Buod ng kumpanya

| Akatsuki Buod ng Pagsusuri | |

| Itinatag | 1997 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Instrumento sa Merkado | Investment Trust, Stock, Bond |

| Demo Account | / |

| Platform ng Paggawa ng Kalakalan | / |

| Minimum na Deposito | / |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

| Tel: 0120-753-960 | |

| Address: 17-10 Koamicho, Nihonbashi, Chuo-ku, Tokyo 103-0016 Nihonbashi Koamicho Square Building 5th floor | |

Impormasyon ng Akatsuki

Ang Akatsuki ay isang broker na nakabase sa Hapon na itinatag noong 1997, na regulado ng FSA. Nag-aalok ito ng mga serbisyo sa Investment Trust, Stock, at Bond.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng FSA | Limitadong impormasyon sa kalakalan |

| Napatunayang may pisikal na opisina | Iba't ibang mga bayarin na kinokolekta |

| Mahabang kasaysayan ng operasyon |

Tunay ba ang Akatsuki?

Ang Akatsuki ay regulado ng Financial Services Agency (FSA) sa Hapon. Mangyaring maging maingat sa panganib!

| Status ng Pagganap | Regulado ng | Lisensiyadong Institusyon | Uri ng Lisensya | Numero ng Lisensya |

| Regulado | Financial Services Agency (FSA) | Akatsuki株式会社 | Lisensya sa Retail Forex | 関東財務局長(金商)第67号 |

Pagsusuri sa Larangan ng WikiFX

Ang koponan ng pagsasaliksik sa larangan ng WikiFX ay bumisita sa address ng Akatsuki sa Japan, at natagpuan namin ang kanilang opisina sa lugar, na nangangahulugang ang kumpanya ay may operasyon sa isang pisikal na opisina.

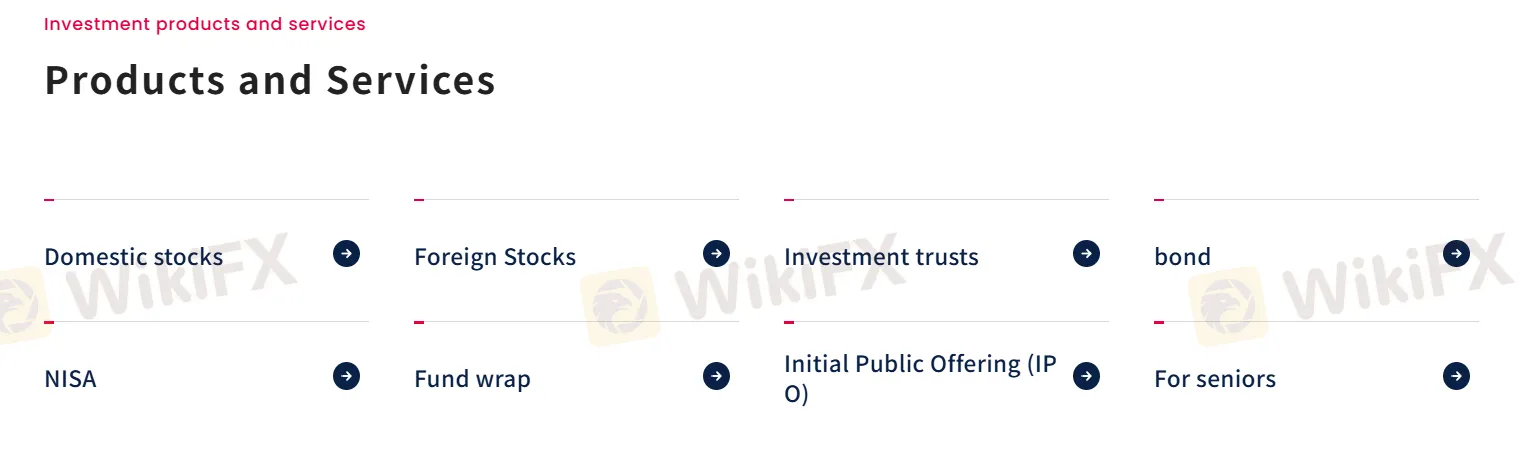

Ano ang Maaari Kong I-trade sa Akatsuki?

| Mga Tradable Instruments | Supported |

| Bonds | ✔ |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

Mga Bayad sa Akatsuki

| Uri ng Serbisyo | Basic Fee |

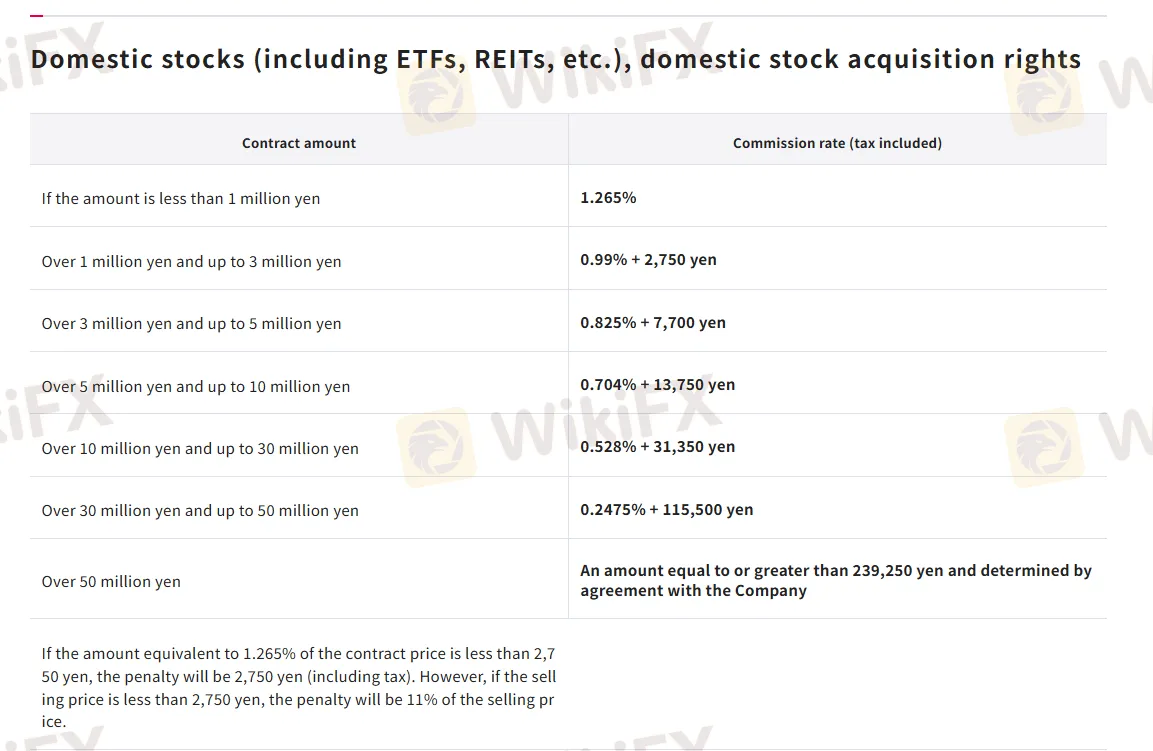

| Domestic Stocks Commission Rate | 0.2475% - 1.265% |

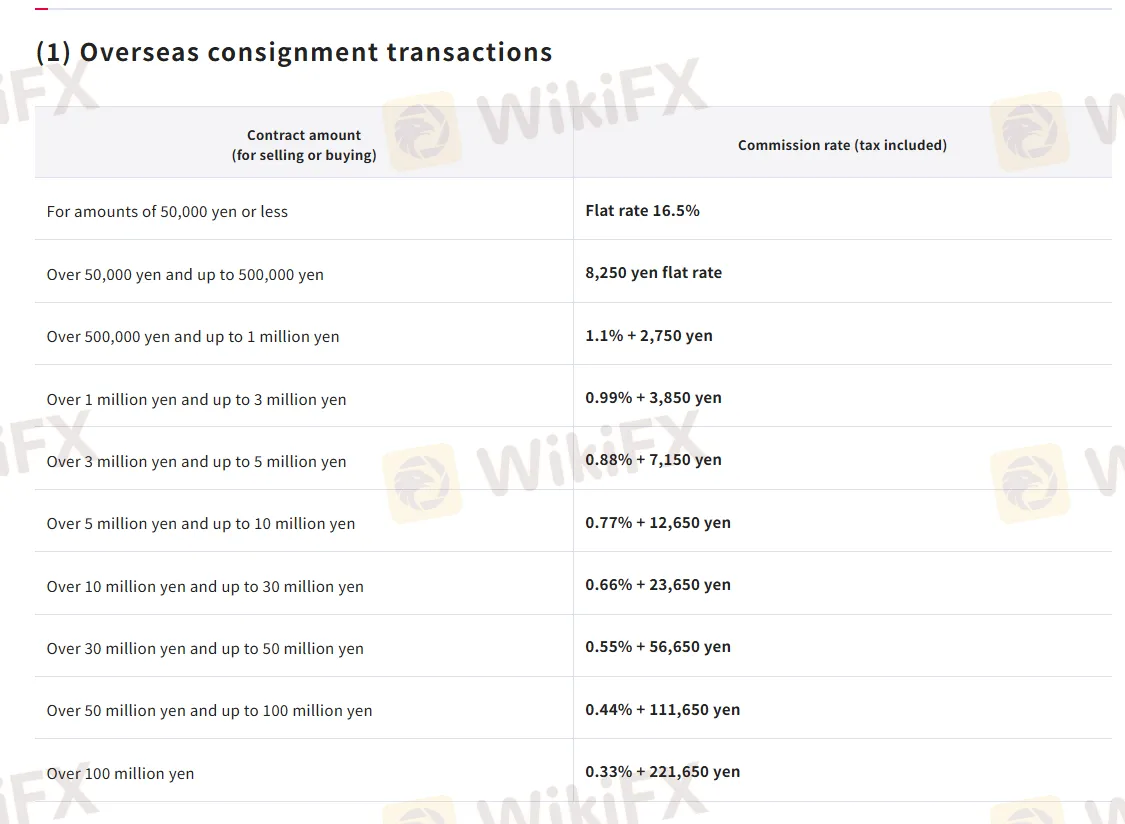

| Foreign Stocks Commission Rate | 0.33% - 16.5% |

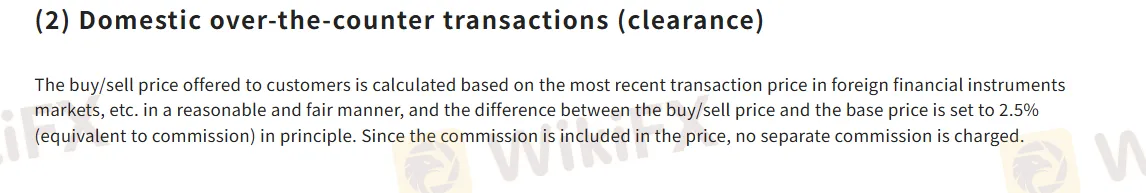

| Domestic over-the-counter Transactions | 2.5% |

| Entering and Exiting | 1,100 yen |

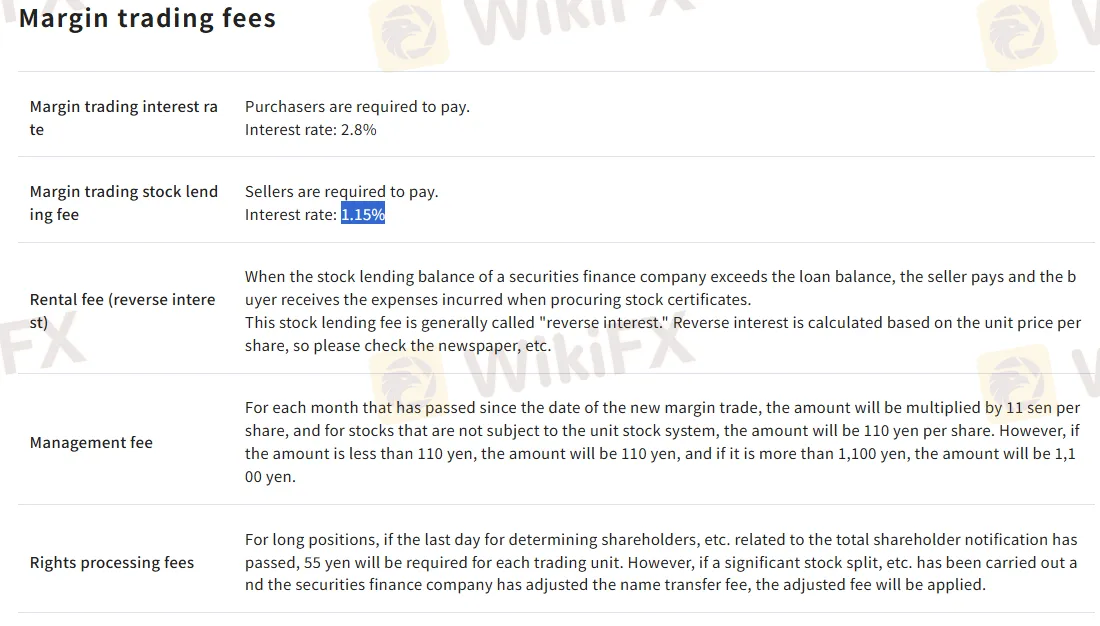

| Margin Trading Fees | 1.15% - 2.8% |