US Fiscal Monitor: Efficiency Office Cuts Jobs, But Spending Hits New Highs

The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an "A" ranking in Influence according to our data, with significant traffic coming from Mexico, Brazil, Colombia, and Indonesia.

A brewing dispute over digital sovereignty threatens to spill over into the real economy, creating distinct downside risks for the Euro (EUR).

If you are looking into the Indonesian forex market, you have likely crossed paths with MIFX (Monex Investindo Futures). They are significantly influential in Southeast Asia, particularly Indonesia, with a footprint expanding into Malaysia and Vietnam. But popularity doesn't always equal safety.

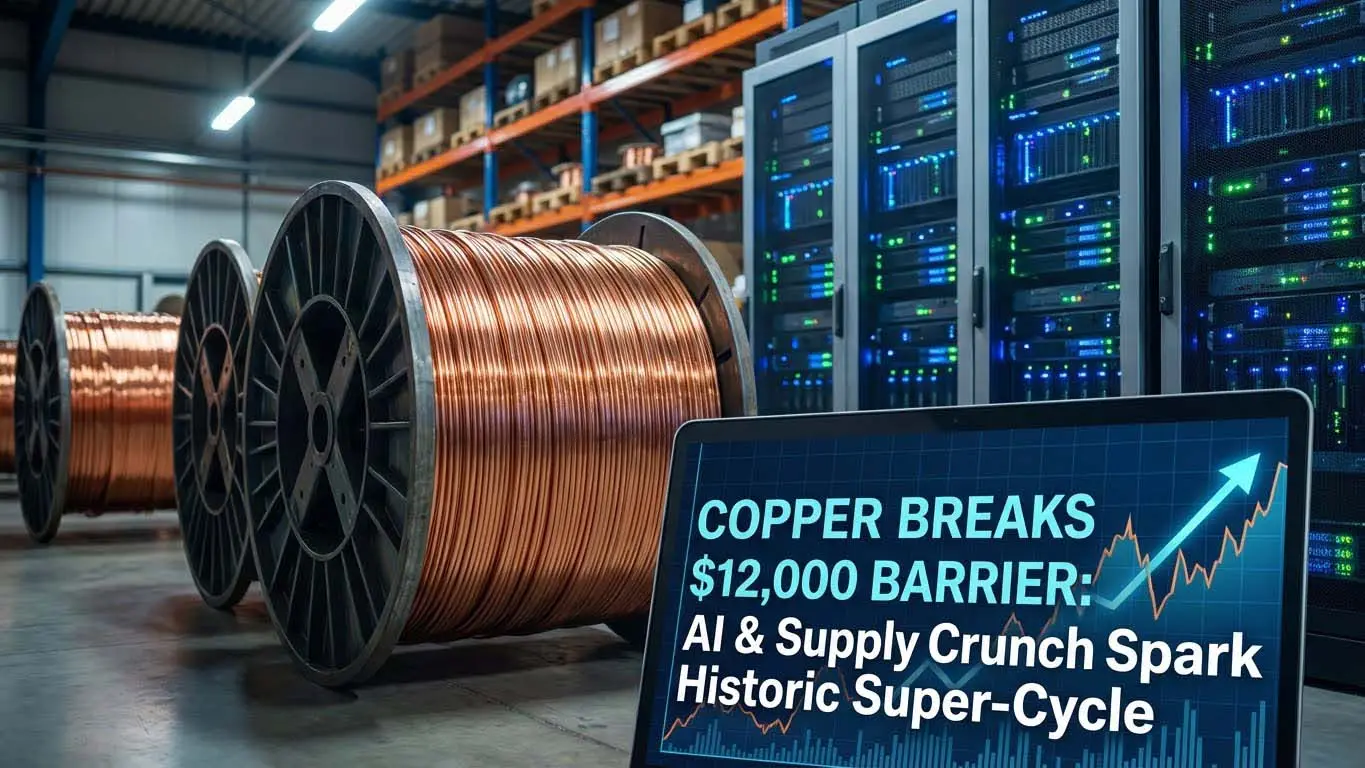

Copper prices on the LME have made history, breaching the $12,000 per ton mark for the first time, as a structural supply deficit collides with voracious demand from the AI and green energy sectors. The red metal has surged over 35% this year, marking its best performance since 2009.

XAG/USD & Commodities update: Volatility is spiking in the commodities sector, driven by speculative mania in precious metals and supply chain shocks in agriculture.

VenturyFX is a relatively new brokerage established in 2023 with its headquarters located in Mauritius. While the broker serves clients internationally, notably in regions such as Brazil/Colombia/Spain/Mexico, it currently operates without valid regulatory oversight. The broker holds a WikiFX Score of 1.37, which is considered low and indicates a high-risk environment for traders.

Crude oil markets have found a floor, with WTI climbing back above $58.50, as geopolitical friction in the Western Hemisphere and Eastern Europe revitalizes the risk premium. While demand-side concerns driven by rising US inventories linger, supply-side threats are taking center stage.

An in-depth review of XCMARKET. While it offers MT5 and diverse assets, the broker operates without a license and faces an official warning from the UAE's SCA.

B2broker or B2Prime Review details the company background, offices, domains, and WikiFX score. Understand regulation and risk alerts.

The US Dollar Index (DXY) touched fresh lows near 97.74 as political pressure on the Federal Reserve mounts, creating a divergence between economic data and monetary policy expectations.

When evaluating financial service providers, trust, regulation, and transparency are key. In this review, we examine Pictet — a well-known Swiss financial institution — and assess whether it is legitimate or a scam, highlight its core services, and compare it with other brokers in the market.

Get hands‑on with the best forex demo accounts from top brokers, designed to help beginners and pros practice trading securely.

Credit Suisse Securities faces a $7.1M FINRA fine after years of supervisory lapses tied to insider and manipulative trading risks.

When choosing between a broker and a prop firm, it mainly depends on your capital and experience. Prop firms are suitable if you’re starting with limited funds, but they come with strict rules and restrictions.

When selecting a forex broker, safety and regulatory status are the most critical factors. BePrimeGroup is a relatively new entrant in the financial markets, having been established in 2024. Headquartered in Saint Lucia, this broker offers digital account opening and operates on the MetaTrader 5 (MT5) platform. Despite offering high leverage and a variety of account types, the broker currently holds a very low WikiFX score of 1.77/10, primarily due to the absence of valid regulation and recent user complaints regarding withdrawals.

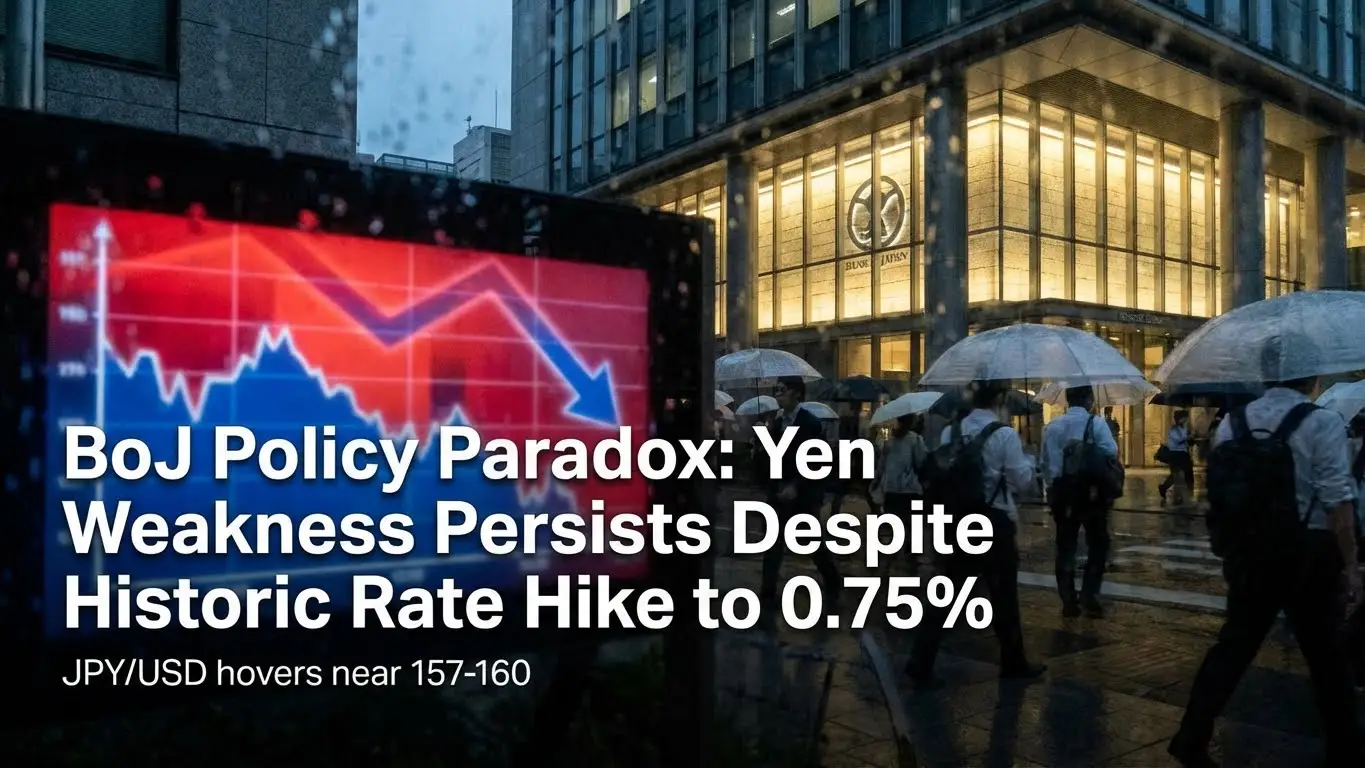

The Bank of Japan (BoJ) finds itself trapped in a policy nightmare. Despite executing a historic rate hike to 0.75% in December—the highest level in 30 years—the Japanese Yen (JPY) remains under severe pressure, hovering near intervention danger zones around 157-160 against the Dollar.

Discover Trading.com’s new zero-commission Investment Account with €50 bonus, transparent investing, and global equities access.

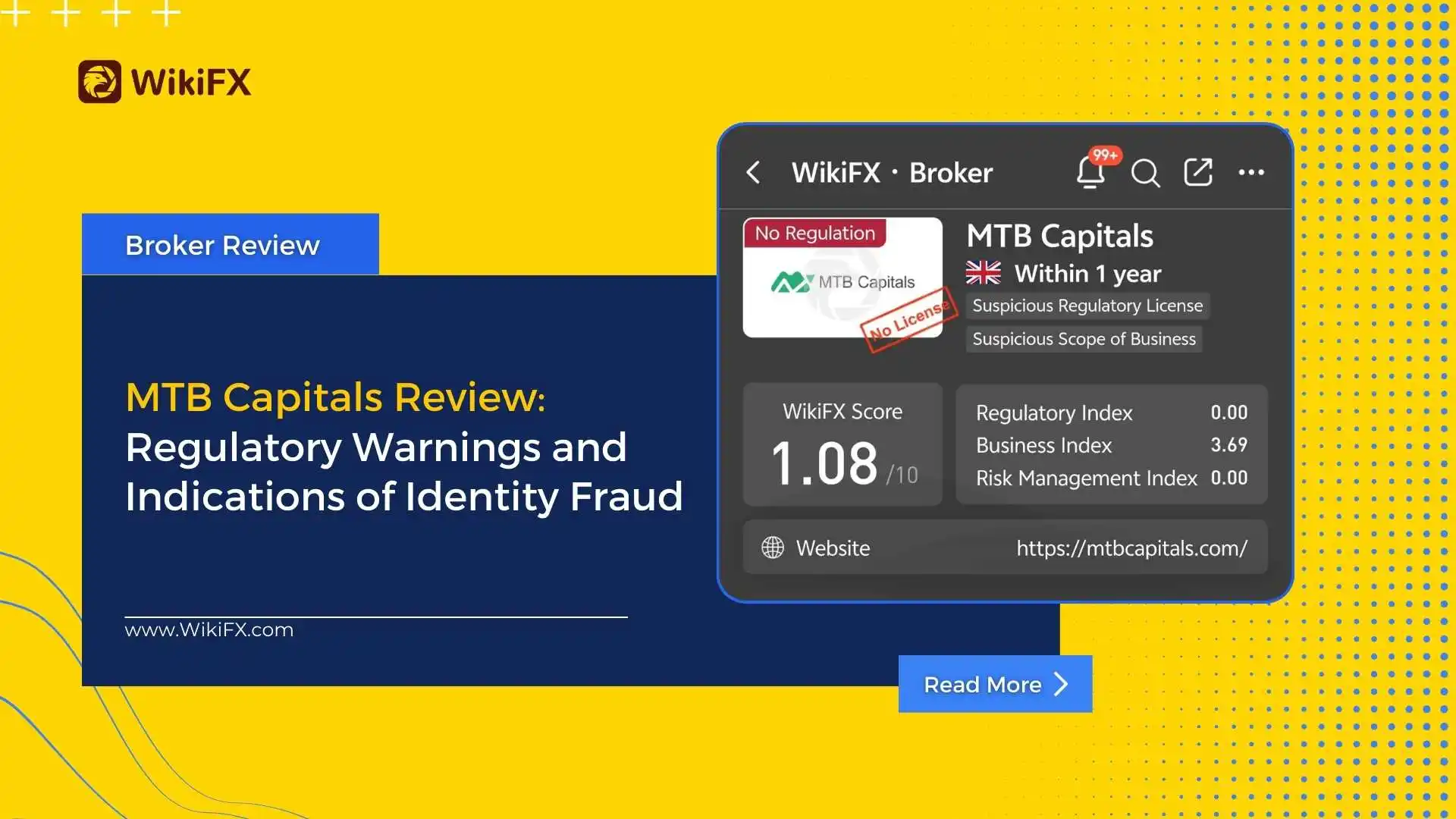

MTB Capitals displays major regulatory logos, yet WikiFX rates it 1.08/10. Investigations reveal official warnings from BaFin regarding identity fraud and alerts from CySEC.

Crypto exchange Bybit will limit access for Japanese users in 2025, citing compliance with strict local regulations.