公司簡介

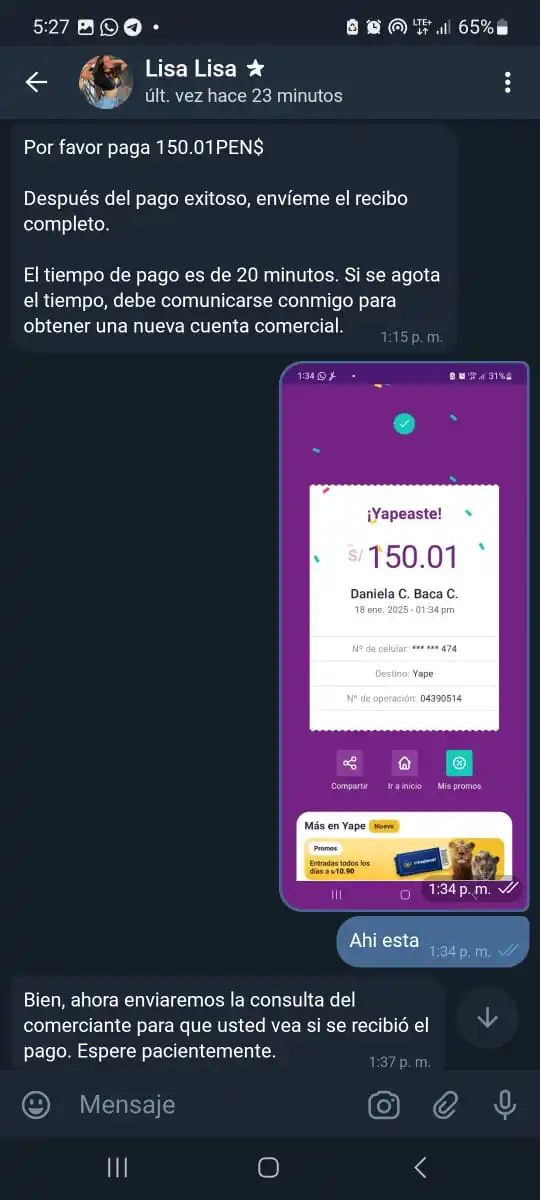

| Multigain 檢討摘要 | |

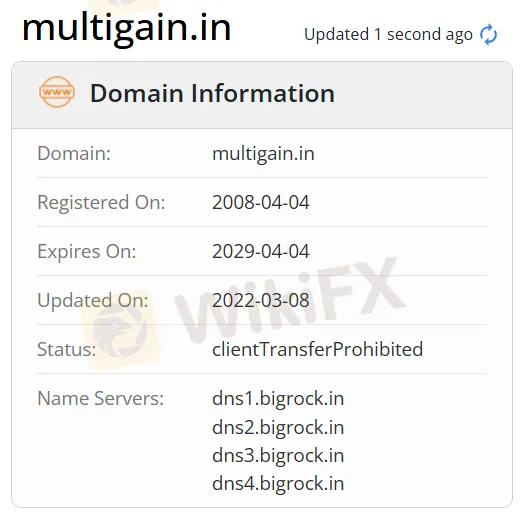

| 成立年份 | 2008 |

| 註冊國家/地區 | 印度 |

| 監管 | 無監管 |

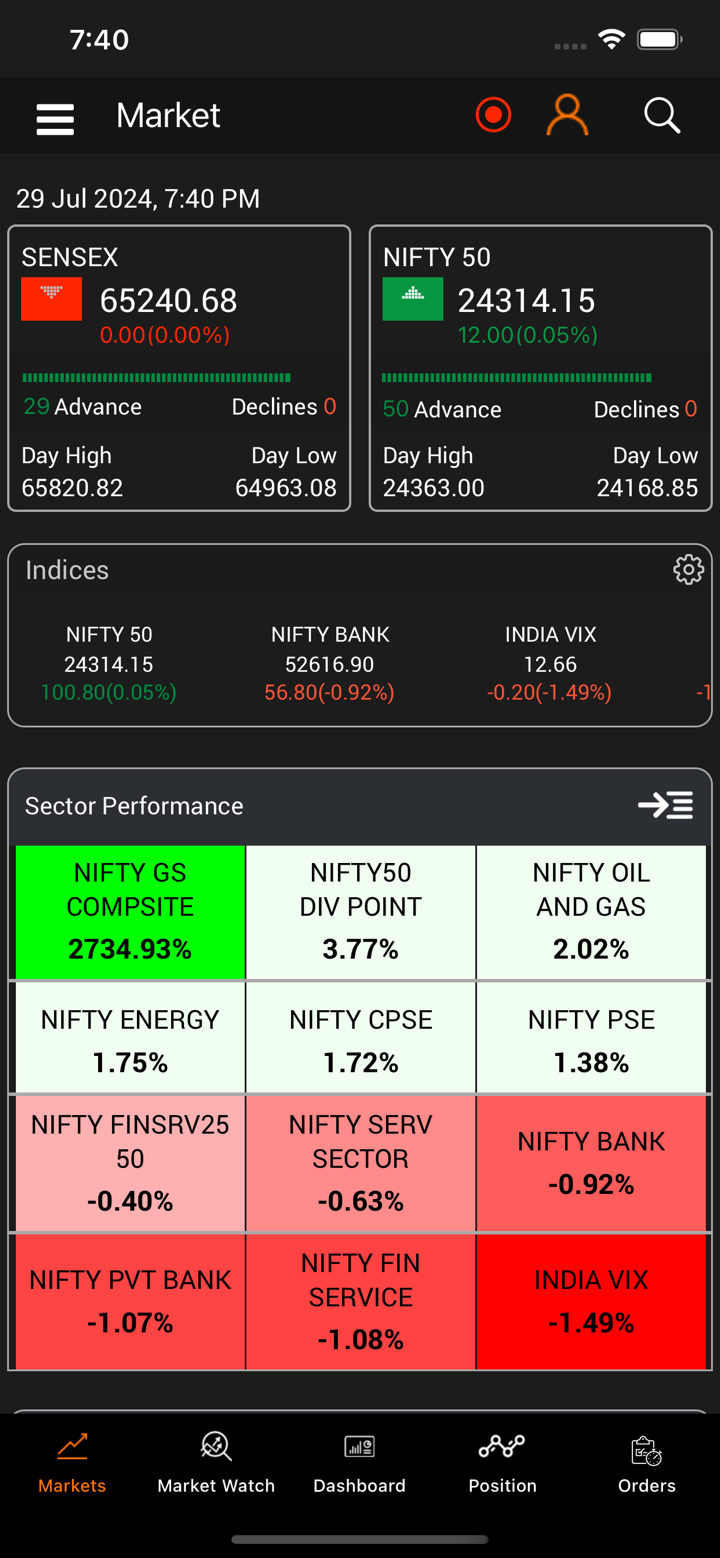

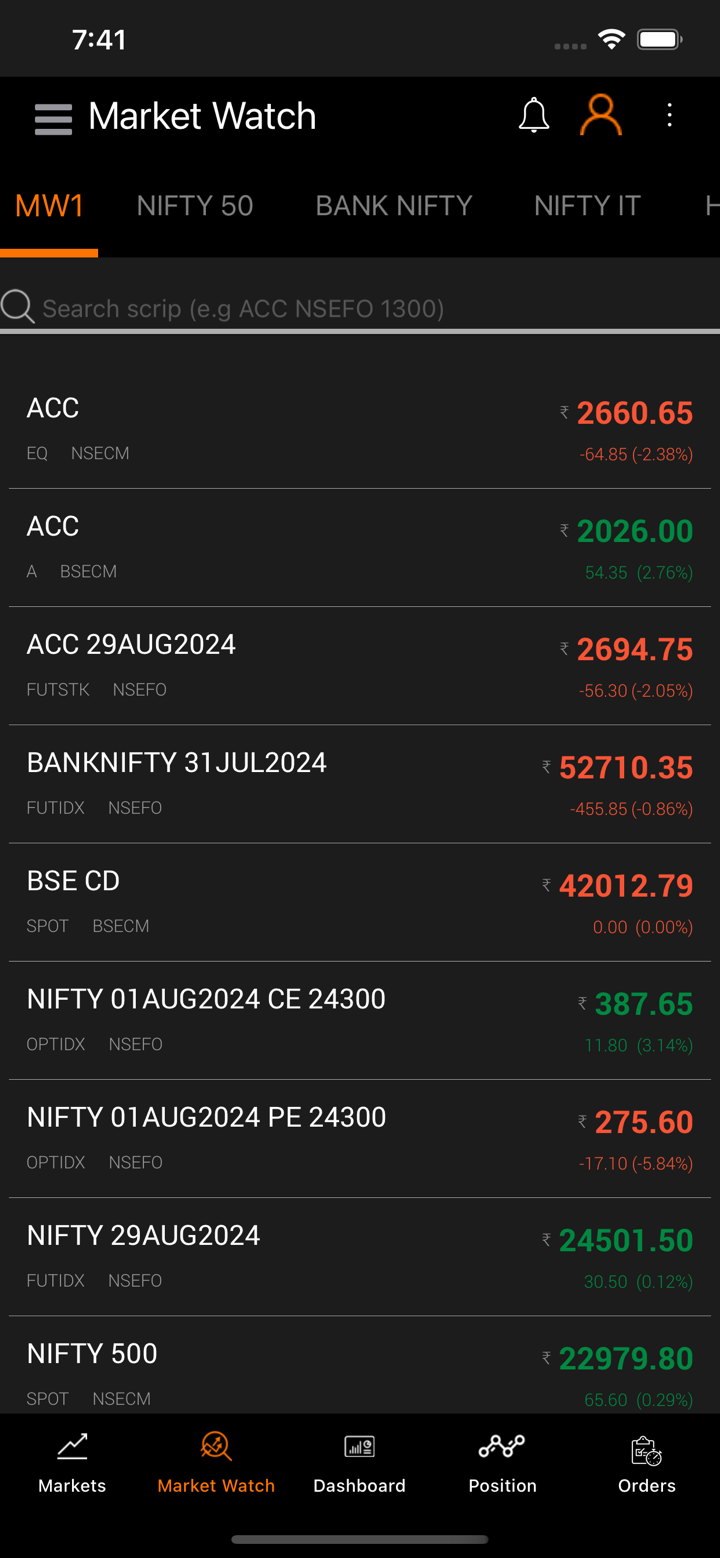

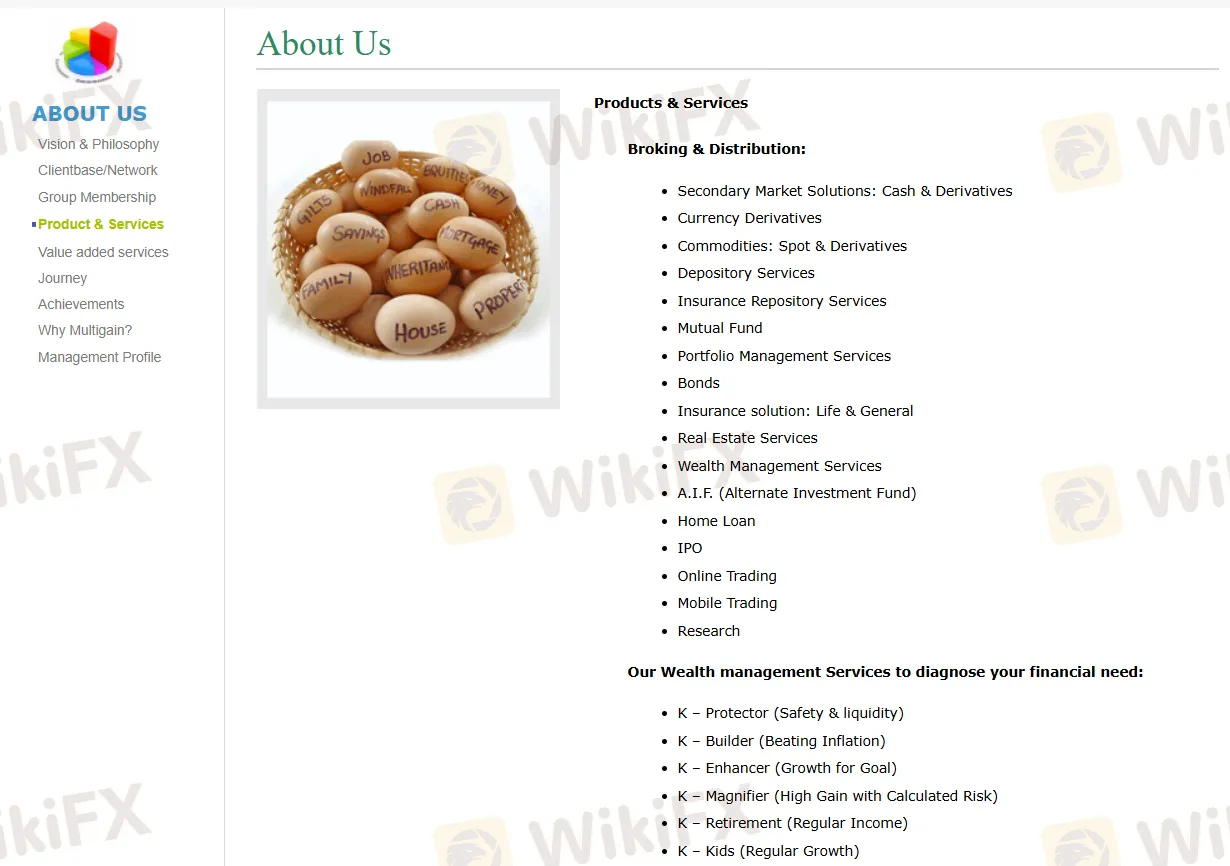

| 市場工具 | 貨幣、衍生品、商品、共同基金、債券、保險、房地產、A.I.F.(替代投資基金) |

| 模擬帳戶 | / |

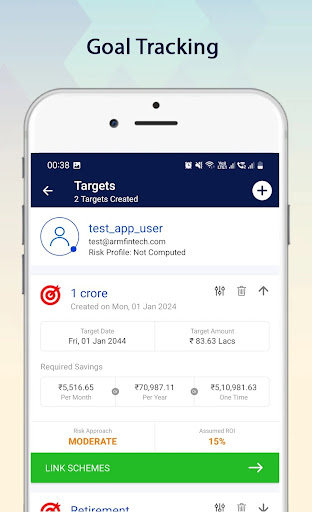

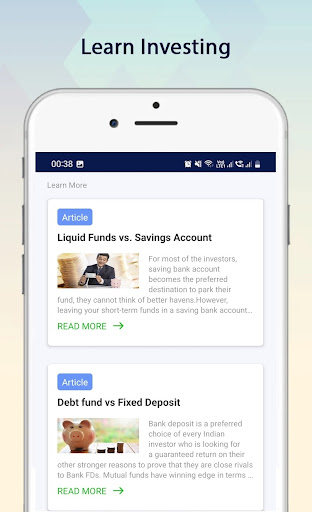

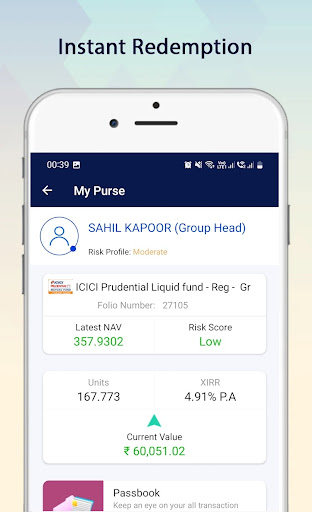

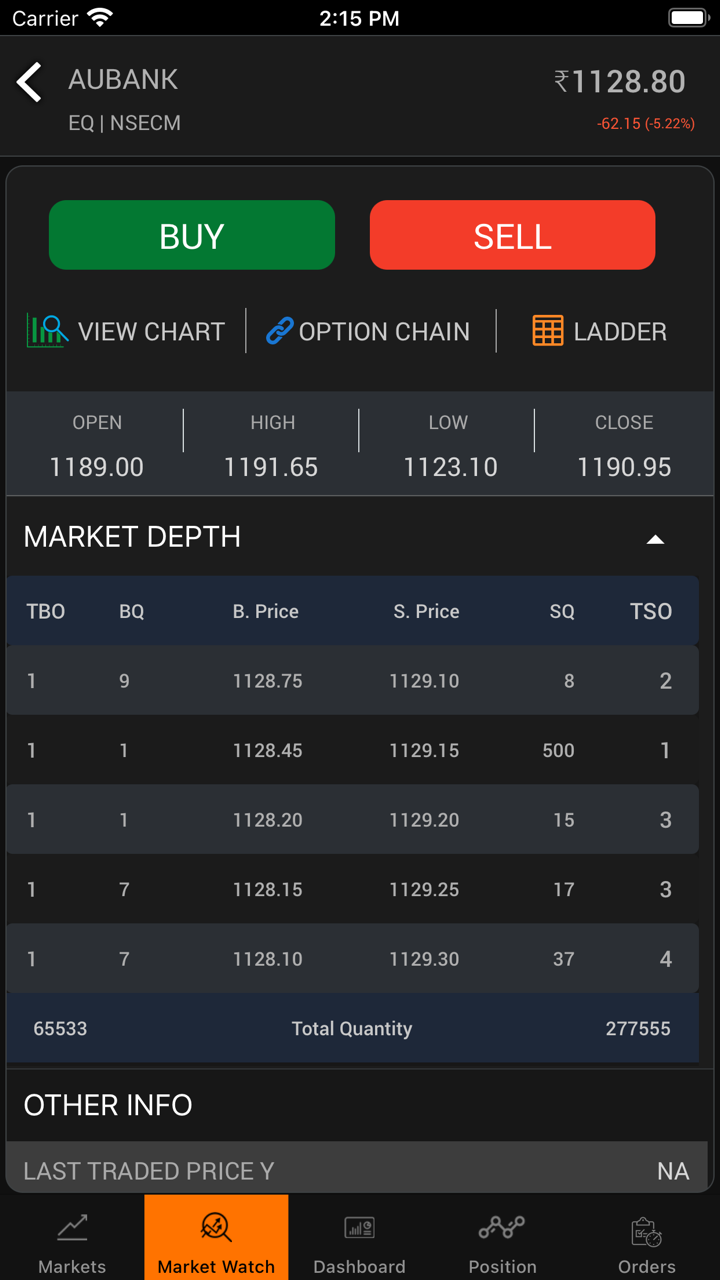

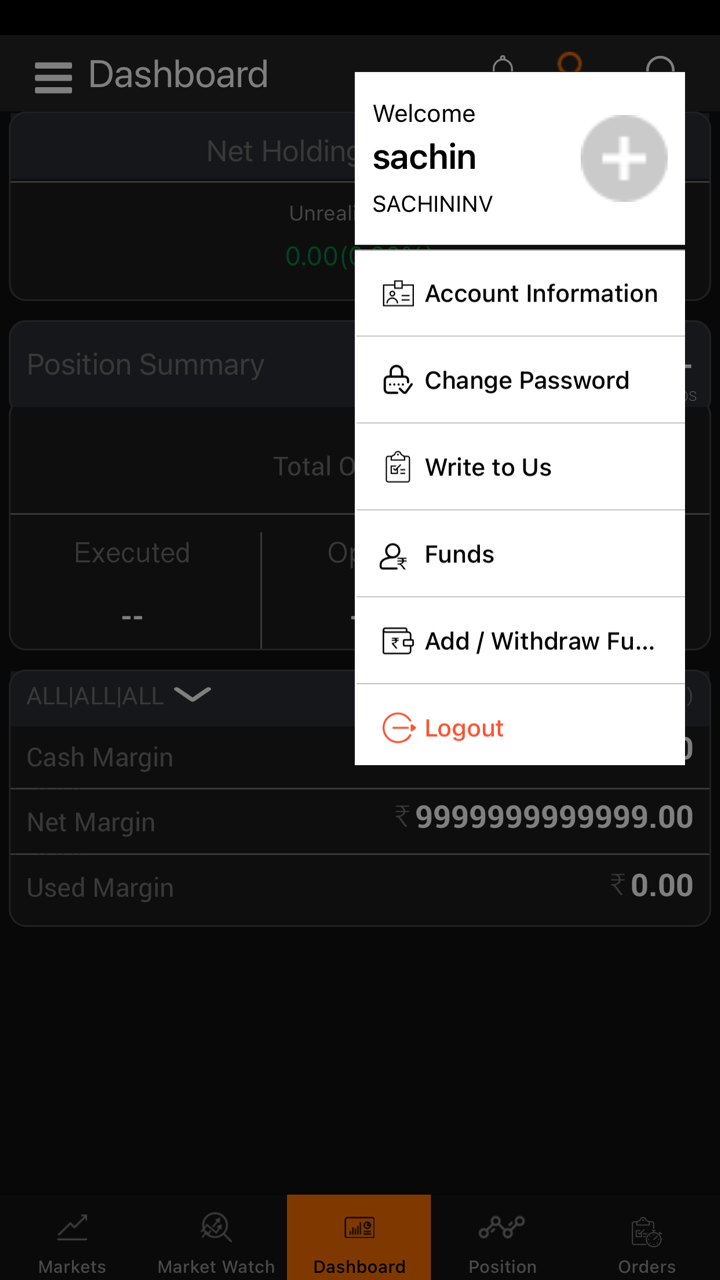

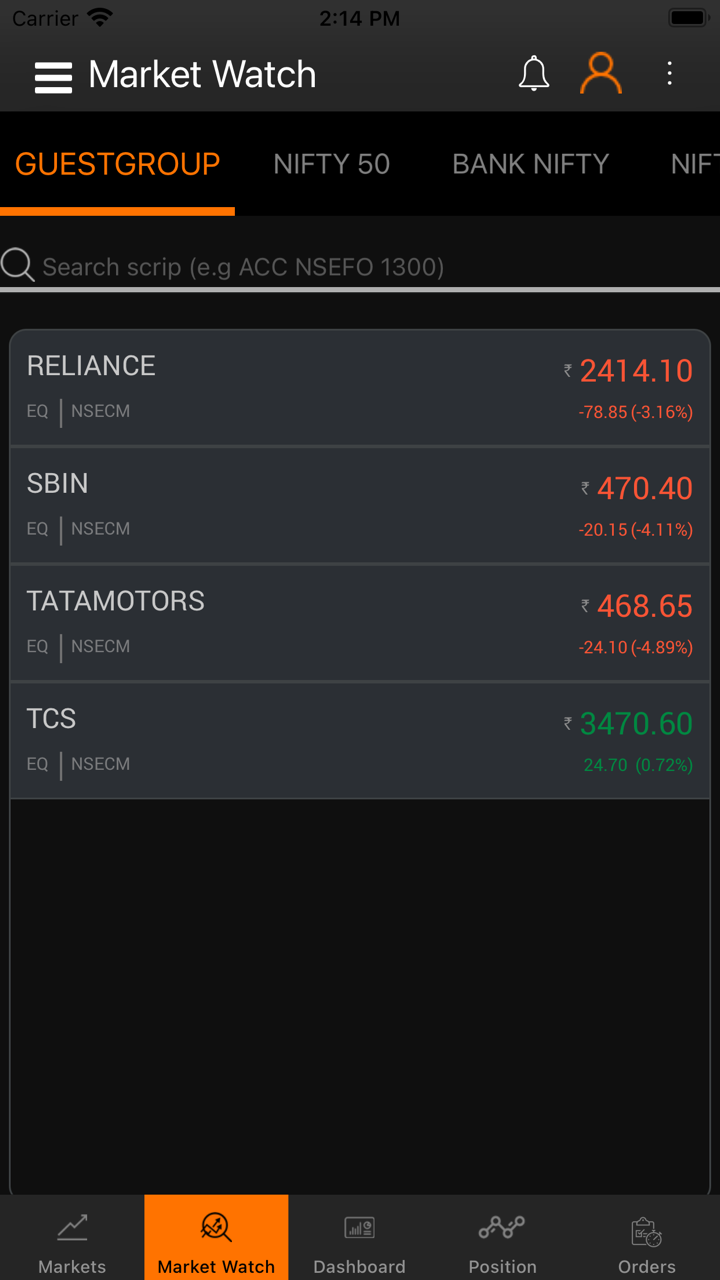

| 交易平台 | 在線和移動一體化平台 |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:0591-2490200/ 400 / 500 | |

| 電郵:info@multigain.in | |

| 傳真:0591-2490400 | |

| 地址:H-50, Lajpat Nagar, Moradabad – 244001 (U.P.) | |

| 社交媒體:Facebook、X、digg、linkedin、myspace | |

Multigain 資訊

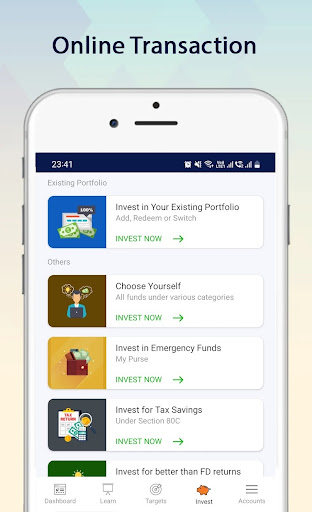

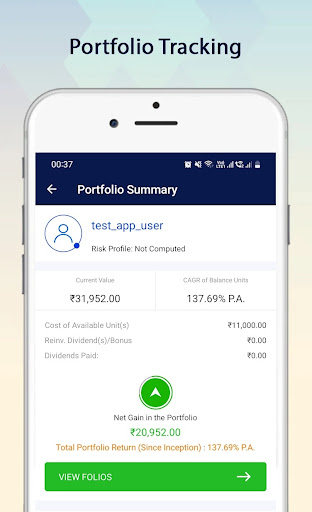

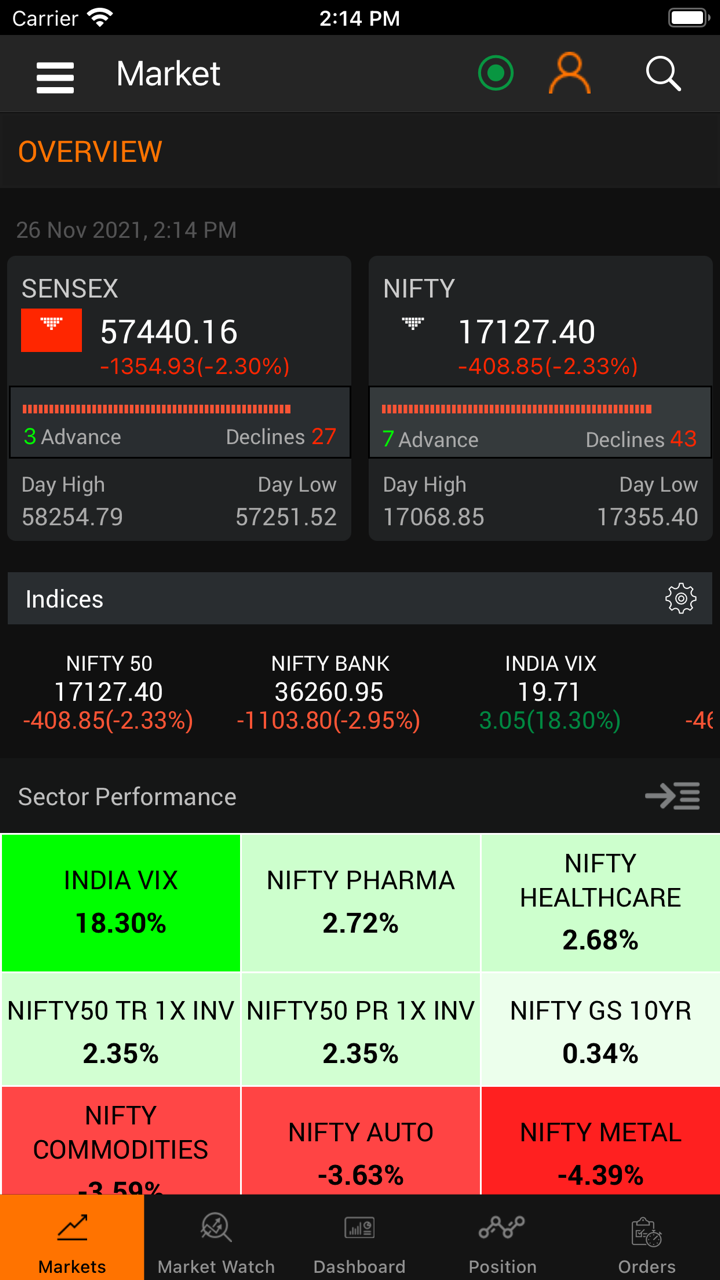

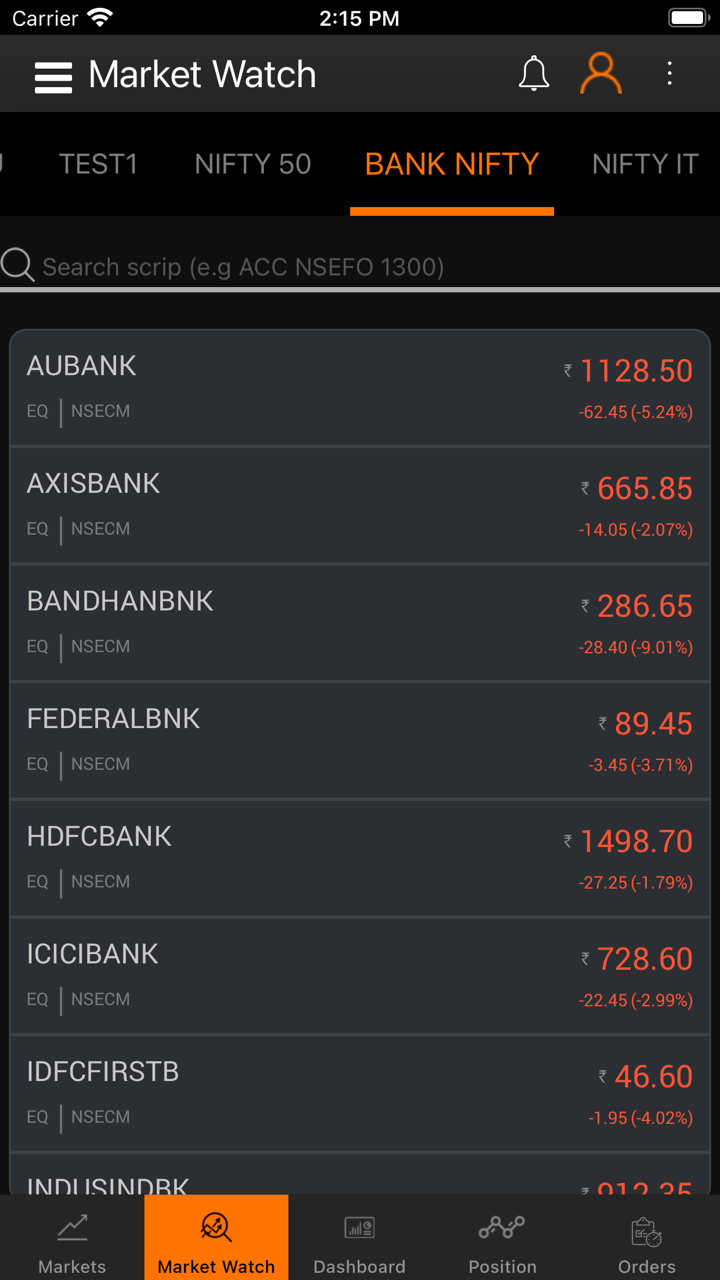

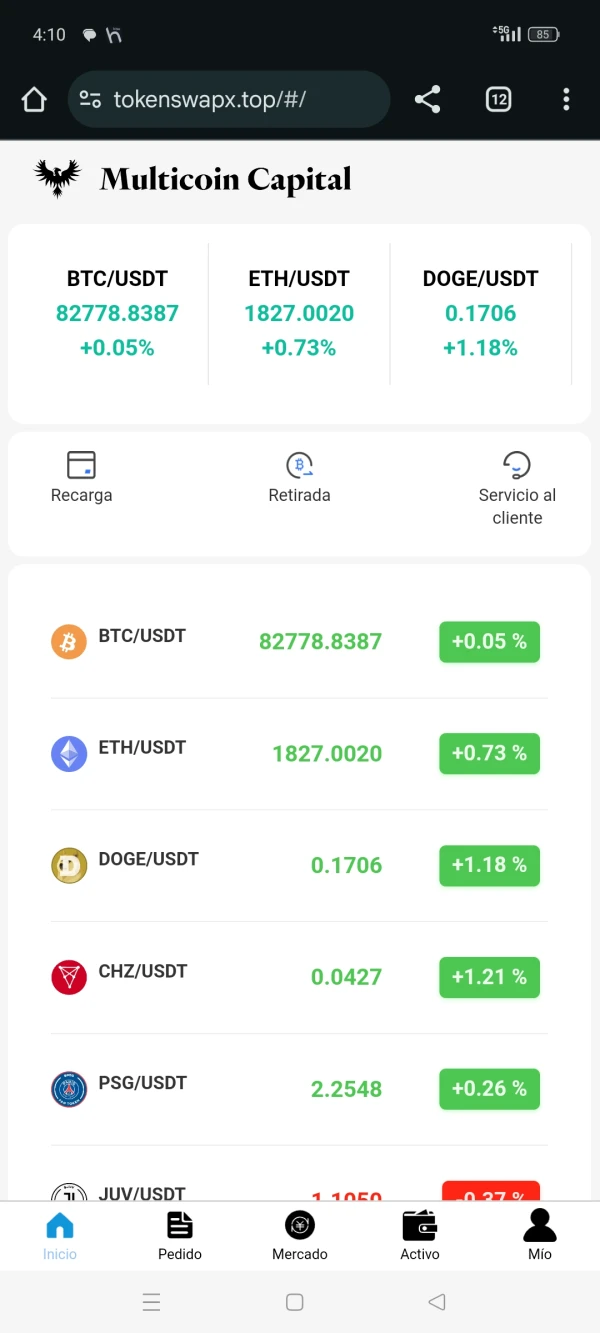

Multigain 是印度證券交易所的一家未受監管的頂級經紀和金融服務提供商。它在二級市場解決方案上提供產品和服務:現金和衍生品、貨幣、衍生品、商品:現貨和衍生品、存管服務、保險庫服務、共同基金、投資組合管理服務、債券、保險解決方案:人壽保險和綜合保險、房地產服務、財富管理服務、A.I.F.(替代投資基金)、房屋貸款、首次公開募股、網上交易、手機交易和研究。

優缺點

| 優點 | 缺點 |

| 營運時間長 | 網站不易訪問(部分) |

| 多元的聯絡途徑 | 缺乏監管 |

| 多樣的交易產品 | 沒有模擬帳戶 |

| 沒有 MT4/MT5 平台 | |

| 缺乏透明度 | |

| 付款選擇有限 |

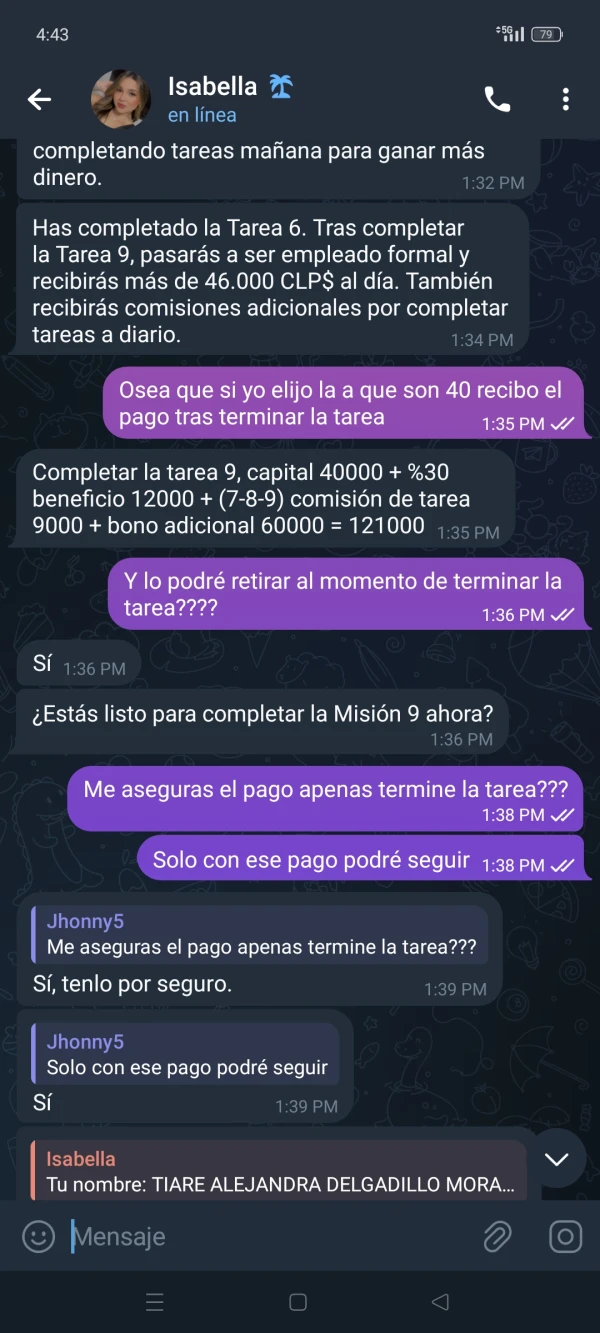

Multigain 是否合法?

No. Multigain 目前沒有有效的監管。請注意風險!

我可以在Multigain上交易什麼?

| 交易資產 | 支援 |

| 貨幣 | ✔ |

| 衍生品 | ✔ |

| 大宗商品 | ✔ |

| 共同基金 | ✔ |

| 債券 | ✔ |

| 保險 | ✔ |

| 房地產 | ✔ |

| A.I.F. (替代投資基金) | ✔ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |

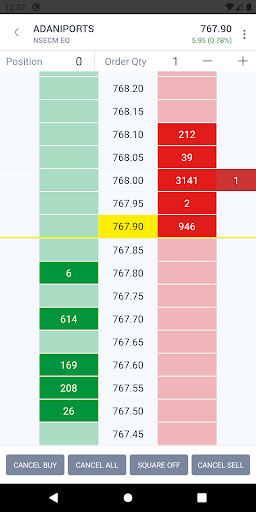

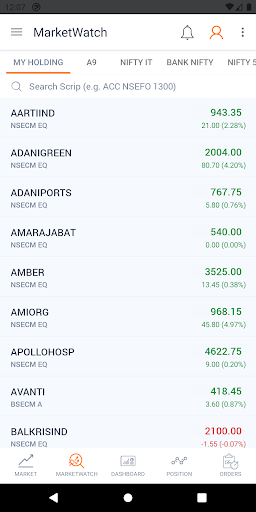

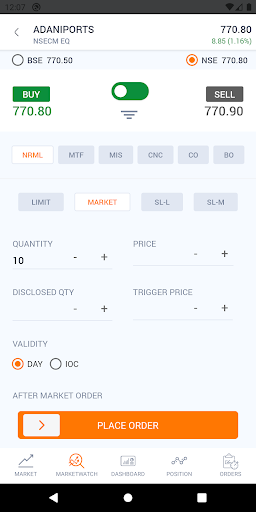

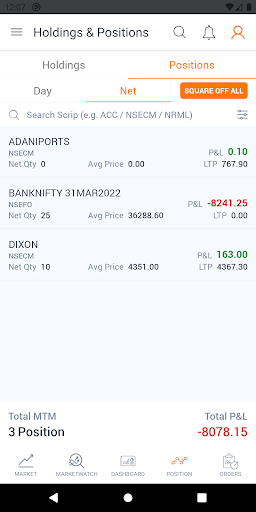

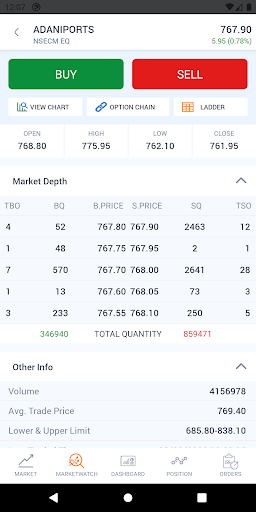

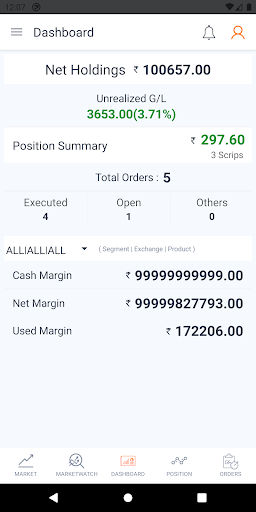

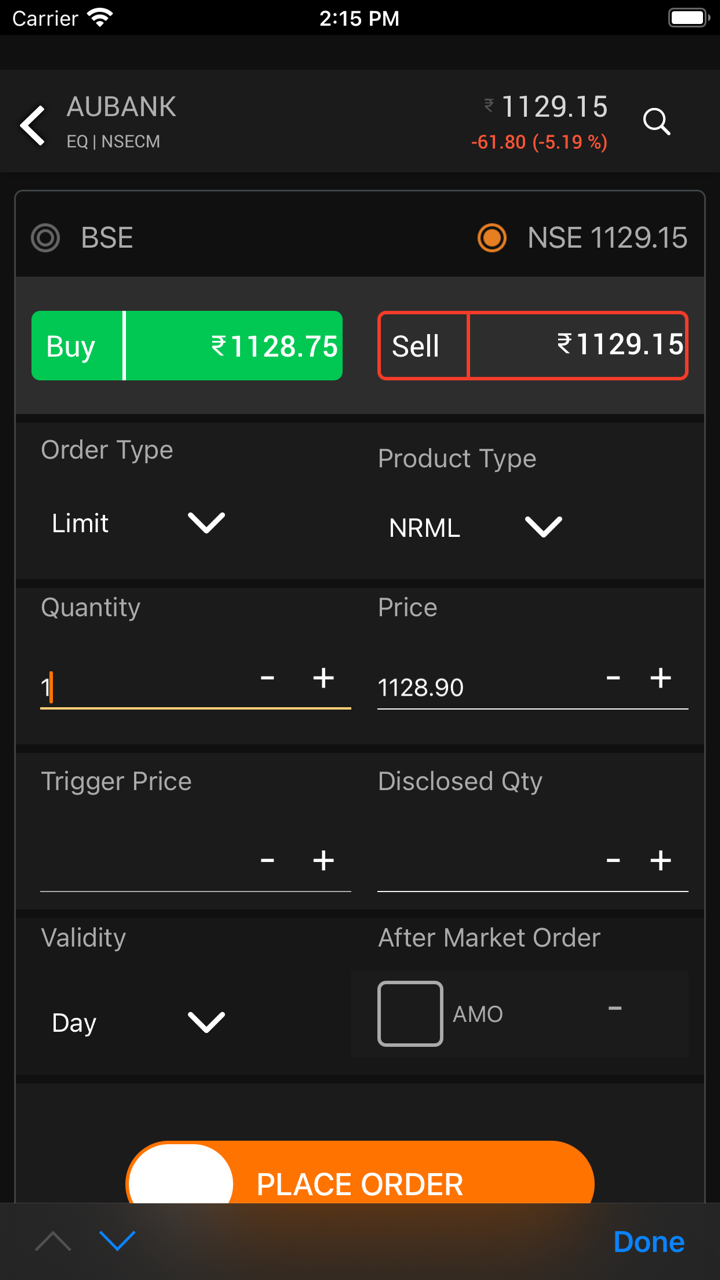

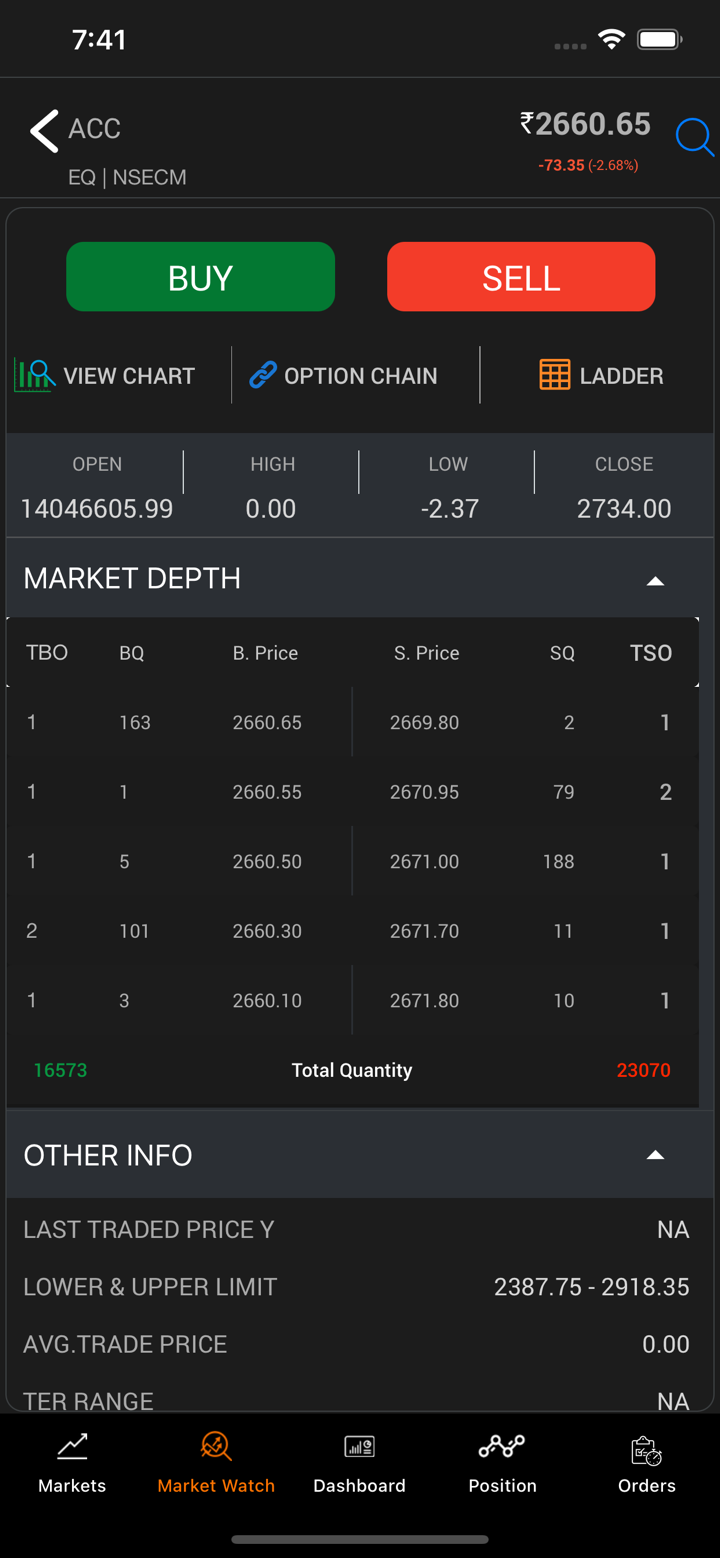

交易平台

| 交易平台 | 支援 | 可用設備 | 適合 |

| 線上和移動一體化平台 | ✔ | 移動,網頁 | / |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

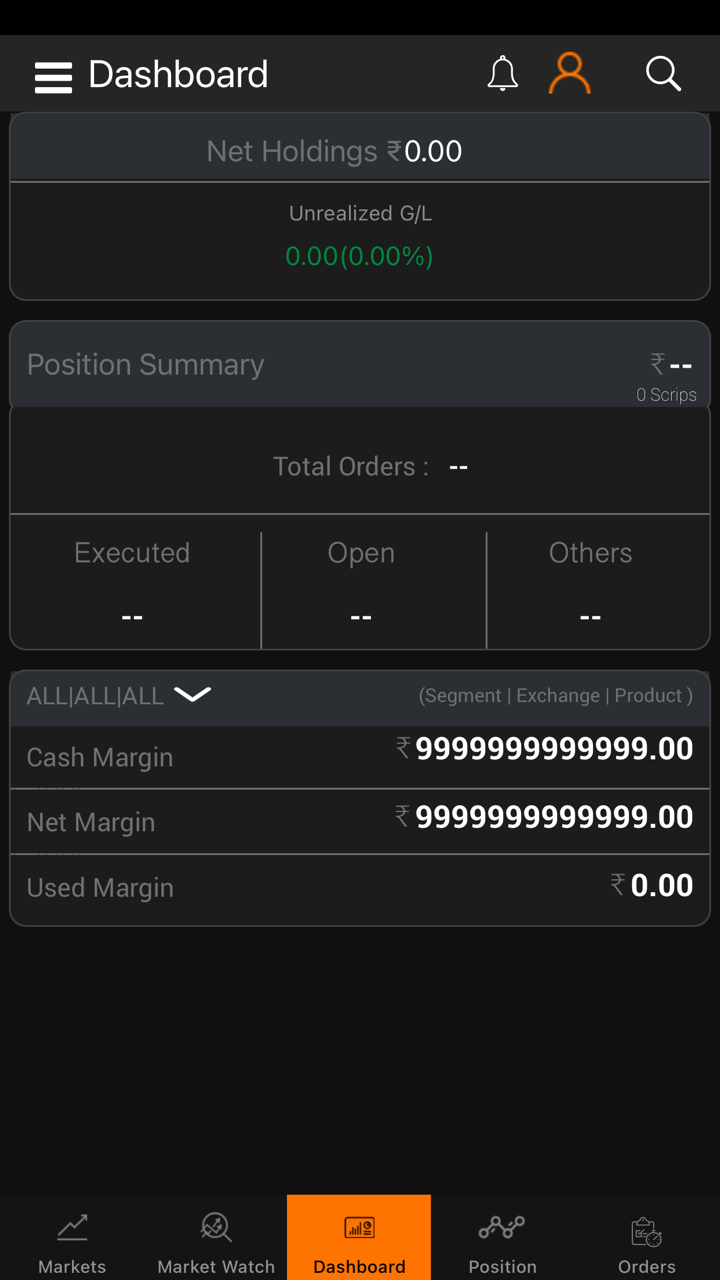

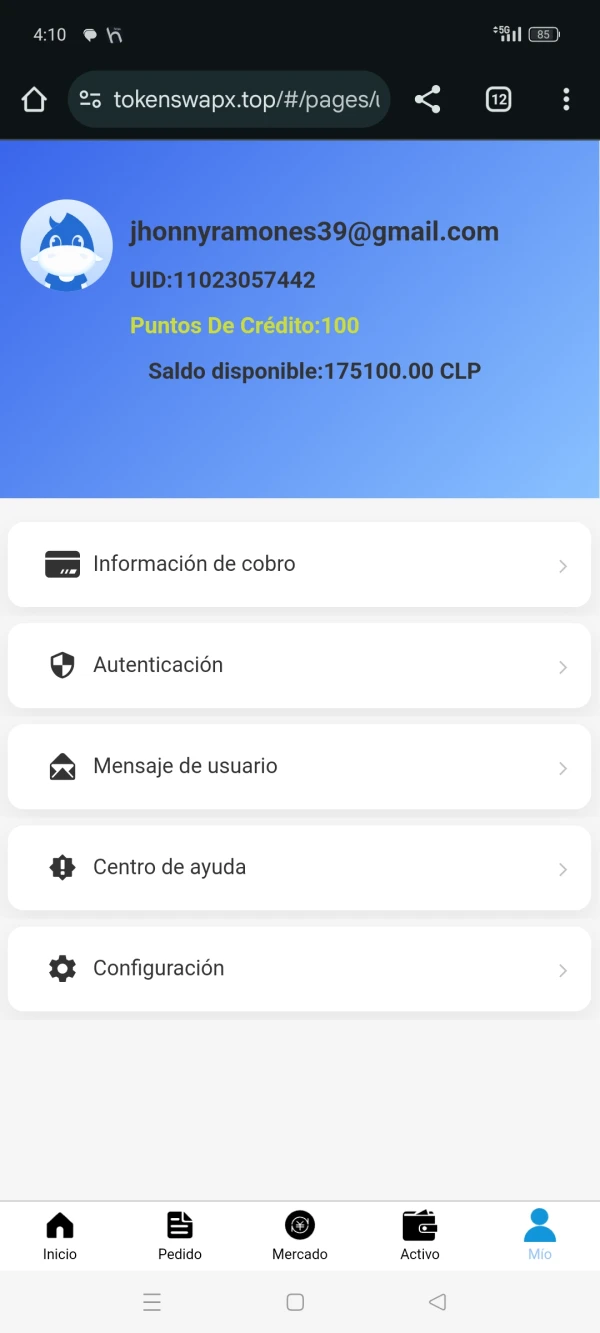

存款和提款

Multigain 接受透過線上/離線銀行,手機銀行和IVR銀行進行的付款。