简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stonefort Broker Review 2025: A Complete Look at Rules, Costs, and What Users Say

Abstract:Stonefort Securities shows mixed signals for traders in 2025. Some users say good things about the company, praising how well it works and how fast they can take out their money. But there are also serious warnings from regulators that make us question if the company follows the rules and if client money is safe. This review looks at these opposing views to give you facts-based information if you're thinking about using this broker. We'll look at how the company is set up, check its regulatory status, explain the trading conditions, and review what users think to give you a complete picture.

Stonefort Securities shows mixed signals for traders in 2025. Some users say good things about the company, praising how well it works and how fast they can take out their money. But there are also serious warnings from regulators that make us question if the company follows the rules and if client money is safe. This review looks at these opposing views to give you facts-based information if you're thinking about using this broker. We'll look at how the company is set up, check its regulatory status, explain the trading conditions, and review what users think to give you a complete picture. The goal is to give you the important information you need to do your own research before putting money in.

Warning Signs About Rules and Company Structure

For any trader, the most important thing when choosing a broker is keeping their money safe, which depends on following regulations. This section puts the most important information about Stonefort's regulation and background first. What we found here is a major concern and should be the main focus when looking at risks. We'll present the official information fairly, but what this means for trader safety is serious and cannot be ignored.

Company and Registration Information

Understanding a broker's company identity is the first step in checking them out. Here are the key details for Stonefort Securities:

• Company Name: Stonefort Securities Limited

• Registered Region: Saint Lucia

• Operating Period: 1-2 years

• Related Company: Records show a related company, `Stonefort Securities Ltd`, was created in Mauritius on June 10, 2024, with Registration No. C209470.

Being registered in Saint Lucia puts the broker in an offshore location. Offshore regulation is often less strict than that of major financial centers, which can mean less investor protection and oversight. Also, only operating for one to two years is quite short in the brokerage business. A longer track record usually gives more information about a firm's stability, financial health, and behavior through different market conditions. Traders should think about the combination of offshore registration and short operating history as a notable risk factor when judging the broker's reliability and long-term stability. The recent creation of a related company in Mauritius adds another layer to its company structure that needs careful watching.

The UAE SCA License Warning

This is the most serious concern for Stonefort Securities. While the broker does have a license, what it covers and the official warnings about it are a major red flag.

• Regulator: United Arab Emirates Securities and Commodities Authority (SCA)

• Licensed Company: Stonefort Securities LLC

• License Type: Investment Advisory License

• License Number: 20200000226

• License Expiry: November 3, 2025

The main problem isn't that the license exists, but what it does and doesn't allow. An official warning has been issued that says: “This broker exceeds the business scope regulated by United Arab Emirates SCA... Investment Advisory Licence Non-Forex License. Please be aware of the risk!”

In simple terms, this means the license Stonefort has is for giving investment advice, not for working as a forex or CFD brokerage that handles client trades and money. By offering trading services, the company appears to be working outside what its regulator allows. This is a serious problem. When a broker works beyond what its license allows, traders may find themselves without the regulatory protections, such as access to compensation programs or dispute resolution help, that they would otherwise expect.

Making this problem worse is another clear warning found in public records: “Warning: Low score, please stay away!” Such a direct warning is rare and shows a high level of perceived risk from third-party evaluators. The combination of working beyond its regulatory authority and a direct “stay away” warning creates a significant risk that should be a main consideration for any potential client.

Trading Conditions and Costs

Beyond regulation, a trader's success depends on the practical parts of their trading environment. This includes account structures, transaction costs, and the quality of the trading platform. Here, we look at the specific trading conditions offered by Stonefort, highlighting both the available features and the areas where transparency is missing.

Account Types and Deposits

Stonefort structures its offerings across three account types, but only provides full transparency on its entry-level account. This creates a high barrier to entry and leaves potential clients with incomplete information.

| Account Type | Minimum Deposit | Minimum Spread | Commission | Maximum Leverage |

| Starter | $50 | From 1.3 | 0 | 1:500 |

| Advanced | $3000 | From 1.0 | 0 | 1:500 |

| Elite | $10,000 | From 0.1 | 8 | 1:200 |

Platform and Technology

The trading platform is a trader's main tool, and Stonefort's choice of technology is a clear strength.

• Trading Platform: The broker offers the globally recognized MetaTrader 5 (MT5) platform. MT5 is known for its advanced charting tools, extensive library of technical indicators, support for automated trading via Expert Advisors (EAs), and superior order management capabilities.

• License Status: The platform is operated under a “Full License.” This is an important distinction. A full license means the broker has purchased the entire platform software from MetaQuotes, giving them more control over server stability and administration. This is generally considered more reliable and robust than a “white-label” solution, where a broker essentially rents the platform from another company.

• Server Information: For technical transparency, the broker's server infrastructure includes:

• `StonefortSecurities-Server` (Live trading, located in Mauritius)

• `StonefortSecurities-Demo` (Demo trading, located in Singapore)

The use of a full-licensed MT5 platform is a positive point, providing traders with a powerful and stable technological foundation. For traders looking to explore the platform offerings and server performance in more detail, we recommend a deeper dive by searching for the broker on WikiFX.

User Reviews and What People Think?

While regulatory information provides a formal picture of a broker, user reviews offer a look into the real-world client experience. In the case of Stonefort, this creates a confusing contradiction. The serious regulatory warnings stand in stark contrast to many overwhelmingly positive, though unverified, user testimonials. This section looks at the common themes from this feedback and provides a framework for understanding such contradictory information.

Common Points from Positive Feedback

A review of the available user testimonials shows several recurring positive points. Traders consistently praise aspects of the broker's service that are common problem areas elsewhere in the industry.

• Smooth and Fast Withdrawals: This is the most frequently mentioned advantage. Multiple users report that withdrawal processes are hassle-free and quick, which is a critical factor for building trust with a broker.

• Responsive and Helpful Support: Customer support receives high marks. Specific account managers, such as “Hassan Abdulla” and “Jack,” are repeatedly mentioned by name for their professionalism, responsiveness, market guidance, and willingness to answer questions promptly.

• User-Friendly Platform: Clients describe the general platform and the dedicated “Stonefort Trader” mobile app as stable, easy to use, and intuitive, simplifying the trading experience for both new and experienced users.

• Transparent IB Program: Introducing Brokers (IBs) have praised the partner portal for its real-time commission tracking, clear reporting, and reliable payouts, suggesting a well-structured partnership program.

It is important to include a disclaimer: *Please note that these reviews are marked as “Unverified” and reflect individual user experiences. They have not been independently validated and should be weighed carefully against the official regulatory information presented earlier.*

Understanding Contradictory Information

How should a potential trader process this conflicting information? The glowing reviews paint a picture of a service-oriented broker that excels in areas where many others fail. The regulatory warnings, however, paint a picture of a firm operating on questionable legal ground.

This raises a fundamental question: Do positive experiences with customer service and withdrawals reduce the risks associated with a broker that has been officially flagged for operating beyond the scope of its license?

From a risk management perspective, the answer must be no. While good service, fast payouts, and a user-friendly platform are highly desirable, they are secondary features. The primary, non-negotiable foundation of a brokerage relationship is regulatory compliance and the security of funds it guarantees. Excellent service from an unregulated or improperly regulated entity provides no protection if the firm becomes insolvent or engages in fraudulent activity. The positive reviews may be genuine experiences, but they do not and cannot outweigh the fundamental risk posed by the broker's regulatory status.

Final Verdict and Recommendation

After a detailed examination of Stonefort's regulatory standing, trading conditions, and user feedback, we can now combine these findings into a final, balanced verdict. This summary aims to help you make an informed decision based on a clear assessment of the risks and potential benefits.

Summary of Pros and Cons

To provide a quick overview, here is a breakdown of Stonefort's key strengths and weaknesses.

Pros:

• Uses the powerful and stable full-licensed MetaTrader 5 (MT5) platform.

• Features many positive (though unverified) user reviews that praise withdrawal speed and customer support quality.

• Offers a dedicated mobile trading app, “Stonefort Trader,” for trading on the go.

Cons:

• A major regulatory red flag: The broker has been officially warned for operating beyond the scope of its UAE SCA Investment Advisory license, meaning it is not licensed for the forex trading services it offers.

• An explicit “Low score, please stay away!” warning has been issued by a third-party reviewer, indicating a high level of perceived risk.

• An extremely high minimum deposit of $10,000 for its entry-level account creates a significant barrier to entry.

• A relatively short operating history of 1-2 years provides a limited track record of stability and reliability.

• A lack of transparency regarding the specifications of its “Advanced” and “Elite” account types.

• Registered in an offshore location (Saint Lucia), which typically offers weaker investor protection than top-tier regulators.

Final Thoughts for Traders

The evidence presents a clear conclusion. The regulatory warnings surrounding Stonefort Securities are too significant to ignore. Operating outside its licensed authority is not a minor violation; it strikes at the very core of a broker's legitimacy and a trader's financial security. The protections, oversight, and legal recourse that come with proper regulation are absent when a firm operates beyond its mandate.

While the positive user feedback on service and withdrawals is noted, it exists in a separate category from fundamental safety. Good customer service cannot substitute for a sound regulatory foundation. Therefore, we strongly advise any trader considering Stonefort to exercise extreme caution. The risks associated with the firm's regulatory status appear to far outweigh the reported service benefits. Before depositing any funds, conduct your own exhaustive due diligence. You can find the latest regulatory updates and a complete profile by searching for stonefort Broker on WikiFX.

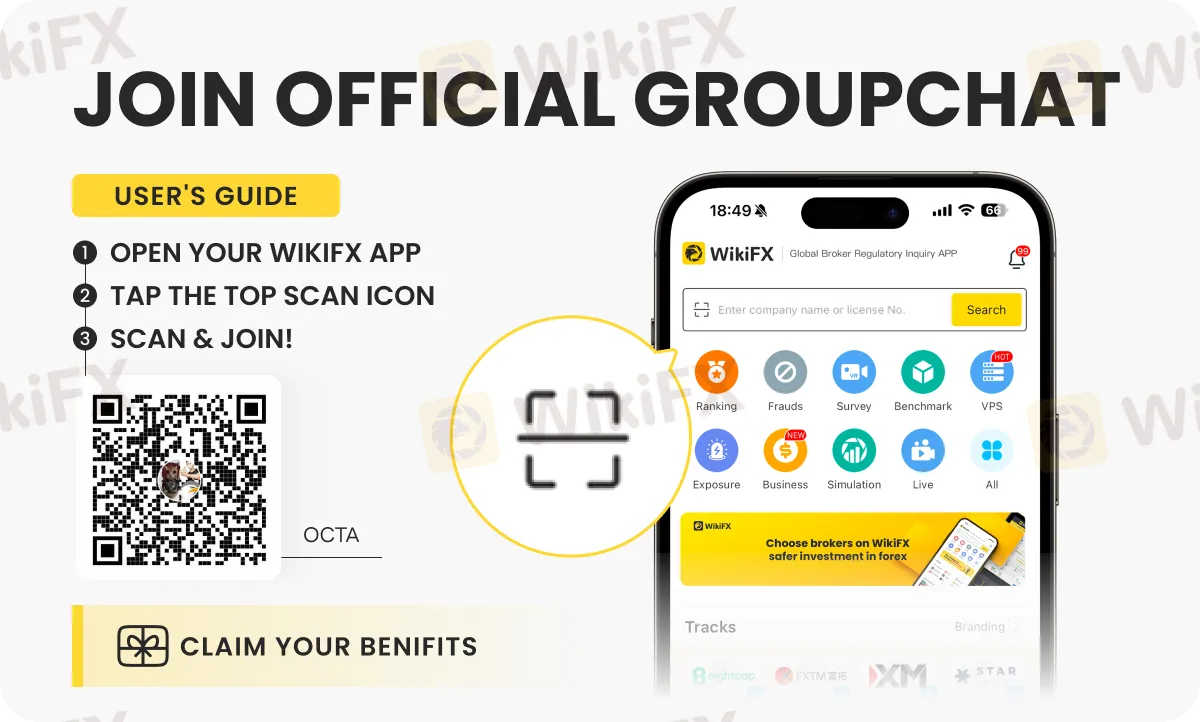

We have created an official Octa Broker community! Join it Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Currency Calculator