简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG USDJPY Market Report November 10, 2025

Abstract:USDJPY traded around 153.77, rebounding from last weeks low near 152.80 as the dollar regained traction amid firmer U.S. yields. The pair extended its intraday recovery after breaking the 50% Fibonacc

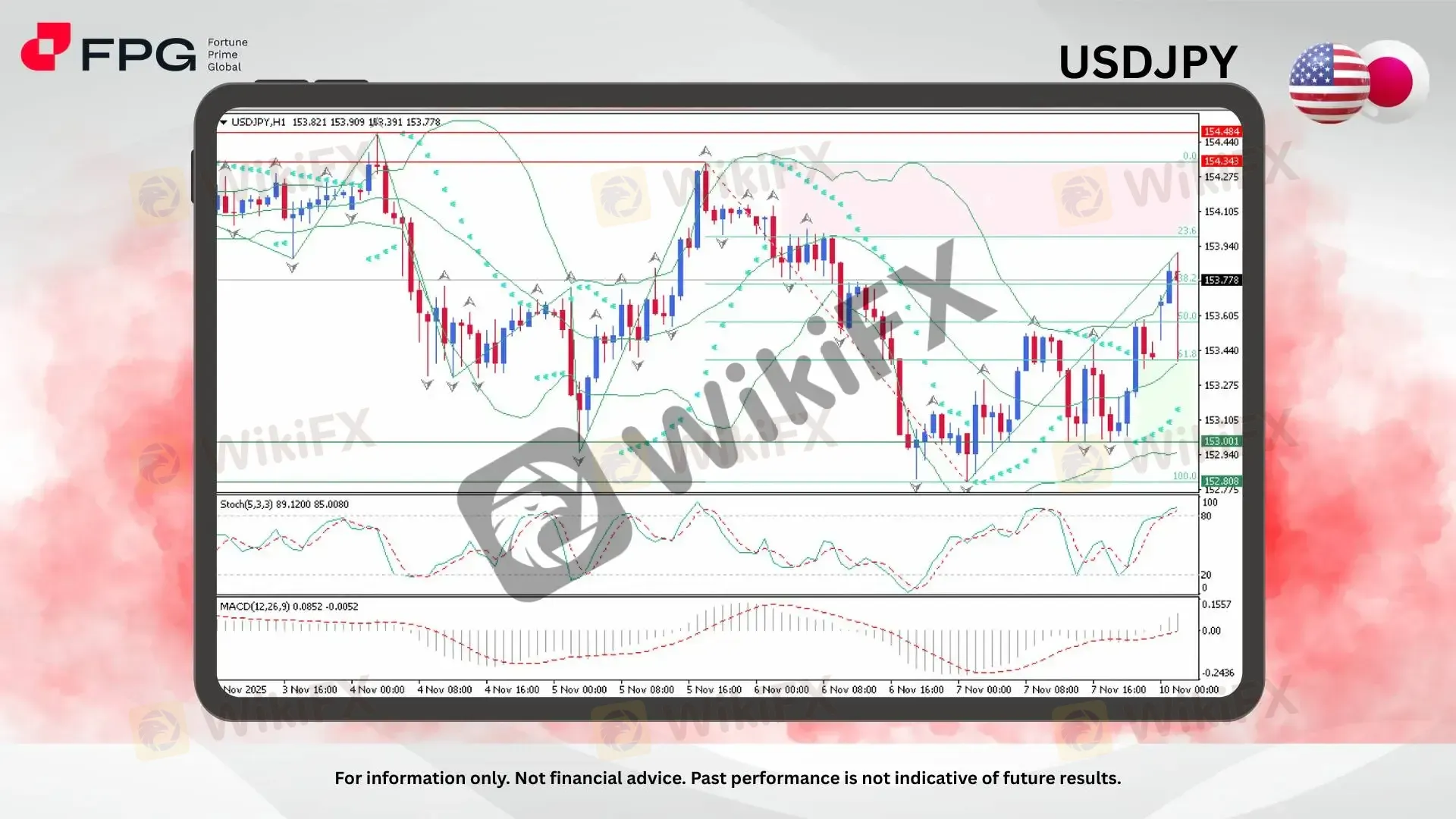

USDJPY traded around 153.77, rebounding from last weeks low near 152.80 as the dollar regained traction amid firmer U.S. yields. The pair extended its intraday recovery after breaking the 50% Fibonacci retracement level, signaling renewed bullish momentum. However, upside movement remains capped below the 154.34–154.48 resistance zone, keeping short-term traders cautious about potential pullbacks within the range-bound structure.

From a structural view, USDJPY continues to oscillate within a corrective range but shows strengthening momentum as prices approach the upper Bollinger Band. The pair has broken the 38.2% and 50% Fibonacci retracement zones, suggesting buyers are regaining short-term control. The Parabolic SAR dots have flipped below the candles, reinforcing the current bullish bias, though the upper Bollinger Band near 153.94 poses a near-term hurdle.

Momentum indicators confirm the recovery phase but also hint at an overheated market. The Stochastic Oscillator (5,3,3) stands high at 89.12 and 85.00, entering overbought territory and warning of possible exhaustion. Meanwhile, the MACD (12,26,9) shows a positive histogram and a bullish crossover, supporting continued upside in the near term before a potential corrective pullback.

Market Observation & Strategy Advice

1. Current Position: USDJPY traded around 153.77, showing bullish continuation after reclaiming the mid-range zone.

2. Resistance Zone: The key resistance sits at 154.34–154.48, aligning with the upper Bollinger Band and previous swing highs.

3. Support Zone: Immediate support lies at 153.00, followed by a stronger base at 152.80, marking the recent local low.

4 Indicators: Stochastic indicates overbought conditions, while MACD supports short-term bullish momentum.The bias remains mildly bullish toward 154.30–154.50, but overbought signals suggest a possible retracement back to 153.20–153.00 if price fails to sustain above 153.80.

5. Trading Strategy Suggestions:

Buy on Dips: Consider long positions near 153.20–153.00 targeting 154.30–154.40, with stops below 152.80.

Sell Near Resistance: Short positions can be considered around 154.40, targeting 153.30–153.00 if reversal signals appear.

Risk Management: Tighten stops on both sides as volatility may increase with U.S. inflation data releases later this week.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1555 −0.05%

GBP/USD 1.3146 −0.12%

Today's Key Economic Calendar:

JP: BoJ Summary of Opinions

JP: BoJ Nakagawa Speech

CA: BoC Market Participants Survey

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Currency Calculator