天眼評分

MSB e -Trade

印度 | 5-10年 |

印度 | 5-10年 |https://msbetrade.com

官方網址

評分指數

影響力

影響力

D

影響力指數 NO.1

印度 2.67

印度 2.67 聯繫方式

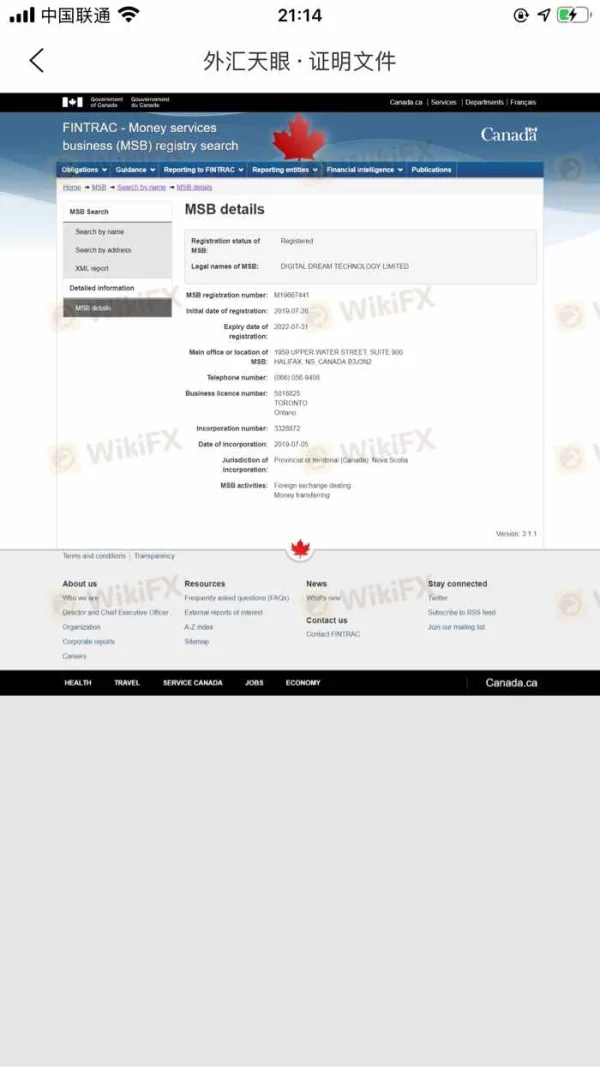

外匯監管

外匯監管

暫無外匯交易類牌照,請注意風險!

- 該交易商當前暫無有效外匯監管,請注意風險!

基礎資訊

印度

印度 瀏覽MSB e -Trade 的用戶還瀏覽了..

VT Markets

Vantage

LIRUNEX

官網鑒定

msbetrade.com

49.50.102.203伺服器所在地印度

備案號--主要訪問國家/地區--功能變數名稱創建時間--網站名稱--所屬公司--

關係族譜

相關企業

Wiki問答

What's the lowest amount I’m allowed to withdraw from my MSB e-Trade account in a single transaction?

Based on my research and personal due diligence, I could not find any clear, verifiable information regarding a minimum withdrawal amount for MSB e-Trade. The lack of details about such basic operational terms is concerning, especially since I typically expect reputable brokers to present transparent withdrawal policies front and center. More importantly, my review of the available information revealed that MSB e-Trade is flagged for having no valid regulatory status, which raises a significant red flag for me as a conservative and risk-averse trader. When I evaluate a broker, especially one operating in the forex market, I always prioritize regulatory oversight because it offers some level of protection and dispute resolution for traders. Unfortunately, MSB e-Trade's suspicious regulatory standing and warnings about high potential risk do not inspire confidence. I also noticed a comment indicating their business scope might focus solely on forex conversion rather than on actual trading, a detail that could impact account functionalities—including withdrawals. Given these uncertainties, I would advise anyone in my position to exercise extreme caution and reach out directly to MSB e-Trade’s support for authoritative clarification before depositing or attempting any financial transaction. In my experience, a lack of clarity or difficulty obtaining such basic information is itself a strong signal to reconsider engagement with the broker. For safety and peace of mind, I’d favor brokers with explicit, easily accessible withdrawal policies and robust regulatory backing.

Can you detail the particular benefits of MSB e-Trade when it comes to its selection of trading instruments and its fee structure?

Drawing from my own experience as a forex trader actively searching for reliability and clarity from brokers, I found significant concerns when evaluating MSB e-Trade, particularly in terms of their trading instrument selection and fee structure. Based on the available information, it appears that MSB e-Trade’s business is primarily focused on forex conversion and does not clearly extend to offering actual forex trading. For me, the lack of transparency around available trading instruments is a major drawback, because as a trader, I rely on the ability to access a diverse range of assets with clarity and certainty about what is offered. When it comes to fee structure, the information I found is worryingly sparse. There is no publicly available detail on spreads, commissions, or potential non-trading fees. In trading, understanding both instrument variety and cost of trading up front is vital—uncertainty in these areas usually signals higher risk in practice. I noticed, too, that MSB e-Trade operates without valid regulatory status, and is flagged for a suspicious business scope. This combination leaves me unable to identify any specific benefit regarding the breadth of tradable instruments or the competitiveness of their fees. In my professional view, the lack of transparency and regulatory oversight here significantly outweighs any potential advantages, and raises critical caution flags for anyone considering them as a trading partner.

Does MSB e-Trade charge a commission per lot on their ECN or raw spread accounts?

After thoroughly reviewing the available information, I cannot find any clear or verifiable details about whether MSB e-Trade charges a commission per lot on ECN or raw spread accounts. For me as a trader, this vacuum is concerning. One of the critical measures I use when assessing a broker’s trustworthiness is the level of disclosure and transparency around trading costs, especially on ECN-type accounts where commissions are a central component of the trading cost structure. What I do know is that MSB e-Trade currently has no valid regulatory license, and WikiFX flags both a suspicious regulatory status and a very high overall risk score, which strongly discourages engagement. Adding to this, there are warnings regarding the broker’s scope of business, which raises more questions than answers about what services they are legally permitted to provide. This uncertain environment does not provide me with enough concrete, authoritative data to make an informed evaluation about MSB e-Trade’s commission structure—or its reliability in general. In my experience, a lack of information and regulatory oversight is a signal to proceed with extreme caution. Without regulatory clarity and transparent fee disclosures, I would advise any trader to be very careful before opening an account or making deposits. I always prioritize brokers with transparent cost structures and strong regulatory backing for my own trading, given the importance of safeguarding my funds and interests.

How much do you need to deposit at a minimum to start a live trading account with MSB e-Trade?

Based on my careful research and analysis of publicly available information, I couldn’t find any clear or transparent details about the minimum deposit required to open a live trading account with MSB e-Trade. As someone who has navigated the forex industry for years, I consider this lack of information a significant red flag. Transparency around account funding is a basic requirement for any trustworthy broker, both for informed decision-making and for building client trust. In my experience, regulated and reputable brokers always state their minimum deposit requirements openly; the absence of this detail often signals either a disregard for industry best practices or potential operational risk. Furthermore, the broader context for MSB e-Trade concerns me. The broker is flagged as having “no valid regulatory information” and is associated with a suspicious regulatory license and scope of business. With a risk management index of zero and specific warnings to stay away due to high risk, I personally would exercise extreme caution. For me, clarity around deposits goes hand-in-hand with proper oversight, and if I can’t verify even the basics, I see that as a strong reason to avoid opening any account—regardless of the minimum deposit size. I would encourage others to be very cautious and prioritize transparency and regulatory status above all else.

你要評價的內容

請輸入...

評價 1