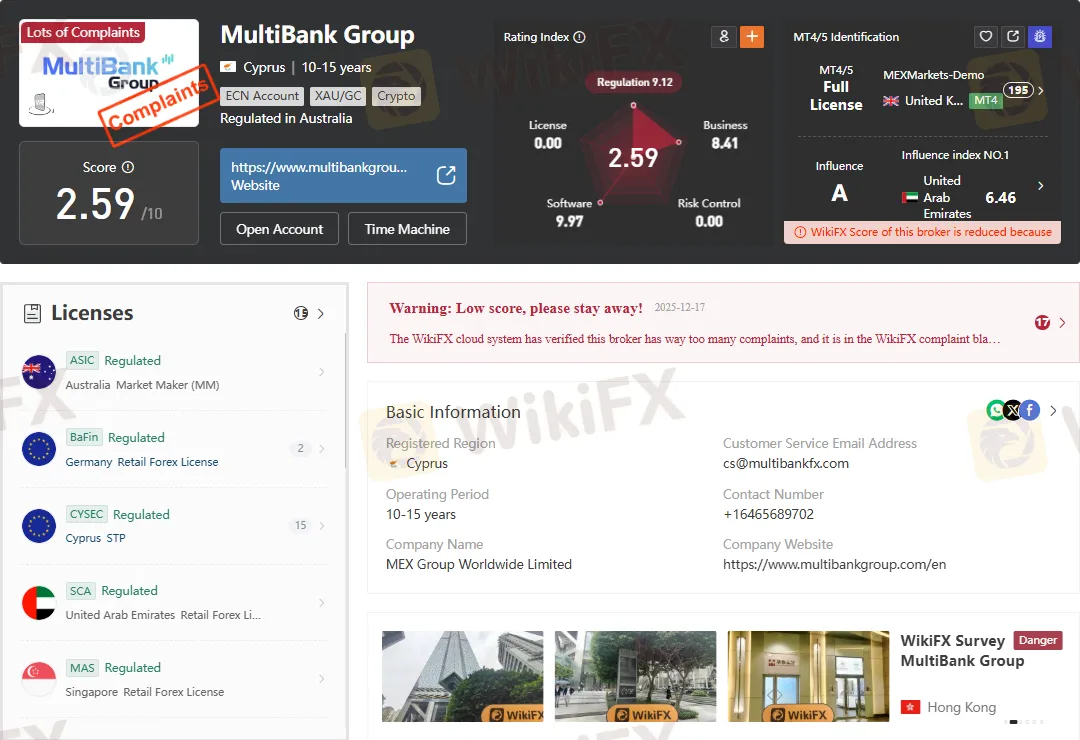

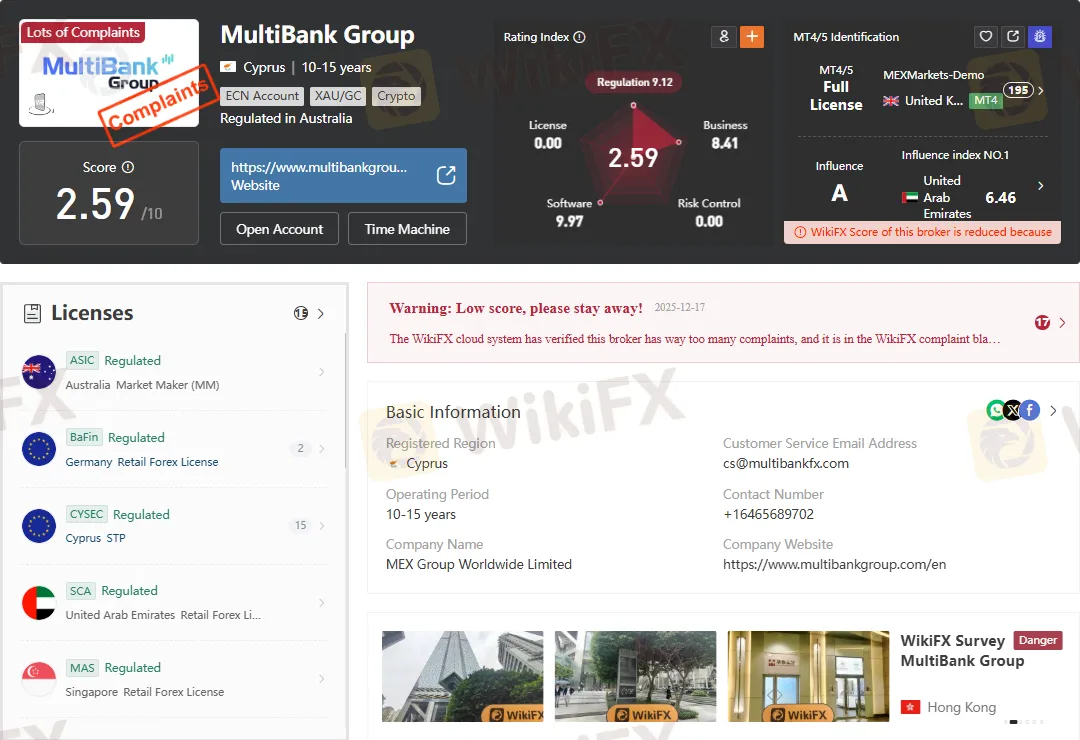

Abstract:Multibank Group broker review: regulated in Cyprus, Australia, and Germany, but facing revoked licenses and severe complaints.

Multibank Group Regulation: A Complex Global Footprint

Multibank Group presents itself as a multinational broker with a wide regulatory footprint. The attached regulatory records confirm licenses across several jurisdictions, including Cyprus (CySEC, License No. 430/23), Australia (ASIC, License No. 416279), and Germany (BaFin, License No. 10119375). These licenses provide the broker with legitimacy in key financial markets.

However, the same records reveal a troubling pattern: revoked authorizations in the United Kingdom (FCA, License No. 843796), Dubai (DFSA, License No. F004403), and the Cayman Islands (CIMA, License No. 1425303). This duality—regulated in some regions, stripped of licenses in others—raises questions about the brokers compliance consistency and long-term credibility.

Multibank Group Broker Offices: Verified and Unverified Claims

Investigations into physical office presence show mixed results.

- Singapore and Malaysia: Offices confirmed operational, with verified addresses in Telok Ayer Street (Singapore) and Jalan Damansara (Kuala Lumpur).

- United Kingdom and Hong Kong: No physical presence found despite claims, flagged as “Danger” by independent verification sources.

- Dubai: A 2021 inspection found no office, contradicting regulatory filings.

This inconsistency in office verification undermines transparency, a critical factor when evaluating any broker‘s legitimacy. Competitors such as IG Group and Saxo Bank maintain clear, verifiable headquarters, contrasting sharply with Multibank’s fragmented presence.

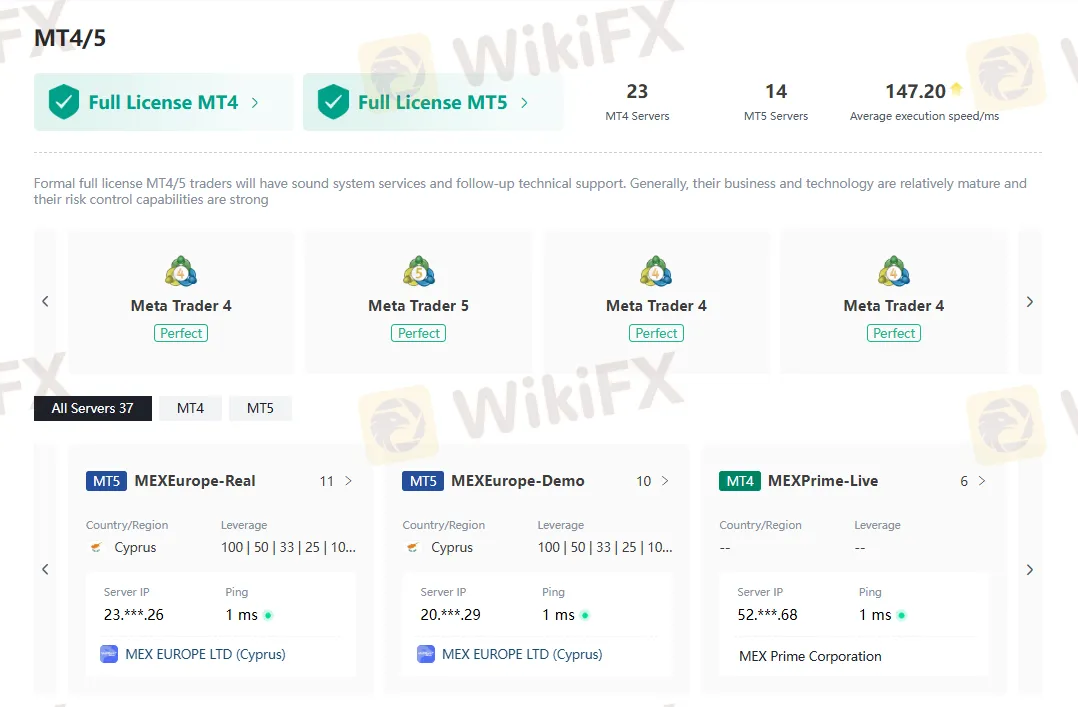

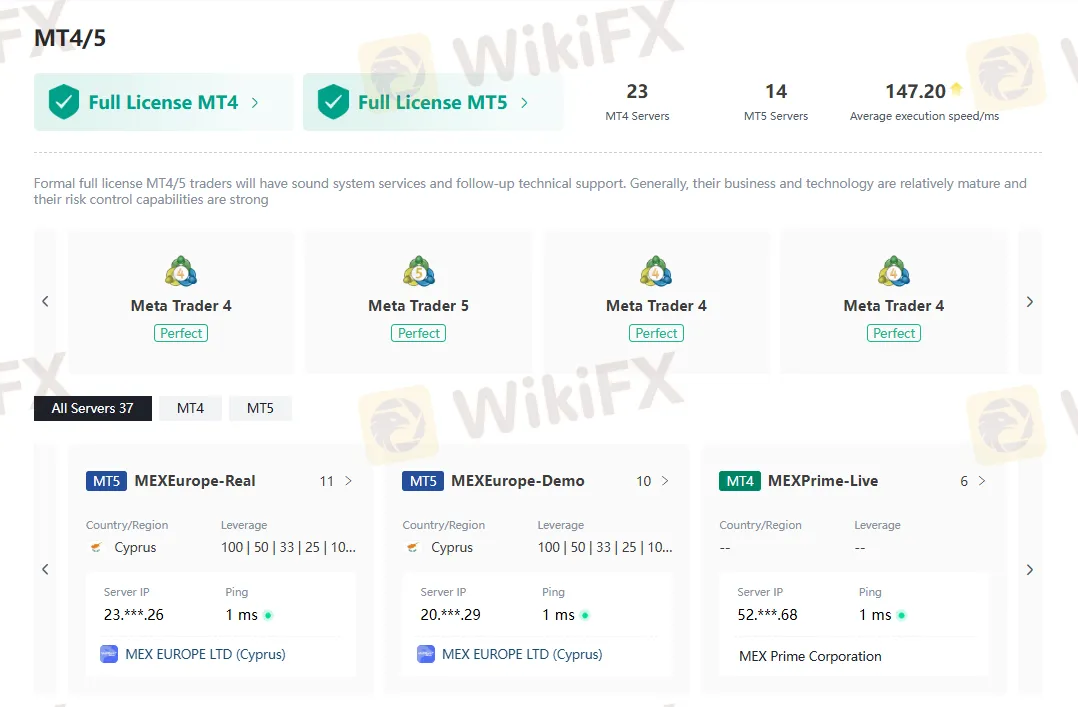

Trading Platforms and Technology

Multibank Group offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) under full licenses, with 23 MT4 servers and 14 MT5 servers. Execution speed averages 147 ms, which is competitive compared to industry standards.

Leverage offerings vary by jurisdiction, with Cyprus accounts showing ratios of 1:100, 1:50, 1:33, 1:25, and 1:10. While these options provide flexibility, they also raise risk concerns, particularly for retail traders.

Competitor brokers such as Pepperstone and IC Markets offer similar MT4/MT5 access but emphasize tighter spreads and faster execution, positioning themselves as more reliable alternatives for high-frequency traders.

Domain Registrations and Transparency

The broker operates multiple domains, including multibankgroup.com, mexeurope.com, and mexmarkets.com. Several domains are hosted in Hong Kong and the United States, with additional registrations under obscure names such as dtjrjt.com and mexjituan.com.

This fragmented domain strategy may confuse clients and complicate due diligence. By contrast, established brokers like OANDA or Interactive Brokers consolidate their digital presence under a single, transparent domain structure.

User Complaints and Exposure Cases

The attached records document 742 user reviews, with 736 classified as exposure cases. Complaints include:

- Withdrawal refusals, even for deposits without trading activity.

- Delays in order execution, leading to losses.

- Bonus disputes, where profitable traders were accused of “gambling” to avoid payouts.

- Account manipulation allegations, including unauthorized trades and deleted customer information.

These complaints are severe and consistent, suggesting systemic issues rather than isolated incidents. In comparison, regulated competitors such as CMC Markets or FXCM face far fewer exposure cases, reinforcing the perception that Multibank struggles with client trust.

Pros and Cons of Multibank Group Broker

Pros:

- Multiple regulatory licenses (CySEC, ASIC, BaFin, MAS).

- Full MT4/MT5 platform support with numerous servers.

- Wide leverage options across jurisdictions.

- Operational offices confirmed in Singapore and Malaysia.

Cons:

- Revoked licenses in FCA, DFSA, and CIMA.

- Numerous unresolved complaints regarding withdrawals and bonuses.

- Unverified or absent offices in major financial hubs (UK, Hong Kong, Dubai).

- Fragmented domain registrations are reducing transparency.

Comparative Context Against Competitors

When compared to brokers like IG Group, Saxo Bank, and Pepperstone, Multibank Group falls short in regulatory stability and client trust. While competitors emphasize transparency, consolidated branding, and consistent compliance, Multibanks revoked licenses and exposure cases highlight vulnerabilities.

Bottom Line: Multibank Group Regulation and Broker Standing

Multibank Groups regulatory footprint is broad but inconsistent. While licenses in Cyprus, Australia, Germany, and Singapore provide legitimacy, revoked authorizations in the UK, Dubai, and Cayman Islands cast a shadow over its credibility.

The brokers technology stack is competitive, offering full MT4/MT5 access, yet persistent complaints about withdrawals and account manipulation undermine its value proposition. Traders seeking reliability may find stronger safeguards with competitors that maintain consistent regulatory compliance and transparent operations.

Multibank Group remains a broker with notable reach but questionable reliability. Its regulatory standing is mixed, and its reputation is marred by severe client complaints. For traders prioritizing trust and transparency, caution is advised when considering this broker.