简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FIBOGROUP Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:FIBOGROUP holds an offshore license from the British Virgin Islands but currently carries a concerning 3.57 WikiFX score due to a surge in user complaints regarding withdrawals and price manipulation. While the broker offers extensive leverage and platform options, the safety profile suggests high risk for retail traders.

Executive Summary: FIBOGROUP is a long-standing broker established in 2010 with offshore regulation in the British Virgin Islands. However, users should proceed with extreme caution as recent reports highlight severe issues with withdrawals and trade execution, reflected in its low WikiFX Score of 3.57.

Introduction

Choosing a trading partner can be stressful. You want to grow your wealth, not worry about whether your funds will disappear overnight. Before you find a Forex broker, it is crucial to look past the flashy marketing and analyze the raw data. In this FIBOGROUP review, we strip away the noise to look at the facts: their safety protocols, their trading fees, and importantly, what current users are saying. With a WikiFX Score hovering in the danger zone at 3.57/10, does this broker deserve your trust?

Question 1: FIBOGROUP Regulation & Safety: Is my money safe?

When you deposit money, the most critical factor is the broker's regulatory oversight. FIBOGROUP is regulated by the British Virgin Islands Financial Services Commission (BVI FSC) offering a Retail Forex License (No. SIBA/L/14/1063).

Analyzing the Regulation Status

While the BVI FSC is a legitimate regulatory body, it is considered an “offshore” regulator. Unlike Tier-1 authorities like the FCA in the UK or ASIC in Australia, offshore regulators often have looser requirements regarding capital reserves and client protection.

Educational Insight: Counterparty Risk

Why does this matter to you? With offshore regulation, there is often less enforcement of “Segregated Accounts”—a safety mechanism where your money is kept in a separate bank account from the broker's own funds. If an offshore broker faces bankruptcy, recovering your funds can be significantly more difficult compared to a broker regulated in a major financial jurisdiction. In simple terms, the safety net here is thinner.

Question 2: Are the trading fees and leverage fair?

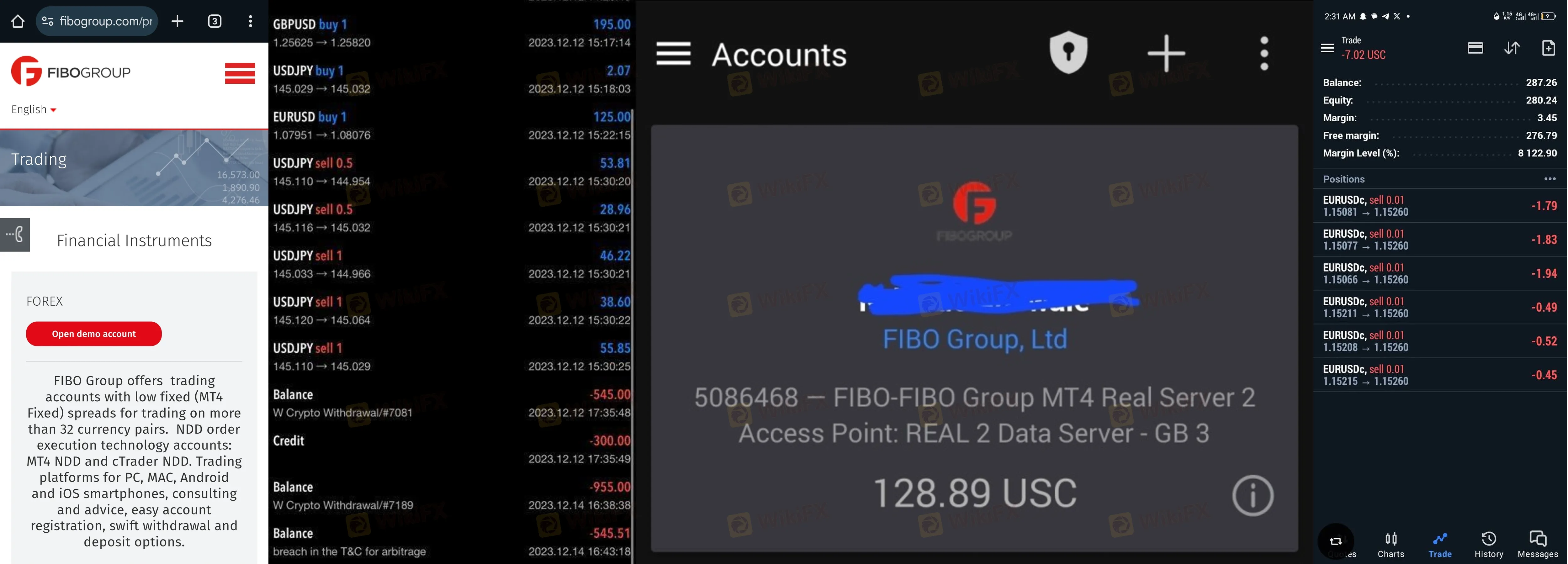

One of the most eye-catching features of FIBOGROUP is the leverage. They offer leverage as high as 1:5000 on certain account types (like the MT5 Cent account).

The Double-Edged Sword of Leverage

In Forex trading, leverage allows you to control a large position with a small amount of capital.

- The Pro: With 1:5000 leverage, a $10 deposit could control $50,000 worth of currency.

- The Con: This is extremely risky. A tiny price movement against you—literally a fraction of a penny—can wipe out your entire account instantly. High leverage is often a trap for new traders who do not understand risk management.

Fees and Spreads

FIBOGROUP offers a variety of account structures, including “NDD” (No Dealing Desk) accounts with spreads starting from 0 pips, and “Fixed” accounts with spreads from 2 pips. While low spreads are attractive, verify if they come with high commissions per lot, which can eat into your profitability.

Question 3: What are real traders complaining about?

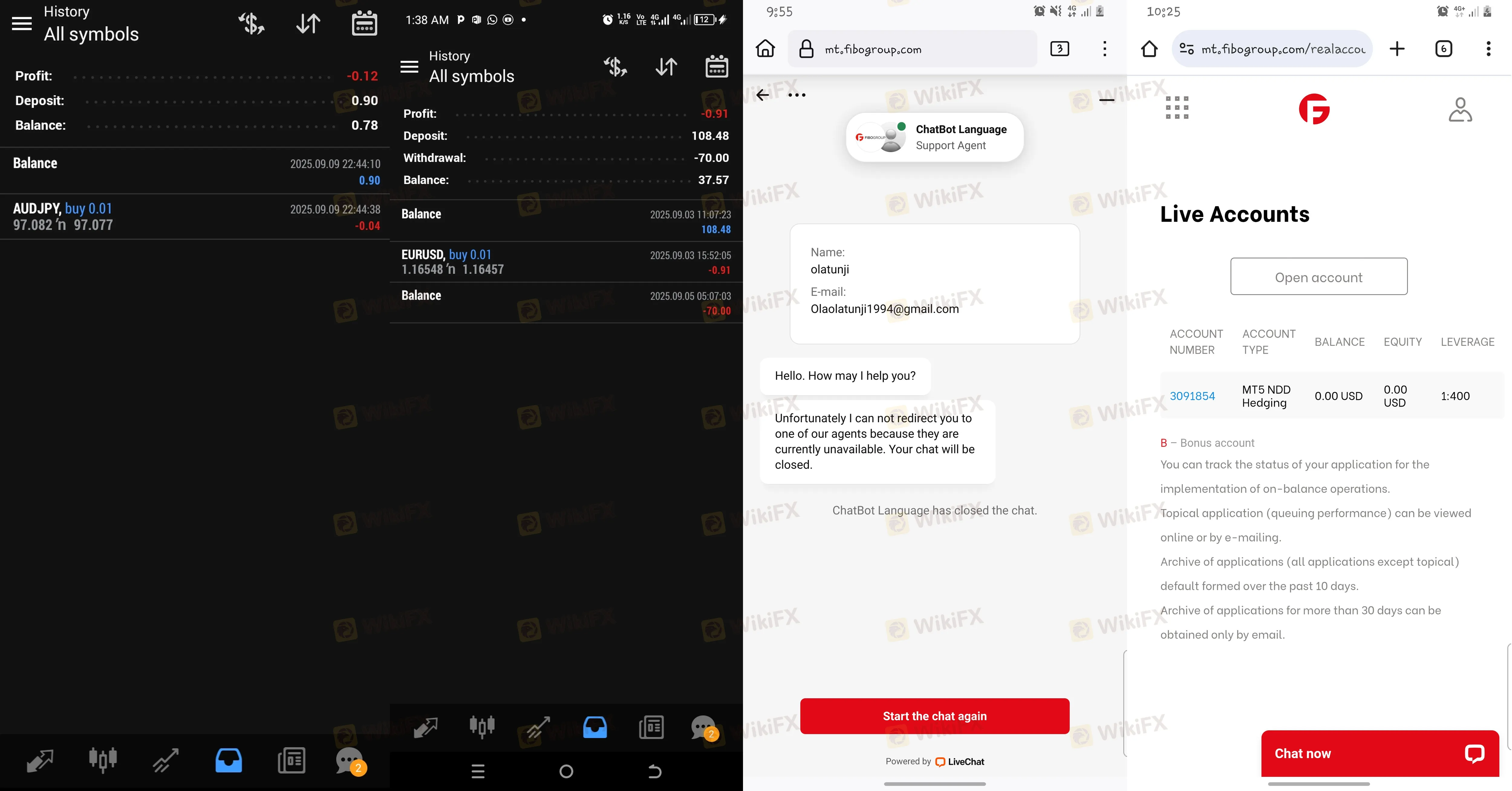

This is the most concerning section of our analysis. In the last three months alone, WikiFX has received 17 complaints from traders across the globe, including the Netherlands, India, and the UK.

Key Complaints Analysis

- Deposit and Withdrawal Failures: Traders have reported depositing funds that never reflected in their trading accounts. Worse, users like one from the UK noted, `i find it difficult to place a withdrawal from here`. In another case, a user stated the `withdraw button not on website`, effectively trapping their funds.

- Price Manipulation: A trader from India described a scenario where their position in US stocks was `maliciously liquidated` during non-trading hours, leading to heavy losses. Another user cited `severe slippage`, where trades were executed at prices much worse than the market rate, costing them over $400.

- Unresponsive Support: Multiple complaints mention that when these issues arise, the customer service team stops responding.

Pro Tip:

If you see a pattern of “slippage” complaints, it often indicates that the broker might be trading against you (taking the other side of your trade) rather than just connecting you to the market. This creates a conflict of interest.

Question 4: What software will I use?

FIBOGROUP provides the industry-standard platforms: MT4 (MetaTrader 4), MT5, and cTrader.

Security and Access

These platforms are generally robust and popular for their charting tools. However, security is your responsibility. Always ensure you are on the official FIBOGROUP website before entering your login details. Phishing scams often create fake login pages that look identical to the real broker's site to steal your credentials.

Since FIBOGROUP also supports a proprietary web terminal, be aware that proprietary apps can sometimes be less transparent than third-party software like cTrader, which is known for its “No Dealing Desk” transparency. Given the complaints about price manipulation, utilizing a transparent platform like cTrader might be safer if you choose to trade here.

Final Verdict: Should I open an account?

We do not recommend opening an account with FIBOGROUP at this time.

Although FIBOGROUP has been operating since 2010, the combination of offshore regulation (BVI) and a recent spike in severe complaints regarding withdrawals and price manipulation presents a risk that outweighs the benefits of high leverage. A WikiFX Score of 3.57 suggests that the broker is currently struggling to maintain a safe environment for retail clients.

Call to Action: Broker stability can change rapidly. Before you make any deposit, check the WikiFX App for the latest real-time certificate and to see if the complaint volume has decreased.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Kudotrade Review: Safety, Regulation & Forex Trading Details

FXPN Review 2026: Is This Forex Broker Safe?

Naira Rallies to Start February as Government targets Fiscal Consolidation

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Currency Calculator