简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

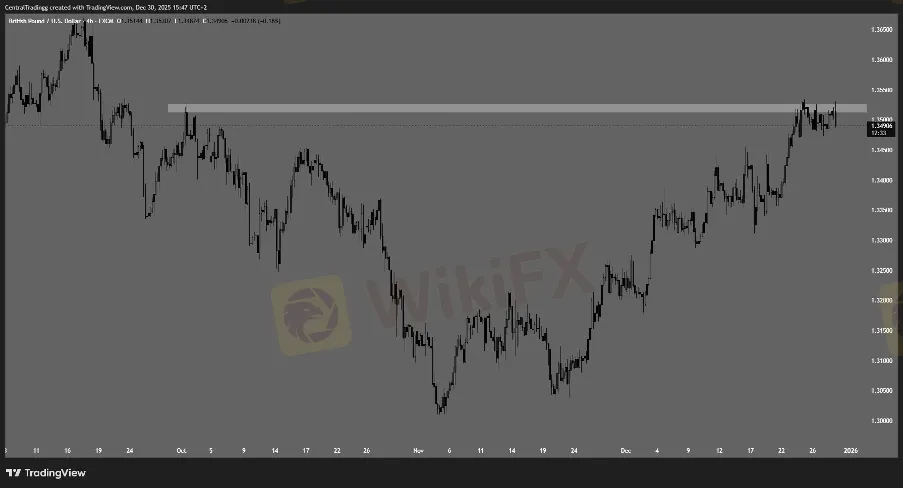

Sterling hits 3 month high against the U.S Dollar, but will it hold?

Abstract:GBP/USD moves above a price that was last seen on the 18th of September. Is this a promising move, or is it the end of the 2-month bull market?

On the 24th of December, GBP/USD went above 1.35272 which was the high that was created on the 1st of October. It then went on to create the high of the current bull market at 1.35339, which is also the first bull market we have seen since April 2025. Price action on the 4H indicated weakness at this level, possibly hinting that the bears might be stepping in around that level.

It seemed like price was failing to break through, but with GBP/USD's history of having trends that last a long time, it was a higher probability for the bull run to continue even further. But as we know, price can not move in just one direction, and that resistance was a good level for bears to start selling. We were then met with a strong downtrend coming into 2026.

The BoE started cutting rates in 2025 because of a slowdown in growth for UK inflation. US interest rates have been kept at an attractive rate for investors, further weakening the overall sentiment against the British pound.

Now, as we have started 2026, GBPUSD did manage to bounce back in what seemed like an overnight move.

Instead of easily growing, it was almost sudden. This could be largely due to the Venezuela situation, which has shaken markets everywhere. But it also might be price action related. If we look at the higher time frame price action (Daily time frame) we can see that the pullback into old highs was necessary in order for GBPUSD to continue this up trend.

What can traders expect in the upcoming few weeks for the pair (GBPUSD)? As we are slowly approaching highs, so is CPI slowly approaching. On the 13th of January, there will be multiple releases of CPI dating from November, due to the government shutdown that took place. This could bring enormous market volatility and will make or break this trend that we are in.

With price breaking through all the significant highs, we have one last high left before we reach 5-year highs. But this high is no joke as it was the highest high in 2025 and could pose a significant threat to the overall trend.

Your main focus should be on what price is currently doing before CPI and what it will do on the days leading up to it, this will show exactly what GBPUSDs intentions are and could set the trend for 2026.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Currency Calculator