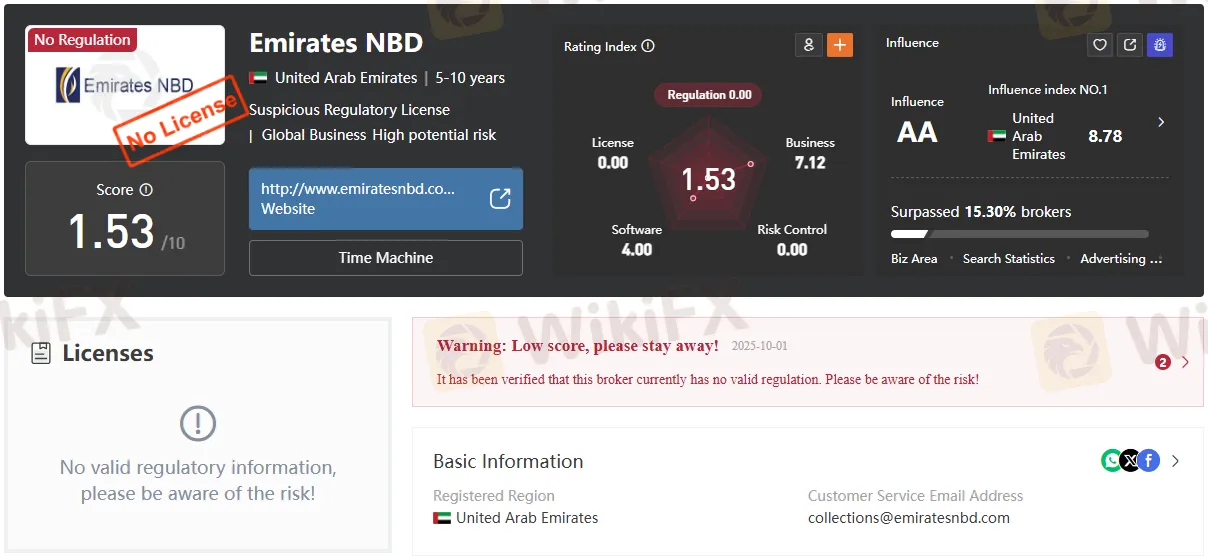

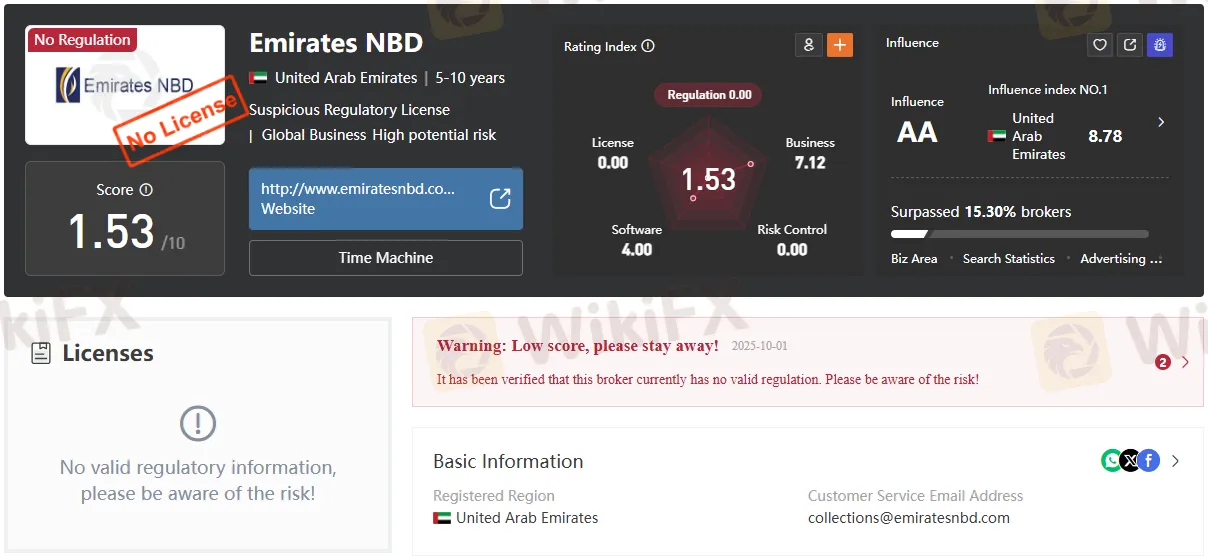

Abstract:Emirates NBD is not regulated as an online "Forex Broker" for online trading. It is an international money transfer services to retail and business customers, with banking oversight rather than brokerage regulation.

Introduction

Emirates NBD is the UAE‘s bank that provides everyday banking, foreign exchange, and international money transfer services to retail and business customers, with banking oversight rather than brokerage regulation. Its appeal centers on competitive currency rates, multiple remittance rails like DirectRemit and telegraphic transfers, and broad customer support channels, balanced against the important clarification that it is not regulated as a broker because it is a bank. This review evaluates Emirates NBD’s strengths and trade-offs in FX, transfers, travel money, and service experience so readers can decide if it matches personal or business needs in the UAE.

Note: Emirate NBD is not regulated as an online “Forex Broker” for online trading.

Pros and Cons

- Pros: Comprehensive FX services, global reach to 100+ countries, competitive buy/sell rates, and flexible support via app, online, WhatsApp, and phone lines for different segments.

- Cons: Regulatory oversight applies to banking, not brokerage activities, and customers should mind channel security and avoid sharing confidential details outside secure paths.

Emirates NBD

Emirates NBD operates from the UAE and offers a full suite of banking, foreign exchange, investment, and wealth solutions under a banking regulatory framework, not as a licensed broker-dealer. The distinction matters for users comparing banks with brokers; services such as FX and remittances flow through banking channels with associated protections, but not broker regulation. For evaluation, readers should weigh desired features like quick remittances and multi-currency access against the correct expectation of bank—not broker—oversight.

FX Services and Rates

Emirates NBD provides real-time buy/sell currency rates across major pairs such as USD, GBP, INR, PKR, CAD, and JPY, supported by a currency conversion calculator for quick estimation before executing a transfer or cash exchange. The bank emphasizes secured transactions, competitive pricing, and convenience across personal, priority, private, business, and corporate segments, aligning FX tools with different user profiles. For cash needs, foreign currency can be bought or sold at branches, complementing digital channels for conversions and remittances.

International Money Transfers

DirectRemit enables 24/7, fee-free transfers to selected corridors with an advertised 60-second delivery window via mobile and online banking, targeting frequent remitters who prioritize speed and certainty. Beyond DirectRemit, users can initiate telegraphic transfers for wider reach, leverage Western Union within online and mobile banking, or use demand drafts where guaranteed payment is needed. Inside the UAE, mePay supports instant transfers using only a mobile number, removing the need for an account number or IBAN for local peer-to-peer payments.

Products for Travelers and Savers

For international travel spending, the GlobalCash Card supports 15 currencies, helping separate budgets by currency and manage fees while traveling and withdrawing abroad. Savers can place foreign currency fixed deposits and maintain FX accounts, positioned for those seeking higher rates in non-AED currencies through online banking access. The combination of multi-currency cards, FX accounts, and branch cash services creates an integrated travel and FX stack for frequent travelers and expatriates in the UAE.

Customer Support and Service Experience

Support spans in‑app secure messaging (responses typically within 24 hours), online banking messaging, WhatsApp Banking with agent chat between 8 am and 10 pm daily (target response within 30 minutes during agent hours), and dedicated phone lines by segment, including personal, priority, business, private, and corporate banking. Email and postal options remain available for formal communications, with published turnarounds of around two working days, reflecting a traditional escalation path. The bank stresses security hygiene across channels, cautioning against sharing PINs or account details and encouraging users to report suspicious emails to mitigate fraud risk.

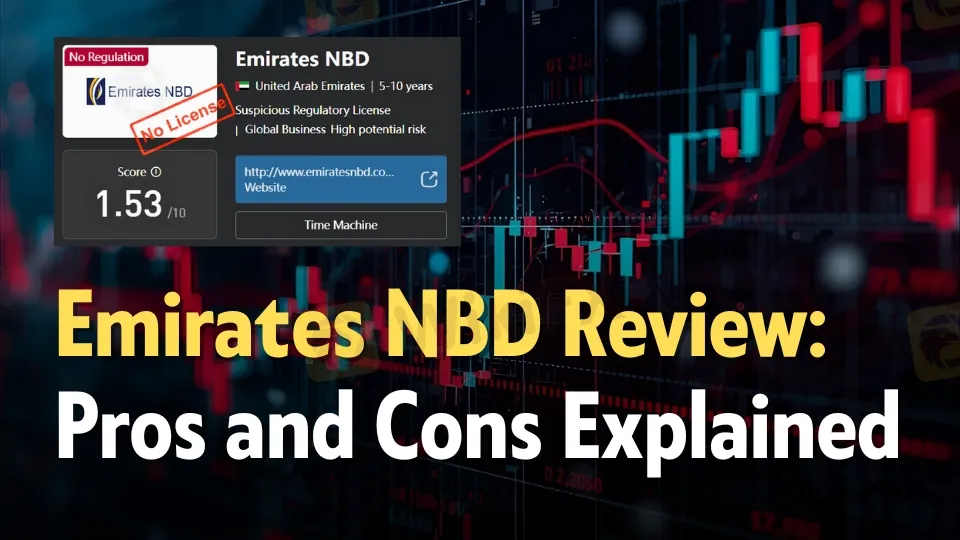

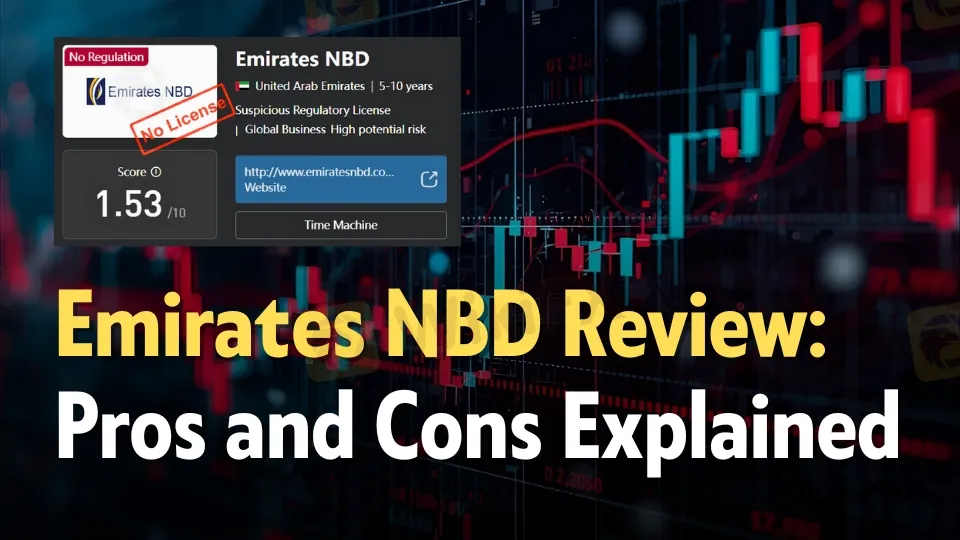

Regulation Status and Trust Signals

Emirates NBD is a bank and is not regulated as a brokerage; its governance and compliance focus on banking activities rather than broker-dealer supervision, which some reviewers conflate when comparing to trading platforms. For users evaluating remittances, FX, and deposit products, this means considering banking regulatory protections relevant to accounts and transfers, not securities brokerage rules. The bank also publishes service guidelines and terms for remittances and FX channels, signaling procedural clarity and operational governance for everyday users.

Fees, Speed, and Usability

DirectRemit‘s value proposition centers on fee-free transfers in selected corridors, with handling availability round-the-clock for speed-sensitive remitters, though availability depends on the destination countries supported. Telegraphic transfers expand global reach at the cost of typical cross-border fees and timelines, while Western Union integration offers convenience for cash-pickup scenarios within the bank’s digital channels. The currency calculator and live FX quotes improve transparency for users planning transfers or cash purchases, enhancing predictability before committing to a transaction.

Security, Risk, and Best Practices

Emirates NBD encourages secure communications and warns against sharing sensitive information by email or unsecured channels, aligning with standard banking security protocols for digital service. Users should favor in‑app or online banking secure messaging for account actions and promptly report suspicious outreach to reduce social engineering risk. For cross-border transfers, verifying recipient details and corridor eligibility for features like DirectRemit helps ensure correct routing and expected speeds.

Who Does Emirates NBD Suits

The bank is well-suited to UAE residents who want an integrated current account, remittance, and FX experience inside a single banking app with broad corridor coverage and familiar support channels. Frequent travelers benefit from the 15‑currency GlobalCash Card and branch cash services, while savers who prefer foreign currency exposure can use FX fixed deposits and accounts. SMEs and corporate clients gain from segment-specific lines and relationship managers that can coordinate FX and transfer services tailored to business operations.

Key Use Cases

- UAE salary earners sending funds home weekly or monthly into supported DirectRemit corridors for fast, fee-free delivery when eligible.

- Families planning travel budgets across multiple countries using the GlobalCash Cards 15 supported currencies to segment spend.

- Small businesses paying suppliers abroad via telegraphic transfer while checking indicative conversion with the currency calculator.

Comparison Mindset: Bank vs Broker

Readers comparing Emirates NBD to retail FX brokers should anchor on the bank‘s regulatory footing and product scope: current accounts, remittances, deposits, and travel cards versus leveraged trading or brokerage accounts. The bank’s advantage lies in embedded payments, FX, and service channels with established support, while brokers specialize in market access and trading tools under different regulations. Deciding between them depends on whether the priority is day‑to‑day banking and remittances or securities/derivatives trading and investment execution.

Practical Tips Before Choosing

Confirm whether a frequently used corridor is eligible for DirectRemit to benefit from fee‑free, 60‑second transfers; if not, plan for TT fees and timelines. Check live FX buy/sell rates and use the calculator to estimate total outlay before sending, especially for large transfers or travel budgets. Select a support path that matches urgency: WhatsApp agent hours for near‑real‑time chat, phone for immediate issues, or secure in‑app messaging for tracked requests within 24 hours.

Bottom Line

Emirates NBD delivers a strong, bank-centered FX and remittance suite with competitive live rates, speedy DirectRemit on supported corridors, and multi-channel support, making it a practical choice for UAE users prioritizing integrated banking over brokerage services. The trade‑offs revolve around understanding that oversight is banking, not broker regulation, and following secure communication practices when engaging across digital channels. For global remitters, travelers, and SMEs operating from the UAE, the portfolio of transfers, FX accounts, and the GlobalCash Card offers cohesive value inside a mainstream bank framework.