Bhavani Durga K

1-2年

In what ways does ZLK's regulatory standing help safeguard my funds?

As an experienced trader, when I evaluate a broker like ZLK, the first thing I consider is its regulatory status because that’s the foundation of basic fund safety and trader protection. In the case of ZLK, I have to be very clear: ZLK does not hold any valid regulatory licenses. This means there is no government or recognized independent body overseeing their operations, enforcing client fund segregation, or providing recourse in case of disputes. For me, this raises an immediate red flag.

In my years of trading, I have learned that reputable regulation helps ensure brokers operate transparently—requiring regular audits, minimum capital standards, and policies to protect client deposits from misuse. Without such oversight, brokers can operate in ways that might not prioritize trader interests, and clients typically have limited options if issues arise. In ZLK’s case, regardless of its years in business or product offerings, the lack of regulation means my deposits would not have the added layer of protection that regulated brokers are required to provide.

Due to this, I would exercise considerable caution before committing funds. Personally, I prefer working with brokers who are fully regulated in reputable jurisdictions, as that extra level of protection is critical for my peace of mind and capital preservation. Without regulatory oversight, I feel the risk to my funds is simply too high to ignore.

Pushpender Sharma

1-2年

Is it possible to deposit funds into my ZLK account using cryptocurrencies such as Bitcoin or USDT?

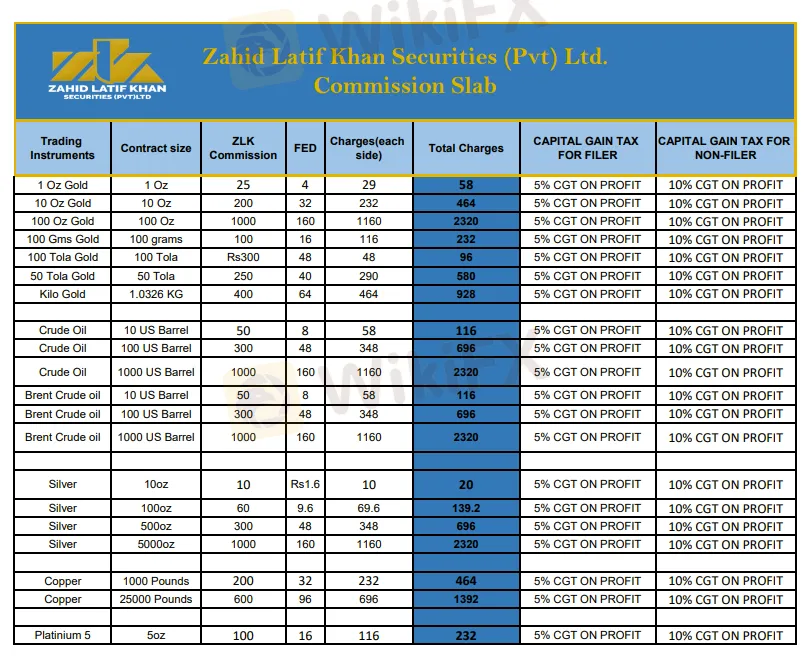

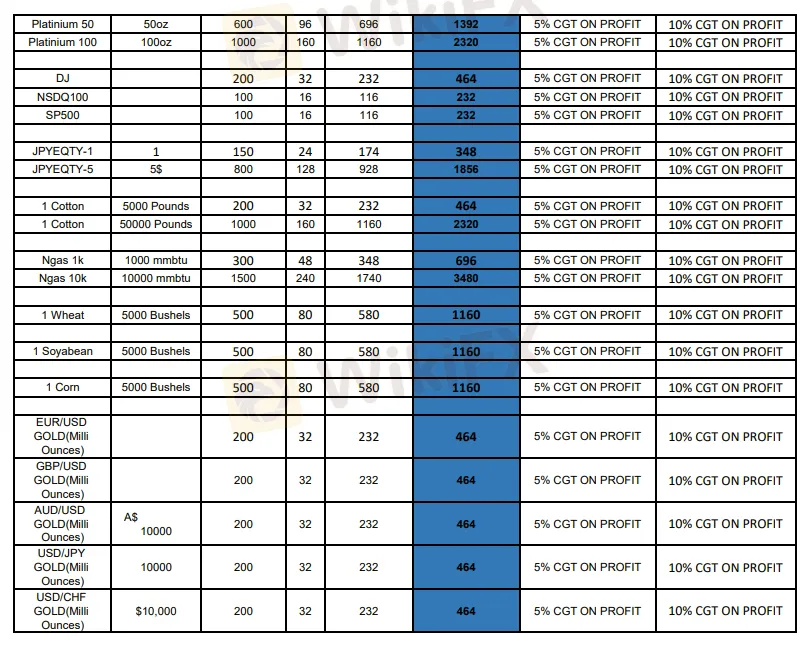

Based on my research and personal evaluation of ZLK, I would approach this broker with a high degree of caution, particularly regarding funding options. ZLK operates without any regulatory oversight, which immediately raises concerns for me as a trader who values both transparency and client protection. From everything I’ve seen, ZLK primarily positions itself as a local equities and commodities provider on the Pakistan Stock Exchange, and there is no indication that they cater to traditional forex or crypto traders’ needs.

Critically, I could not find any evidence or official mention that ZLK supports deposits via cryptocurrencies such as Bitcoin or USDT. Instead, the available information suggests more conventional funding and contact channels like WhatsApp, phone, and direct forms, but nothing about digital assets or blockchain-based methods. The absence of clear, published details on deposits is especially concerning for me because opaque processes can often signal underlying risks, especially with brokers that lack regulation.

Given the lack of regulation, transparency issues, and the fact that ZLK doesn’t even offer industry-standard trading platforms like MT4/MT5, I personally would not feel comfortable depositing through unofficial or unlisted channels. While the option to use cryptocurrencies might seem appealing for flexibility, I would firmly avoid attempting such methods with this broker due to the elevated risk profile and the absence of support for these deposit types in their official information. For traders prioritizing security and clear funding procedures, this should be considered a significant drawback.

Broker Issues

Deposit

Withdrawal

Arnold Joseph

1-2年

Does ZLK offer fixed or variable spreads, and how are these affected during periods of high market volatility, such as major news releases?

From my experience as a trader thoroughly researching brokers before committing any funds, I approach platforms like ZLK with particular caution. One major concern with ZLK is the lack of publicly available information about their spreads—whether fixed or variable. This lack of clarity leaves me unable to directly compare their offering to brokers with transparent trading conditions. Adding to my unease is that ZLK operates without any valid regulatory oversight, raising significant questions over their risk management and duty of care to clients.

With established and regulated brokers, spread policies—whether fixed or variable—are clearly disclosed and there’s typically documentation on how spreads may widen during high-volatility events like major economic news. In contrast, ZLK’s absence of such disclosures means I cannot reliably predict how their spreads behave under stressful market conditions. Without demo accounts or transparent fee structures to test, I would have no way of confirming if spreads remain fair, or if they dramatically widen during news releases, potentially leading to poorer trade executions and heightened trading costs.

Given the high potential risks and lack of regulatory backing, I personally would not feel confident trading around news releases or during volatile times on ZLK’s platform. For me, the unpredictability of trading costs in these conditions is unacceptable, especially when paired with the overall lack of transparency. My view is that this uncertainty presents a material risk to anyone considering active trading, especially during key market events.

Broker Issues

Fees and Spreads

S jonas

1-2年

Which trading platforms are offered by ZLK? Do they support MT4, MT5, or cTrader?

In my direct assessment and based on extensive vetting, ZLK does not offer MT4, MT5, or cTrader—three platforms that, as an experienced trader, I consider the industry standard for both reliability and advanced functionality. Instead, ZLK provides its own branded trading platform, accessible through web browsers, desktop, and a mobile app. While the accessibility across devices is notable, the absence of established platforms like MT4 or MT5 raises several concerns for me.

The key issue I personally face is the lack of proven, robust trading tools that I have come to rely on for charting, technical analysis, and the execution of automated strategies. Over years of trading, I have found proprietary platforms can sometimes lack the transparency, comprehensive features, or interoperability of third-party platforms, making it harder for me to implement and backtest my trading systems effectively.

Additionally, the inability to use MT4 or MT5 means I cannot easily transfer my trading habits or indicators, which I view as a potential operational risk—especially without a demo account for practice. For traders who value platform stability, widespread community support, or algorithmic trading options, ZLK’s limited platform offering may not meet those needs. Given all this, I urge caution and recommend careful consideration before choosing a broker that does not support standard industry platforms.

Broker Issues

Instruments

Account

Leverage

Platform