简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

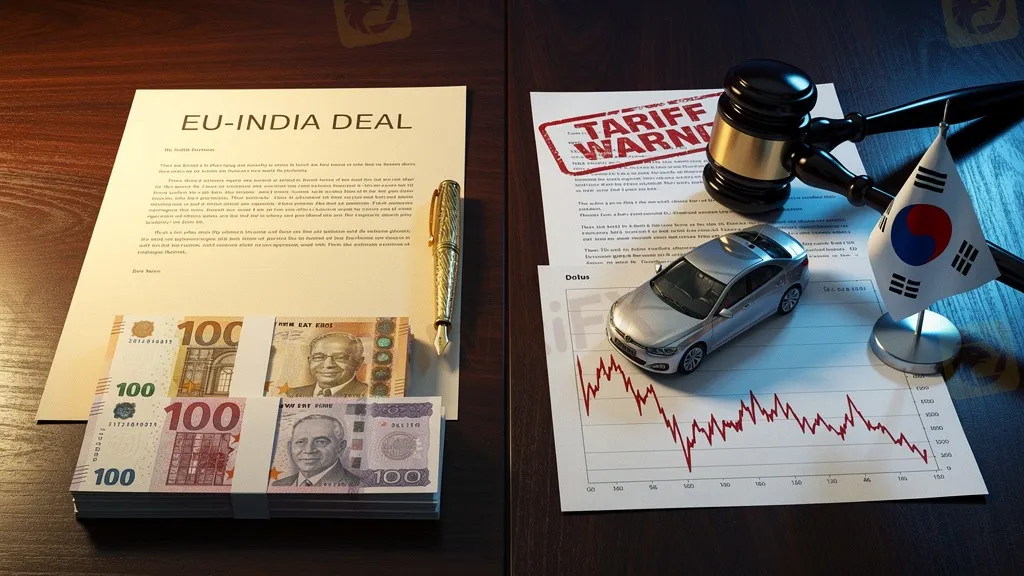

Trade Wars & Alliances: EU-India Seal 'Century Deal' as Trump Targets Korea

Abstract:As the EU and India sign a historic trade pact to hedge against protectionism, South Korea scrambles to respond to Trump's latest 25% tariff threat on automobiles.

Global trade dynamics are bifurcating rapidly. While Europe and India solidified economic ties with a historic free trade agreement this week, the United States has reignited volatility in the Pacific rim with fresh tariff threats against South Korea.

The 'Century Deal': EU and India Pivot

After 20 years of negotiations, the European Union and India signed a landmark trade agreement on Tuesday, slashing tariffs on over 90% of traded goods. The deal, expected to create a free trade zone covering 2 billion people by 2026, is widely viewed as a strategic hedge against US protectionism and Chinese dominance.

- India will lower duties on European automobiles, wines, and machinery.

- The EU grants zero-tariff access to Indian textiles, leather, and jewelry—sectors previously hit hard by US punitive tariffs.

- US Reaction: The White House has expressed dissatisfaction, with officials criticizing the EU for cutting a deal while India continues to purchase Russian oil.

Seoul in Panic Mode

Conversely, geopolitical tensions spiked in Asia after President Trump threatened a 25% tariff on South Korean automobiles, citing the country's failure to fast-track specific investment legislation. The announcement caused immediate tremors in Seoul, with Kospi-listed automakers like Hyundai and Kia seeing sharp equity sell-offs.

South Korean officials have launched emergency inter-agency meetings and plan to dispatch trade envoys to Washington immediately to prevent the tariffs from taking effect.

The 'Bluff' Factor

Despite the immediate market anxiety, data from Bloomberg Economics suggests investors should remain level-headed. An analysis of Trump's first months back in office reveals that only 25% of his tariff threats have been fully implemented, while over 40% have been withdrawn or watered down. The prevailing consensus among seasoned FX traders is that the threats are primarily leverage for negotiation rather than immovable policy, though the short-term volatility for the Korean Won (KRW) remains acute.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Trade deal: India and EU to announce FTA amid Trump tariff tensions

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Currency Calculator