Profil perusahaan

| HGNHRingkasan Ulasan | |

| Didirikan | 15-20 tahun |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | Tidak Diatur |

| Layanan | Futures Business/Securities Business/Asset Management Business |

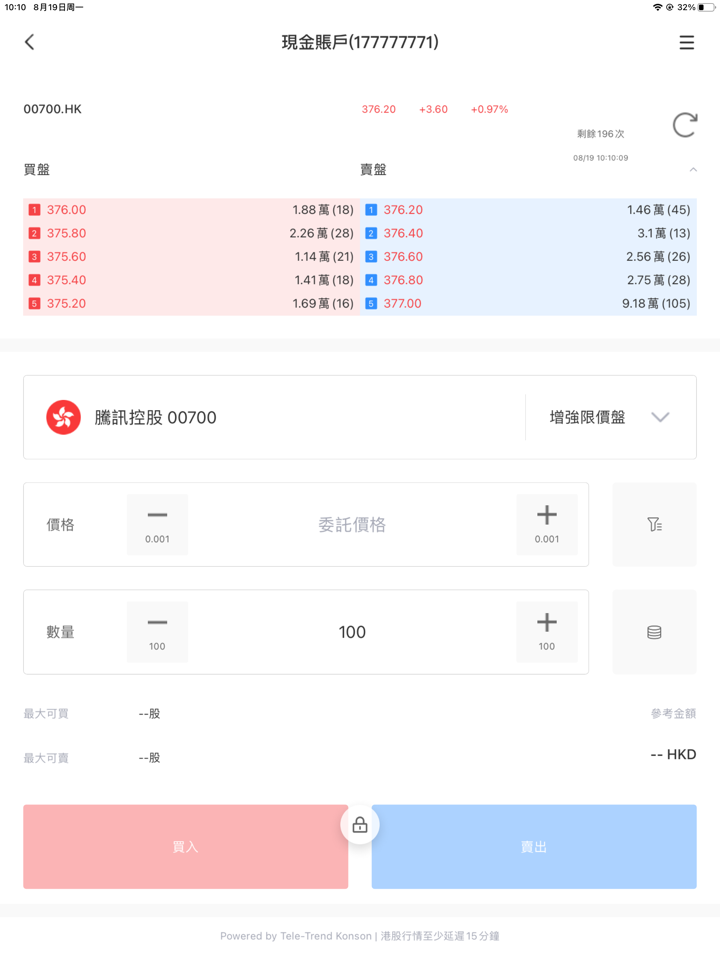

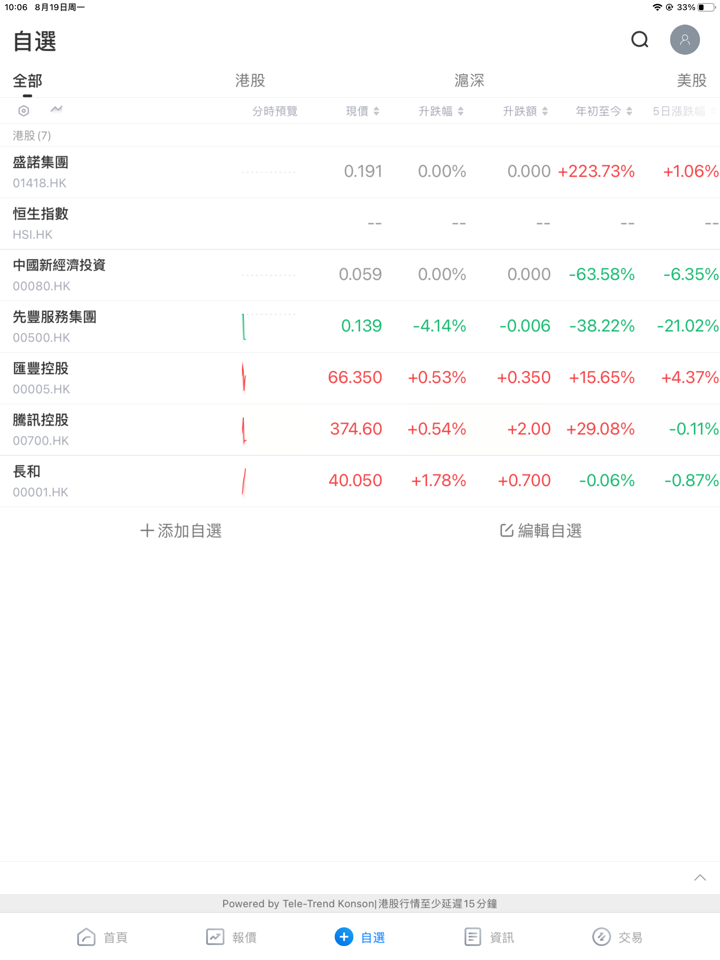

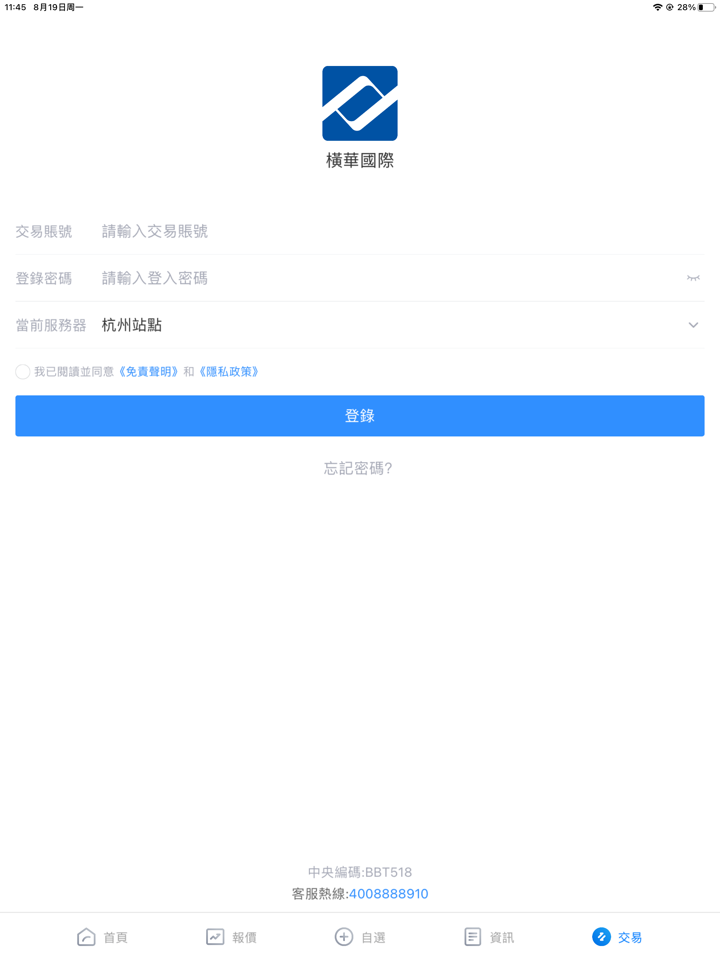

| Platform Perdagangan | Polestar Global Trading/Henghua International Trading |

| Dukungan Pelanggan | Telepon: 4008888910-2 |

| Hotline layanan: 400-8888-910 ext. 2 | |

| Hotline perdagangan 400: 400-8888-910 ext. 2 ext. 2 (Sekuritas)/400-8888-910 ext. 2 ext. 1 (Futures) | |

| Hotline perdagangan futures: 852-2805 2701, 2805 2702 /86-139 1147 1423 | |

| Hotline perdagangan sekuritas: 852-2534 9137 / 86-1471503 6063 | |

| Keluhan dan saran: hgnh-co@nawaa.com / 400 8888 910-2 | |

| Faks perusahaan: 852-28052978 | |

Informasi HGNH

HGNH (sebelumnya Nanhua Hong Kong) adalah anak perusahaan sepenuhnya dari China Nanhua Futures Co., Ltd., yang didirikan di Hong Kong pada tahun 2006.

Henghua International saat ini menyediakan perdagangan sekuritas, perdagangan kontrak futures, perdagangan valuta asing berdaya ungkit, konsultasi sekuritas, konsultasi kontrak futures, pengelolaan aset, pinjaman, penyelesaian kontrak futures, dan layanan lainnya.

Apakah HGNH Legal?

HGNH diotorisasi dan diatur oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC) dengan nomor lisensi AOU118, sehingga lebih aman daripada perusahaan yang diatur.

Layanan apa yang disediakan oleh HGNH?

HGNH menyediakan layanan dalam empat bidang utama: usaha futures, usaha sekuritas, usaha pengelolaan aset, dan usaha pengelolaan kekayaan.

Usaha Futures: Termasuk perdagangan derivatif sekuritas komoditas, perdagangan, R&D, layanan tambahan, dan layanan kantor tengah.

Usaha Sekuritas: Layanan perdagangan saham, reksa dana, indeks, dan lainnya.

Usaha Pengelolaan Aset: Menyediakan pengelolaan dana, konsultasi investasi, pengelolaan bisnis RQFII, bisnis RQFII, dan produk FOF di pasar Tiongkok.

ONEDAY31658

Hong Kong

Saya sudah mencoba lima kali tetapi saya tidak dapat menarik dana. Setiap kali saya diberi tahu bahwa penarikan saya ditolak. Saya tidak berhasil menarik dana, bahkan sekali

Paparan

ONEDAY31658

Hong Kong

Harus membayar margin untuk info kartu bank yang salah. Bayar biaya pemeriksaan untuk kartu bank yang tidak normal. Bayar 50% untuk pengendalian risiko CBRC. Membayar biaya pembekuan untuk mekanisme perlindungan. Bayar uang untuk meningkatkan nilai kredit.

Paparan

美乐公司赫宏梅

Hong Kong

Beberapa penarikan pertama dapat dilakukan. Tetapi penarikan dalam jumlah besar, Anda tidak dapat menariknya., Layanan pelanggan dan dukungan ditingkatkan selama ini.

Paparan

lele_

Vietnam

…Ketika saya melihat perusahaan ini mengatakan bahwa itu telah berdiri selama hampir 20 tahun, saya masih berpikir bahwa tidak ada masalah besar jika dapat bertahan begitu lama. Lalu saya melihat keluhan para korban di wikifx! Tampaknya mata massa yang tajam selalu yang paling efektif! Jangan berurusan dengan penipu ini!

ulasan netral

FX3420080831

Hong Kong

Menolak untuk menarik uang dan membekukan akun saya, dan saya perlu membayar untuk mencairkan uang

Paparan

无悔76728

Hong Kong

Pada awalnya, Anda dapat mengambil sebagian dari uang Anda tetapi setelah Anda mengeluarkannya, Anda tidak dapat

Paparan