Unternehmensprofil

| IndiaNivesh Überprüfungszusammenfassung | |

| Gegründet | 2006 |

| Registriertes Land/Region | Indien |

| Regulierung | Keine Regulierung |

| Marktinstrumente | Aktien, Investmentfonds, Derivate, IPO, Währungen, Versicherungen, Rohstoffe |

| Demo-Konto | ❌ |

| Handelsplattform | IndiaNivesh APP |

| Kundensupport | Tel: 022 – 62406240 |

| Soziale Medien: Facebook, X, Instagram, LinkedIn, YouTube | |

| E-Mail: customersupport@indianivesh.in | |

IndiaNivesh Informationen

IndiaNivesh ist ein unregulierter Dienstleister für erstklassige Makler- und Finanzdienstleistungen an der Börse in Indien. Es bietet Produkte und Dienstleistungen zu Aktien, Investmentfonds, Derivaten, IPO/OFS, Währungen, Versicherungen, Rohstoffen, LAS&MTF, maßgeschneiderten Lösungen, Portfolioverwaltungsdiensten, privatem Beteiligungskapital, strategischen Investitionen, Forschung, Verkauf und Handel, Kapitalbeschaffung (Eigenkapital & Schulden), Markteintritt in Indien, Globalisierung indischer Unternehmen, Fusionen & Übernahmen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Lange Betriebszeiten | Fehlende Regulierung |

| Verschiedene Kontaktmöglichkeiten | Keine Demokonten |

| Verschiedene Produkte & Dienstleistungen |

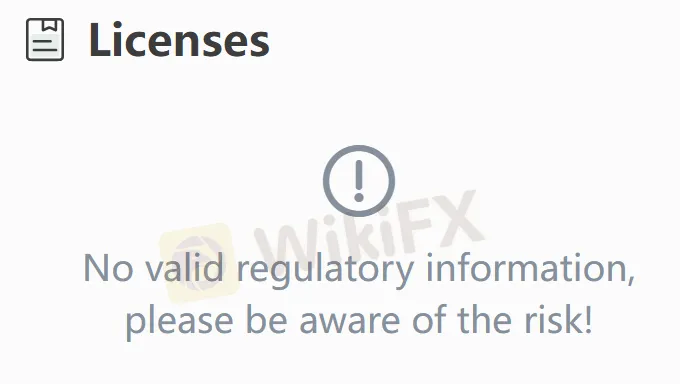

Ist IndiaNivesh legitim?

Nein. Es gibt derzeit keine gültigen Vorschriften. Bitte beachten Sie das Risiko!

Was kann ich bei IndiaNivesh handeln?

| Handelswerte | Unterstützt |

| Aktien | ✔ |

| Mutual Funds | ✔ |

| Derviate | ✔ |

| IPO | ✔ |

| Währungen | ✔ |

| Versicherung | ✔ |

| Waren | ✔ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| IndiaNivesh APP | ✔ | Mobile | / |