Abstract:Did you find MT4 platform glitches while trading via S.A.M. Trade? Did these glitches disallow you from withdrawing your funds or making an internal transfer? Finding profit on the S.A.M. Trade login, but cannot access it for weeks? Did you fail to withdraw because the authorities found the broker suspicious during their investigation? Have you faced increased trading costs due to manipulated spreads? Many traders have expressed similar concerns while sharing the broker’s review online. In this article, we have decoded S.A.M. Trade reviews. Take a look!

Did you find MT4 platform glitches while trading via S.A.M. Trade? Did these glitches disallow you from withdrawing your funds or making an internal transfer? Finding profit on the S.A.M. Trade login, but cannot access it for weeks? Did you fail to withdraw because the authorities found the broker suspicious during their investigation? Have you faced increased trading costs due to manipulated spreads? Many traders have expressed similar concerns while sharing the brokers review online. In this article, we have decoded S.A.M. Trade reviews. Take a look!

Explaining the Top Complaints Against S.A.M. Trade

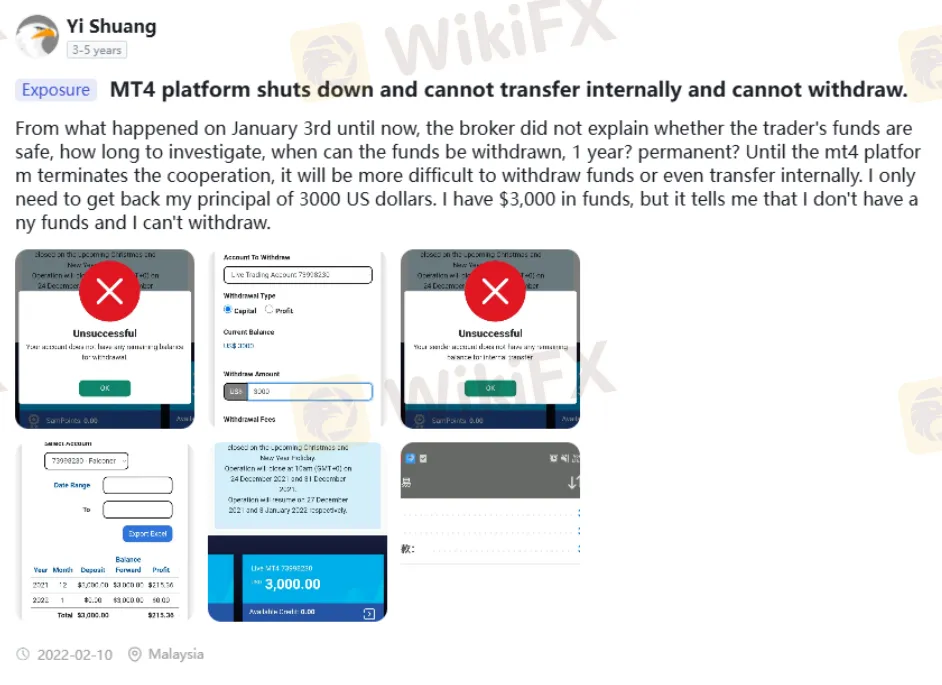

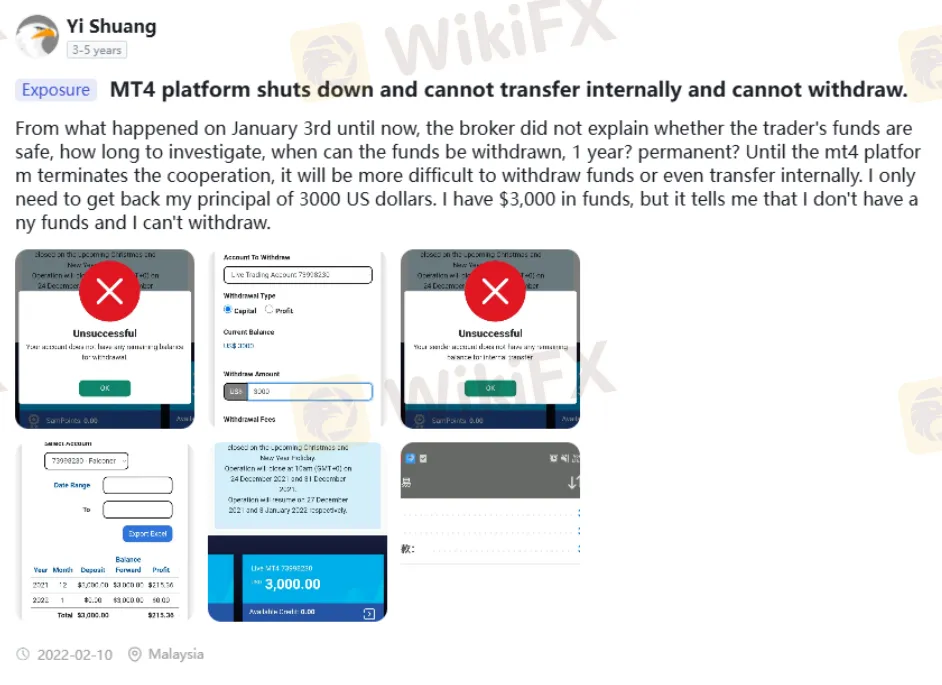

S.A.M Trade Fund Withdrawal Transfer Issues Amid MT4 Platform Glitches

A trader reported that, as the MT4 platform was shut down, confusion surrounded traders. Because S.A.M. Trade did not assure traders about their capital safety. The trader openly expressed the difficulty experienced while accessing withdrawals and making fund transfers. Sounding worried about the situation, the trader remained confused about whether he would be able to withdraw capital worth 3,000 USD.

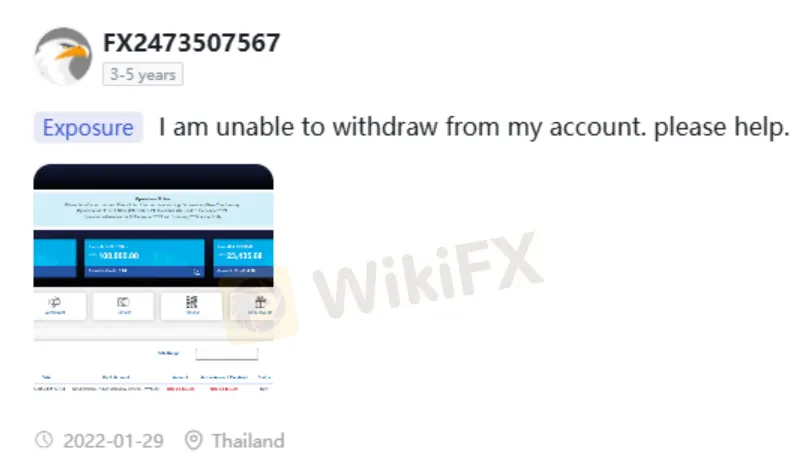

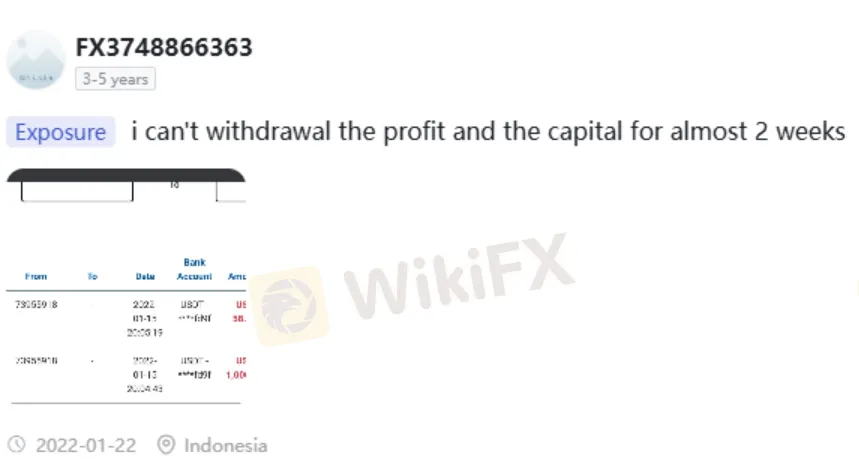

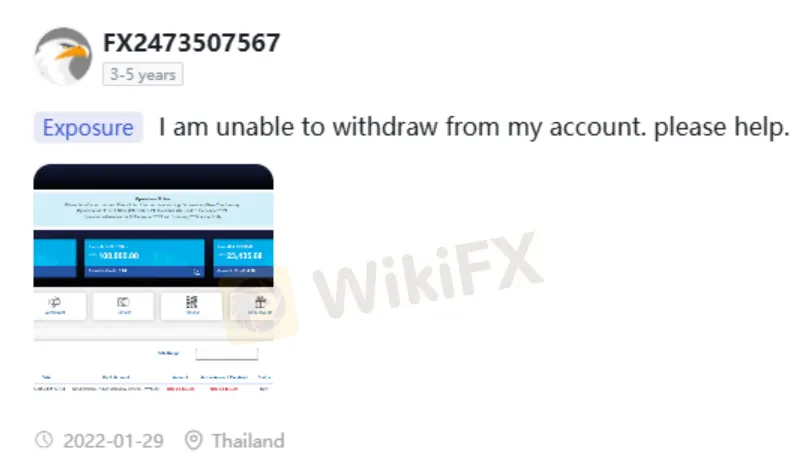

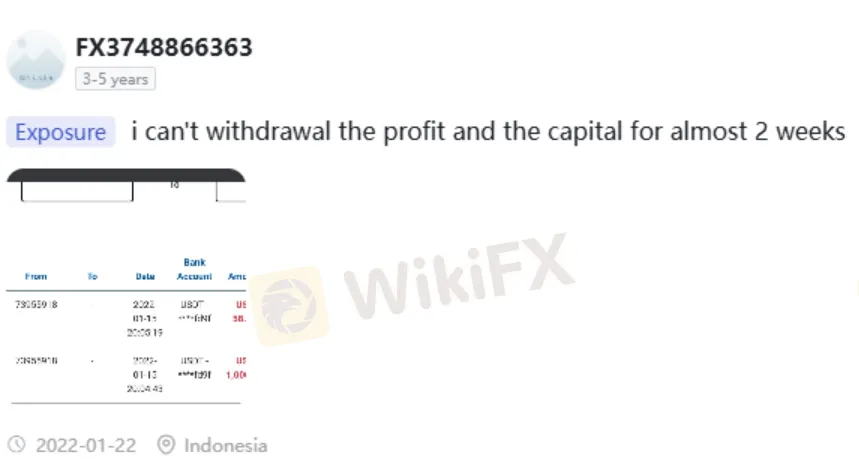

The List of Withdrawal Denial Cases Against S.A.M. Trade

Similar to brokers accused of scams, S.A.M. Trade blocks withdrawal access for many of its clients, with some waiting haplessly for weeks or more. Here are multiple fund withdrawal-related complaint screenshots.

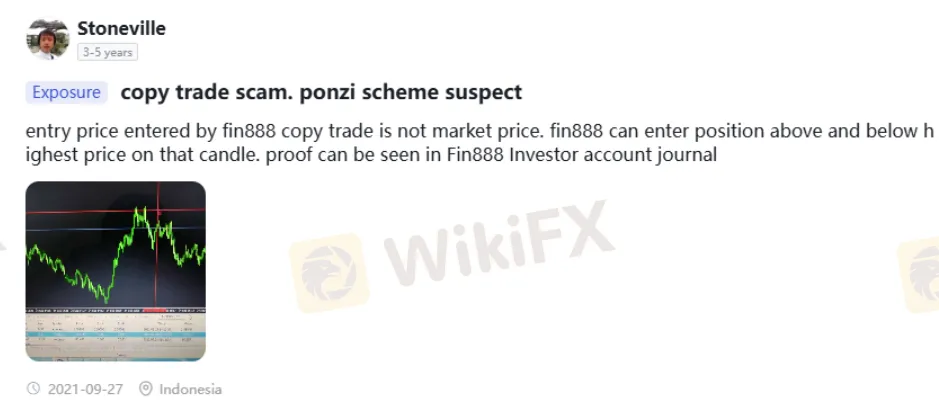

The Costly Trade Order Execution Error

A trader alleged that the trading system service provided by the broker does not execute the trade order at the market price. Depending on the situation, the system can enter the position below or above the highest market price. Given the rampant trade execution errors, the trader shared the S.A.M. Trade review through this complaint.

The Poor S.A.M. Trade Customer Support Service Complaint

While many face withdrawal-related issues, as highlighted through the complaints above, one trader did not face any such issues. However, the trader did not receive good and fast responses from the customer support service team. As per the trader‘s admission, the lack of effective service caused a delay in trade order executions. The screenshot below aptly describes the trader’s complaint.

High Service Fee & Manipulated Spreads

A trader alleged that the broker charged him a high service fee while manipulating spreads to widen trading costs. He further reported difficulties in accessing fund withdrawals. Here is the complaint wording and the trading figures the trader found on the S.A.M. Trade login.

S.A.M. Trade Review by WikiFX: Score & Regulatory Status

After screening the complaints, the WikiFX team thought it was time to investigate the Saint Vincent and the Grenadines-based forex broker thoroughly on several aspects, including the regulatory supervision status. The findings reveal a no license for S.A.M. Trade, proving why its traders face trading hassles. As a result, the team could give the broker a score of just 1.60 out of 10.

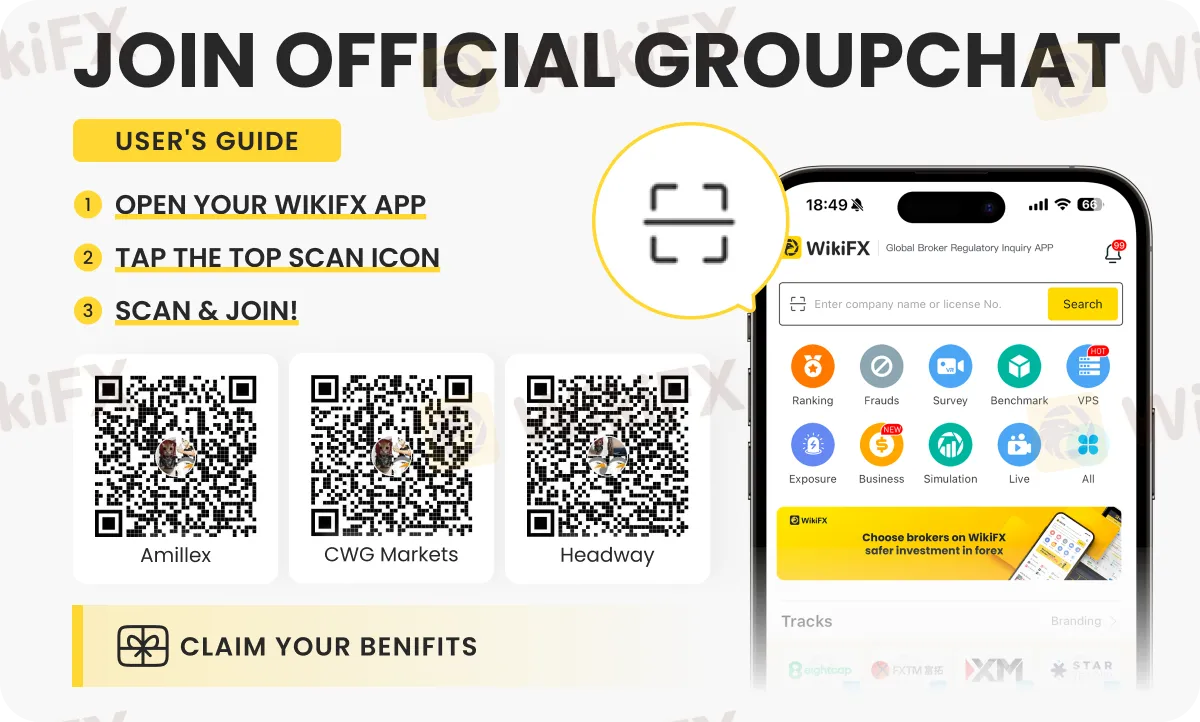

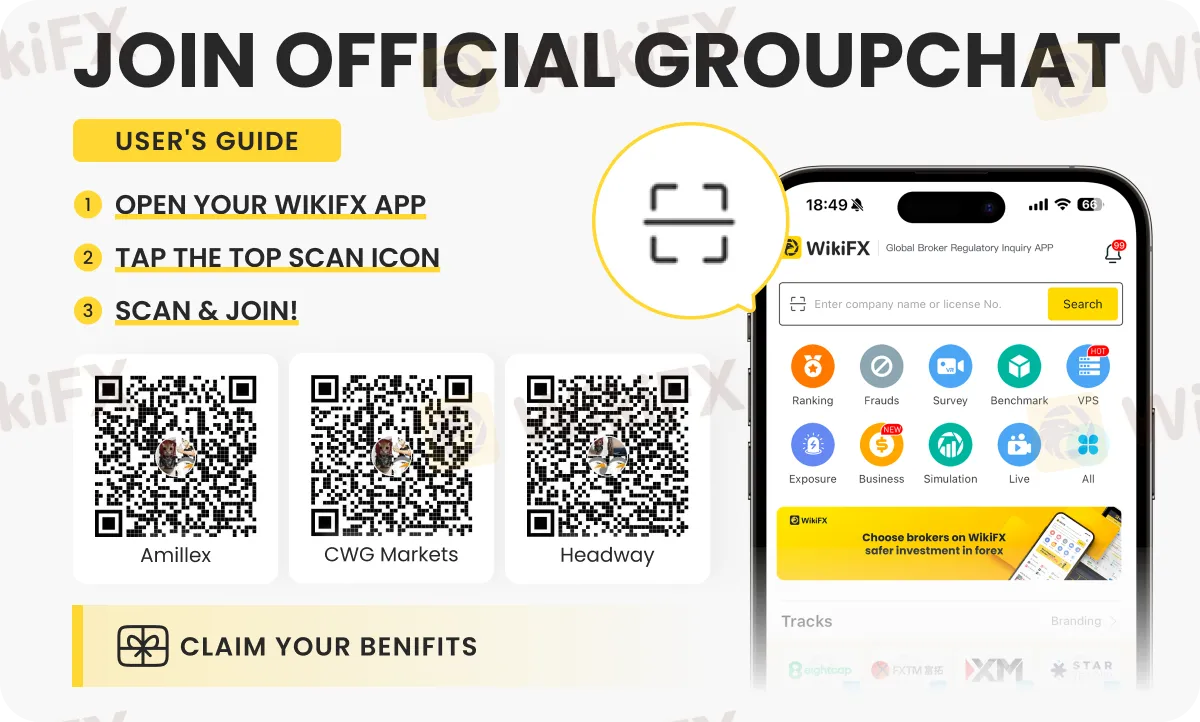

Checking the latest forex updates is easy on any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join these by following the instructions shown below.