Rpy Sundram

1-2年

Does OSL charge a commission per lot on their ECN or raw spread accounts?

From my assessment and experience researching OSL, I found several areas of concern that make it difficult to provide a clear answer regarding commissions per lot, especially on ECN or raw spread accounts. First, OSL is not regulated, and WikiFX flags its regulatory license and business scope as suspicious, both of which significantly undermine trust. As a conservative trader, platform regulation is non-negotiable for me due to client safety and recourse in case of disputes.

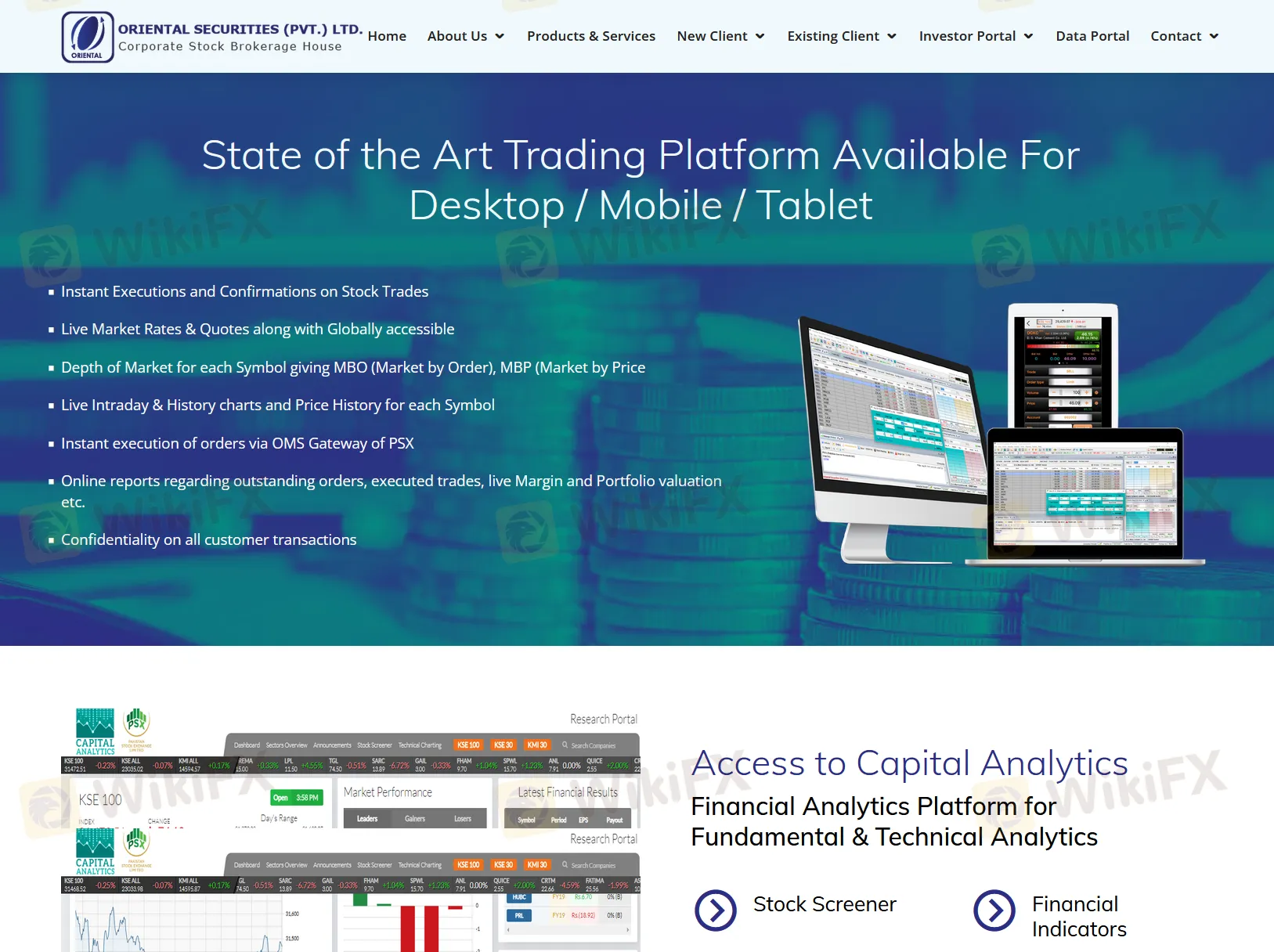

Digging into OSL’s offering, the only available trading products appear to be equities. OSL does not offer forex, commodities, indices, or typical account structures like ECN or raw spread accounts that are found with other brokers. There’s also no MetaTrader (MT4 or MT5) support, and trading occurs exclusively on OSL’s proprietary platform. The documentation does not provide details about account types, spreads, or commission charges, and the absence of such critical information is worrisome.

Overall, from my perspective, if you’re seeking a broker for forex trading with ECN or raw spreads and transparent per-lot commissions, OSL does not meet those industry standards. The lack of regulatory oversight, clarity on costs, and transparency is a serious red flag for me, and I would exercise caution before engaging with OSL for any trading activity.

Broker Issues

Fees and Spreads

Aman A

1-2年

What major risks or downsides should I keep in mind when using OSL?

Based on my experience as a trader, I always approach platforms like OSL with heightened caution, especially after carefully evaluating their background. The most pressing concern for me is the absence of any regulatory oversight—OSL operates without a valid license, which means there is no external body ensuring fair practices, protecting client funds, or mandating transparency. This lack of regulation dramatically increases potential risk, as it’s much harder to seek recourse should anything go wrong.

Additionally, OSL has a notably low trust score, which further erodes my confidence in its reliability. The only tradable asset offered is equities, with no access to forex, commodities, or other instruments I usually look for to diversify risk. Another downside I noticed is the restriction on payment methods and the absence of a demo account. For me, not being able to test the platform or utilize flexible funding options limits my ability to manage risk before committing real capital.

Finally, the proprietary trading platform used by OSL isn’t industry-standard like MT4 or MT5, which can affect both reliability and compatibility with tools I trust. For all these reasons, I find the risk profile too high for my personal trading criteria and would be extremely cautious before depositing any funds.

Sam35

1-2年

Is it possible to deposit cryptocurrencies such as Bitcoin or USDT into my OSL account?

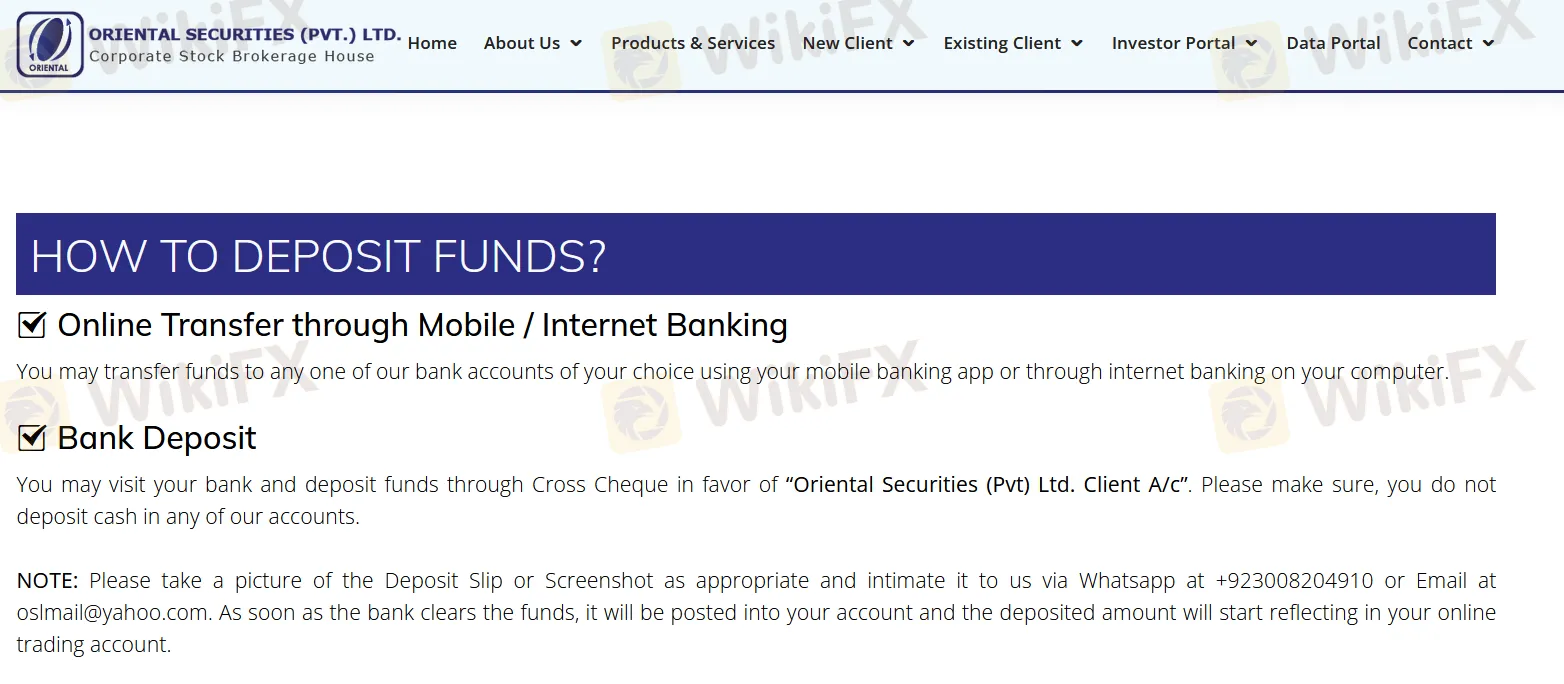

Based on my close review of OSL’s available information, I would not be able to deposit cryptocurrencies such as Bitcoin or USDT into my OSL account. For me, this is a significant limitation. OSL only supports deposits through traditional methods: either by online transfer via mobile or internet banking to a company account or by submitting a cross cheque. There is a clear instruction to avoid cash deposits, and no references or mechanisms appear to accommodate cryptocurrency transfers.

This restriction matters from both a practical and a risk-management perspective. Crypto deposits can offer added convenience and efficiency for international traders, but the absence of those options with OSL, combined with their lack of regulatory oversight, raises important questions for me about client fund security and transparency. In my experience, regulated brokers are more likely to adopt robust and diverse funding options, including digital assets, but OSL’s current framework is traditional and quite limited. Ultimately, with no crypto deposit support and no regulatory backing, I would be extremely cautious about using this platform for any trading activities involving digital assets.

Broker Issues

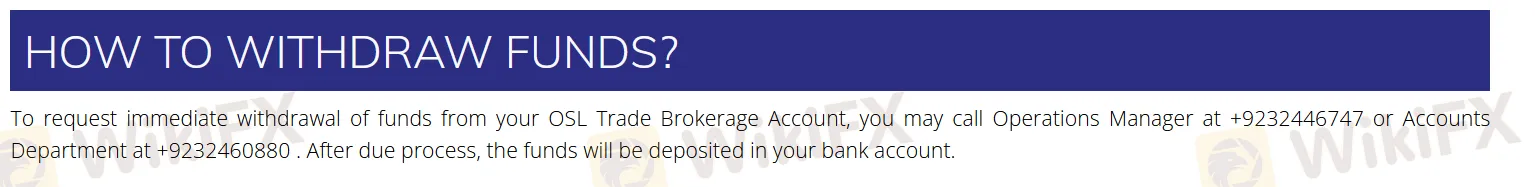

Withdrawal

Deposit

Wahab

1-2年

Is a free demo account available with OSL, and if so, are there any restrictions such as a time limit?

Speaking from my experience as an independent trader who values strong risk management tools, I always look for platforms that provide free demo accounts—especially if I’m considering a new broker. With OSL, however, I found that they do not offer a demo account at all. For me, this is a significant limitation. Demo accounts are essential for testing platform functionality, familiarizing oneself with order execution, and refining strategies without risking real capital. When a broker doesn’t provide this option, it becomes difficult for me to assess both their trading environment and their order processing under real-world conditions before making a financial commitment.

The absence of a demo account not only removes a critical step in the due diligence process but, in my view, also signals a lack of commitment to beginner education and client transparency. Moreover, OSL is unregulated, which already sets a conservative tone for me regarding their overall safety and client protection. I am always cautious with platforms that don’t provide avenues for practice or trial, as it increases the barrier for new users to learn safely. In summary, if you require a demo account for practice or evaluation, OSL is not suitable in this respect, and this factor weighs heavily in my risk assessment of the broker.

Broker Issues

Account

Platform

Instruments

Leverage