Abstract:IG cashback offer UK 2025 gives investors up to £100 back. Compare the best UK investment platforms with cashback today.

IG Cashback Offer UK 2025 Draws New Investors

IG's latest initiative targets UK residents seeking entry into markets with tangible rewards. From 21 November to 31 December 2025, new customers opening an ISA, GIA, or SIPP qualify for 5% cashback on average daily invested value, capped at £100. This structure rewards commitment, requiring a first trade of £50 and a £50 minimum portfolio through March 2026, with credits by 30 April.

Such promotions align with rising UK retail participation, where platforms leverage incentives amid economic shifts. IG stands out by tying rewards to sustained activity, fostering habits over one-off gains. Eligibility limits entry to first-time share dealing users aged 18+, excluding prior ISA, GIA or SIPP holders.

Market data underscores appeal: UK stocks and shares ISA investments hit record levels in 2025, per FCA reports, as savers chase returns beyond 4% cash rates. IG's zero-commission UK shares and 4% AER on uninvested cash amplify value.

Best UK Investment Platforms with Cashback: IG Leads Pack

Among the best UK investment platforms with cashback, IG's 5% rate shines for simplicity and broad account coverage. Competitors like Freetrade offer 2% on pensions or up to £1,000 on ISA transfers, but demand larger commitments. Charles Stanley provides up to £1,500 on transfers, suiting switchers over newcomers.

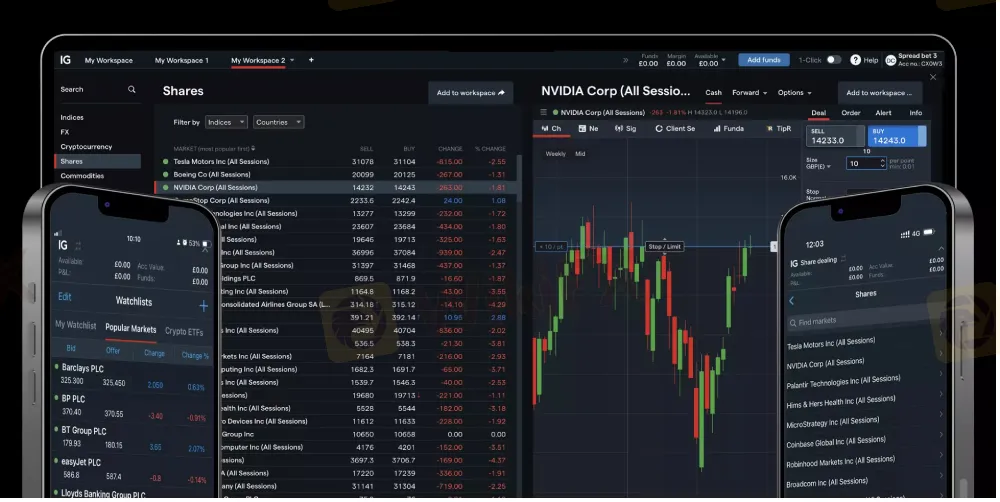

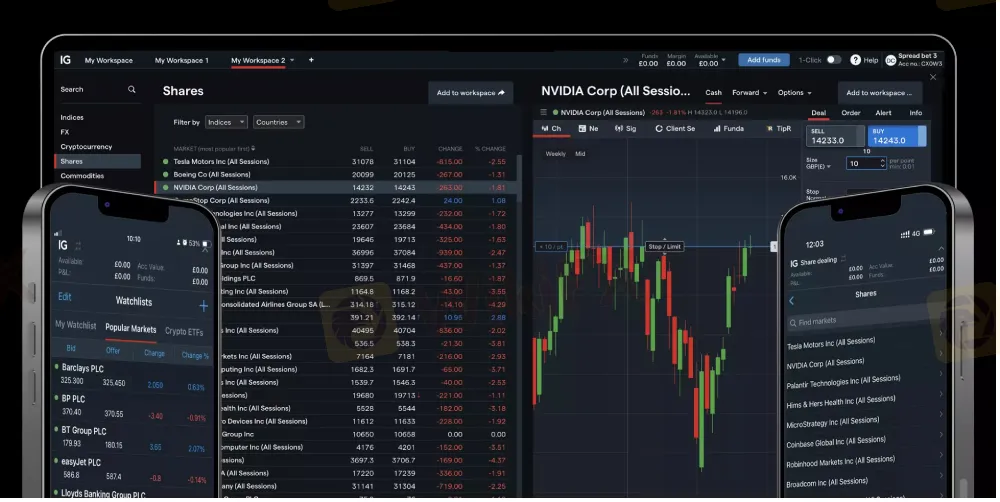

IG's edge lies in low barriers: no deposit minimum beyond the £50 trade, versus higher thresholds elsewhere. Platforms such as AJ Bell focus on low fees without cashback, while Wealthify ties rewards to £5,000+ ISAs. IG balances accessibility with 12,000+ shares and ETFs.

This table highlights why IG tops the best UK investment platforms with cashback for beginners. Tax wrappers enhance long-term efficiency: ISAs shield £20,000 annually from gains tax.

IG ISA GIA SIPP Promotion Maximizes Tax Efficiency

The IG ISA GIA SIPP promotion caters to diverse goals, from tax-free growth to retirement planning. ISAs suit annual savers; GIAs offer unlimited flexibility; SIPPs provide relief on contributions up to £60,000 yearly. All deliver identical 5% cashback under uniform terms.

Experts note SIPPs gain traction as UK pension freedoms expand, with 1.5 million new plans in 2025 per industry stats. IG's intuitive app and educational tools lower entry hurdles for novices. Cashback credits to a GIA, ensuring quick access.

Compared to peers, IG's promotion avoids complexity like random free shares (its prior autumn deal up to £200). Marketing Director Elise Ash calls it a “rewarding nudge” for hesitant starters, emphasizing commission-free trades across global assets.

Broader context: UK platforms face scrutiny on fees, with MSE naming IG among the cheapest for shares. Inflation at 2.1% in late 2025 pushes savers toward equities averaging 7-10% historical returns.

Strategic Fit in Competitive Landscape

IG's timing capitalizes on year-end reviews, when 40% of UK adults reassess finances per surveys. Zero FX fees on GBP trades and diverse ETFs bolster retention post-promotion.

Risks remain: capital at risk, with markets volatile; past performance no guarantee. FCA regulates IG, ensuring client protections like FSCS up to £85,000.

For switchers, tools like IG's portfolio analyzer aid transitions. Long-tail seekers of “IG cashback offer UK 2025 terms” find clear FAQs: new customers only, no combo with other deals.

This positions IG as a frontrunner among the best UK investment platforms with cashback, blending rewards with robust features. UK investors gain from competitive innovation, driving better terms.