简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tickmill Review: Regulation, Licences and WikiScore Analysis

Abstract:This Tickmill review provides an objective overview of the regulatory framework, licensing credentials and WikiScore.

This Tickmill review provides an objective overview of the regulatory framework, licensing credentials and WikiScore of the Tickmill broker, based on information published on the WikiFX platform. Regulation is one of the most important factors when assessing an online trading broker, and this article focuses on Tickmill regulation and the financial authorities responsible for supervising its operations.

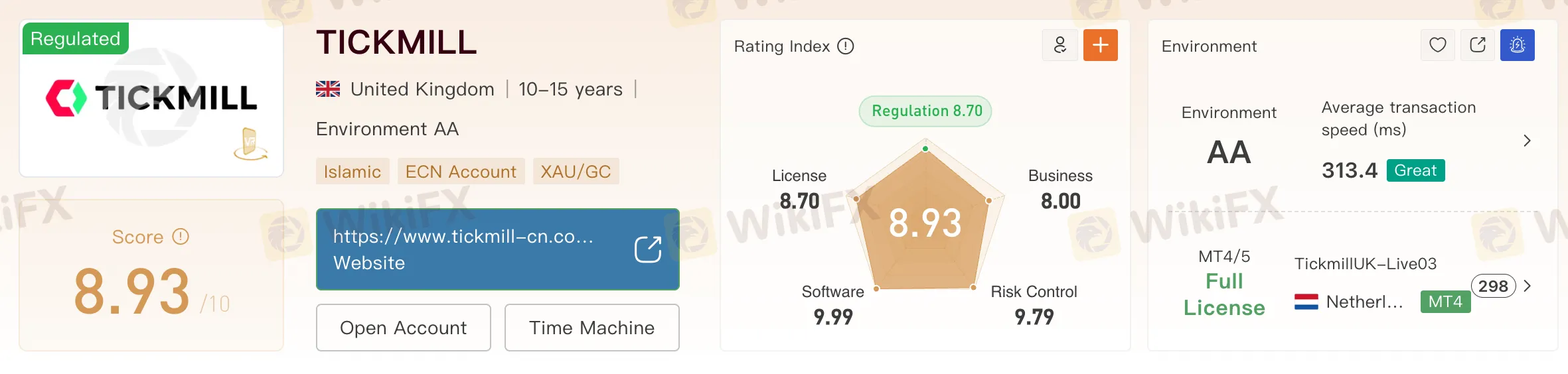

Tickmill is an international forex and derivatives broker serving clients in multiple regions. According to WikiFX, Tickmill holds a WikiScore of 8.93 out of 10. This score places Tickmill among the higher-rated brokers listed on the platform and reflects a strong regulatory foundation combined with stable operational indicators.

The WikiFX scoring system assesses brokers across several dimensions, including the number and quality of regulatory licences, business transparency, operational history, platform performance and exposure to risks or complaints. The WikiScore is designed as a comparative reference tool to help users better understand a brokers standing within the wider market.

View WikiFXs full review of Tickmill here: https://www.wikifx.com/en/dealer/0001623491.html

For the Tickmill broker, the high WikiScore is primarily supported by its licences from established financial authorities in the United Kingdom, Cyprus and South Africa.

Tickmill Regulation Overview

Tickmill regulation is based on authorisation from three recognised regulatory bodies. Each authority enforces its own regulatory framework, with varying requirements related to client protection, market conduct and operational compliance.

Financial Conduct Authority of the United Kingdom

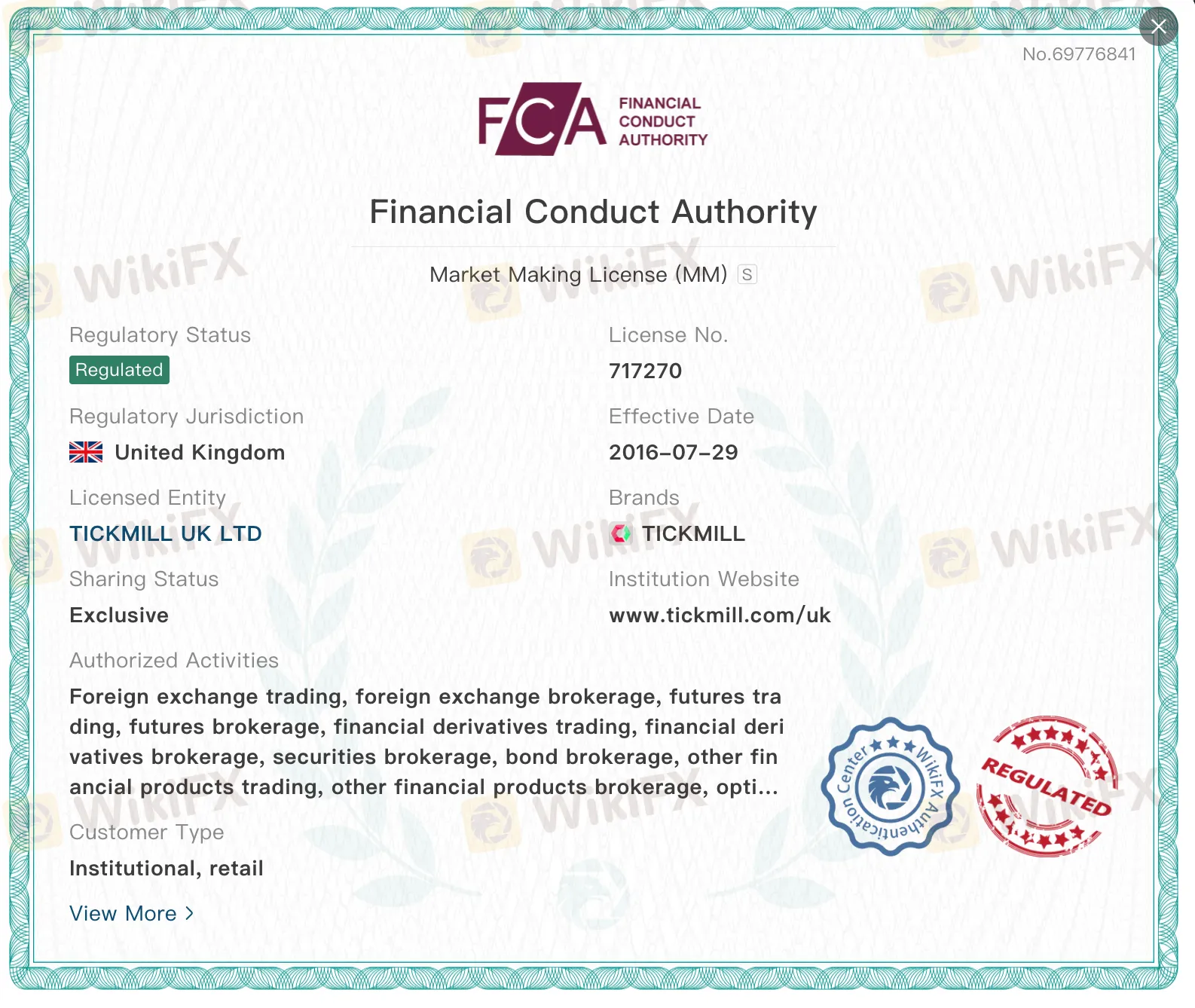

Tickmill is authorised by the Financial Conduct Authority of the United Kingdom under licence number 717270. This authorisation is issued as a Market Making Licence.

The FCA is widely regarded as one of the most rigorous financial regulators globally. It oversees financial services firms operating in the United Kingdom and enforces strict rules concerning client fund segregation, capital adequacy, internal controls and transparency. Brokers regulated by the FCA are required to keep client funds separate from company funds and are subject to regular audits and reporting obligations.

Within the context of this Tickmill review, the FCA licence represents the strongest element of Tickmill regulation. It provides a high level of regulatory oversight and is a key contributor to the brokers strong WikiScore.

Cyprus Securities and Exchange Commission

Tickmill is also authorised by the Cyprus Securities and Exchange Commission under licence number 278 15. This authorisation is issued as a Market Making Licence and allows the broker to operate within the European Union regulatory framework.

CySEC is the national financial regulator of Cyprus and operates under European financial regulations. Firms authorised by CySEC must comply with rules relating to investor protection, disclosure requirements, capital reserves and operational transparency. CySEC-supervised brokers are also required to participate in investor compensation schemes, subject to applicable conditions.

In terms of Tickmill regulation, the CySEC licence extends the brokers regulatory coverage across the European Economic Area and reinforces its compliance with recognised European standards.

Financial Sector Conduct Authority of South Africa

In addition to its European and United Kingdom licences, Tickmill is authorised by the Financial Sector Conduct Authority of South Africa under licence number 49464. This licence is classified as a Forex Trading Licence.

The FSCA is responsible for regulating market conduct within South Africas financial sector. Its mandate includes protecting financial customers, ensuring fair treatment and overseeing compliance with local financial legislation. Brokers licensed by the FSCA must adhere to conduct standards, maintain appropriate risk management systems and provide transparent information to clients.

For the Tickmill broker, the FSCA licence provides regulatory oversight within the African market and adds geographic diversity to its regulatory structure.

Regulatory Significance and Oversight

The combination of FCA, CySEC and FSCA licences means that Tickmill operates under multiple recognised regulatory frameworks. Each authority applies its own supervisory standards, but all three are considered established regulators with defined enforcement powers.

Licences issued by the FCA and CySEC are generally regarded as offering strong investor protection due to their strict compliance requirements and regulatory enforcement mechanisms. The FSCA licence adds regional oversight and further strengthens Tickmill's regulation in jurisdictions outside Europe.

This multi-authority regulatory structure is a key factor behind Tickmills high WikiScore, as WikiFX assigns greater credibility to brokers authorised by recognised financial regulators.

WikiScore Context

The WikiScore of 8.93 reflects Tickmills regulatory strength, business stability and overall risk profile as assessed by WikiFX. Higher scores typically indicate a combination of strong licensing credentials, transparent operations and lower reported risk exposure. While the WikiScore does not serve as a guarantee of trading outcomes, it provides a structured way to compare brokers based on objective criteria.

Conclusion

This Tickmill review highlights a broker with a robust regulatory framework supported by licences from the Financial Conduct Authority of the United Kingdom, the Cyprus Securities and Exchange Commission and the Financial Sector Conduct Authority of South Africa. Tickmill regulation spans multiple major jurisdictions and reflects compliance with established regulatory standards.

With a WikiScore of 8.93, the Tickmill broker ranks among the higher-rated brokers on the WikiFX platform. As with any broker assessment, traders are encouraged to consider regulatory information alongside other factors such as trading conditions, platform features and personal risk tolerance. WikiFX presents this information as a reference to support informed decision-making rather than as an endorsement.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Kudotrade Review: Safety, Regulation & Forex Trading Details

FXPN Review 2026: Is This Forex Broker Safe?

Naira Rallies to Start February as Government targets Fiscal Consolidation

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Currency Calculator