简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG GBPUSD Market Report November 17, 2025

Abstract:GBPUSD on the H4 chart shows a clear transition from a strong bearish trend into a broader consolidation phase. After the pair bottomed near the 1.3007 support zone, buyers stepped in, triggering a no

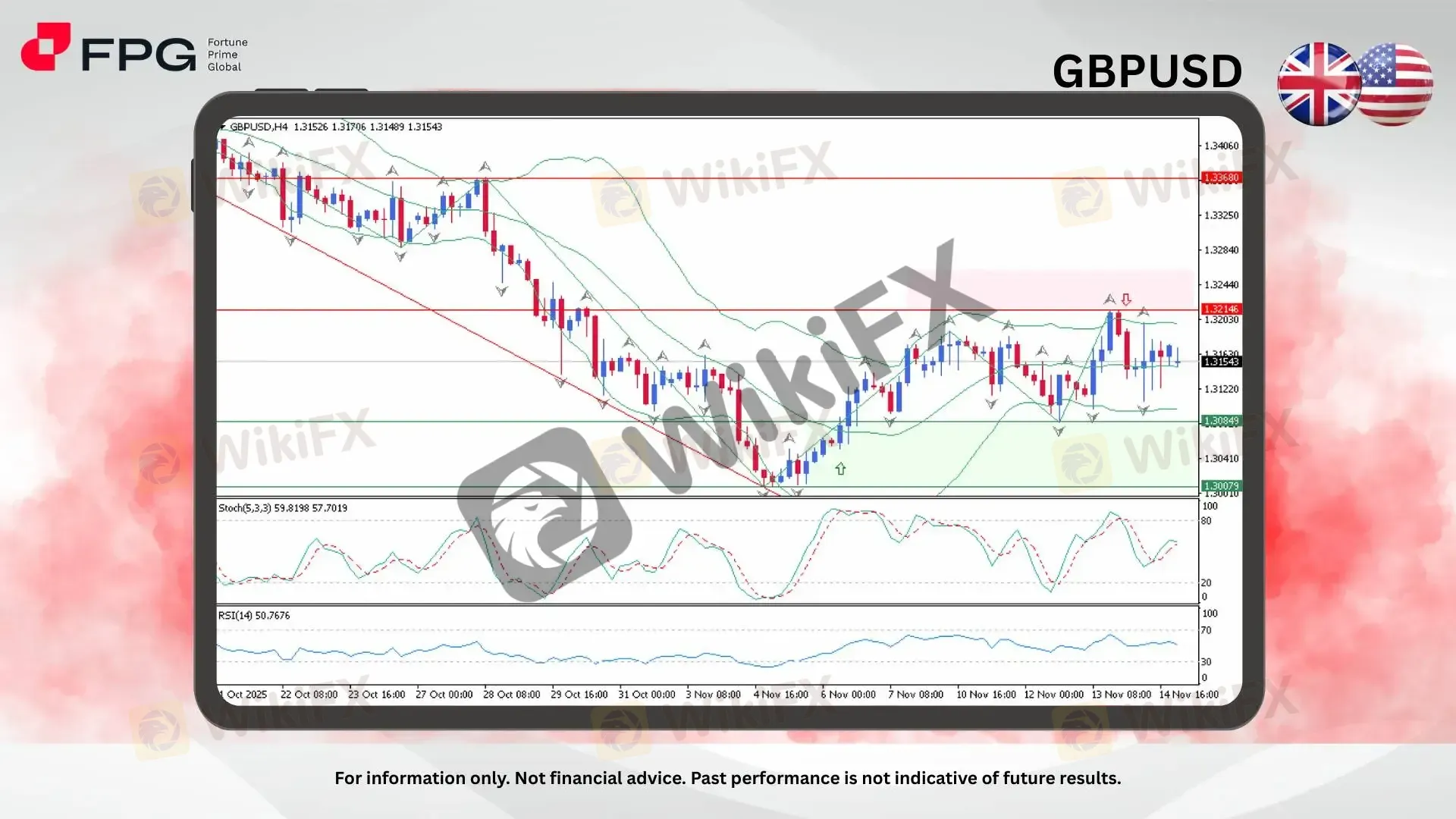

GBPUSD on the H4 chart shows a clear transition from a strong bearish trend into a broader consolidation phase. After the pair bottomed near the 1.3007 support zone, buyers stepped in, triggering a notable rebound and shifting price action into a sideways structure. Since then, the market has been oscillating between 1.3085 support and 1.3214 resistance, reflecting indecision as neither bulls nor bears have established strong dominance. Current price action around 1.3150 indicates reduced momentum but steady bullish attempts to retest the upper boundary of the range.

Bollinger Bands have tightened, suggesting decreasing volatility compared to earlier periods, while the mid-band continues to provide dynamic support during minor pullbacks. Stochastic Oscillator is hovering around mid-levels, showing mild bullish rotation but no overbought signal, confirming a balanced market. RSI(14) is positioned near the 50 level, reinforcing the neutral sentiment. Despite the lack of strong directional conviction, candles continue forming higher lows above 1.3085, signaling underlying buying interest even within the choppy environment.

The key area to watch remains the 1.3214 resistance, marked by repeated rejections and a visible supply zone where sellers have previously regained control. A clear breakout above this level could revive bullish momentum and open room toward 1.3368. Conversely, failure to break higher—combined with weakening oscillators—may trigger another rotation back toward 1.3085 support. Until then, traders can expect continued range-bound movement with intraday swings offering tactical opportunities.

Market Observation & Strategy Advice

1. Current Position: GBPUSD is trading around 1.3150, moving within a horizontal consolidation zone after recovering from its recent low near 1.3007.

2. Resistance Zone: Strong resistance is located at 1.3214, where repeated rejections and a visible supply area continue to cap bullish momentum.

3. Support Zone: Key support sits at 1.3085, followed by deeper support at 1.3007, both levels where buyers previously stepped in strongly.

4. Indicators: Bollinger Bands are narrowing, Stochastic is rotating upward from mid-levels, and RSI remains near neutral at 50—signaling equilibrium and reduced volatility within the range.

5. Trading Strategy Suggestions:

Buy on Dips: Consider long positions if price retraces toward 1.3085 with bullish candles or indicator alignment.

Breakout Confirmation: Only pursue strong buys if 1.3214 is decisively broken with momentum and volume.

Reversal Opportunity: Watch for bearish rejection patterns near 1.3214 as potential short setups within the ongoing range.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1607 −0.12%

USD/JPY 154.61 +0.06%

Today's Key Economic Calendar:

JP: GDP Growth Annualized Prel

JP: GDP Growth Rate QoQ Prel

CN: FDI (YTD) YoY

EU: European Commission Autumn Forecasts

CA: Inflation Rate MoM & YoY

US: NY Empire State Manufacturing Index

US: Fed Williams & Jefferson Speech

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Currency Calculator