Punteggio

WorldFirst

Australia | 15-20 anni |

Australia | 15-20 anni |--

Sito ufficiale

Indice di valutazione

Influenza

Influenza

AA

Indice di influenza NO.1

Cina 9.11

Cina 9.11 Contatto

Single core

1G

40G

1M*ADSL

- Il numero di recensione del sondaggio sul campo nagitivo di questo broker ha raggiunto 1, si prega di essere consapevoli del rischio e della potenziale truffa!

Informazioni di base

Australia

Australia

Gli utenti che hanno visualizzato WorldFirst hanno visualizzato anche..

HFM

GTCFX

fpmarkets

Mitrade

Sito web

Singapore

Singaporeworldfirst.com

104.17.92.71Posizione del serverStati Uniti

Registrazione ICP--Principali paesi/aree visitatiSingapore

Data di validità del dominio2000-02-03Nome del sitoWHOIS.MONIKER.COMAziendaMONIKER ONLINE SERVICES LLC

Relazioni Genealogia

Società collegate

Domande e risposte Wiki

Given the available reviews and your evaluation, what is your assessment of WorldFirst's trustworthiness?

From my standpoint as an experienced trader, WorldFirst presents a mixed picture when it comes to trustworthiness. Its regulation under Australia’s ASIC and its lengthy operational history initially gave me a sense of confidence. Having ASIC oversight has historically been a sign that a broker must adhere to certain legal and operational standards. WorldFirst’s structure also appears highly tailored to businesses and e-commerce operators, with transparent fees for most services and a focus on global payments rather than spot retail forex trading. However, my deeper investigation raised significant concerns. Notably, there are multiple user reports of sudden account locks and demands for large “risk funds” or “unfreezing deposits” as a prerequisite for withdrawing funds. These demands—such as requiring $5,000 or even $10,000 to access one’s own money—are not standard industry practice and frankly set off alarm bells for me. The difficulty users faced when trying to escalate or resolve these disputes further erodes my confidence. I am always cautious about any broker where account access can be restricted and communication is not transparent or readily available via multiple verified channels. In short, while WorldFirst is officially regulated and has some positive client feedback, the repeated, unresolved withdrawal issues reported by multiple users would make me personally extremely cautious about placing significant funds with them. For me, transparent processes and the ability to withdraw funds without arbitrary conditions are non-negotiable prerequisites for trust.

Which types of trading instruments does WorldFirst offer, such as forex, stocks, indices, cryptocurrencies, or commodities?

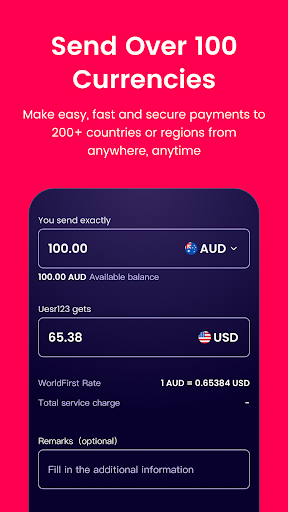

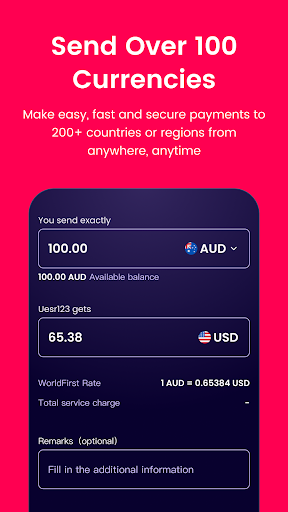

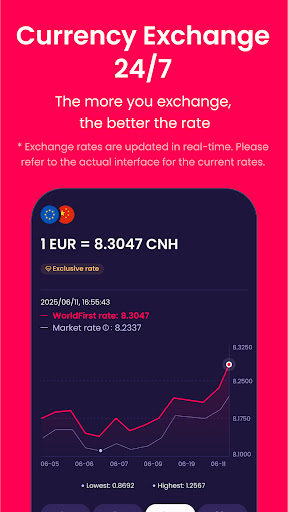

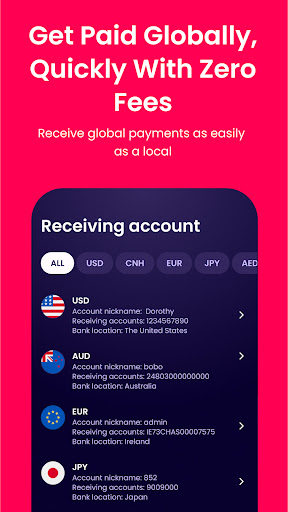

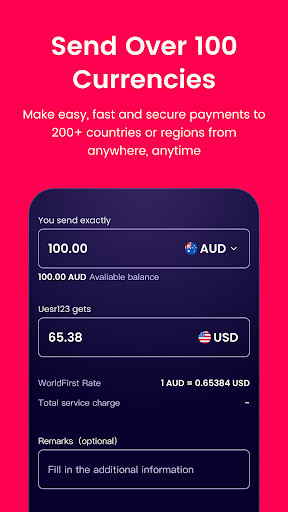

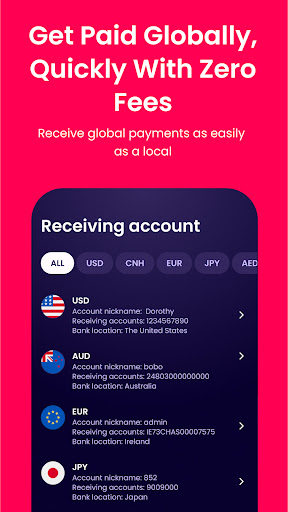

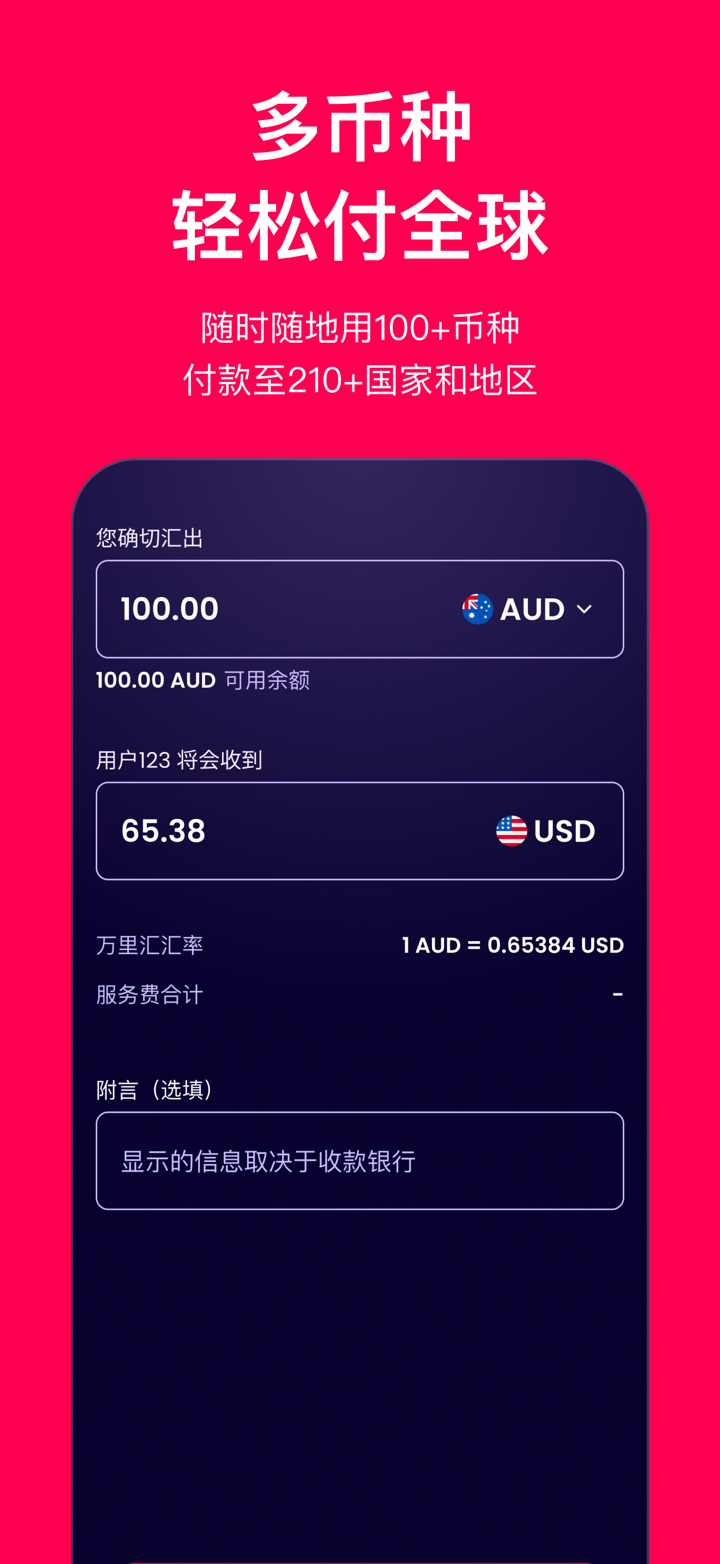

As an experienced trader, I’ve learned to scrutinize each broker’s core offerings and regulatory footing before considering them for either personal or business use. With WorldFirst, what stands out most clearly from my research and review is that their platform is not structured as a typical multi-asset trading environment. WorldFirst specializes in business-centric services, primarily geared towards international payments, currency exchange solutions, and multi-currency accounts. While they are regulated by ASIC in Australia and previously had FCA approval in the UK (though that status appears to be lapsed or exceeded), their focus is almost exclusively on cross-border payments, spot and forward FX contracts, and risk management tools aimed at SMEs and e-commerce operators. I was unable to find any evidence that WorldFirst offers trading in stocks, indices, cryptocurrencies, or commodities. Their listed services center around exchanging and managing dozens of fiat currencies, mass payments, and integrations for streamlined business operations rather than speculative or derivative trading. For me, this makes WorldFirst unsuitable if you’re seeking leveraged CFD or multi-asset trading; it simply doesn’t cater to that market. In summary, WorldFirst’s offerings are limited to forex in the context of business payments and do not extend to the broader spectrum of instruments like equities, indices, or crypto. This distinction is important to understand so traders like myself can match our needs with the appropriate provider.

Can I trust WorldFirst as a reliable and secure broker for trading?

As a trader who places a premium on regulatory oversight and platform transparency, I took a close look at WorldFirst. They are regulated by ASIC in Australia, which certainly adds a layer of credibility for me. The fact that they have over 15 years in operation and offer clearly outlined, capped fees is reassuring, especially for those who frequently handle international payments. However, my confidence became mixed after examining user experiences. I noticed multiple withdrawal complaints, specifically accounts being locked and demands for additional “risk fees” before funds would be released. This is deeply concerning. In my experience, any broker that restricts withdrawals or asks for unexpected payments after depositing or trading deserves extreme caution. Moreover, while WorldFirst is positioned as a B2B payment solution with robust features for cross-border commerce rather than classic forex trading, their business focus might not perfectly suit individual traders like myself. The UK payment license is also marked as “Exceeded,” which means I have to question the ongoing reliability of their regulatory status outside Australia. For me, strong regulation is only as meaningful as the broker’s conduct toward client funds in practice. Based on what I’ve learned, I can’t ignore the consistent red flags about fund access. Despite a seemingly strong regulatory backbone in Australia, if I were considering placing significant capital, I’d proceed with considerable caution and consider alternatives with flawless withdrawal histories and clearer individual trading support. For me, full trust requires not only regulation but also proven client fund security in practice.

How do the different account types provided by WorldFirst compare to one another?

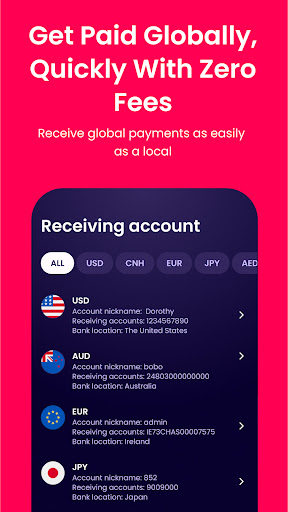

Drawing directly from my experience as a trader and after careful research into WorldFirst, I found that their service model is quite distinct from most retail forex brokers. WorldFirst does not offer the typical tiered trading account types that many forex traders might expect, such as standard, ECN, or VIP accounts. Instead, the accounts are designed primarily for businesses, providing what they call “multi-currency accounts” intended to streamline cross-border payments, currency conversion, and business funding needs. For me, this means the comparison is less about different trading account levels and more about the integrated functionality offered to global SMEs. The main offering—World Account—allows users to hold, send, and receive payments in over 20 currencies with no ongoing maintenance fees. Features like marketplace collection, client invoicing, mass payments, and integration with tools such as Xero or NetSuite are geared toward operational efficiency for companies, not trading flexibility for individuals. From a risk management perspective, while the platform advertises capped and transparent fees—which can provide cost clarity—there have been several user complaints about account holds and withdrawal difficulties, citing requests for additional funds to unlock accounts. This raises a cautionary flag for me, especially when dealing with substantial sums. Ultimately, if you’re seeking a traditional forex trading experience with varied account options, WorldFirst’s business-focused model may not align with what most retail traders need. Their offering serves international payment and business FX needs, and traders should approach with measured expectations and always prioritize security and regulatory compliance.

Recensioni utenti6

Cosa vuoi valutare

inserisci...

Commento 6

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora

蘇義盛

Taiwan

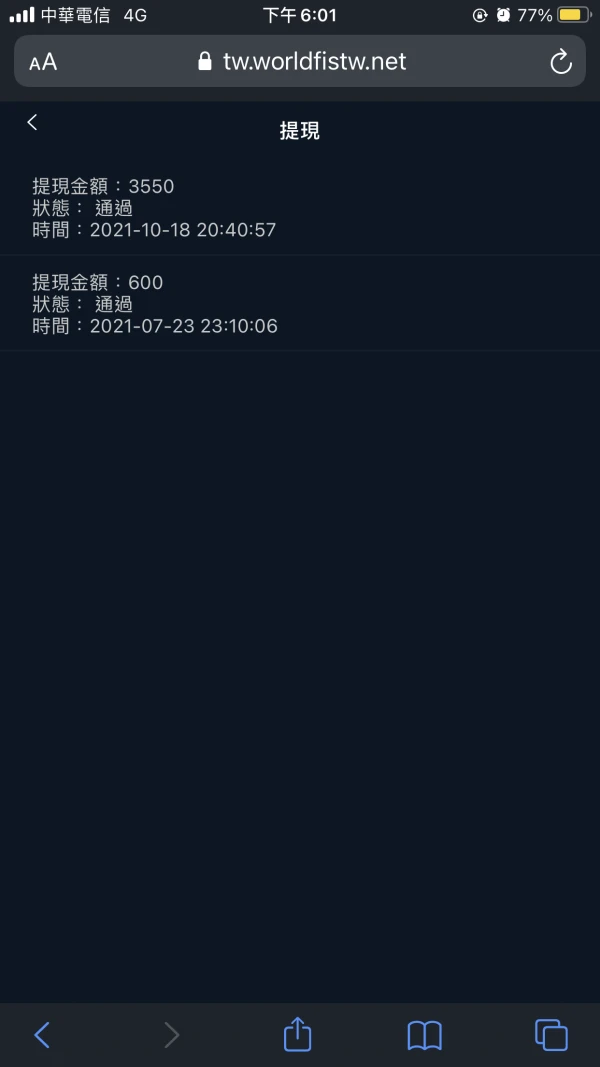

Il servizio clienti ha risposto e mi ha chiesto di pagare $ 10.000 per sbloccare il deposito. Poiché le autorità di regolamentazione finanziaria hanno requisiti più severi in materia di sicurezza del conto e delle risorse, sono necessari più depositi. Non ci sono regole chiare sulla piattaforma. Sembra irragionevole ritirare il deposito di scongelamento.

Esposizione

蘇義盛

Taiwan

Risposta del servizio clienti: Salve, la società ha informato che poiché l'ufficio tecnico ha rilevato un problema anomalo con il tuo account, che potrebbe essere stato rubato. Quindi il prelievo non ha superato la revisione e devi pagare un fondo di rischio di $ 5000. Domanda: non ho operato in modo anomalo e il prelievo di $20.572 non ha avuto successo. Il servizio clienti mi ha chiesto di pagare $ 5.000 a causa di un'operazione impropria. È ragionevole?

Esposizione

蘇義盛

Taiwan

Impossibile ritirare. La piattaforma mi ha chiesto di depositare $ 5.000 per la commissione di rischio. Questo non aveva senso. Eravamo solo investitori e incapaci di controllare prelievi e depositi sulla piattaforma. Pensavo fosse una piattaforma di frode. Ha risposto solo il servizio clienti ufficiale. Nessun telefono. Avevo ancora $25.124 sul mio conto, ma non potevo prelevare.

Esposizione

FX1485573802

Filippine

WorldFirst è stata la mia scelta per i trasferimenti internazionali. È rassicurante sapere che sono regolamentati da ASIC e registrati presso AUSTRAC. Il trasferimento di denaro è senza problemi e sono abbastanza chiari riguardo a eventuali commissioni.

Positivo

Alfred

Indonesia

Onestamente, WorldFirst potrebbe ricevere 5 stelle, ma i miei fondi non sono arrivati fino ad ora, dato che sono passati cinque giorni. Scrivo questa recensione in attesa...

Positivo

葉翰隆

Taiwan

Pensavo fosse una piattaforma di cambio, ma il mio account è stato bloccato quando mi sono ritirato. Mi ha chiesto di pagare $ 5000 come margine, ma ho potuto contattarlo solo online. Non sono sicuro di poter recuperare il margine.

Esposizione