简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

eToro Under Review: How Safe is This Popular Broker?!

Abstract:Despite its strong global regulation and solid WikiScore of 7.77, eToro faces mounting trader complaints and uneven investor protections that raise important questions about how safe this popular broker truly is.

As one of the most well-known online trading platforms globally, eToro has established itself as a leader in social and multi-asset trading. Its innovative copy-trading feature and wide market access have attracted millions of users worldwide. However, popularity alone is not the same as reliability. According to data from WikiFX, eToro holds a WikiScore of 7.77 out of 10, reflecting a broker that is well-regulated and largely reputable, though not without its challenges. The rating is influenced by both its extensive regulatory framework and a noticeable number of trader complaints recorded on WikiFXs Exposure section.

View WikiFXs full review on eToro here: https://www.wikifx.com/en/dealer/0001283907.html

Global Regulation and Licensing Overview

eToro operates across multiple regions under different regulatory authorities. This multi-license structure gives it broad legitimacy but also introduces variations in the level of investor protection offered to clients in different jurisdictions.

In the United Kingdom, eToro (UK) Ltd is regulated by the Financial Conduct Authority (FCA) under a Straight Through Processing (STP) license. The FCA is considered one of the worlds most respected financial regulators. Its oversight ensures that eToro follows strict standards on client fund segregation, financial reporting, and fair dealing practices. Traders under the FCA license are also covered by the Financial Services Compensation Scheme (FSCS), which can provide protection of up to £85,000 in the event of broker insolvency.

Within the European Union, eToro (Europe) Ltd operates under the Cyprus Securities and Exchange Commission (CySEC) with a Market Maker (MM) license. This license allows eToro to provide services to clients throughout the European Economic Area (EEA) under EU passporting rules. CySEC regulation is recognized but considered less stringent than that of the FCA, offering a moderate level of protection. It requires brokers to maintain sufficient capital, provide transparent communication, and participate in investor compensation schemes.

In Australia, eToro AUS Capital Pty Ltd holds a Market Maker (MM) license issued by the Australian Securities and Investments Commission (ASIC). ASIC is a top-tier regulator known for its emphasis on financial transparency and consumer protection. Under this supervision, eToro must meet high compliance and reporting standards, further supporting its reputation in the Asia-Pacific region.

Another significant license is in Singapore, where eToro is authorized by the Monetary Authority of Singapore (MAS) under a Retail Forex License. MAS regulation is highly respected globally and adds strong credibility to eToros presence in Southeast Asia.

In the Middle East, eToro is licensed by the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority, also under an STP license. This authorization allows eToro to provide trading services in the United Arab Emirates, a region that is rapidly becoming an important financial hub with growing regulatory sophistication.

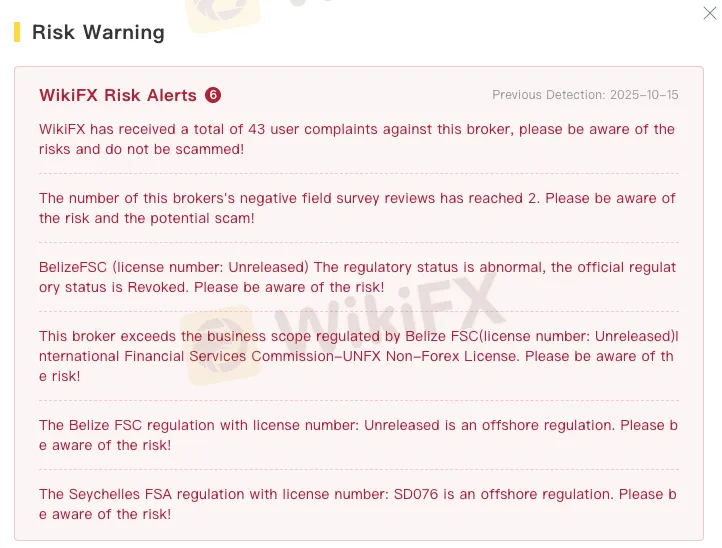

However, not all of eToros licenses carry the same weight. The broker also holds a Retail Forex License from the Financial Services Authority (FSA) in Seychelles, which is categorized by WikiFX as offshore regulated. Offshore licenses typically offer less oversight, weaker investor protections, and limited recourse in the event of disputes. They are often used by brokers to serve clients in jurisdictions where local licensing is not available, but they do not provide the same level of assurance as major regulators such as the FCA, ASIC, or MAS.

Additionally, WikiFX records show that eToro‘s Common Financial Service License under the Financial Services Commission (FSC) in Belize has been revoked. The loss of this license indicates that eToro no longer operates under FSC oversight, although the reason for the revocation has not been publicly disclosed. Revoked or surrendered licenses typically lower a broker’s overall compliance standing.

Implications of Multi-Jurisdictional Regulation

eToros extensive licensing coverage demonstrates its commitment to regulatory compliance in key markets. Being supervised by multiple top-tier regulators such as the FCA, ASIC, MAS, and ADGM offers clients a strong degree of protection. These authorities enforce rigorous standards on capital adequacy, risk management, and client fund security.

However, the protection a trader receives depends entirely on which entity they are registered under. For example, clients under the FCA or MAS entities benefit from robust safeguards and compensation rights. In contrast, those registered under the Seychelles FSA entity are subject to far looser oversight.

This difference in regulatory environments has been a recurring topic among traders. Some have reported being moved from strong regulatory jurisdictions like ASIC to offshore entities without clear communication, reducing their level of protection. Such structural arrangements are legal but highlight the importance of knowing exactly which eToro entity manages ones account.

User Complaints on WikiFX Exposure

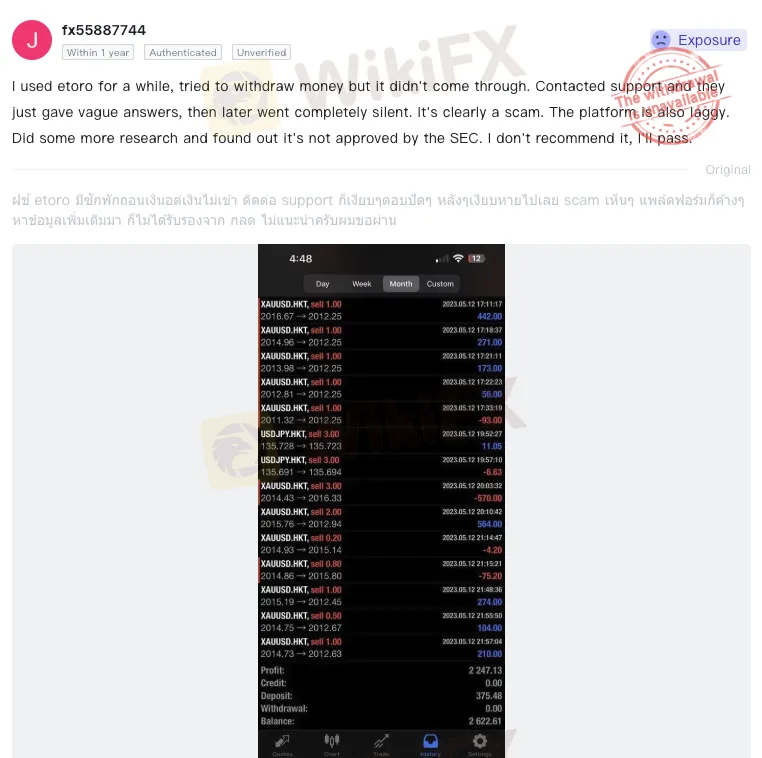

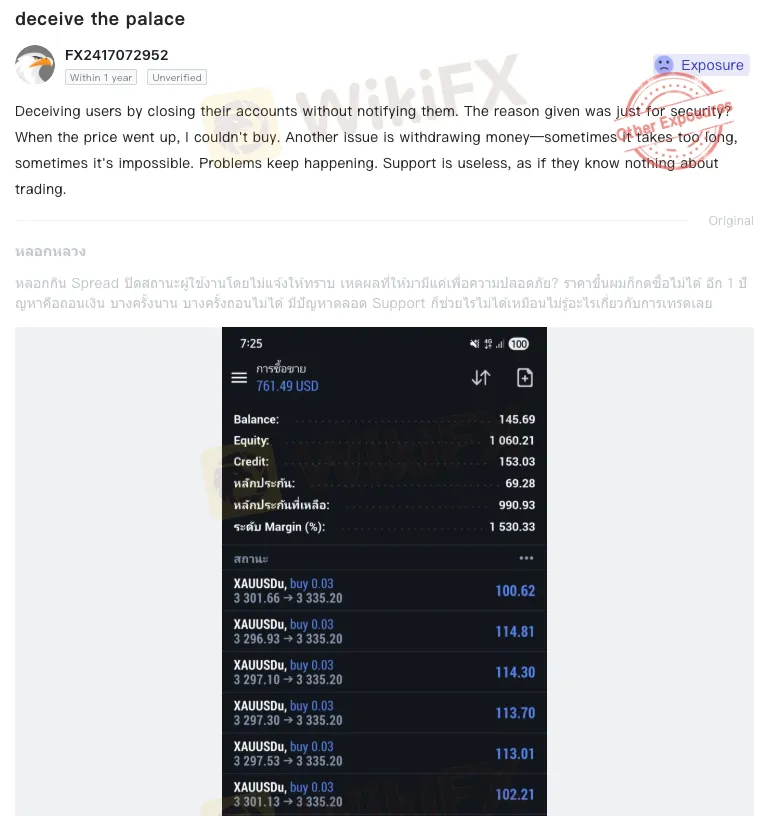

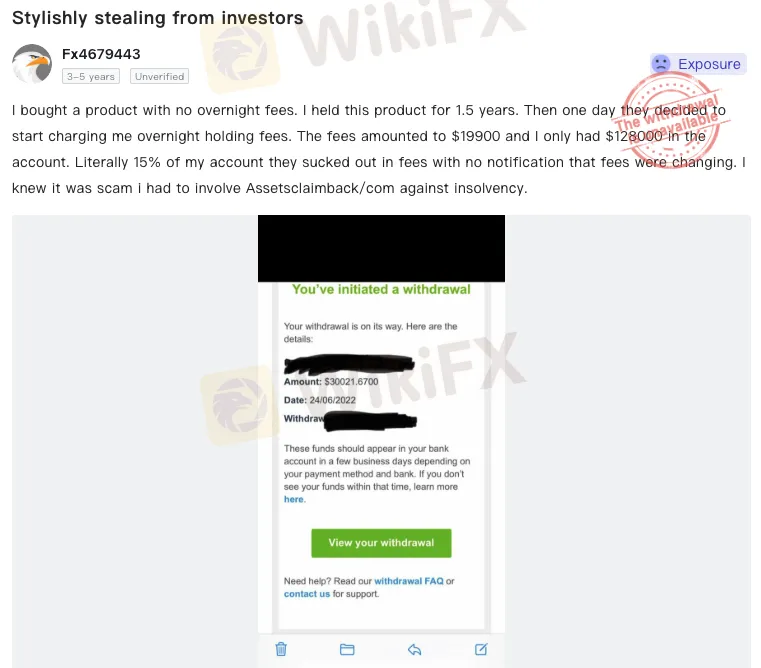

Despite eToro‘s strong regulatory foundation, WikiFX’s Exposure section features a considerable number of user complaints that have contributed to the brokers lower-than-expected WikiScore. These reports come from traders across different regions and share several recurring themes.

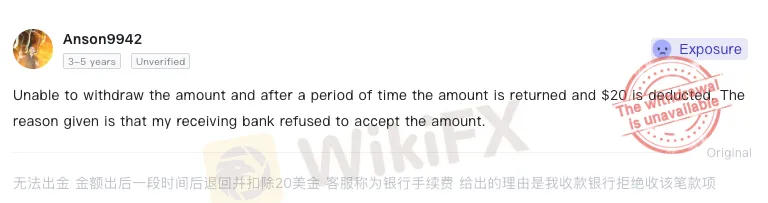

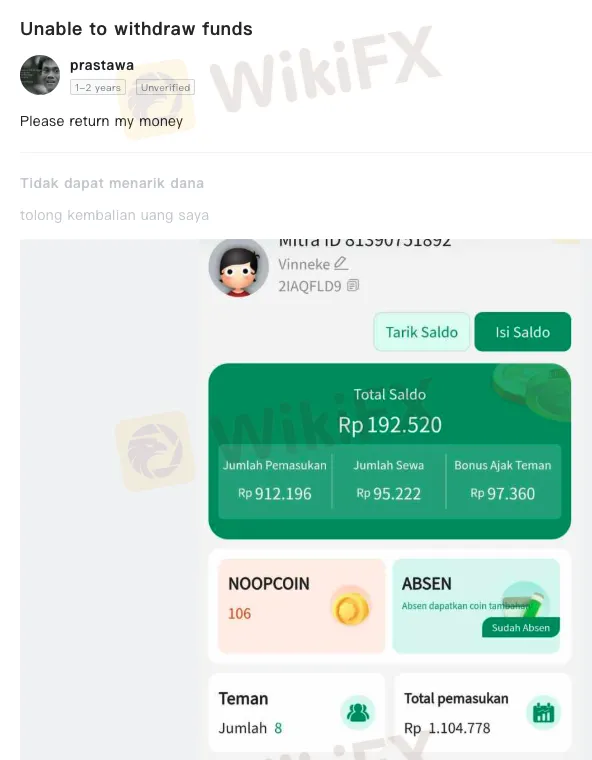

The most common issue involves withdrawal difficulties. Many traders report delays in receiving their funds, sometimes waiting several weeks for processing. In some cases, users claim that their accounts were temporarily frozen or placed under additional verification just when they attempted to withdraw profits. While such checks can be part of standard anti-fraud procedures, repeated delays can understandably create frustration and raise doubts about efficiency.

Another frequently mentioned concern is customer service quality. Traders have described slow response times, repetitive automated messages, or a lack of clear resolutions from eToro‘s support channels. Some complainants state that their inquiries remained unresolved for long periods, prompting them to file public complaints through WikiFX’s Exposure platform.

A smaller but notable portion of complaints involve unexpected fees or changes in trading conditions. For instance, some users have cited higher overnight charges, undisclosed withdrawal fees, or discrepancies between displayed and executed prices. A few have also mentioned slippage or trade rejections during periods of market volatility. While such occurrences can happen with most brokers, a pattern of similar complaints can indicate operational challenges or insufficient communication.

Strengths and Limitations

From a regulatory standpoint, eToro remains one of the better-established brokers in the global market. Its licenses from authorities such as the FCA, ASIC, and MAS place it among the industrys more credible names. These regulatory bodies require regular audits and strict adherence to client protection laws, which greatly reduces the risk of misconduct.

However, the broker‘s use of offshore regulation in Seychelles and the revocation of the Belize license introduce notable weaknesses. Offshore entities generally provide lower levels of oversight and limited investor recourse in disputes. Additionally, the volume of user complaints regarding withdrawals and customer support cannot be ignored, as it suggests gaps in eToro’s operational processes.

Conclusion

Overall, eToro presents a mixed but generally positive picture. With a WikiScore of 7.77 out of 10, it is a broker that demonstrates substantial regulatory commitment but still faces challenges in maintaining consistent service quality across its global network.

For traders, the key takeaway is the importance of verifying which eToro entity their account is registered under. Clients operating under the FCA, ASIC, or MAS licenses can expect stronger investor protection, while those under offshore jurisdictions should exercise greater caution.

While eToros compliance record remains solid, the number of user complaints related to withdrawals and support responsiveness highlights areas where the company must improve. Transparency, faster communication, and uniform global standards would go a long way in strengthening user confidence.

In summary, eToro is a reputable but imperfect broker. It is well-regulated in structure, but still developing in consistency and customer experience. Traders should approach with informed caution, understanding both its regulatory strengths and its operational shortcomings.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AI Revolutionizes Modern Medicine and Diagnostics

Geopolitics meets Liquidity: EU Freezes Trade Talks as Trump 'Greenland' Gambit Rattles Alliance

De-Dollarization Reality: Gold Overtakes Treasuries in Central Bank Reserves

Pocket Option Review: The Offshore Mirage Luring Traders into a Withdrawal Abyss

Markets Rally as Trump Suspends EU Tariffs on 'Greenland Framework'

Weltrade Review: Assessing the Critical Risks Behind the "A" Influence Rank

iq option Review 2026: Is this Forex Broker Legit or a Scam?

JGB Meltdown: Japan's Debt Crisis Deepens as Snap Election Stirs Fiscal Panic

Oil Markets Boxed In: Supply Glut Overpowers Geopolitical Floor

JGB Market Turmoil: Volatility Spikes as BOJ Ownership Dips Below 50%

Currency Calculator