简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

She Made One Click, and RM914,750 Was Gone Entirely!

Abstract:A 40-year-old lecturer tapped on an advertisement that promised quick profits through online stock trading and lost nearly RM1 million!

A 40-year-old lecturer, scrolling through social media, tapped on an advertisement that promised quick profits through online stock trading. She had no idea that this simple action would lead her into a well-planned scam that would eventually cost her almost RM1 million.

The ad she saw on 28 July looked convincing. It offered stock trading lessons through an app and claimed users could earn returns within minutes. Curious and hopeful, she followed the link. Soon, she was speaking to someone on WhatsApp who claimed to be an investment representative. He spoke confidently and told her the system was safe, simple, and highly profitable.

She was instructed to download an app through a link he sent. After setting up what she believed was an investment account, she started transferring money. The suspect told her the more she invested, the more she could earn.

From 1 September to 18 October, the transfers continued. They became larger and more frequent. In total, she made 20 payments into nine different bank accounts. The amount reached RM914,758.82. She waited for the promised profits, checking her phone constantly. But nothing came.

Then the tone of the messages changed. The suspect claimed she needed to pay an extra RM20,000 as a quarterly fee before her earnings could be released. It was at this moment that she finally realised something was wrong. The profits she had been promised were never going to appear.

WikiFX urges readers to read this important article:

On 23 November, she lodged a police report in Jasin. Investigators confirmed that the entire scheme was a scam. They found that the use of personal bank accounts, the promise of fast returns, and the reliance on WhatsApp messages were all clear signs of fraud. The case is now being investigated under Section 420 of the Penal Code for cheating.

Police said the lecturers experience is a warning to the public. Many scammers today use social media ads and fake apps to look trustworthy. They know that people searching for investment opportunities often want quick results, and they use that to their advantage.

Scams like this are becoming more common as online trading grows. Fraudsters create platforms that look real, use convincing language, and push victims to invest more money over time. Once the funds are transferred, they disappear.

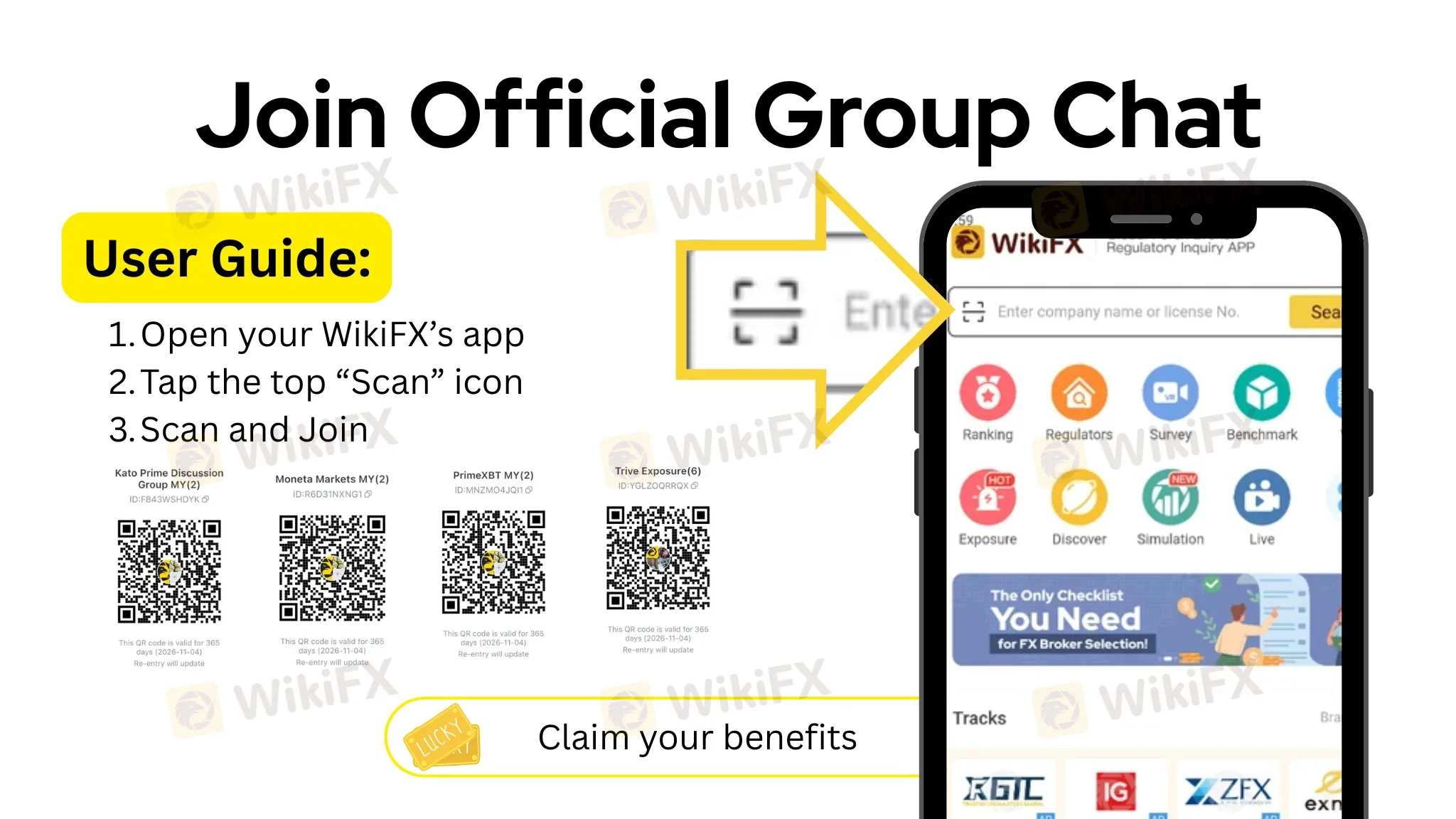

Experts say that anyone considering an online investment should always check whether the platform is licensed and regulated. One tool that can help is the WikiFX mobile app, available on Google Play and the App Store. It allows users to look up brokers, see their regulatory status, read reviews, and check safety ratings. This helps investors avoid unlicensed platforms and understand the risks before committing their money.

For the lecturer, the lesson came too late. What started as a hope for better financial security turned into a devastating loss. Her story is a reminder that online opportunities can be dangerous when they seem too easy or too profitable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator