Profil perusahaan

| Renaissance Capital Ringkasan Ulasan | |

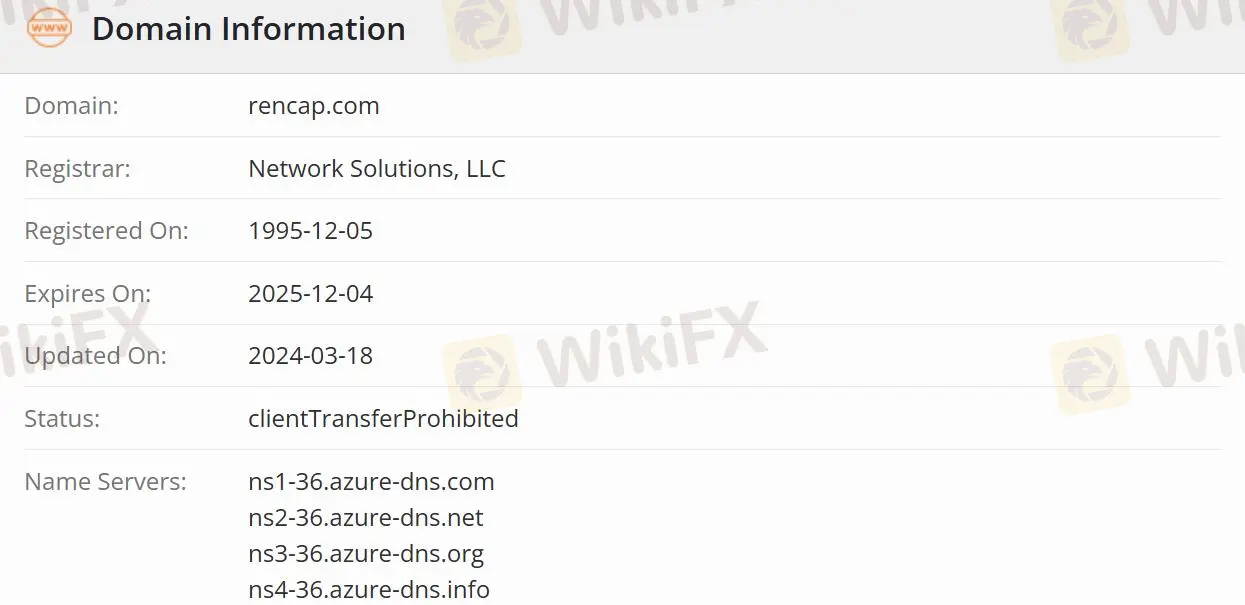

| Dibentuk | 1995-12-05 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | Teregulasi |

| Bisnis | Investment Banking, Global Markets/Top Brokerage. |

| Dukungan Pelanggan | Telepon: + 357(22)505 800 |

| Fax: + 357(22)676 755 | |

| E-mail: info@rencap.eu | |

Informasi Renaissance Capital

Renaissance Capital adalah bank investasi yang berlisensi CYSEC. Itu dinobatkan sebagai "Bank Investasi Pasar Emerging Eropa Tahun Ini" dan "Bank Investasi Independen Keberlanjutan Tahun Ini" dalam "2020 Investment Bank Awards" majalah The Banker. Perusahaan ini memiliki tiga area bisnis inti seperti investment banking, global markets, dan top brokerage.

Renaissance Capital Legal?

Cyprus Securities and Exchange Commission (CYSEC) mengatur Renaissance Capital dengan lisensi No.053/04 dan Tipe Lisensi Market Making (MM), yang lebih aman daripada yang tidak diatur.

Apa yang Dilakukan Renaissance Capital?

Divisi Investment Banking menawarkan solusi unik bagi klien dengan menggabungkan keahlian internasional dan lokal dalam merger dan akuisisi, pasar modal ekuitas, pasar modal utang, dan pembiayaan kustom.

Pasar modal ekuitas menawarkan produk ekuitas utama dan terkait ekuitas, monetisasi, dan solusi struktural.

Pasar modal utang berfokus pada obligasi lokal dan internasional, memberikan nasihat dan solusi restrukturisasi utang untuk manajemen kewajiban, pembiayaan, lindung nilai, dan juga mencakup layanan manajemen kewajiban dan penilaian kredit untuk klien korporat dan pemerintah.

Mergers and Acquisitions mengkhususkan diri dalam memberikan nasihat kepada perusahaan, investor keuangan, dan pemegang saham tentang transaksi besar dan kompleks, merger, akuisisi, restrukturisasi, pelepasan aset, transaksi swasta, buyout manajemen, buyout berleverage, dan situasi lainnya.

Area Global Markets melayani entitas hukum, lembaga keuangan, dan individu berkekayaan bersih tinggi serta menyediakan layanan yang disesuaikan untuk klien.

Area brokerage premier memungkinkan klien menggunakan kemampuan pasar global perusahaan serta manfaat tambahan secara eksklusif bagi klien yang membuka rekening brokerage dengan Renaissance Capital.

Ulasan Negatif Renaissance Capital di WikiFX

Di WikiFX, "Paparan" diposting sebagai kata dari mulut yang diterima dari pengguna.

Klien harus meninjau informasi dan menilai risiko sebelum bertransaksi di platform yang tidak diatur. Silakan konsultasikan platform kami untuk rincian terkait. Laporkan broker penipuan di bagian Paparan kami dan tim kami akan bekerja untuk menyelesaikan masalah yang Anda hadapi.

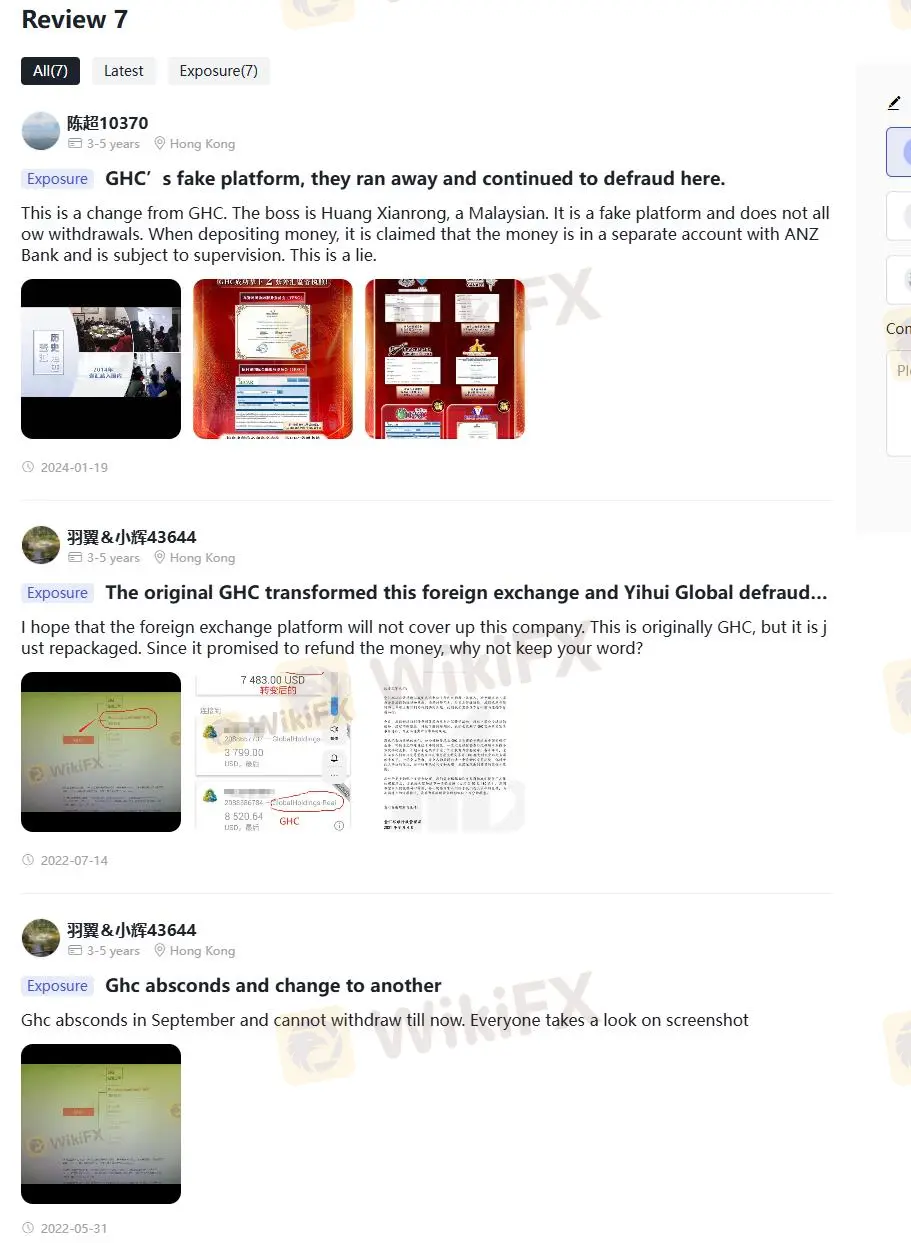

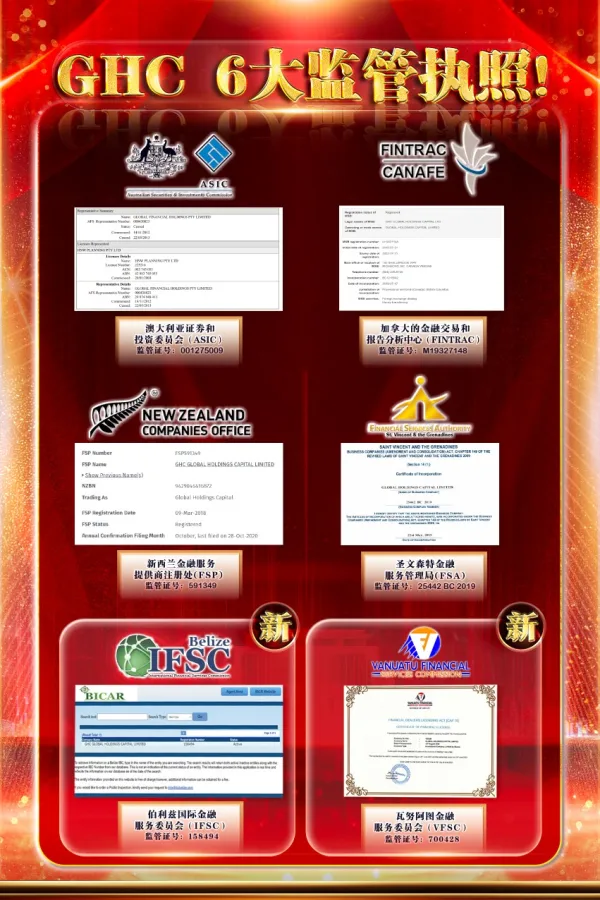

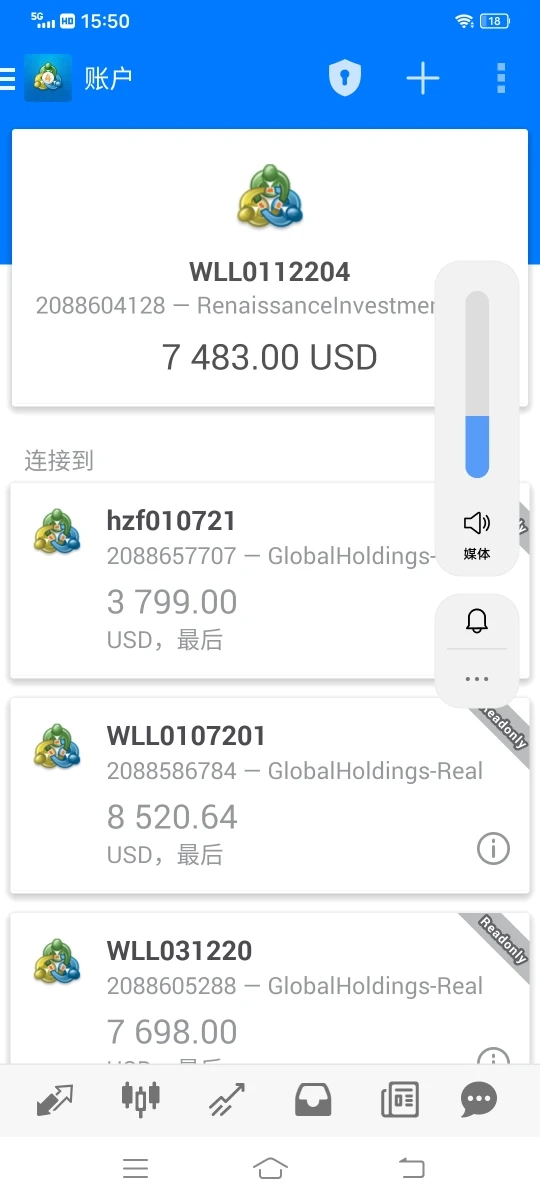

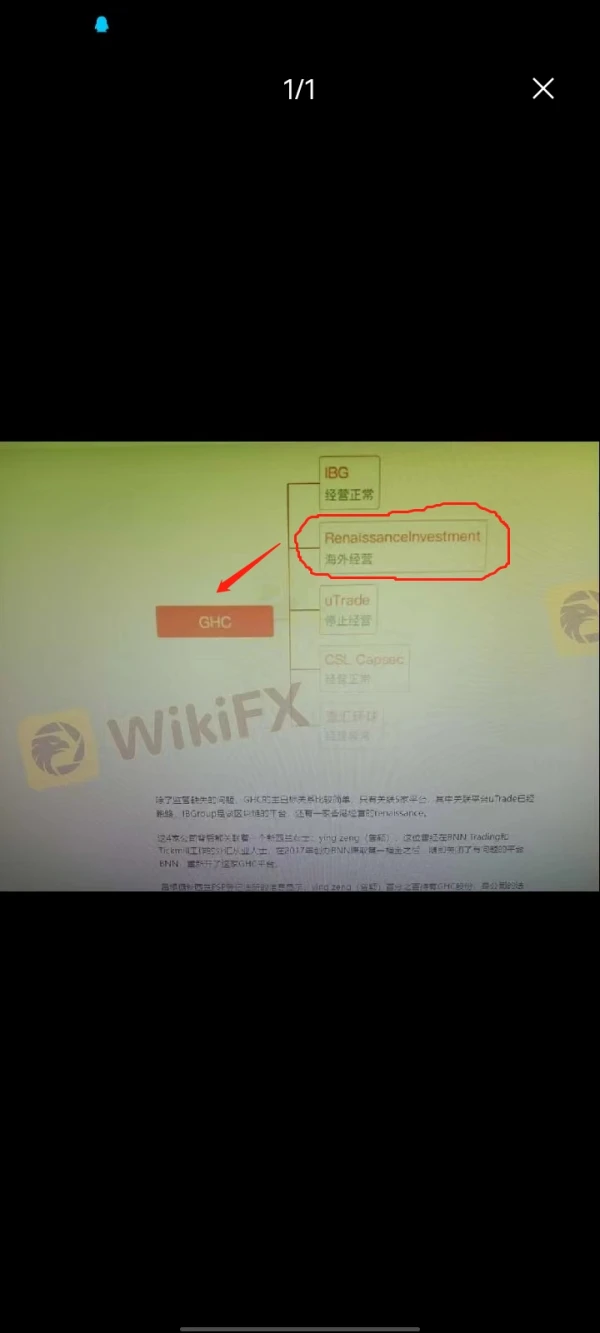

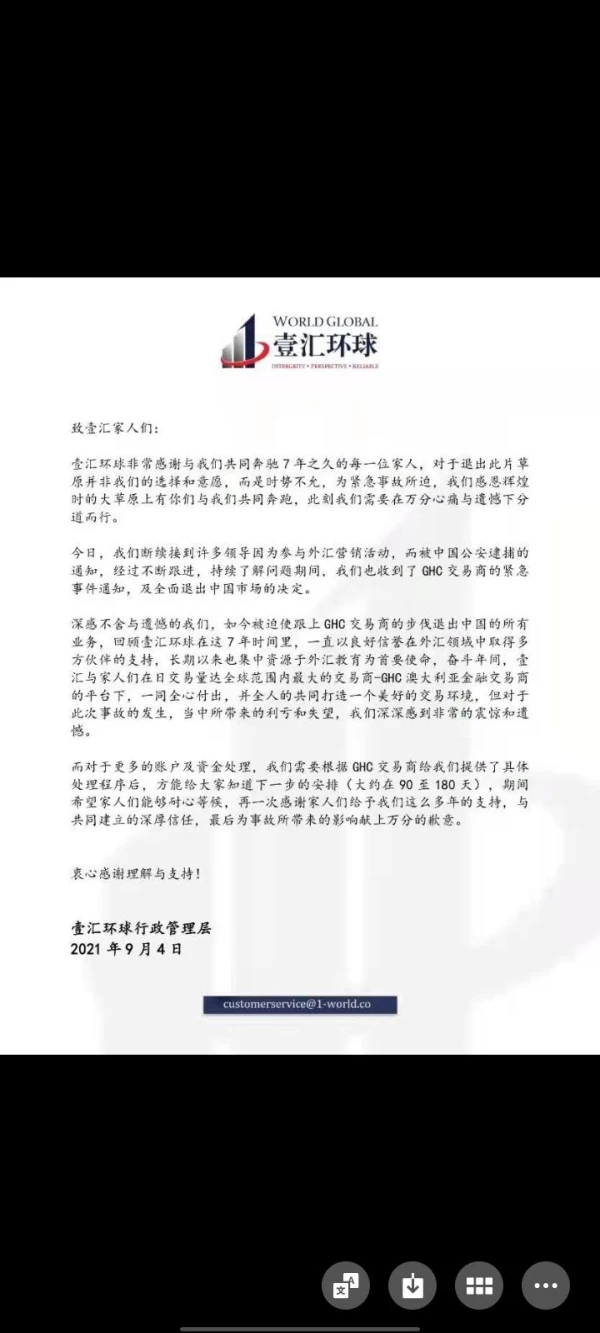

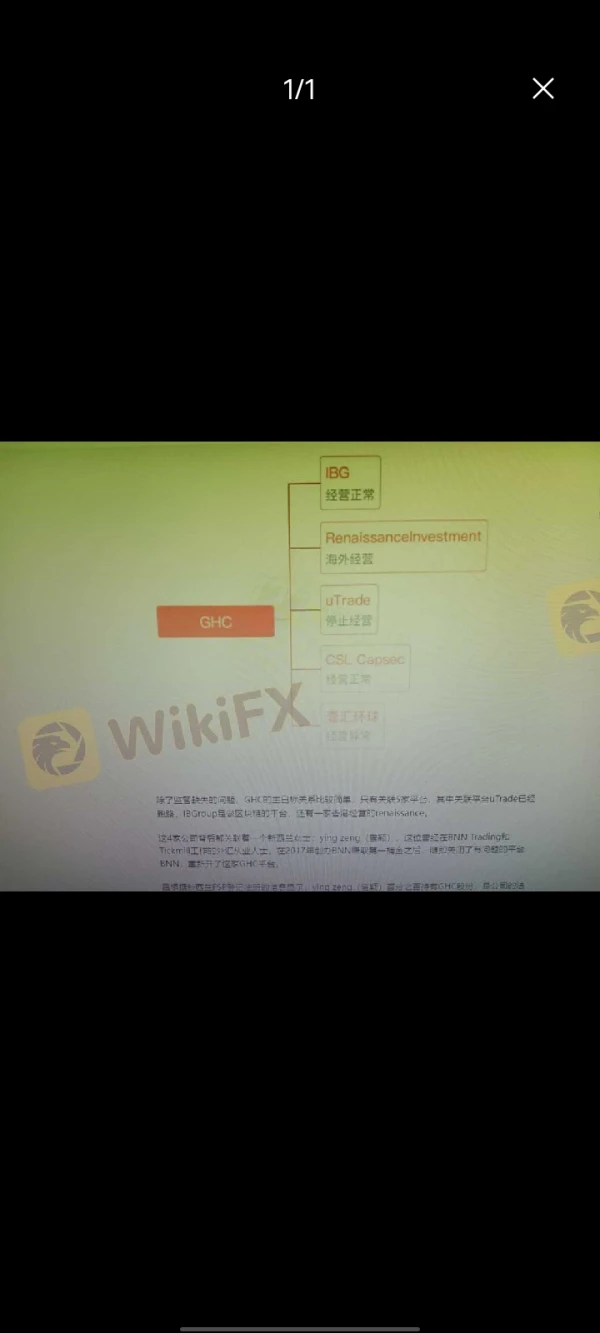

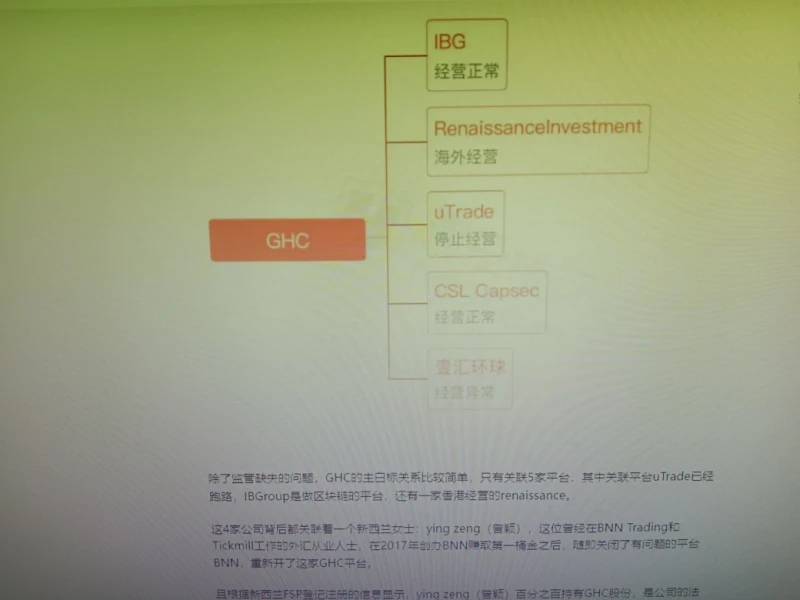

Beberapa pengguna mengatakan bahwa perusahaan ini dan GHC memiliki pemilik yang sama. GHC menipu mereka dan tidak dapat menarik uang. Hal ini akan menimbulkan beberapa kekhawatiran keamanan. Anda dapat mengunjungi: https://www.wikifx.com/en/comments/detail/202401199212973915.html https://www.wikifx.com/en/comments/detail/202207146672596195.html https://www.wikifx.com/en/comments/detail/202205315752526357.html.

陈超10370

Hong Kong

Ini adalah perubahan dari GHC. Bosnya adalah Huang Xianrong, seorang Malaysia. Ini adalah platform palsu dan tidak mengizinkan penarikan. Saat melakukan deposit, diklaim bahwa uang berada di rekening terpisah dengan ANZ Bank dan tunduk pada pengawasan. Ini adalah kebohongan.

Paparan

壞丫头

Hong Kong

Ini adalah nama lain dari GHC dan terus melakukan penipuan.

Paparan

A天蓝蓝(牙医)

Hong Kong

Dari GHC lagi ke pedagang ini, scammers terus menipu. Hanya kami investor China yang mengambil hasilnya.

Paparan

羽翼&小辉43644

Hong Kong

Saya berharap platform valuta asing tidak akan menutupi perusahaan ini. Ini awalnya GHC, tetapi hanya dikemas ulang. Karena itu berjanji untuk mengembalikan uang, mengapa tidak menepati janji Anda?

Paparan

羽翼&小辉43644

Hong Kong

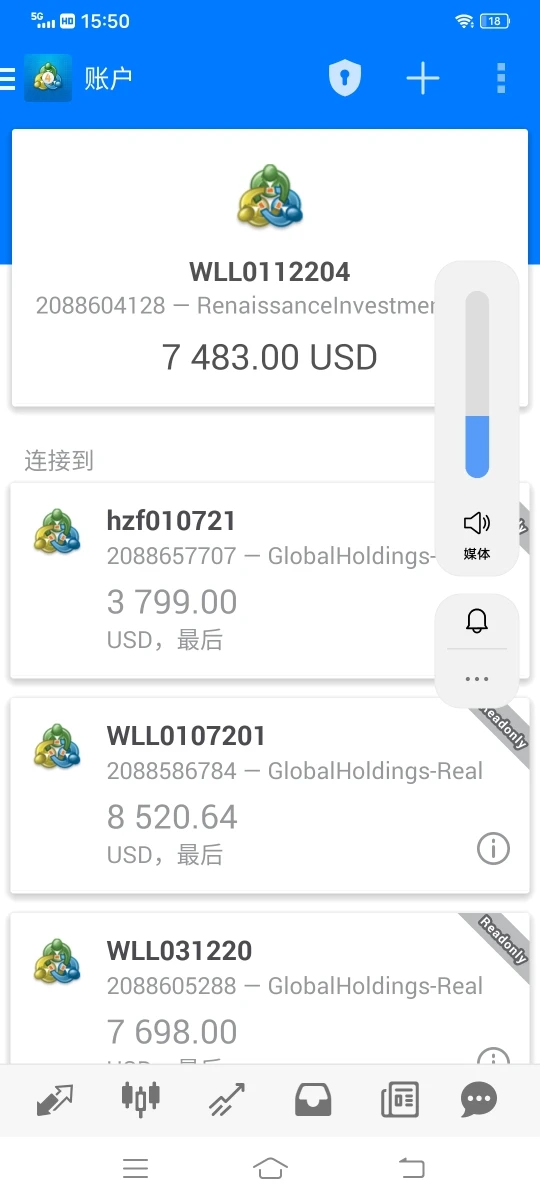

Ghc melarikan diri pada bulan September dan tidak dapat mundur sampai sekarang. Semua orang melihat pada tangkapan layar

Paparan

羽翼&小辉

Hong Kong

Sudah dikatakan bahwa Anda memiliki koneksi dengan GHC. Anda telah menipu begitu banyak orang.

Paparan

A天蓝蓝(牙医)

Hong Kong

Pada tanggal 4 September, situs web tidak dapat dibuka secara bersamaan, dan kemudian GHC menjadi dealer ini, scammer.

Paparan