Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:IUX (also known as IUX Markets) is a forex and CFD broker established in 2019 with its headquarters in Mauritius. The broker has gained visibility in regions such as the UAE, Australia, Brazil, and parts of Europe, achieving a WikiFX Score of 6.08. While the broker holds licenses from reputable authorities like ASIC and FSCA, recent data indicates a significant volume of user complaints regarding fund security and operational issues.

IUX (also known as IUX Markets) is a forex and CFD broker established in 2019 with its headquarters in Mauritius. The broker has gained visibility in regions such as the UAE, Australia, Brazil, and parts of Europe, achieving a WikiFX Score of 6.08. While the broker holds licenses from reputable authorities like ASIC and FSCA, recent data indicates a significant volume of user complaints regarding fund security and operational issues.

This review analyzes the brokers regulatory framework, trading conditions, and the serious exposure regarding withdrawal delays reported by users in 2024 and 2025.

The most important factor in assessing a broker is its regulatory oversight. IUX currently holds licenses from two major financial authorities. However, investors should also be aware of negative disclosures from other regulatory bodies.

| Regulator | Country | License Details | Status |

|---|---|---|---|

| ASIC (Australian Securities & Investments Commission) | Australia | License No. 529610 | Regulated |

| FSCA (Financial Sector Conduct Authority) | South Africa | License No. 53103 | Regulated |

Despite holding Tier-1 regulation in Australia, IUX has faced scrutiny in other jurisdictions. Data from the Cyprus Securities and Exchange Commission (CySEC) indicates negative disclosures. In 2025, CySEC issued warnings regarding unauthorized entities associated with IUX domains (e.g., iux.com), placing them on a warning list/blacklist for offering investment services without local authorization.

While the ASIC and FSCA licenses provide a level of legitimacy, the cross-border warnings suggest that traders outside of the protected jurisdictions should exercise caution.

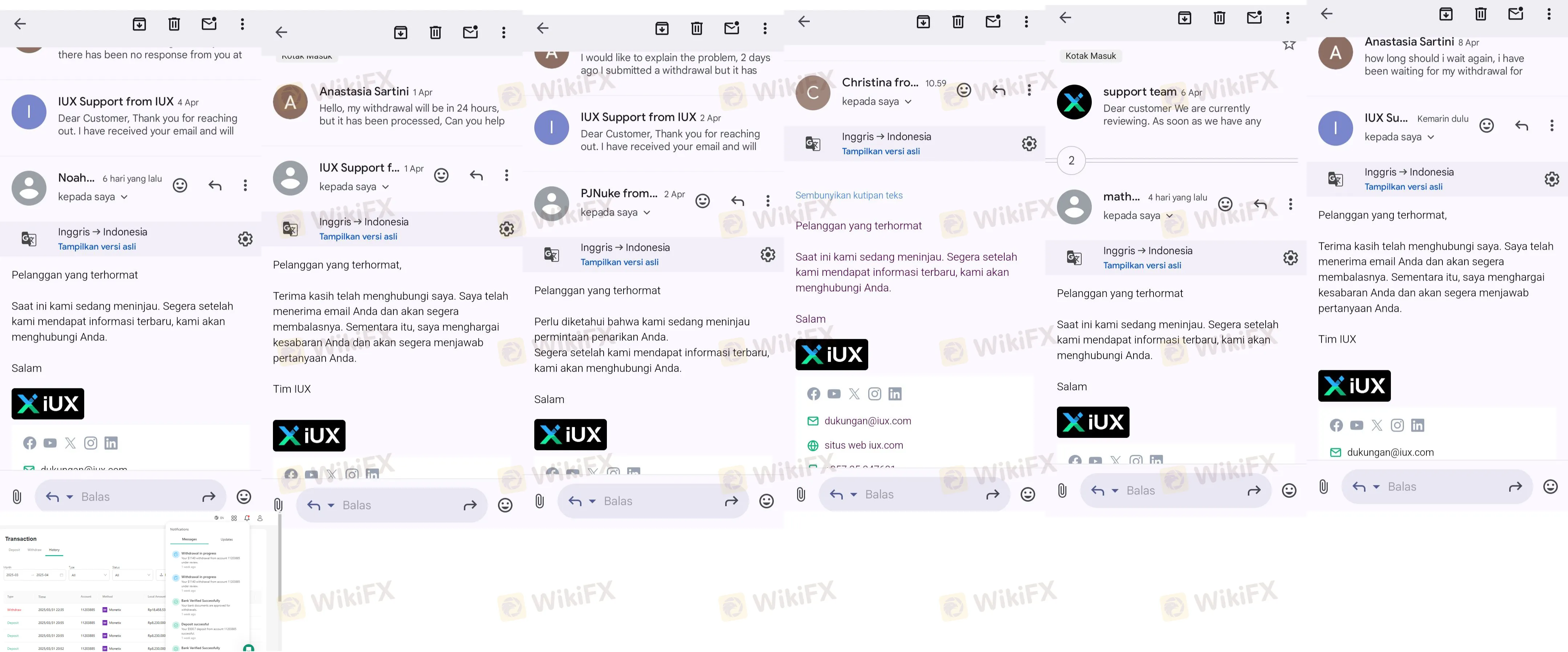

Although the broker opens accounts easily and supports digital processes, the user feedback regarding post-trading operations is concerning. Over the last three months, there have been 19 reported complaints, with a total of nearly 30 specific cases detalied in the data.

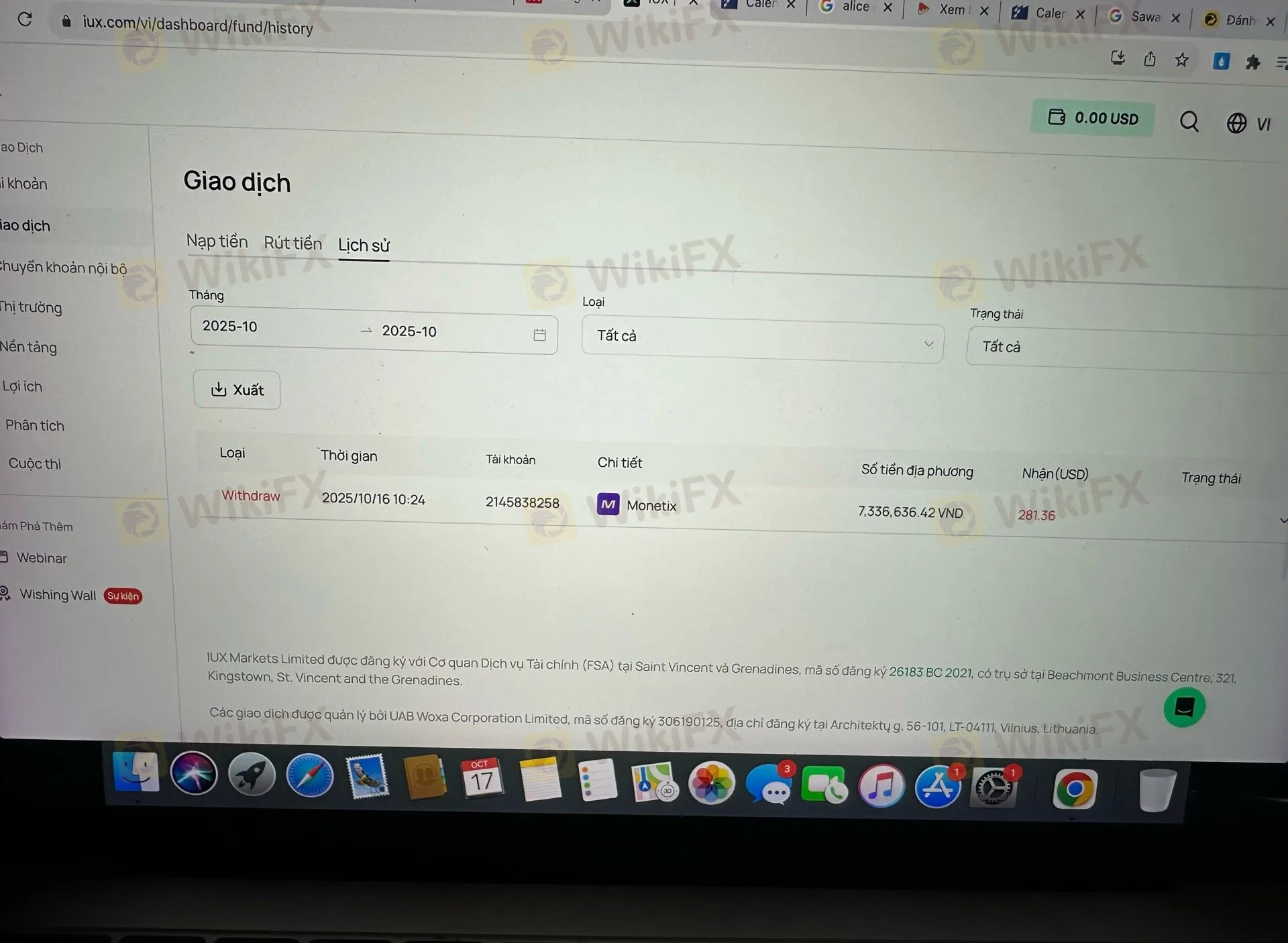

1. Persistent Withdrawal Delays

The majority of complaints hail from Vietnam, Indonesia, Thailand, and India. Users consistently report that withdrawals remain in a “Pending” or “Processing” state for extended periods—ranging from several days to over two weeks.

Case Example (Indonesia): A user attempting to withdraw $1,140 waited over 10 days. Despite daily complaints, the status remained pending.

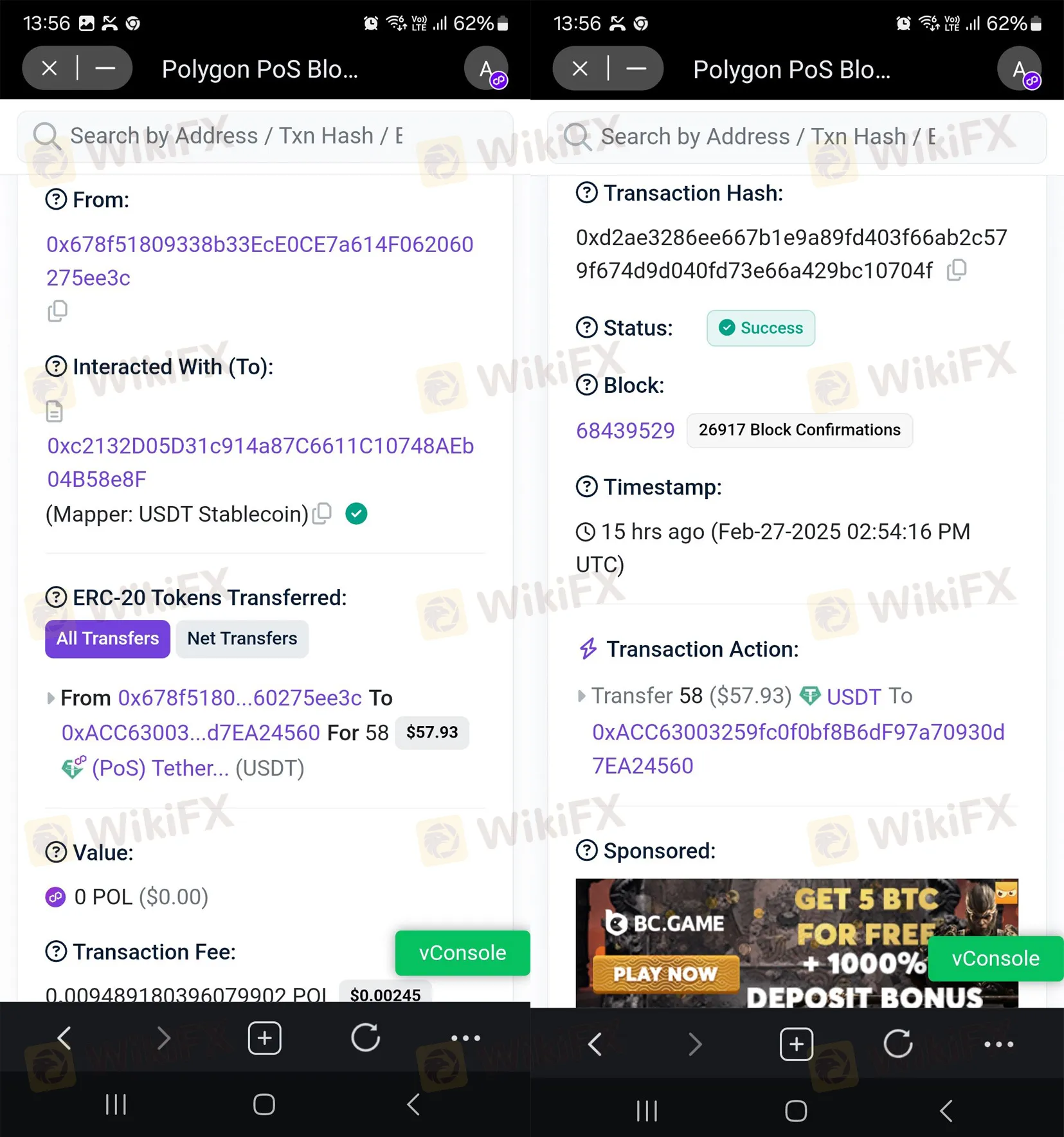

2. Deposit Issues (Crypto)

Several traders reported issues with cryptocurrency deposits, specifically USDT.

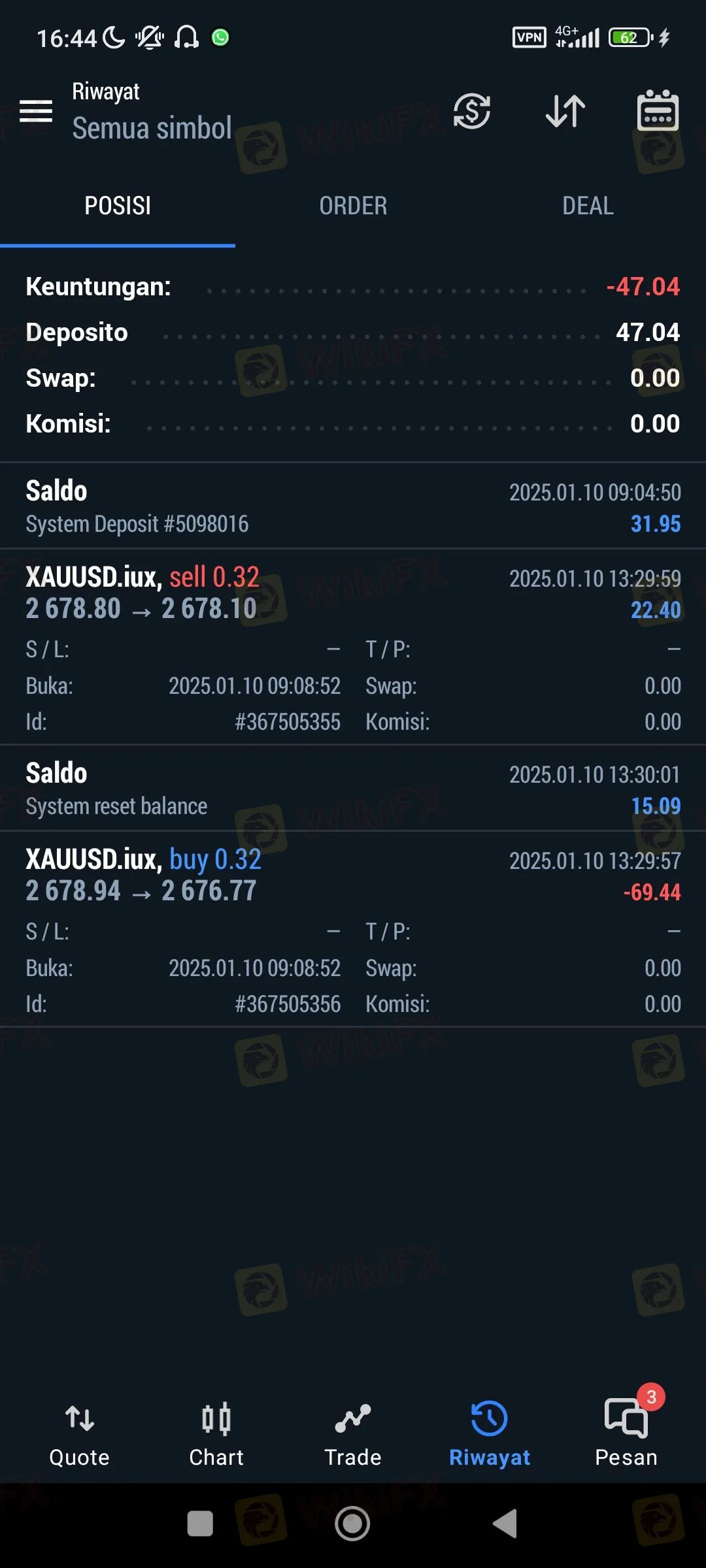

3. Account Blocking and Profit Cancellation

More severe allegations involve the deletion of profits and account locking.

4. Slippage and Price Execution

Users from Indonesia have reported unnatural price closing. One user noted their Buy position was closed at a price lower than the market rate during stable conditions, resulting in an unfair loss.

For traders who can overlook the operational risks, IUX offers competitive trading conditions characterized by very high leverage and low entry barriers.

IUX offers three main account types. All accounts are swap-free capable (“transactionType”: null, but implies Islamic/standard structures often have this) and support Expert Advisors (EAs) and Scalping.

| Account Type | Minimum Deposit | Spread From | Commission |

|---|---|---|---|

| Standard | $10 | 0.2 pips | None/Low |

| Professional | $500 | 0.1 pips | None/Low |

| Raw | $500 | 0.0 pips | Commission applies |

Pros

Cons

IUX presents a complex profile. On paper, it appears legitimate due to its ASIC and FSCA licenses and a reasonable WikiFX score of 6.08. However, the practical experience of traders paints a different picture. The overwhelming number of recent complaints regarding unprocessed withdrawals, missing deposits, and account closures suggests significant operational risks.

The regulatory warnings from CySEC further indicate that the broker may be operating aggressively in jurisdictions where it lacks authorization. While the trading conditions (high leverage, low spreads) are attractive, the risk of being unable to withdraw profits is a critical concern.

Recommendation: Traders are advised to proceed with extreme caution. The high leverage combined with substantiated reports of withdrawal blocks makes this a high-risk broker for holding significant capital.

Ensure you protect your capital by checking the latest broker reports and complaints on the WikiFX App before opening an account.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.