S jonas

1-2年

Considering recent reviews and your own evaluation, how would you assess the legitimacy of Fidelity?

Based on my thorough evaluation and recent observations, I consider Fidelity to be a legitimate financial institution with a strong regulatory standing. My confidence primarily comes from the clear regulatory oversight by the Securities and Futures Commission (SFC) in Hong Kong, where Fidelity holds a valid license for dealing in futures contracts. I find this particularly important because SFC is recognized for its stringent regulatory requirements, which directly enhances investor protection and operational transparency.

Fidelity’s established presence—having been active for over two decades in both Japan and Hong Kong—also contributes to my trust. Over time, I’ve learned that longevity and continued regulatory compliance are strong indicators of a broker's legitimacy and commitment to fair practices. Furthermore, I appreciate Fidelity’s focus on diverse, long-term investment products like mutual funds, retirement schemes (MPF/ORSO), and multi-asset strategies, rather than more opaque instruments like FX or CFDs. This minimizes product complexity and reduces potential conflicts of interest.

However, I have noted that there is no demo or Islamic (swap-free) account available, and the fee structure can be relatively high for smaller investment balances. While these factors do not compromise legitimacy, they do require careful consideration for prospective investors. Overall, in my experience and judgment, Fidelity demonstrates the hallmarks of a reputable, strictly regulated firm. I advise anyone interested to review its product scope and fee terms diligently before committing funds.

sinopi

1-2年

Can you outline the particular advantages Fidelity offers in terms of its trading instruments and the way its fees are structured?

From my own experience as a trader who values transparency and regulatory oversight, Fidelity stands out primarily for its credibility and specialization. Unlike many brokers focused on forex or CFDs, Fidelity’s main strengths lie in its broad selection of mutual funds, retirement schemes like MPF and ORSO, and thematic, multi-asset investment options. For me, this means I access a range of global opportunities across asset classes, with a particular emphasis on structured, long-term growth and risk diversification. The range of sustainable and Asia-focused funds, for example, provides strategic tools for investors keen on either regional growth or ESG values.

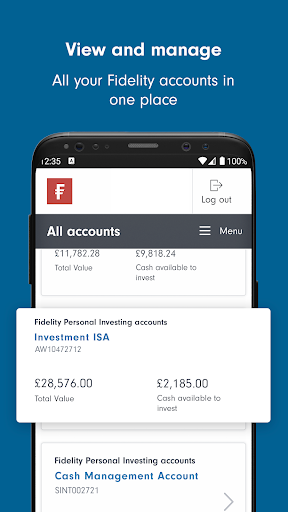

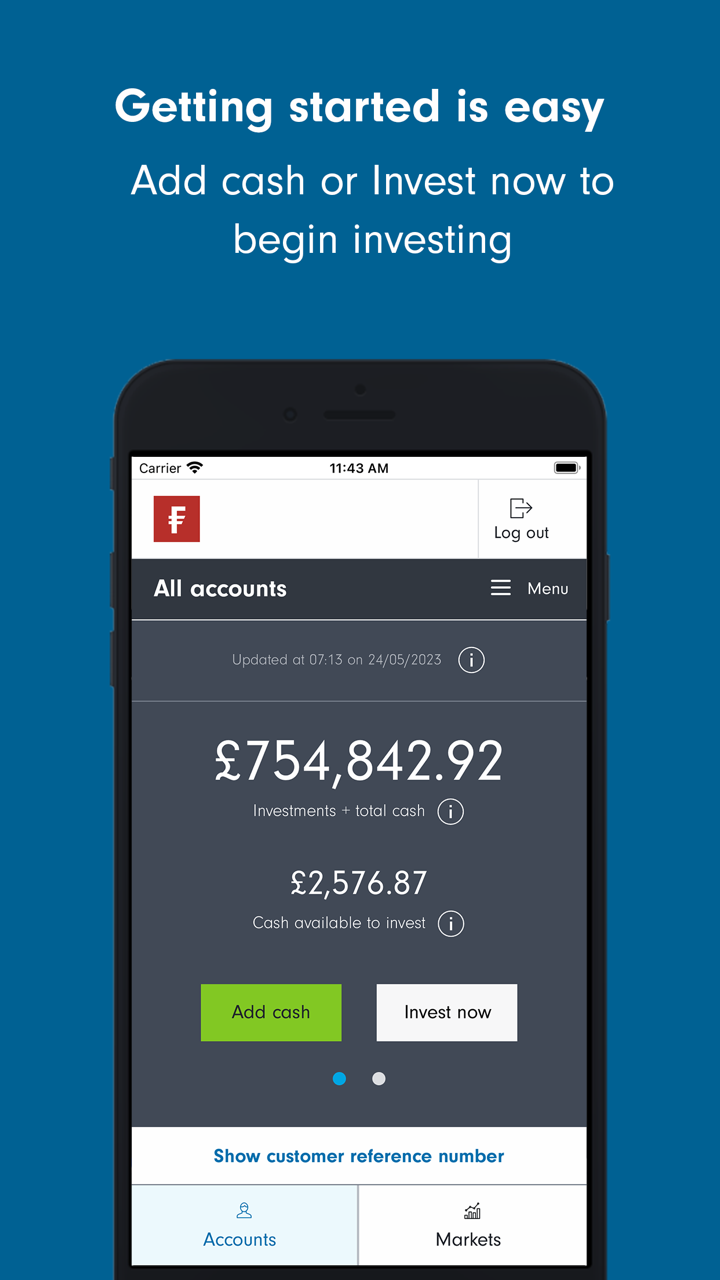

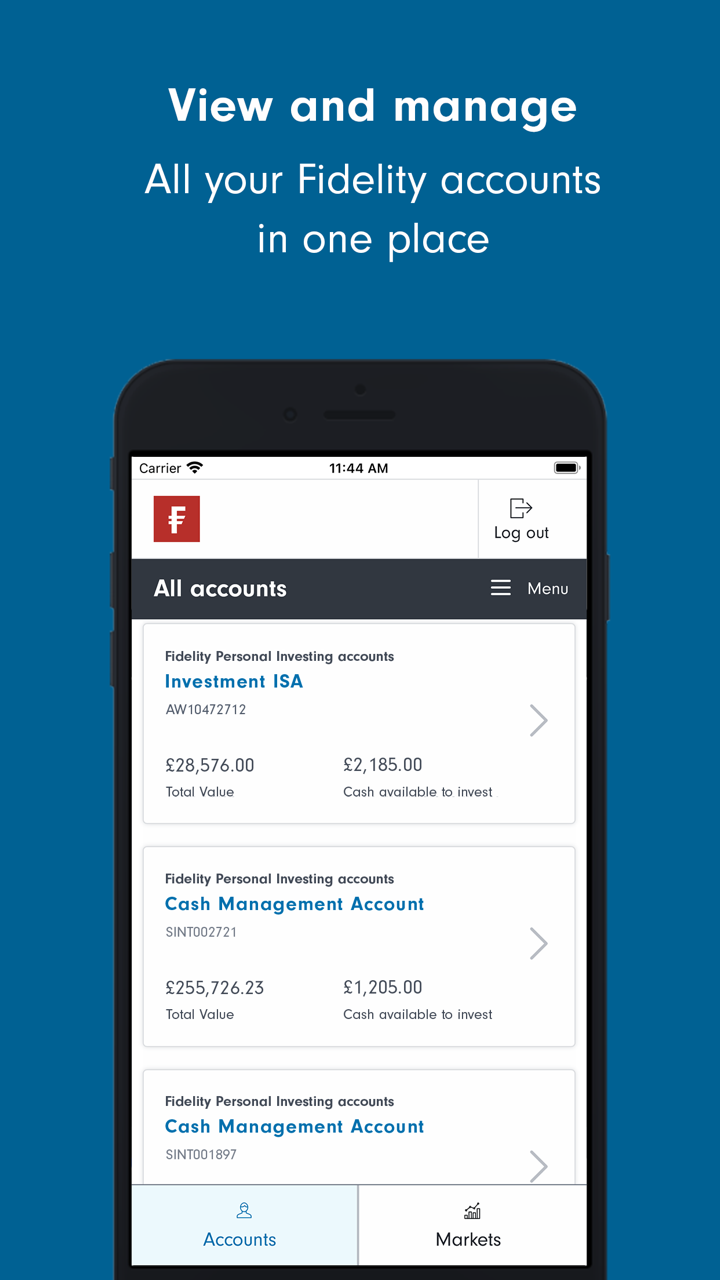

The fee structure at Fidelity, while on the moderate to high side by industry standards, employs a tiered system that rewards higher balances with lower relative costs. In my view, this is significant because for larger, more committed investors, the decreasing marginal fees can make strategic allocation more efficient over time. However, for those starting with lower capital, it’s important to be aware that relative charges will be higher, which calls for careful weighing of investment size versus cost. There are no hidden deposit or withdrawal fees from Fidelity itself, though standard bank fees may apply—this clarity is something I have come to value as it helps with accurate planning and avoids unexpected costs. While the lack of demo or Islamic accounts limits accessibility for some groups, the trade-off is access to mature, regulated services ideal for investors looking for global portfolio solutions rather than speculative trading.

maseko

1-2年

Is it possible to trade particular assets such as Gold (XAU/USD) and Crude Oil through Fidelity?

Drawing on my first-hand experience and after closely examining Fidelity’s current range of services, I can confirm that trading specific assets like Gold (XAU/USD) and Crude Oil directly through Fidelity is not an option. From what I’ve observed, Fidelity focuses its offerings on mutual funds, retirement investments such as MPF and ORSO, and thematic or multi-asset solutions. While these products may include some exposure to commodities within diversified portfolios, the platform does not allow for direct speculative trading in individual commodities, spot metals, or CFDs commonly associated with forex brokers.

This distinction is crucial for traders who, like me, prefer hands-on approaches or real-time trading of instruments like XAU/USD or oil. Fidelity’s business model is set up for long-term wealth management and investment objectives, regulated by strong oversight such as the SFC in Hong Kong, which reassures me about their compliance and safety standards. However, for direct commodity trading—especially with a focus on short-term price movements or leverage—I would seek a specialized broker that offers such instruments as standalone tradable assets.

It’s essential to be clear about your trading goals and risk tolerance when choosing a broker. For those interested in direct access to precious metals or energy commodities, Fidelity’s platform may not be suitable for this need. Instead, it serves investors looking for broader, more diversified, and regulated investment solutions rather than active commodity trading.

Broker Issues

Account

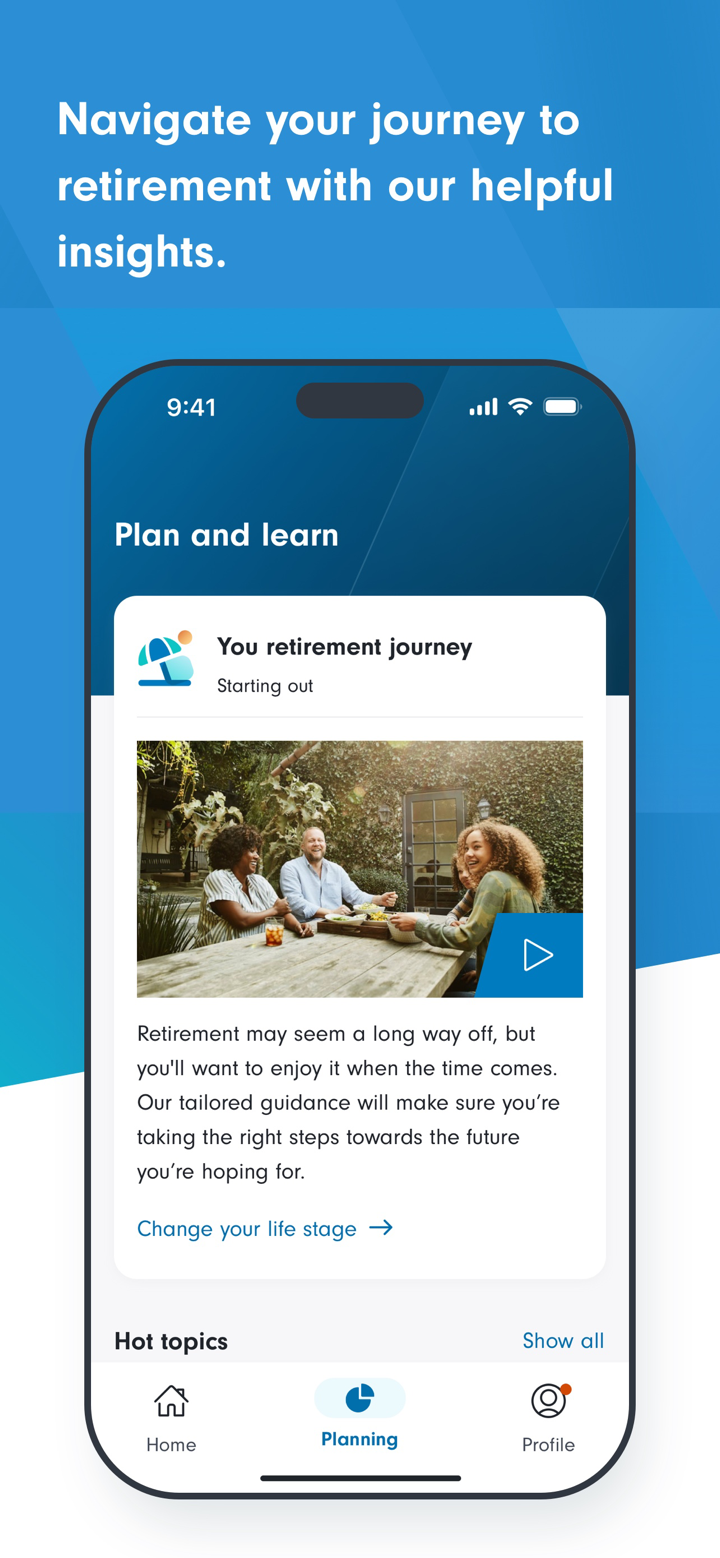

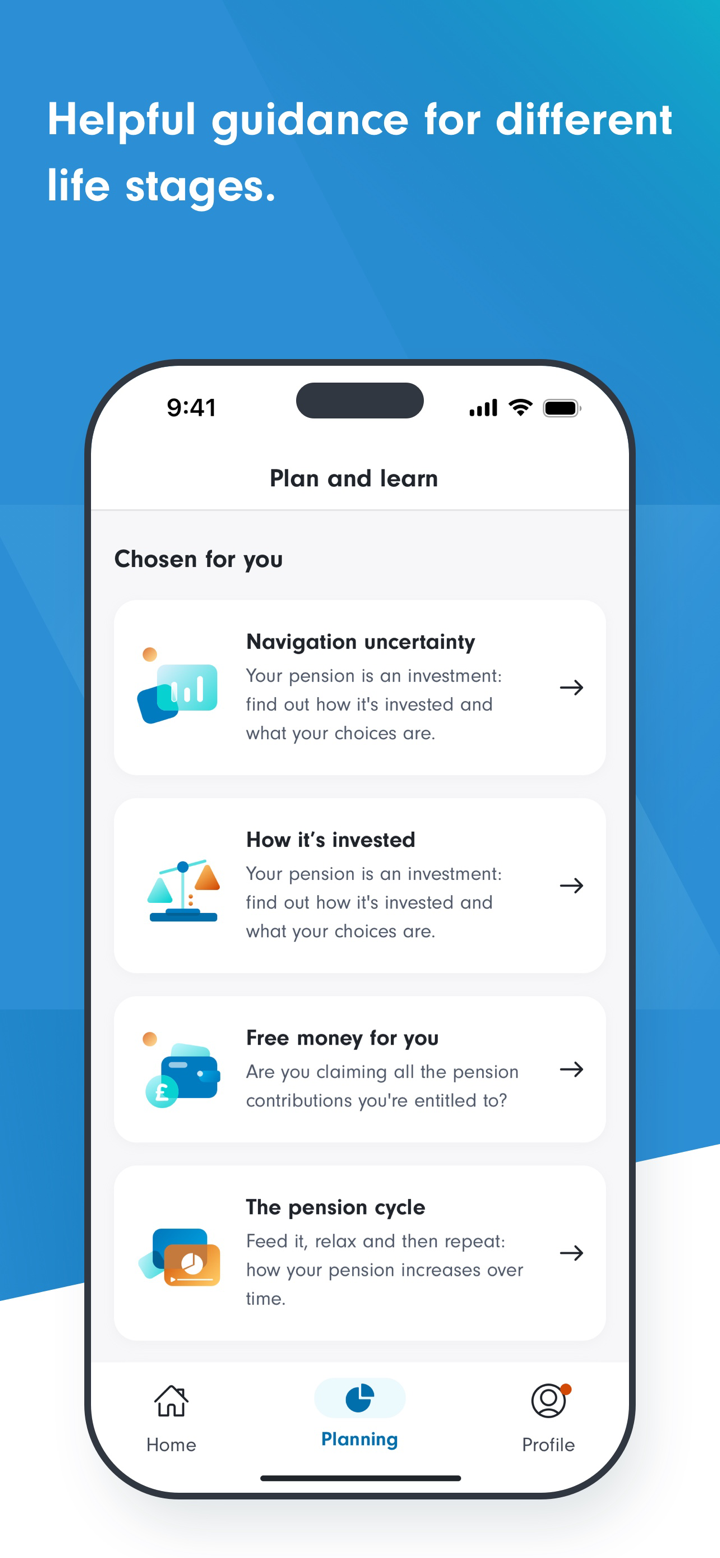

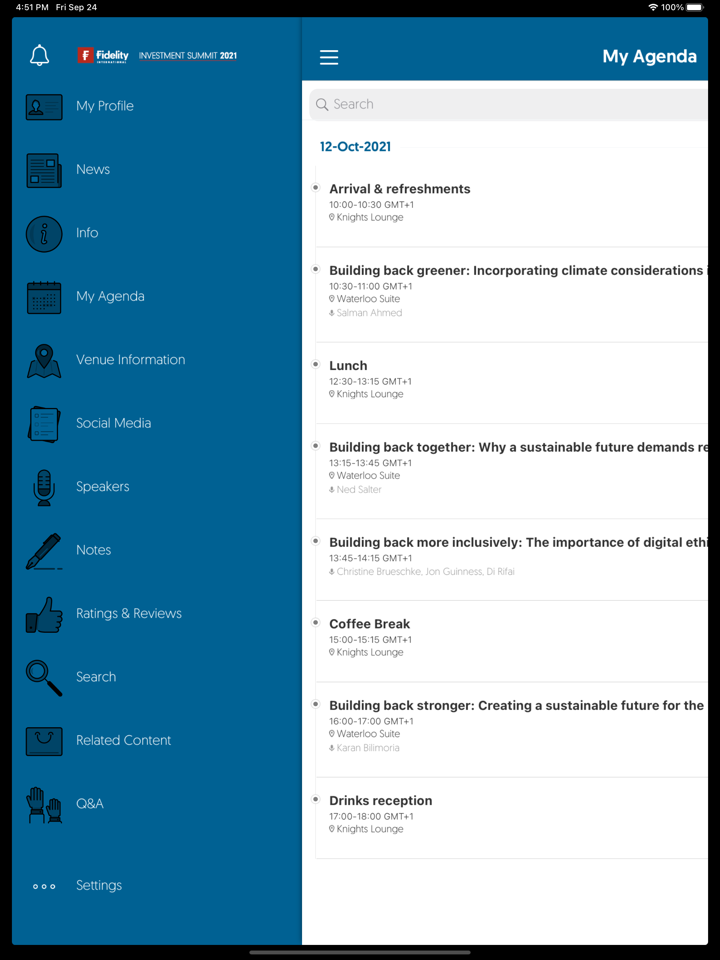

Platform

Leverage

Instruments

maseko

1-2年

Can I trust Fidelity as a secure and reputable broker for my trading activities?

In my experience as a trader, evaluating a broker like Fidelity comes down to regulation, longevity, transparency, and the products offered. From what I’ve found, Fidelity is regulated by the Securities and Futures Commission (SFC) in Hong Kong, and has a license for dealing in futures contracts. It also has a presence in Japan with relevant local regulation, and its parent company has been operating globally since 1969. For me, this level of oversight and history is a positive indication of operational security, as regulatory bodies like the SFC enforce strict compliance measures on client protection and company conduct.

However, as a trader, I have to note that Fidelity does not actually provide forex or CFDs; instead, their focus is on mutual funds, retirement schemes, and themed multi-asset investment solutions. For someone like me looking for active forex trading or speculative products, Fidelity isn’t an appropriate fit. Their fee structure is transparent but tends to be moderate to high unless you are investing large sums, which could impact returns for those with smaller portfolios.

Based on its regulatory status and long-standing reputation, I consider Fidelity trustworthy in terms of security and legitimacy for long-term, investment-focused strategies. But if your interests are in active forex or short-term leveraged trading, Fidelity’s offerings are simply not suitable. For conservative investors prioritizing regulation and stability, Fidelity meets the high standards I would look for.