Abstract:Beware, Vietnam traders! VCP Markets faces a surge in 2025 complaints about blocked withdrawals and losses. Check verified reports on WikiFX now.

Beware, Vietnam traders: multiple 2025 WikiFX reports accuse VCP Markets of unfair losses, blocked withdrawals, and account manipulation, with 10 negative “exposure” cases out of 18 reviews. These patterns raise serious concerns that VCP Markets may be operating more like a scam than a legitimate forex broker for many clients.

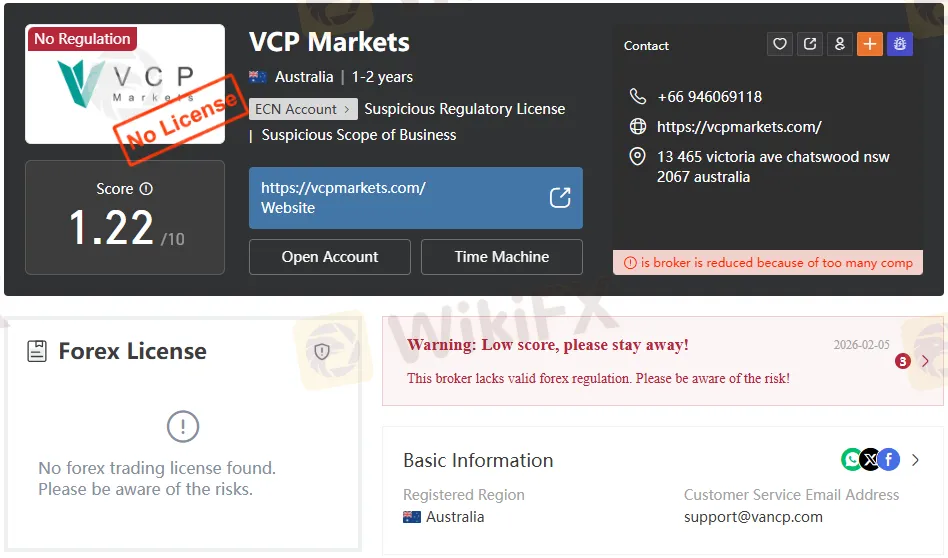

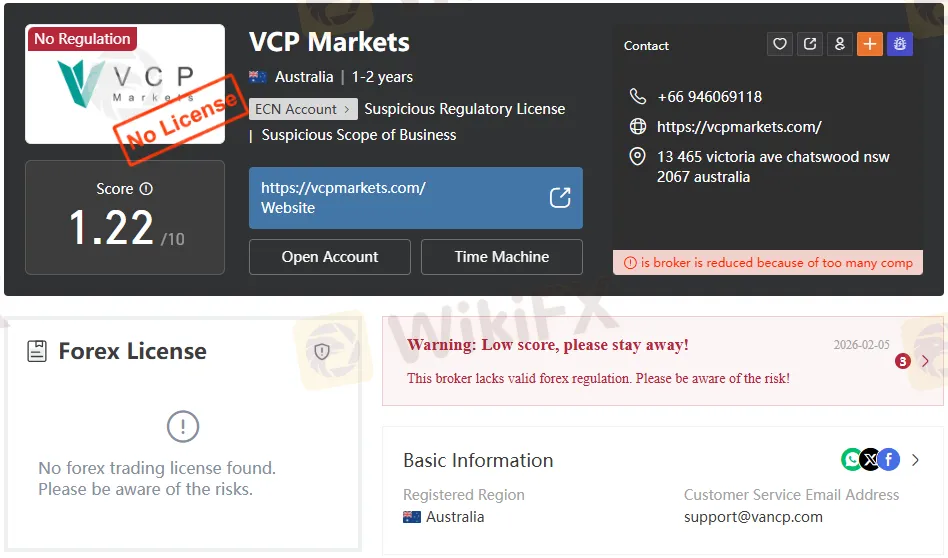

VCP Markets at a Glance

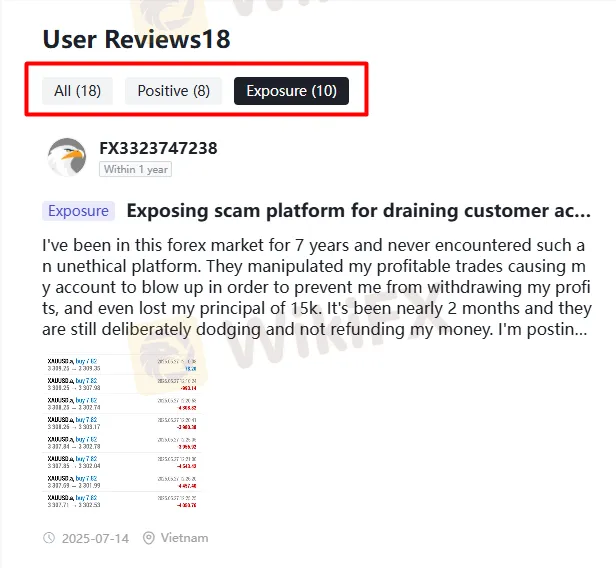

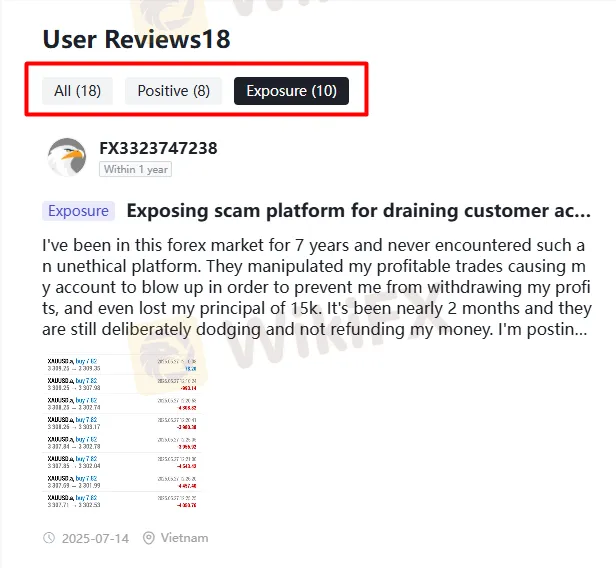

VCP Markets is listed as a forex and CFD broker on WikiFX, where traders from Vietnam and abroad can leave public reviews. As of 2025, the brokers page shows 18 user reviews, including 10 exposure complaints describing serious financial harm and withdrawal issues.

While some users post positive comments about quick deposits and withdrawals, the volume and severity of the negative cases should alarm any retail trader. For traders in Vietnam, these VCP Markets reviews signal a high-risk platform where your capital and profits may not be safe.

Pattern of Exposure Cases in 2025

WikiFX categorizes 10 of the 18 reviews as “Exposure,” meaning they publicly accuse VCP Markets of misconduct, fraud, or abusive practices. Most of these exposure reports are from 2025 and come directly from Vietnamese users, with one from South Korea, showing a concentrated wave of complaints that year.

These exposure posts frequently use strong language such as “scam platform,” “shoddy scam,” and “theyve rigged me,” emphasizing both emotional distress and significant monetary losses. When so many independent traders describe similar VCP Markets scam behavior in the same period, it points to more than isolated dissatisfaction.

Case 1: Profitable Account Blown, Principal Lost

In Case 1, a trader with seven years of forex experience reports that VCP Markets manipulated profitable trades until the account “blew up,” wiping out both profits and a 15,000 USD principal. The trader claims the platforms actions were deliberate and aimed at preventing withdrawals after the account became profitable.

Nearly two months after the loss, the client had still not received a refund and said VCP Markets kept dodging responsibility. This trader explicitly urges others to boycott the platform andalways to check VCP Markets reviews and other scam-warning sites before depositing their hard-earned money.

Cases 2 and 3: Copy Trading to 40,000 USD, Then Forced Crash

In Cases 2 and 3, Vietnamese traders describe almost identical experiences with VCP Markets copy trading. Each deposited about 15,000 USD in May 2025 to copy trade a master account, and their balances rose to about 40,000 USD within a week.

Once these accounts reached high profits, both report that VCP Markets allegedly interfered with their trading accounts by stuffing them with 7 large lot trades (around 7.82 lots each) or large hedging orders, burning the entire balance in about 15 minutes. One trader says the platform then ignored their complaints and even tried to pressure them for more funds, prompting the victim to file a complaint with the Hanoi City Criminal Police Department at 62 Nguyen Van Huyen for investigation.

These cases illustrate a serious VCP Markets withdrawal problem: traders never receive their profits because the platform allegedly forces losing trades or manipulates positions before any payout can occur. For Vietnamese retail traders, such reports are a red flag that VCPMarketss fake trading behavior could be systematically targeting profitable accounts.

Case 4: Losses via Introducing Brokers (IBs)

Case 4 comes from a Vietnamese trader who says, “Theyverigged me. Their IBs cost me 1,300 USD in a single day.” This suggests that problems may not only lie in the platform itself but also in its network of introducing brokers, which may push risky trades or misleading strategies to generate commissions.

If IBs encourage overleveraged positions or act in concert with the brokers interests, the client faces a double risk: platform-side manipulation and conflicted advice from intermediaries. This aligns with broader VCP Markets complaints in 2025 about accounts being drained quickly under questionable circumstances.

Case 5, 6, 7, 8, 9, 10: Withdrawals Blocked and Accounts Locked

Several 2025 exposure cases highlight classic VCP Markets withdrawal problems rather than trading losses alone. In Case 5, a trader from Vietnam reports requesting a withdrawal, then waiting for days with no progress, no Vietnamese support, and no email replies from the platform.

Case 6 describes VCP Markets as a “shoddy scam platform” that offers big bonuses but “burns” client funds, stating clearly that “you can deposit, but can‘t withdraw.” Case 7 echoes this, calling the broker a scam and saying the platform does not allow withdrawals, with an introducer causing the customer’s account to blow up.

In Case 8, a user reports that their trading account was suddenly locked and that they were unable to withdraw any remaining balance. Case 9, from South Korea, reports that VCP Markets demanded additional deposits “to verify theownerss account” and then locked the account the next morning after the funds were deposited.

Case 10 is straightforward but severe: “This platform is a scam, I deposited money but cannot withdraw it.” Together, these cases show a consistent pattern: clients can deposit funds easily, but once profits appear or withdrawal requests are made, accounts are locked, withdrawals are blocked, or additional funds are demanded under suspicious pretexts.

Comparing Positive and Negative Reviews

Although VCP Markets has positive comments about fast deposits and withdrawals and “good” trading conditions, these are mostly brief and lack detail. By contrast, scam exposure reviews are lengthy and specific, often involving large sums such as 15,000–40,000 USD, locked accounts, and direct references to failed withdrawals or forced losses.

For risk assessment, the depth and consistency of the negative VCP Markets reviews of Vietnam in 2025 carry more weight than brief praise. When a broker attracts 10 exposure complaints within 18 total reviews, it suggests that serious operational or ethical issues may be affecting a significant portion of its client base.

Practical Warnings for Vietnam Traders

If you are in Vietnam considering this broker, treat VCP Markets complaints 2025 as a serious warning, not background noise. Repeated claims of VCP Markets scam tactics—such as manipulating profitable trades, inflating position sizes, and blocking withdrawals—indicate a platform where the odds may be stacked against clients beyond normal market risk.

Before investing, check verified VCP Markets reviews Vietnam on independent sites like WikiFX and compare them to other licensed brokers with stronger regulatory oversight. Avoid any platform that asks you to deposit more money to “unlock” your account or “verify” ownership, as this is a common pattern in fraudulent operations.

If you already have funds with VCP Markets and face withdrawal problems, document every interaction, keep transaction records, and consider filing complaints with local financial regulators or the police, as one victim planned to do in Hanoi. Do not send additional funds to resolve these issues, especially if demands come through unofficial channels or aggressive IBs.

Conclusion

The 2025 exposure reports on WikiFX paint a troubling picture of VCP Markets: 10 out of 18 reviews describe serious allegations of account manipulation, forced liquidations, blocked withdrawals, and locked accounts affecting traders in Vietnam and South Korea. While a few users report smooth trading and fast transfers, the scale and detail of the negative cases strongly suggest that many clients face unacceptable risks when dealing with this broker.

For Vietnam traders, the safest approach is to treat VCP Markets as a high-risk platform and look instead for well-regulated alternatives with transparent operations and a clean track record of withdrawals. Your capital, your profits, and your peace of mind are worth more than any promised bonus or “too good to be true” trading opportunity that could end in frozen funds and unanswered emails.