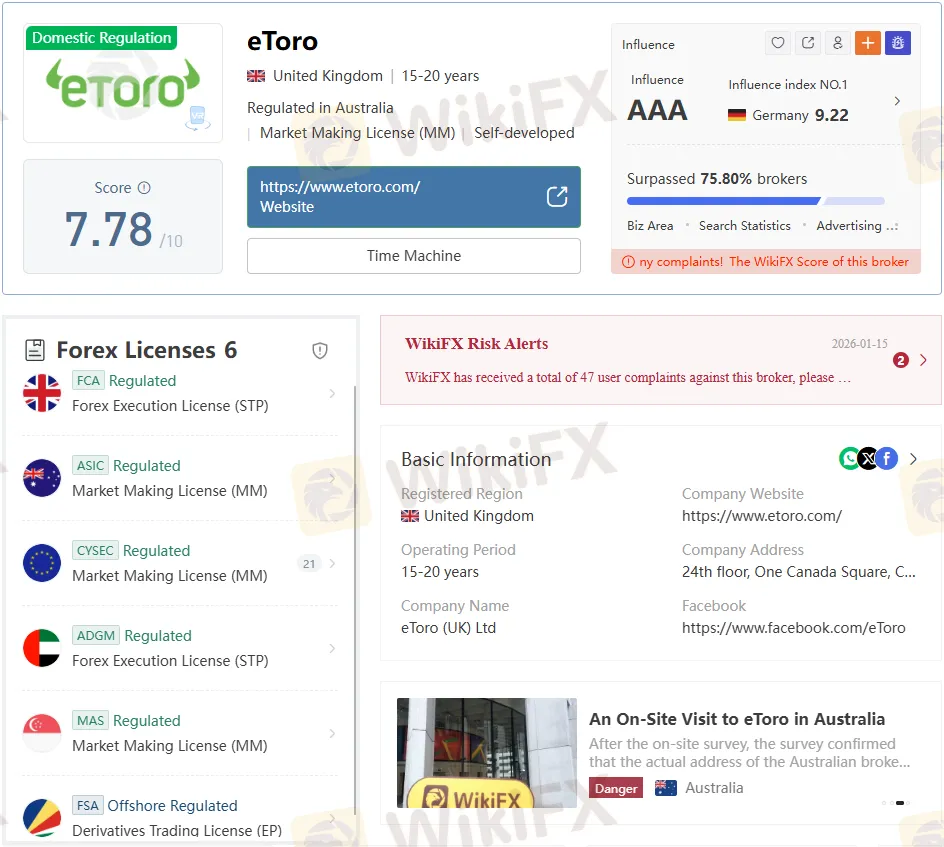

Abstract:eToro is regulated by ASIC, FCA, CySEC, MAS & ADGM, though some users report withdrawal delays and offshore risks.

eToro operates under multiple regulatory licenses across global jurisdictions, raising questions about trader protection amid reports of withdrawal hurdles. Platforms like this balance innovation with oversight, but offshore elements introduce nuances worth probing.

eToro Regulation Overview

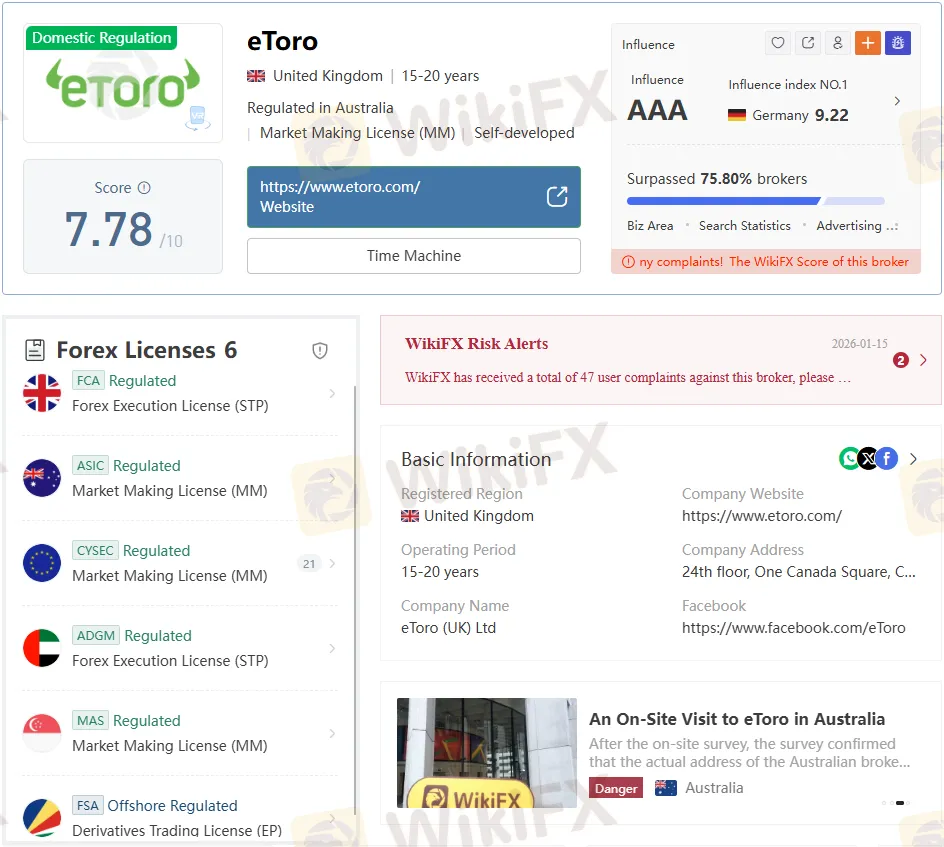

eToro holds licenses from top-tier bodies including ASIC in Australia, FCA in the UK, CySEC in Cyprus, MAS in Singapore, and ADGM in the UAE. These cover entities like ETORO EUROPE LIMITED under CySEC license 109/10 since 2010, ETORO UK LIMITED under FCA 583263 since 2013, and eToro ME Ltd under ADGM 220073 from 2023. An offshore Seychelles license SD076 for eToro Seychelles Limited adds derivatives trading but flags lighter oversight.

CySEC authorization spans forex, derivatives, and asset management, with cross-border access in 20 EU states. FCA approval targets retail and institutional clients for forex, futures, securities, and more. MAS license CMS101824 enables forex, derivatives, securities, and trust services in Singapore. ADGM permits forex execution, securities, bonds, and crypto agency in Abu Dhabi. ASIC regulates market making, though site visits noted no physical presence in Sydney.

Key eToro Regulators Examined

ASIC enforces strict client fund segregation and leverage caps for Australian traders. FCA demands transparency in execution and risk warnings, with eToros STP license ensuring straight-through processing. CySEC, as the oldest license, mandates negative balance protection across EU operations. MAS applies a market-making framework, while ADGM focuses on execution in the Middle East. Seychelles FSA offers basic derivatives coverage but lacks the rigor of Tier-1 peers.

Comparisons reveal eToro‘s spread: Plus500 matches FCA and CySEC but skips offshore; IG Group adds ASIC and FCA without Seychelles exposure. eToro’s multi-jurisdiction setup serves global users, yet routing to Seychelles for high-risk profiles echoes complaints of diminished protections.

Offshore Risks in eToro Setup

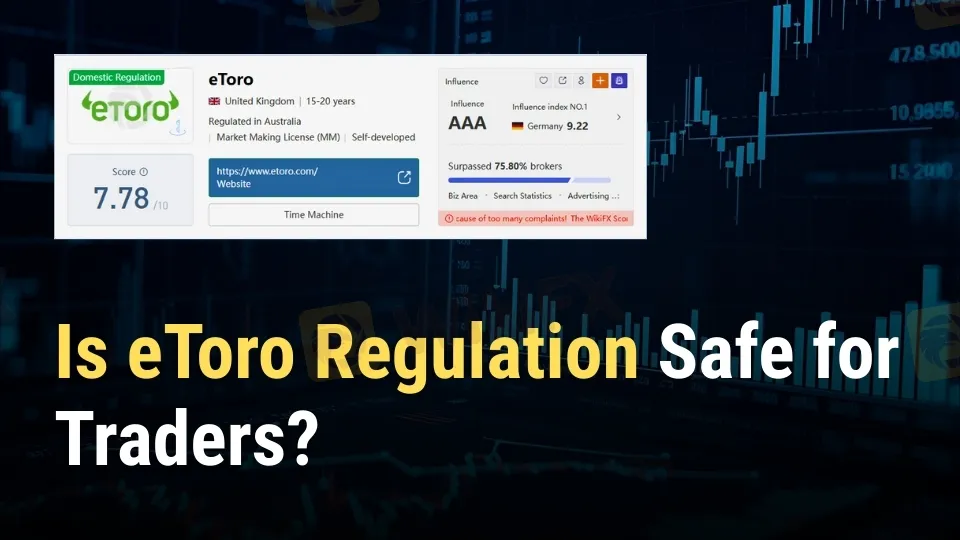

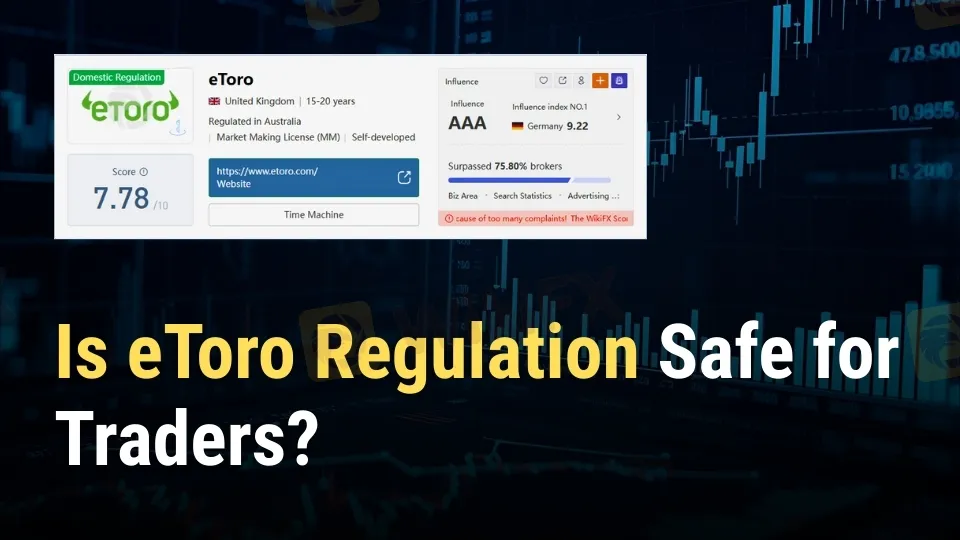

Seychelles regulation draws scrutiny for its light-touch approach, covering futures, securities, bonds, and options without full investor recourse. One trader alleged eToro shifted their account from Australian AFCA oversight to Seychelles, exposing them to slippage and forced closures amid $170,000 losses. WikiFX scores eToro at 7.58, surpassing 75% of brokers but noting offshore blacklists.

Site verifications confirm addresses: Cyprus regulatory site validated in 2019, but no physical offices in UK or Australia as of 2025 checks. Domain etoro.com, registered since 2007, aligns with the platforms longevity. Traders in unsupported regions face transfer issues, amplifying offshore dependency.

eToro Trading Instruments Scope

Over 7,000 assets include 6,202 stocks, 703 ETFs, 42 commodities, 55 currencies, 18 indices, 106 cryptocurrencies, bonds, and options. Leverage varies: 30:1 retail on major forex (400:1 pro), 20:1 commodities (100:1 pro). Crypto commissions hit 1%, stocks 1-2%; CFDs and ETFs are commission-free.

EURUSD spreads start at 1 pip, competitive versus IG‘s 0.8 or CMC Markets’ 0.7. Social copy trading lets users mirror top performers, an edge over traditional brokers like Saxo Bank. Diversification spans global markets, though a CFD-heavy focus suits short-term plays.

Account Types and Accessibility

eToro skips tiered accounts but offers retail, professional, and demo options universally. Minimum deposit stands at $10-200 by region, lower than Interactive Brokers $0 but matching Robinhood. Demo accounts enable risk-free practice, ideal for novices testing social features.

Professional status unlocks higher leverage, suiting experienced users versus retail caps under ESMA. All accounts support multi-asset trading; no dedicated Islamic swaps noted. KYC verification precedes withdrawals, standard across regulators.

Fees Breakdown: Hidden Costs?

Account opening and management cost nothing. Withdrawals incur $5 for USD accounts (free GBP/EUR), minimum $30; bank transfers lag 1-3 days. Inactivity fee: $10/month after 12 idle months. Conversion: 0.75%.

Versus peers, eToro‘s $5 withdrawal trails Plus500’s free but exceeds eXness $0. Spreads offset commissions on non-stocks, though crypto 1% bites volume traders. No deposit fees, but third-party charges apply.

Trading Platforms

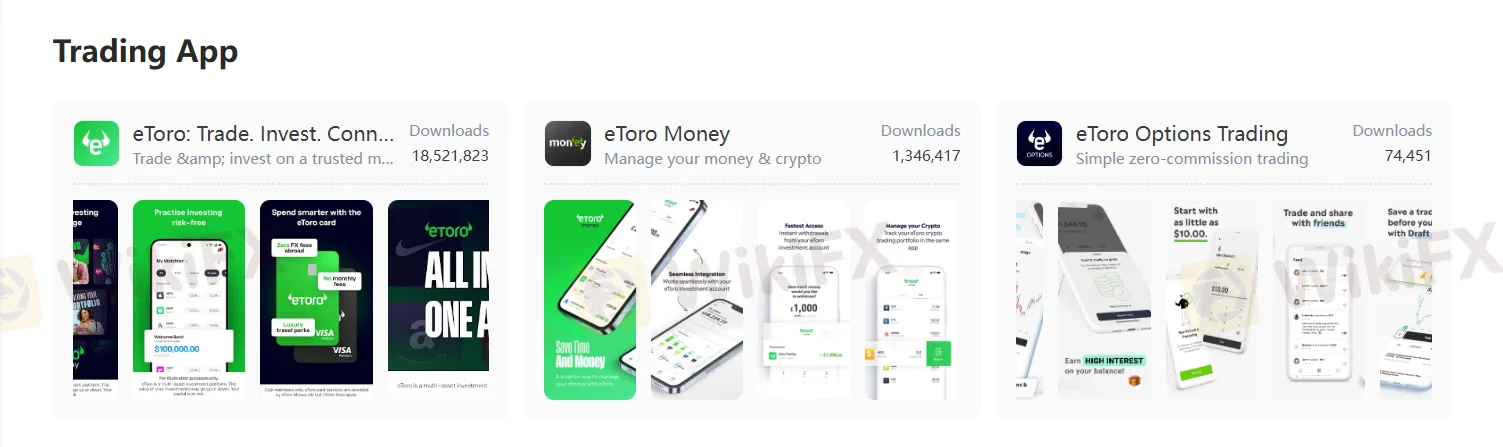

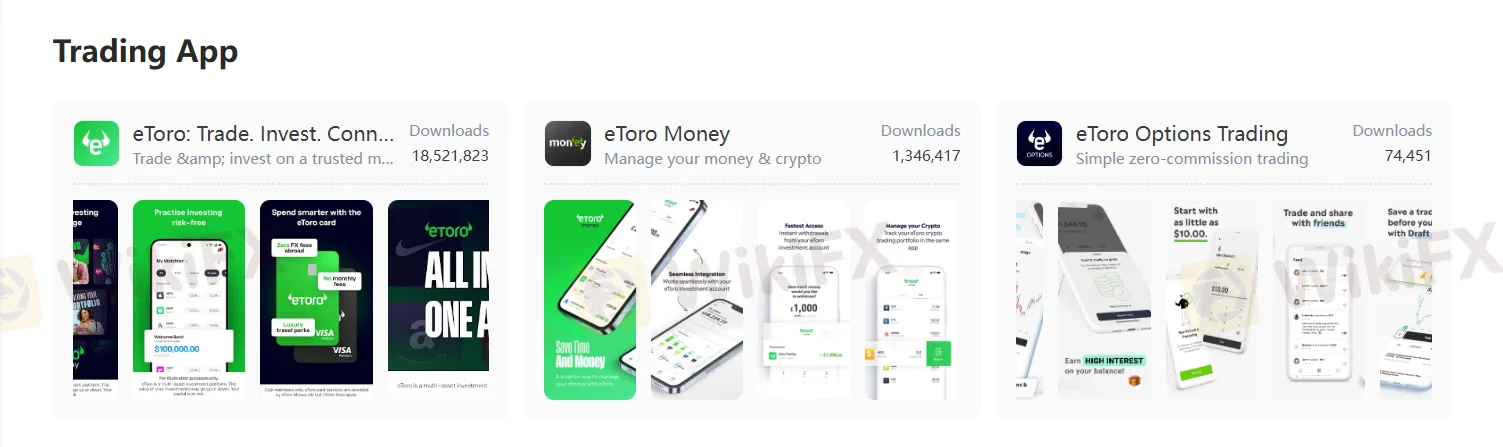

Proprietary app delivers real-time data, charting, and one-click orders. Social feeds enable trade copying, absent in MT5-focused Pepperstone. MT4 support adds EAs and indicators for pros. Mobile apps: eToro Trade (18M+ downloads), eToro Money, Options.

eToro Academy supplies videos, webinars, and guides on strategies and analysis. Beats Trading 212‘s basics but lags Thinkorswim’s depth. The VISA card integrates spending; high-interest balances up to $1,000.

Deposits and Withdrawals Reality

Deposits via cards, transfers, PayPal, Neteller, and Skrill process instantly or same-day, with no fees from eToro. Withdrawals mandate KYC, return to source methods, but delays plague users. France BTC transfer blocked; AUD/USDT withdrawals failed sans explanation. ppl-ai-file-upload.s3.amazonaws

Country delistings trap funds, as one user couldn‘t extract $58 USDT. Processing claims in 1 day, yet complaints highlight weeks-long holds. Compared to Binance’s swift crypto outs, eToro lags for fiat.

Pros and Cons Balanced View

Pros:

- User-friendly interface draws beginners.

- Regulated by ASIC, FCA, CySEC, MAS, and ADGM.

- Copy trading fosters community learning.

- Demo accounts and a low $10 deposit entry.

- Vast 7,000+ assets for diversification.

Cons:

- $5 USD withdrawal fee stings small accounts.

- Offshore Seychelles routing weakens protections.

- Withdrawal delays and failures were reported.

- Inactivity $10/month burdens casuals.

- Limited support channels frustrate issues.

eToro edges CopyTrader rivals but trails fee-free zero-commission pure-plays.

User-Reported Cases Spotlight

2025 logs detail woes: BTC wallet transfers unavailable in France despite holdings. AUD withdrawals rejected without cause. USDT extraction glitched post-country ban. Massive $170k loss tied to slippage, platform faults, Seychelles shift from ASIC. Account closures for “security” amid buy blocks and endless delays.

Support dismissed trading queries; no resolutions noted. These echo offshore risks versus Tier-1 stability at DEGIRO.

eToro vs Competitors Snapshot

eToro leads in social but concedes on fees and assets to IG.

Bottom Line on eToro Regulation

eToro Regulation blends robust Tier-1 oversight with offshore gaps, safe for diversified social traders but risky for high-volume withdrawers. Strengths in accessibility and instruments suit novices; withdrawal snags and Seychelles exposure demand caution. Weigh against peers—viable if social features align, but verify jurisdiction routing pre-funding.