Abstract:PRCBroker is accused of withholding $1.13M in profits and freezing withdrawals. Read the details and decide if this broker is right for you.

PRCBroker is now under intense scrutiny as multiple Hong Kong traders and long‑time agents accuse the broker of blocking profits, refusing withdrawals, and even cutting off communication once money is on the line. These serious allegations challenge the brokers credibility and raise urgent questions about whether PRCBroker is a safe place for your capital.

What Is PRCBroker And Why Are Hong Kong Traders Concerned?

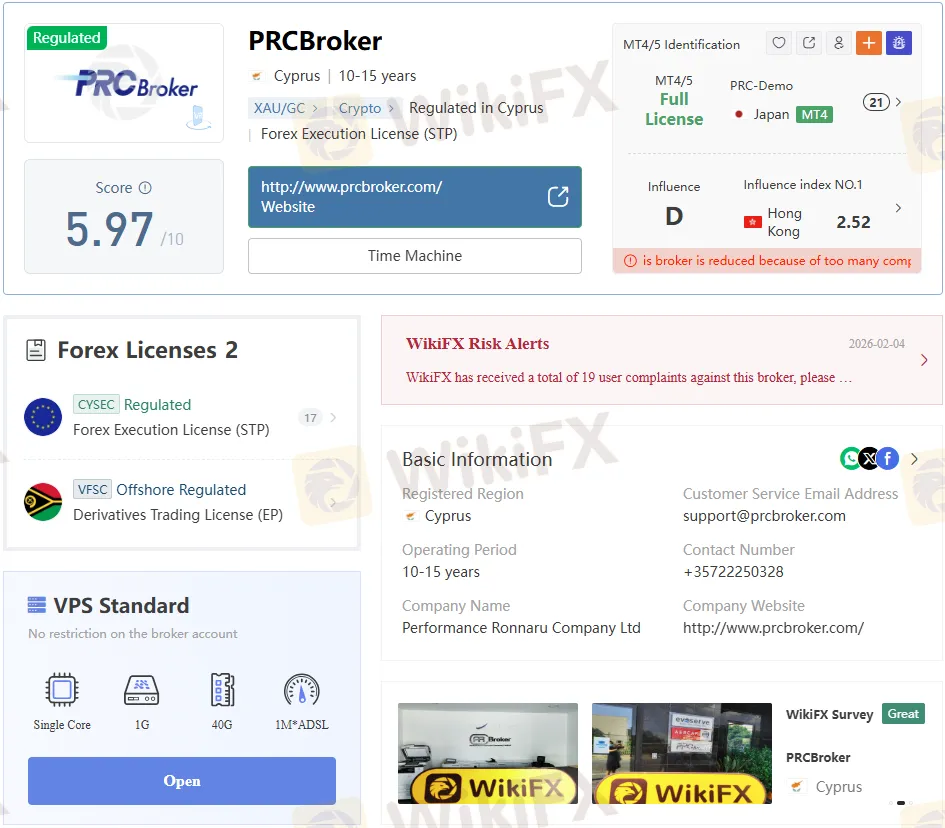

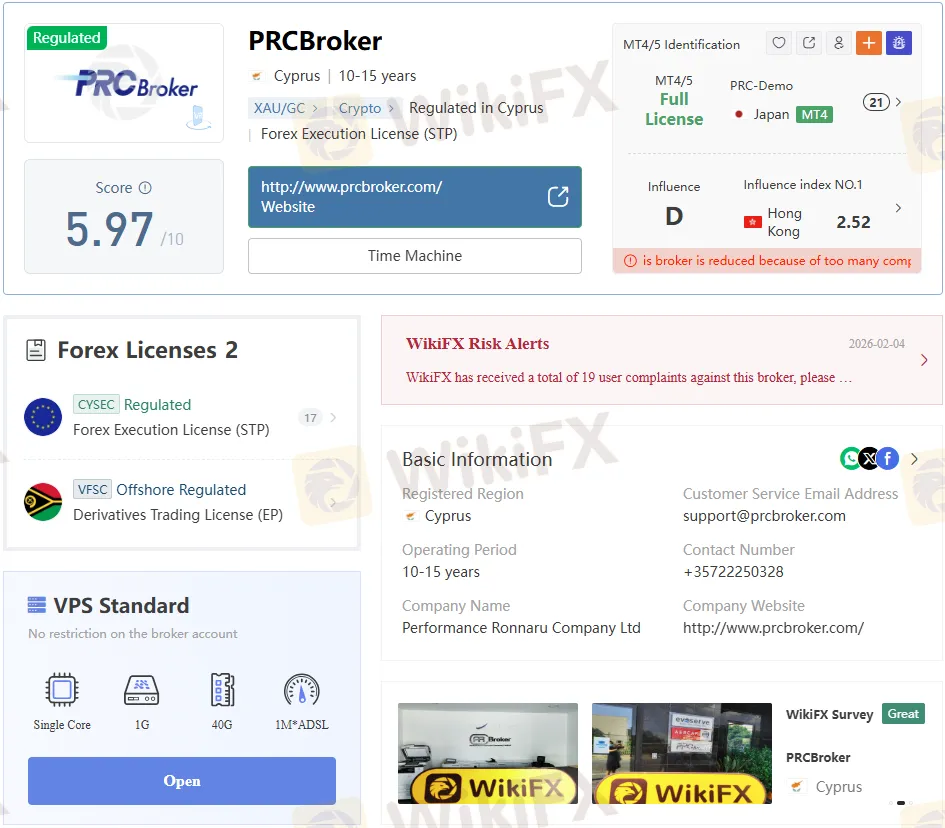

PRCBroker presents itself as a forex and CFD broker offering mainstream platforms like MetaTrader and claiming regulatory credentials, which can easily give new clients a sense of security. However, recent exposure reports from Hong Kong describe a very different experience once accounts become profitable or commissions are due. The core of these complaints is simple but alarming: when money needs to leave the platform, traders say the doors slam shut.

According to public complaint records, several users and agents in Hong Kong report that profitable accounts were frozen, withdrawals were rejected, and communication channels were abruptly cut. If accurate, these patterns point to fund‑safety risks that go far beyond normal market volatility or technical slippage.

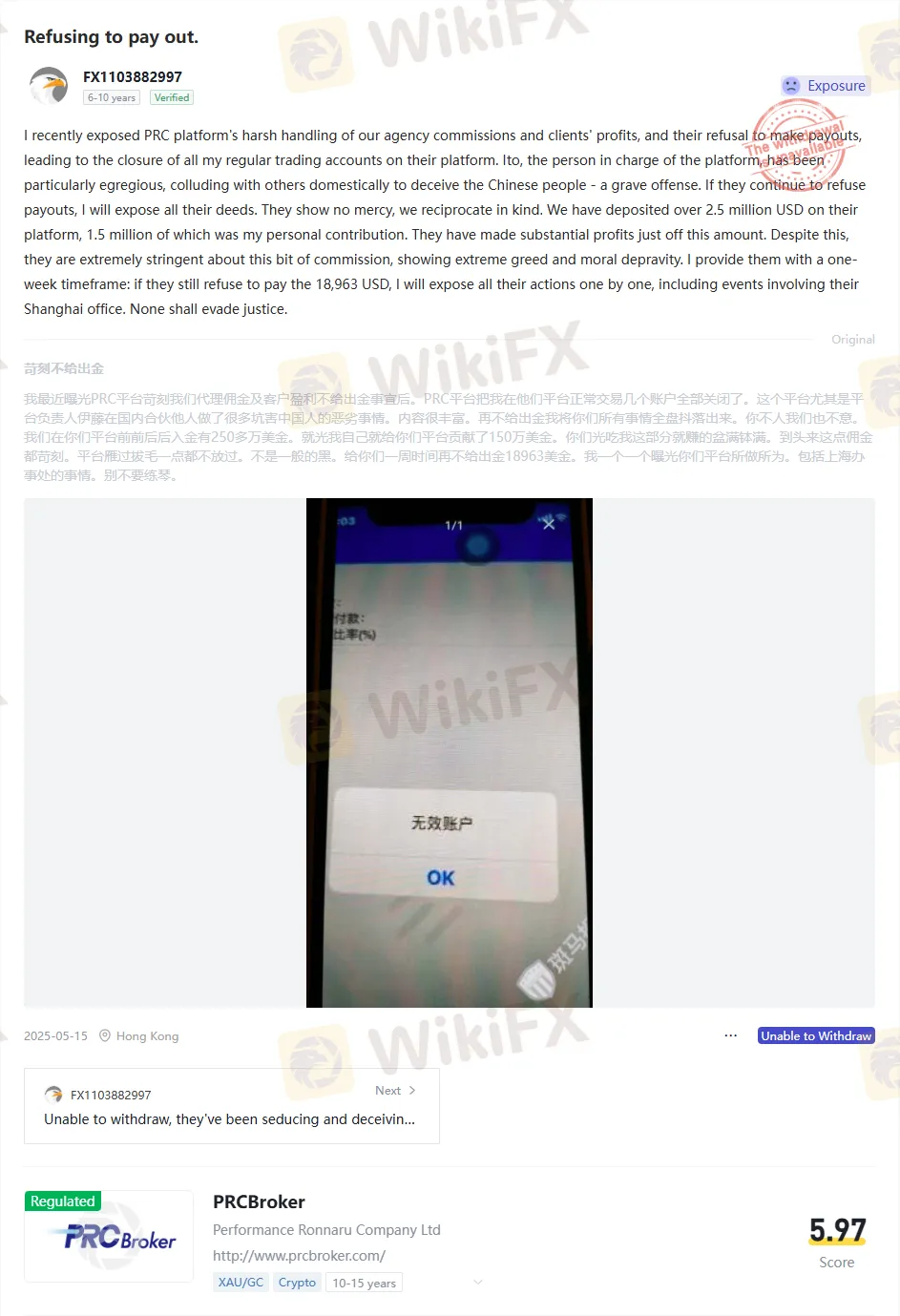

Millions Deposited, Commissions Allegedly Withheld

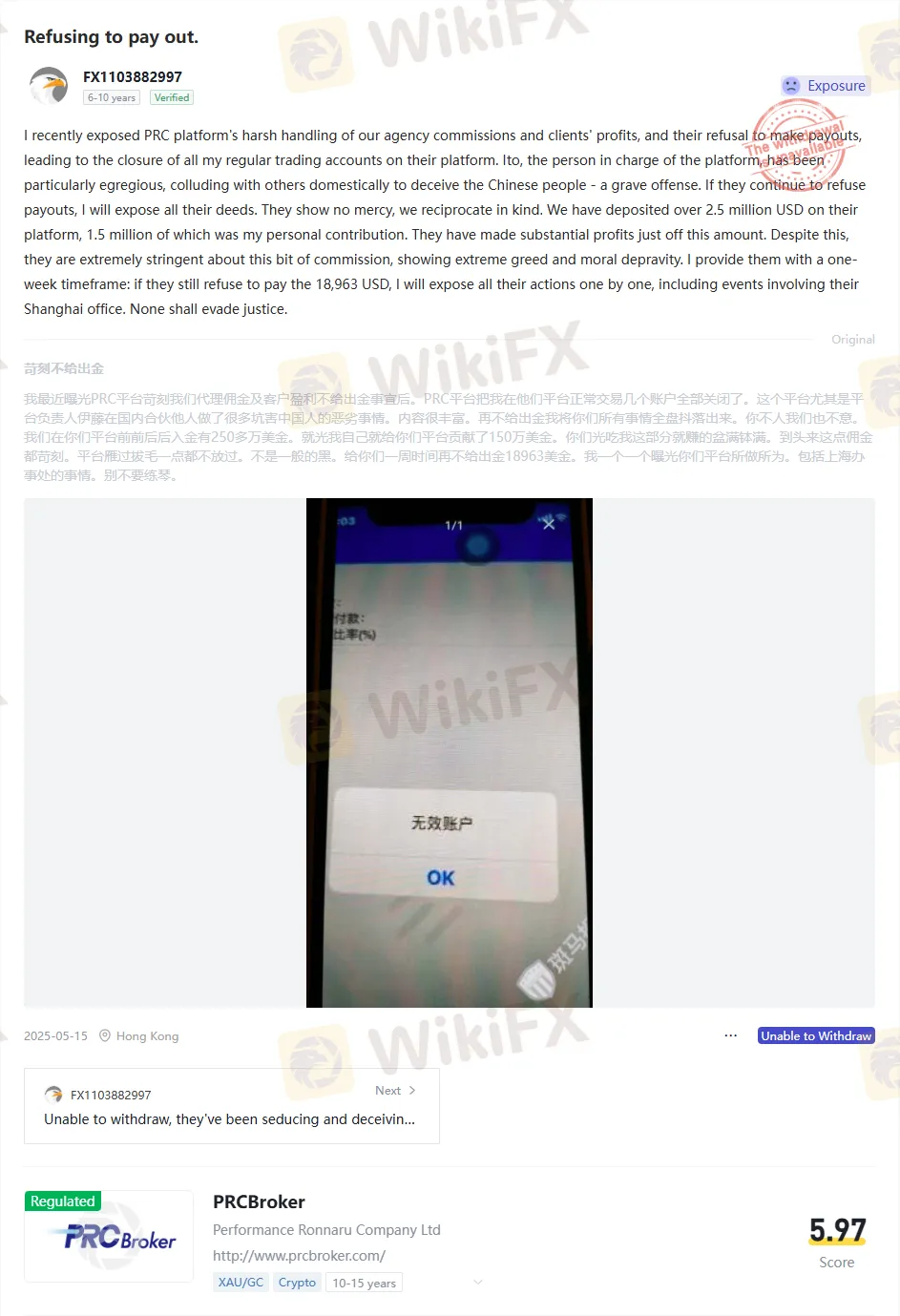

In the first reported case, an agent claims to have deposited more than 2.5 million USD on PRCBroker, 1.5 million of which came from their own funds, only to be refused payment of a relatively small commission of 18,963 USD. The complaint says that after exposing the broker‘s handling of commissions and client profits, all of the agents’ regular trading accounts were closed directly on the platform.

The complainant further alleges that the person in charge, identified as “Ito,” has been colluding domestically to deceive clients, and that the Shanghai office is implicated in these disputes. The agent states that if the unpaid commission is not settled within a set time frame, they intend to continue exposing thebrokerss actions one by one, suggesting that more unresolved issues may exist behind the scenes.

For readers, this case illustrates a key risk. If a broker is willing to jeopardize a long‑term business relationship over a commission dispute, retail traders may have even less protection when their own profits are at stake.

Profits of $1.13M, Blocked and Account Shut Down.

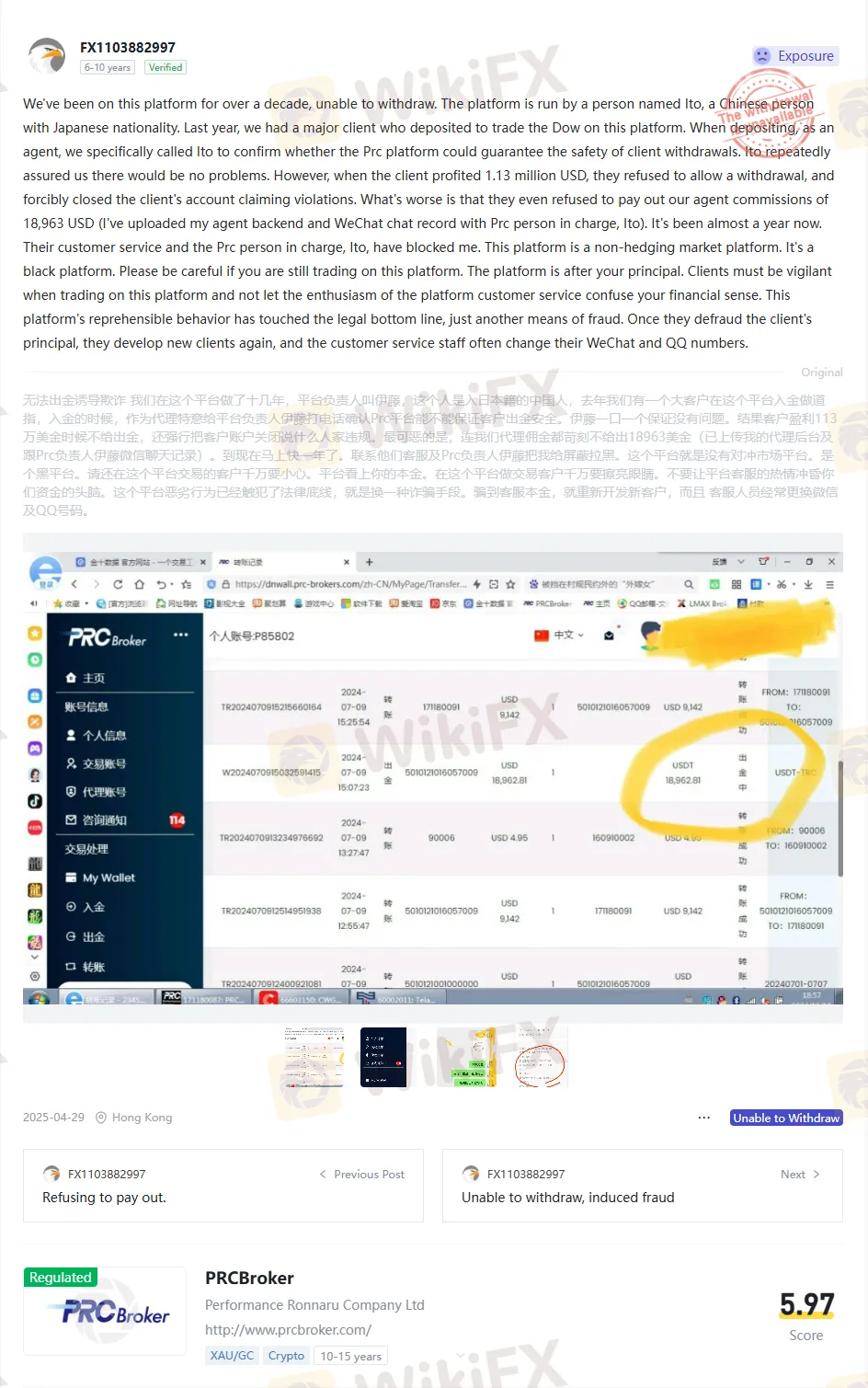

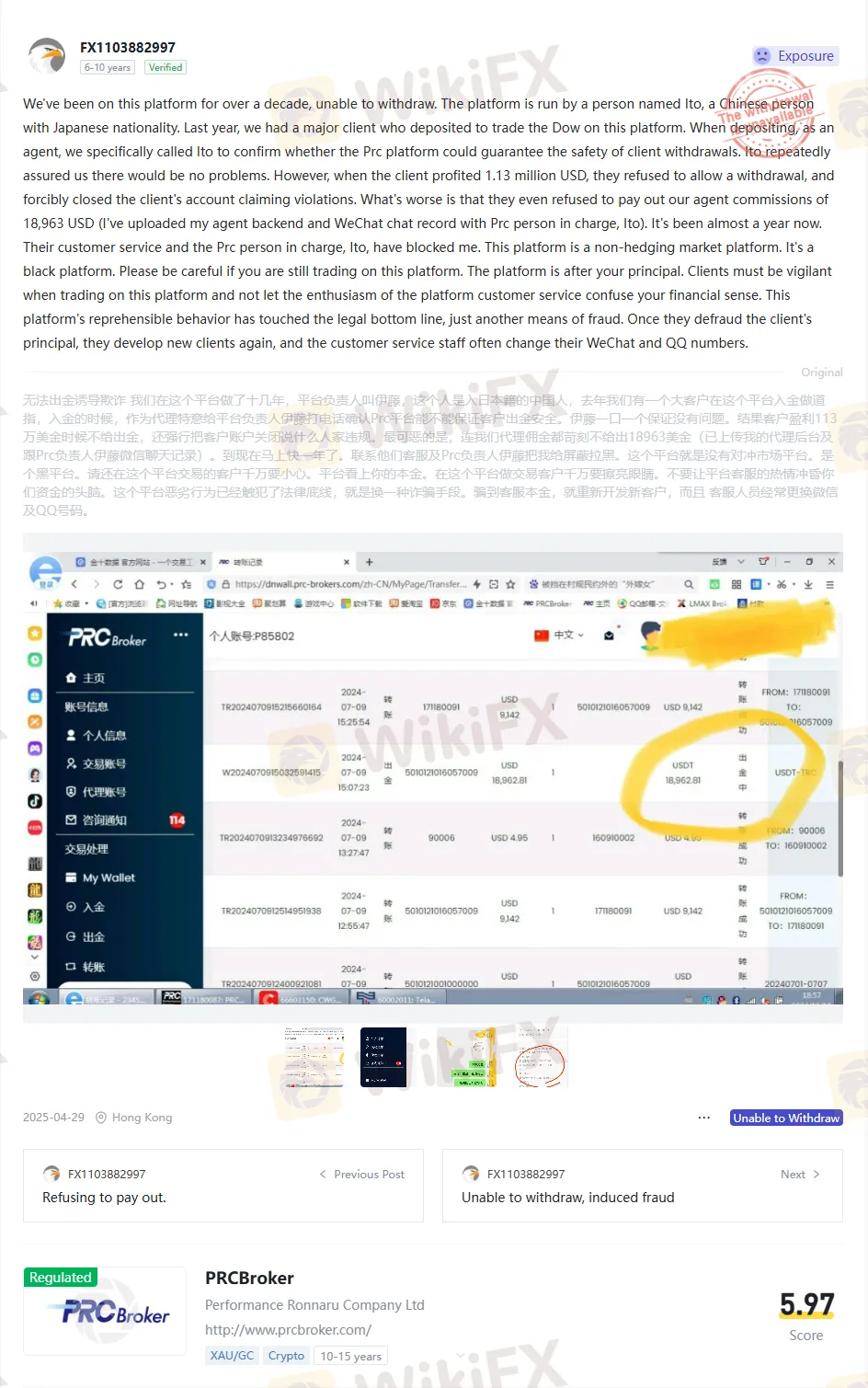

Several overlapping complaints from Hong Kong agents describe the same central story: a major client deposits funds to trade the Dow Jones, generates around 1.13 million USD in profit, and then faces an outright refusal when attempting to withdraw the funds. According to these reports, PRCBroker allegedly responds by forcibly closing theclientss account and citing vague “violations” instead of honoring the withdrawal request.

Across these cases, the agents say they had personally contacted Ito before the deposit, asking whether withdrawals were safe and whether clients‘ funds could be withdrawn without issue. They claim Ito repeatedly assured there would be no problem. Yes, when the account became highly profitable, the broker allegedly blocked withdrawals and withheld the agent’s commission of USD 18,963 for nearly a year.

Complainants also report that:

- Customer service and Ito allegedly blocked them on WeChat after they started asking for withdrawals and commissions.

- The platform is described as a “non‑hedging” or “black” platform, implying that client trades may not be properly hedged in the wider market.

- Customer service contact details, such as WeChat and QQ numbers, are reportedly changing frequently, making it harder for clients to pursue unresolved issues.

For a retail trader, a blocked withdrawal on a seven‑figure profit is more than an inconvenience; it suggests that profitability itself may trigger punitive treatment instead of a standard payout.

Server Crashes During Key Price Moves

Another Hong Kong user reports that PRCBrokers servers repeatedly crashed during critical market moments, including a spike in gold prices, resulting in significant trading losses. According to this complaint, there were four outages in a single night, with the worst disruption occurring precisely when gold made a sharp move.

Whether these incidents were purely technical glitches or something more deliberate, the timing raises serious questions about platform stability and fair execution. When servers fail during high‑volatility periods, traders can:

- Lose the ability to close positions at desired prices.

- Suffer unexpected margin calls if the platform later reopens at worse levels.

- Miss profitable exits entirely, turning winning trades into losses.

For any trader evaluating PRCBroker, repeated outages at “crucial price levels” are a red flag for thebrokerss operational reliability.

Patterns Emerging From The Hong Kong Exposure Reports

When these Hong Kong cases are viewed together, several consistent patterns emerge that potential clients should weigh carefully.

Key recurring themes include:

- Withdrawal denials after large profits are often justified by unclear rule violations.

- Withheld agent commissions, including long‑delayed payments such as 18,963 USD.

- Forced account closures are affecting profitable clients rather than the transparent resolution of disputes.

- Communication blackouts via blocking on messaging apps once clients pursue their money.

- Unstable platform performance, including outages during major moves in instruments like gold.

For readers, this pattern matters more than any single complaint; repeated stories with similar details suggest systemic issues rather than isolated misunderstandings.

How Hong Kong Traders Can Protect Themselves

If you are currently trading with PRCBroker or considering opening an account, it is crucial to take proactive steps to reduce your exposure to potential fund‑handling problems. You can use the Hong Kong cases as a checklist of warning signs to watch for in your own experience.

Practical steps to consider include:

- Start with smaller deposits and test withdrawals early, before scaling up your trading size.

- Keep screenshots and records of all communications, including assurances about the safety of withdrawal.

- Monitor platform stability during major news events or volatile market sessions.

- If you encounter delayed withdrawals, document timelines and responses carefully.

In addition, comparing PRCBroker with other brokers that have cleaner complaint histories, more transparent withdrawal statistics, and stronger third‑party reviews can help you make a more informed decision about where to place your funds.

Final Warning: Is PRCBroker Right For You?

The exposure cases from Hong Kong paint a troubling picture of brokers approach to profitable accounts, agent relationships, and withdrawal requests. Allegations of blocked profits, unpaid commissions, forced account closures, and server outages at critical price points are exactly the kind of red flags that experienced traders learn not to ignore.

Ultimately, the decision to trade with PRCBroker is yours, but these reported incidents suggest that caution is not just advisable—it is essential. Before you commit serious capital, take time to review independent complaints and consider whether a broker with a cleaner track record on fund withdrawals and client treatment better protects your money.