Présentation de l'entreprise

| IndiaNivesh Résumé de l'examen | |

| Fondé | 2006 |

| Pays/Région Enregistré | Inde |

| Régulation | Pas de régulation |

| Instruments de Marché | Actions, fonds communs de placement, dérivés, IPO, devises, assurance, matières premières |

| Compte de Démo | ❌ |

| Plateforme de Trading | IndiaNivesh APP |

| Support Client | Tél : 022 – 62406240 |

| Réseaux sociaux : Facebook, X, Instagram, LinkedIn, YouTube | |

| Email : customersupport@indianivesh.in | |

Informations sur IndiaNivesh

IndiaNivesh est un fournisseur de services non réglementé de premier plan en courtage et services financiers à la Bourse de l'Inde. Il propose des produits et services sur les actions, les fonds communs de placement, les dérivés, les IPO/OFS, les devises, l'assurance, les matières premières, LAS&MTF, des solutions personnalisées, des services de gestion de portefeuille, des fonds propres privés, des investissements stratégiques, de la recherche, des ventes et du trading, des levées de fonds (actions et dettes), l'entrée en Inde, la mondialisation des entreprises indiennes, des fusions et acquisitions.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Temps d'opération prolongé | Manque de régulation |

| Divers canaux de contact | Pas de comptes de démonstration |

| Divers produits et services |

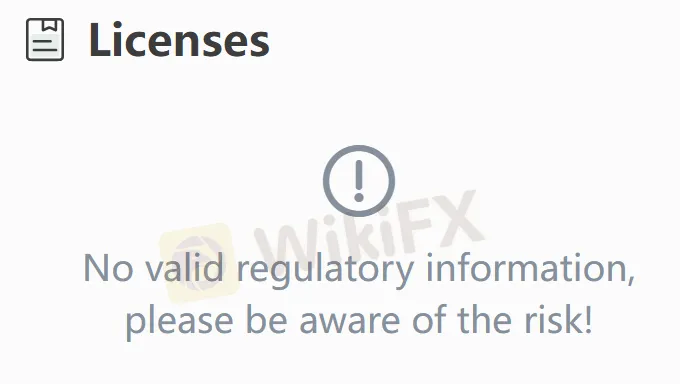

IndiaNivesh est-il Légitime ?

Non. Il n'a actuellement aucune réglementation valide. Veuillez être conscient du risque !

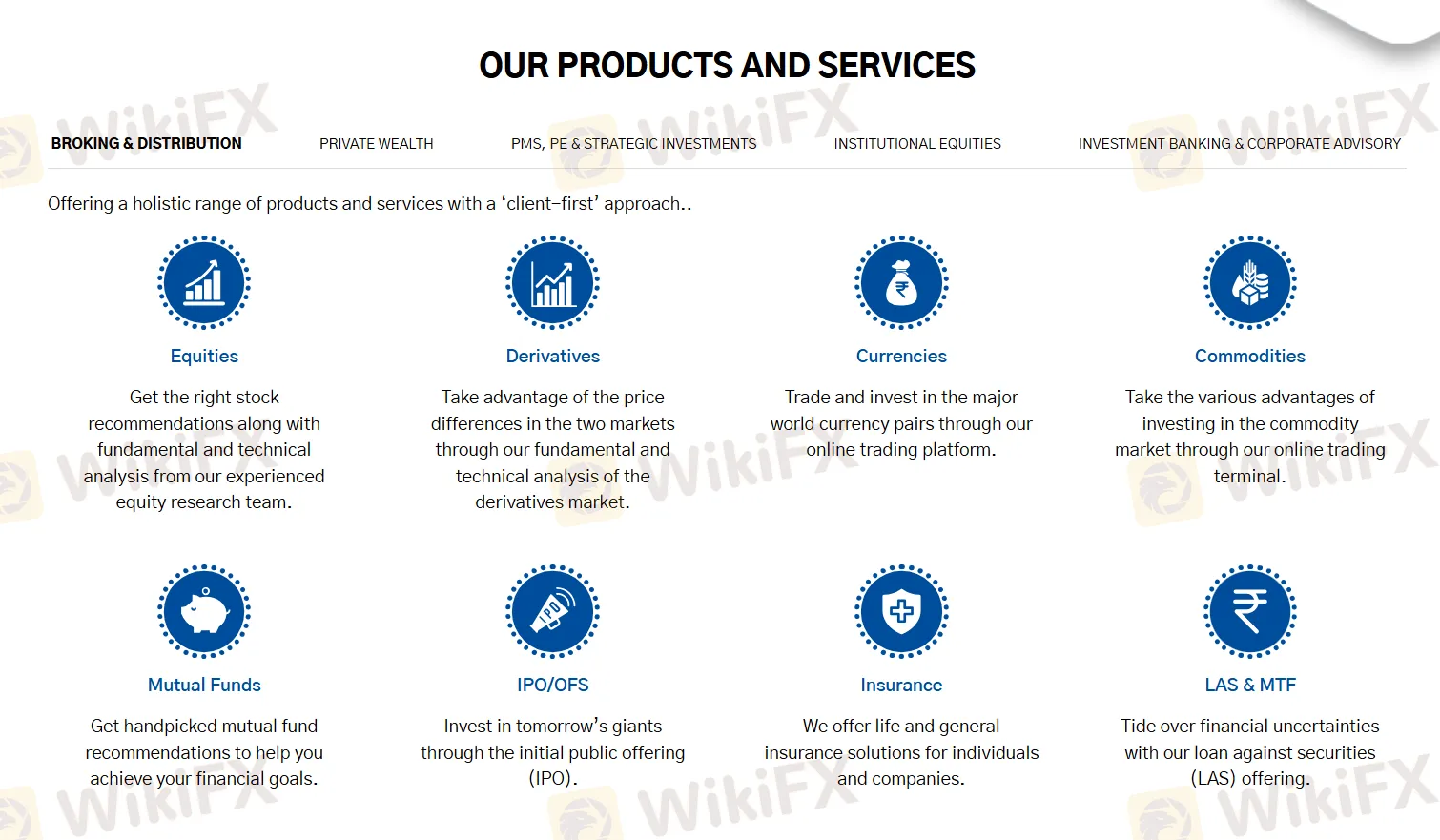

Que puis-je trader sur IndiaNivesh ?

| Actifs de trading | Pris en charge |

| Actions | ✔ |

| Fonds communs de placement | ✔ |

| Dérivés | ✔ |

| IPO | ✔ |

| Devises | ✔ |

| Assurance | ✔ |

| Matières premières | ✔ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| IndiaNivesh APP | ✔ | Mobile | / |