Abstract:Despite holding a recognized license in Hong Kong and maintaining a seemingly high score on some metrics due to its establishment year, the broker JRJR (金荣中国) has become the subject of an alarming volume of trader complaints. In the last three months alone, WikiFX has received over 141 individual complaints. The core risk isn't just market volatility—it is a systematic pattern of behavior that suggests trading conditions may be manipulated to ensure client losses, coupled with a refusal to process withdrawals for profitable accounts.

Is JRJR safe? Our investigation uncovers a disturbing pattern of severe slippage, frozen accounts, and withdrawal failures hiding behind a Hong Kong license.

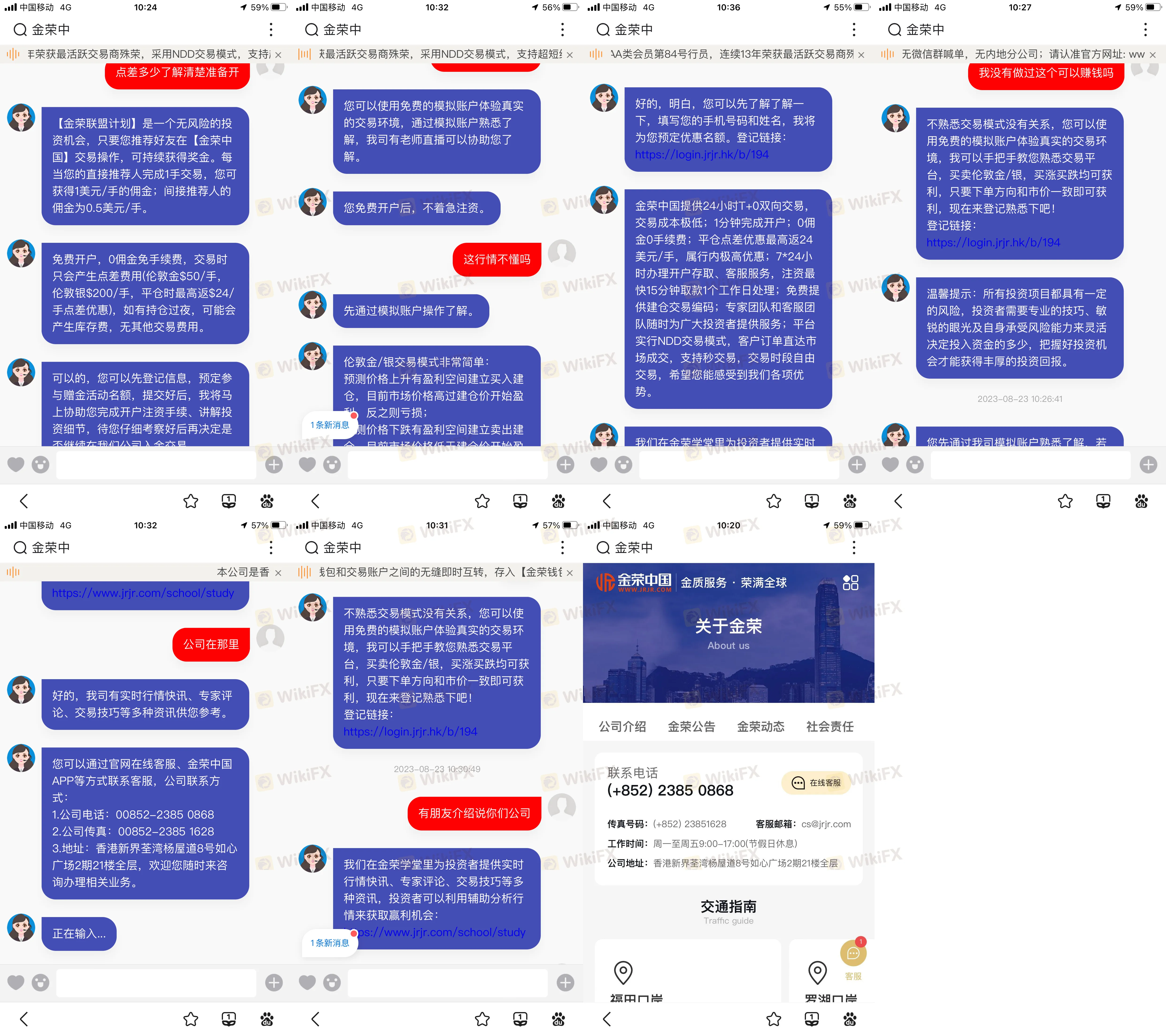

Despite holding a recognized license in Hong Kong and maintaining a seemingly high score on some metrics due to its establishment year, the broker JRJR (金荣中国) has become the subject of an alarming volume of trader complaints. In the last three months alone, WikiFX has received over 141 individual complaints. The core risk isn't just market volatility—it is a systematic pattern of behavior that suggests trading conditions may be manipulated to ensure client losses, coupled with a refusal to process withdrawals for profitable accounts.

Anonymity Disclaimer

All cases cited in this article are based on real records submitted to the WikiFX Exposure Center. To protect the privacy of the individuals involved, personal identities have been anonymized.

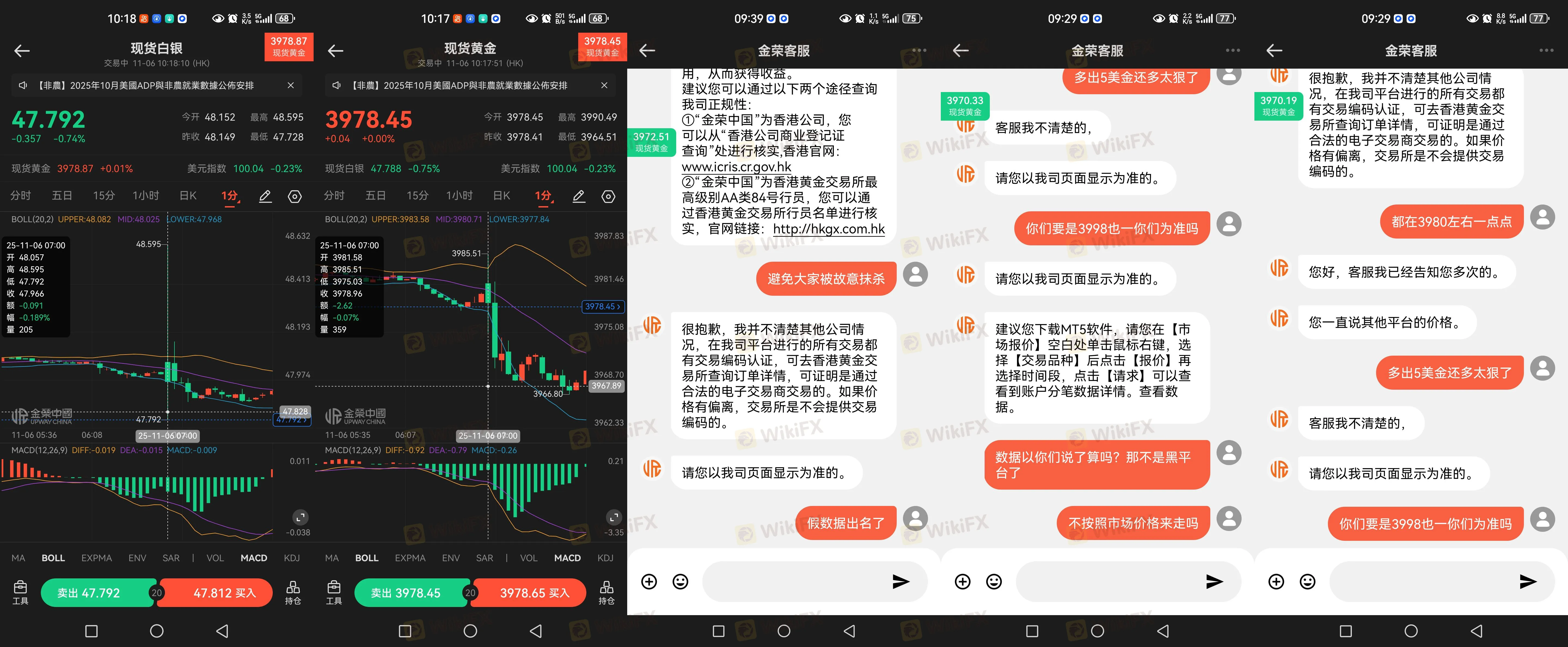

The “Phantom” Price Mechanism: Slippage and Forced Liquidation

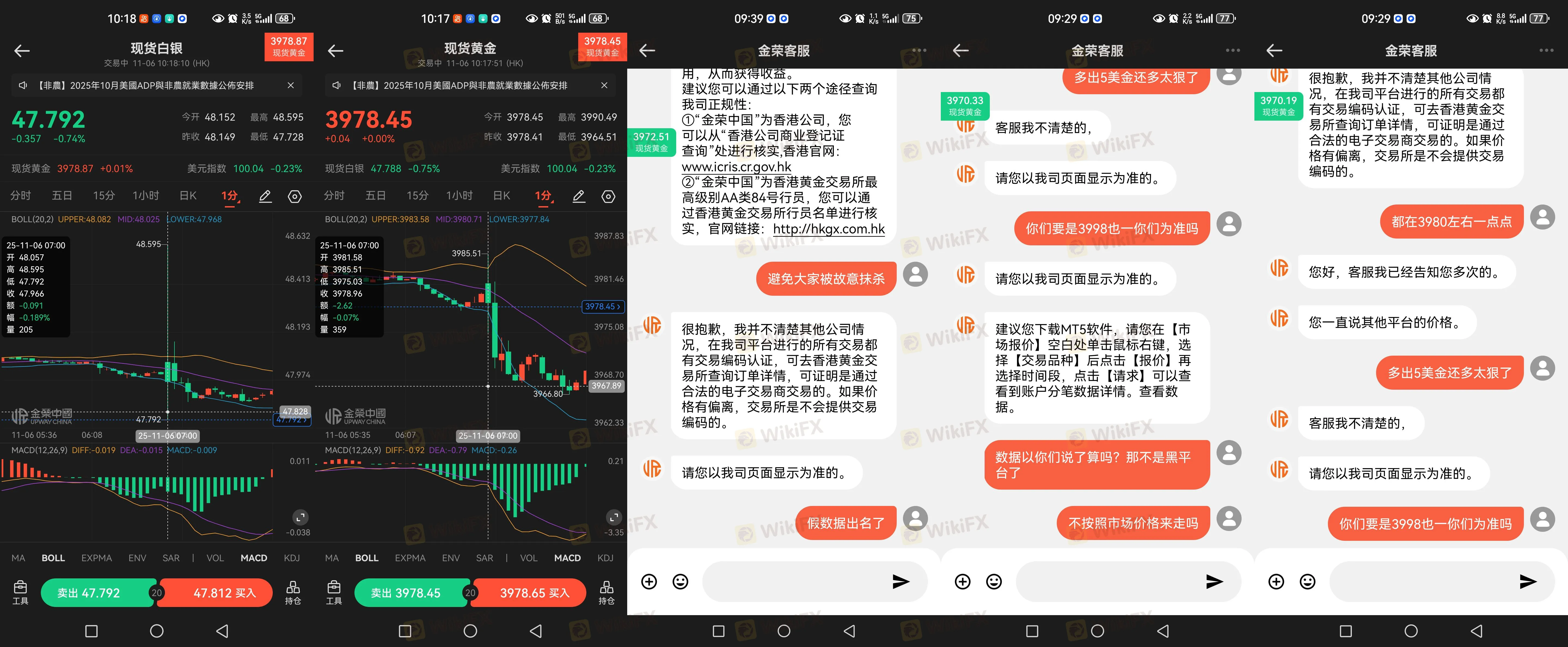

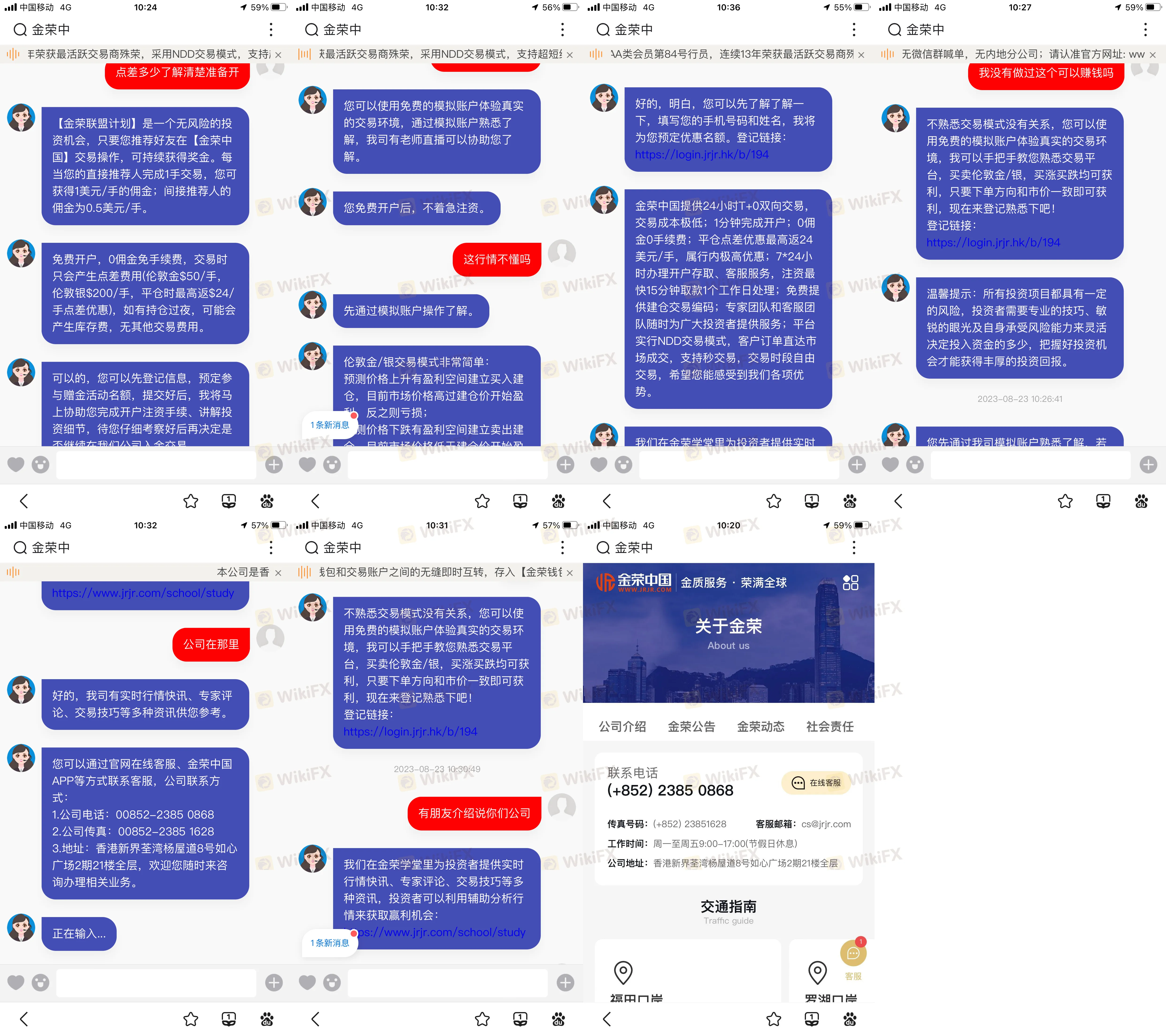

For a trader, there is nothing more terrifying than watching the market move in your favor, only to have the platform trigger a loss. Our review of recent user feedback indicates that JRJR users are suffering from what appears to be “artificial” slippage.

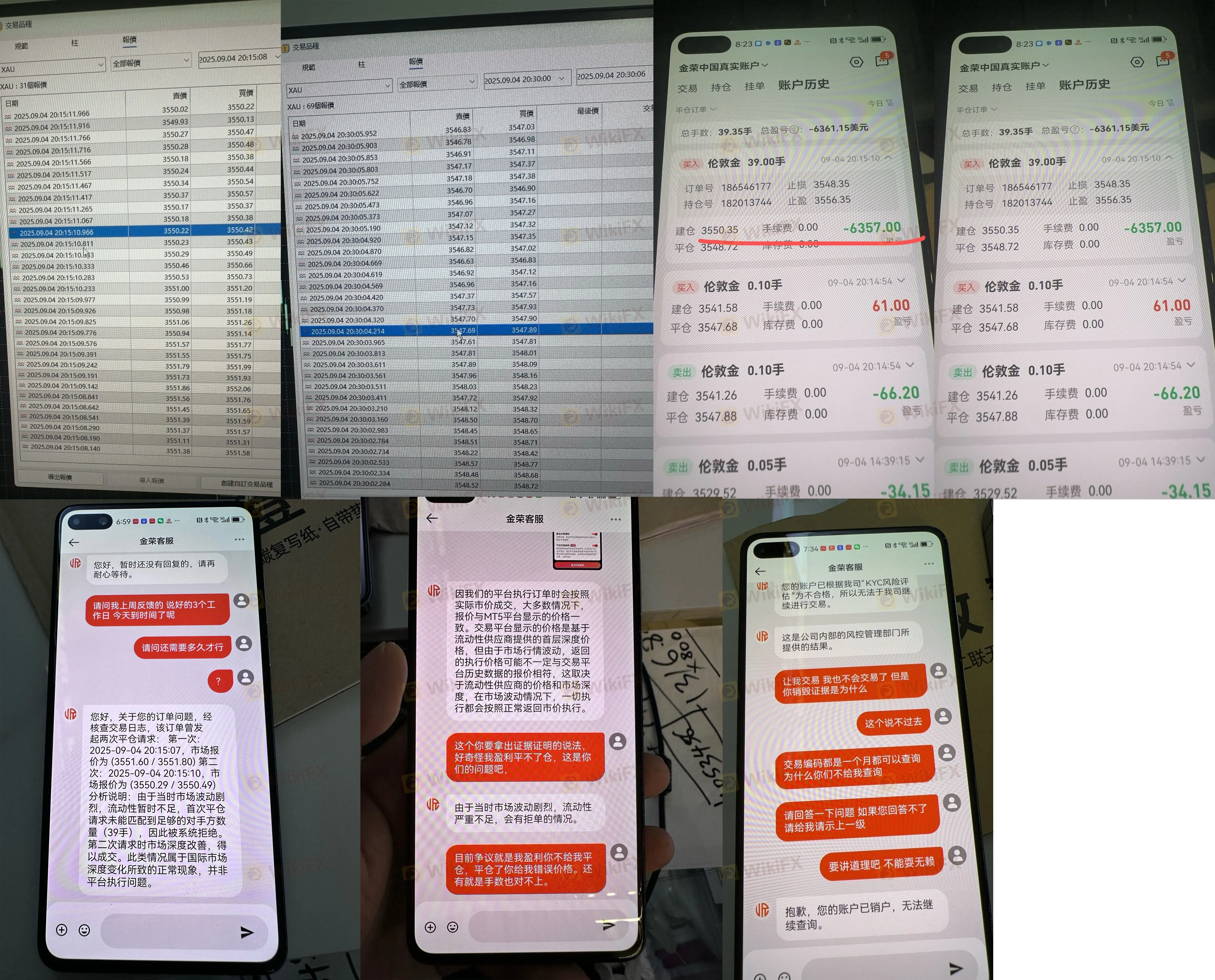

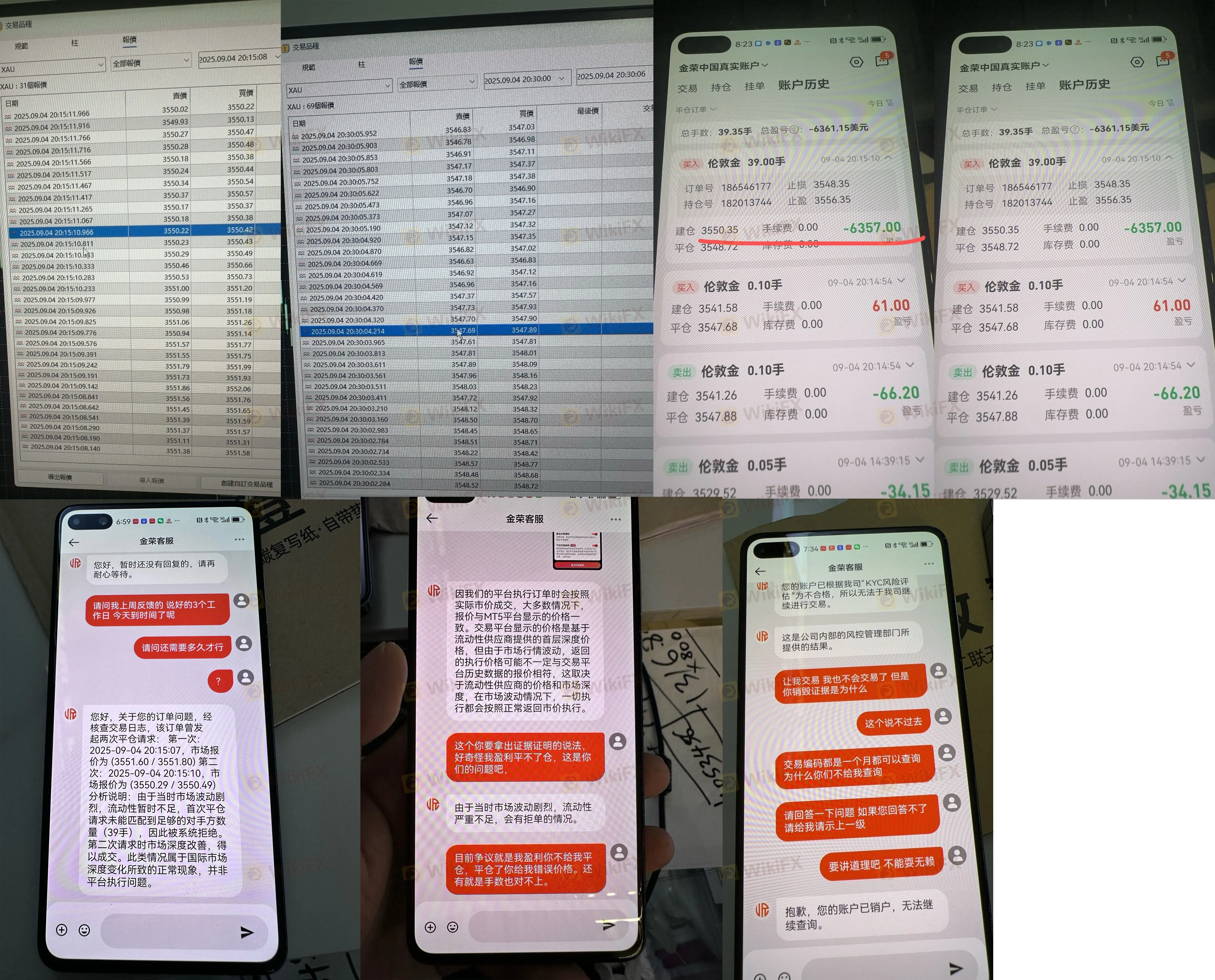

Multiple users have reported that the price quotes on the JRJR platform often deviate significantly from the broader international market. One trader (Case 24) detailed a scenario where they set a stop-loss at 2370. The market high was only 2369.83—yet their position was liquidated. The trader noted, “If it was a difference of 5 or 10 points, I could accept it. But a difference of 17 points just to hit my stop loss? This looks intentional.”

Another user (Case 3) provided a harrowing account of the platform's price sweeping up and down aggressively within minutes, hitting a high that didn't exist on other platforms, specifically to wipe out their sell position. This phenomenon, often referred to as “stop hunting,” is highly irregular for a compliant broker.

Furthermore, technical instability seems to strike at the most convenient times for the broker. A trader from South Africa (Case 26) reported that the platform has a “habit of freezing up” during critical market movements, preventing them from closing positions and managing risk. This “system paralysis” effectively locks traders into losses.

The Withdrawal Maze: Winning Means Nothing

While technical issues can sometimes be attributed to poor infrastructure, the inability to withdraw funds is a hallmark of high-risk financial conduct. Our investigation into JRJR reveals a widespread withdrawal problem.

Traders are reporting that small withdrawals (often under $1,000) are sometimes processed to build trust. However, once a trader generates significant profits or attempts to withdraw a larger principal, the doors slam shut.

We received a report (Case 18) from a user who deposited $500. After losses, they attempted to withdraw the remaining $20 balance, only to find their account frozen. The customer service response was to disconnect the chat. If a broker refuses to return even $20, the risk to larger capital is immense.

More concerning are the allegations of aggressive account closures. One trader (Case 16) stated, “The black platform froze my account to prevent withdrawal and then maliciously cancelled my account.” Another user (Case 8) recorded their screen showing a profitable position that the platform refused to let them close. Moments later, the system forced a close at a price that never existed on the market, turning a profit into a loss, followed by an immediate account ban to “destroy the evidence.”

Regulatory Reality Check: The Hong Kong HKGX Limit

Many traders are confused. How can a broker like JRJR, which claims to be regulated in Hong Kong, engage in such behavior? The answer lies in the type of regulation.

WikiFX regulatory records show that JRJR (Gold / Upway) is regulated by the Chinese Gold & Silver Exchange Society (CGSE / HKGX).

While this is a legitimate organization, it is a self-regulatory body, not a statutory government regulator like the UK's FCA or Australia's ASIC. The CGSE primarily manages the conduct of bullion trading among its members. Critically, it does not offer the same level of statutory investor compensation funds or strict legal enforcement regarding software manipulation that a government securities regulator would.

For traders—especially those in Africa or outside Hong Kong—this means if JRJR acts unethically, your avenues for legal recourse or fund recovery through the regulator are extremely limited compared to a broker regulated by the SFC (Securities and Futures Commission).

Regulatory Disclosure Table

Note: While the status is “Regulated,” the high volume of complaints regarding slippage and withdrawals suggests the broker may be operating significantly outside industry best practices.

Conclusion: A High-Risk Environment

The disconnect between JRJR's longevity (established 2017) and the current user experience is stark. The complaints are not isolated technical glitches; they form a pattern of withdrawal problems, unexplained slippage, and hostile customer service.

For traders asking “is JRJR safe?”, the evidence provided by the trading community suggests a resounding caution. The platform appears to function less like a neutral market gateway and more like an adversary that holds the kill switch on your trades and the lock on your wallet.

WikiFX Risk Warning

The level of protection offered by different regulators varies significantly. Trading forex and leveraged financial instruments involves a high level of risk and may not be suitable for all investors.