Company Summary

| Mirrox Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Comoros |

| Regulation | No regulation |

| Market Instruments | Forex, stocks, commodities, indices, cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 0.9 pips |

| Trading Platform | Mirrox mobile/web |

| Minimum Deposit | USD 250 |

| Customer Support | Contact form, Live chat |

| TEL: +447701426264 | |

| Email: support@mirrox.com | |

| Registered Address: P.B. 1257 Bonovo Road, Fomboni, Comoros, KM | |

| Restricted Areas | European Union, UAE, GCC countries |

Mirrox Information

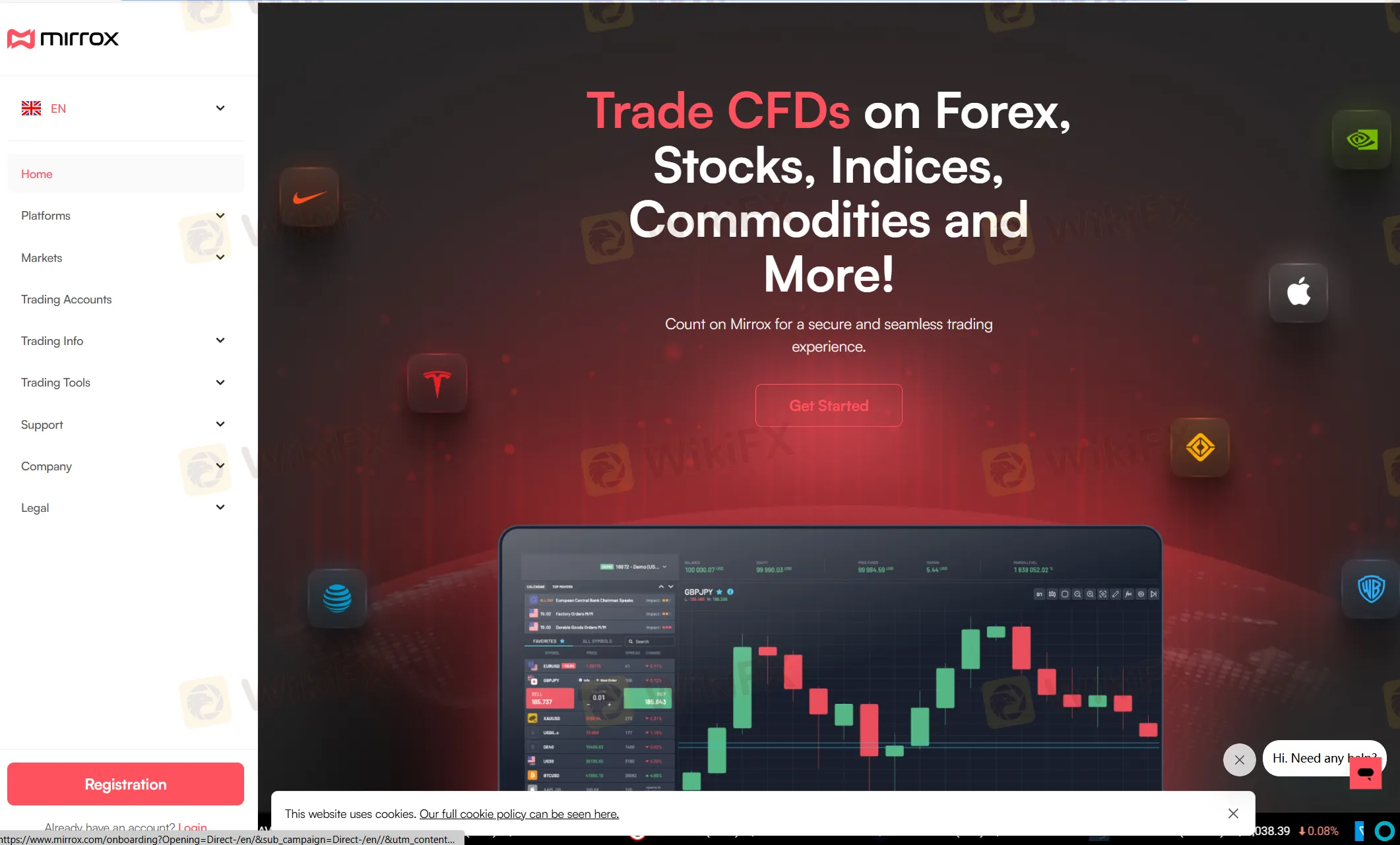

Mirrox is a brokerage company registered in Comoros and offers more than 160 trading instruments for trading. These include forex, stocks, metals, indices and cryptocurrencies.

The broker provides a demo account for practicing before actual trading and 5 tiered live accounts for different client groups. To protect customer funds, Mirrox implements segregated accounts to separate client assets from operational funds.

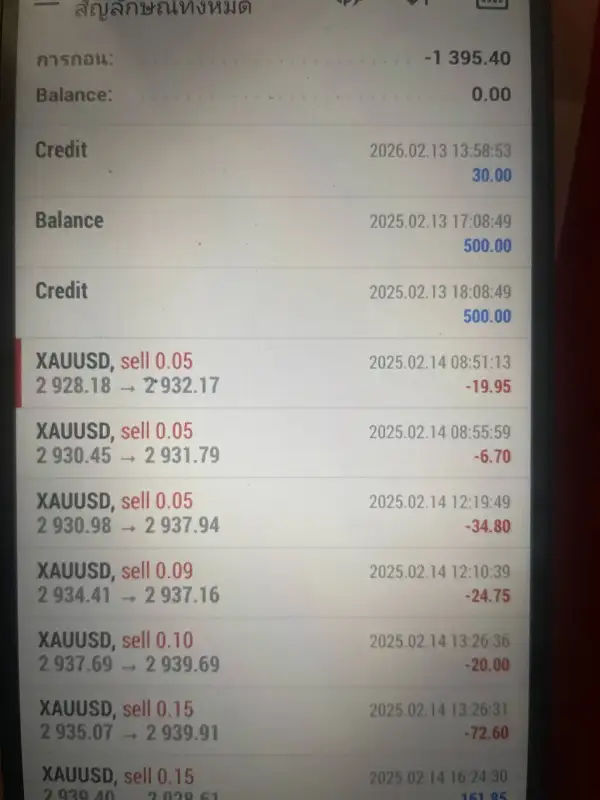

However, the broker charges a series of trading fees and inactivity fees, which is the most sensitive points for traders.

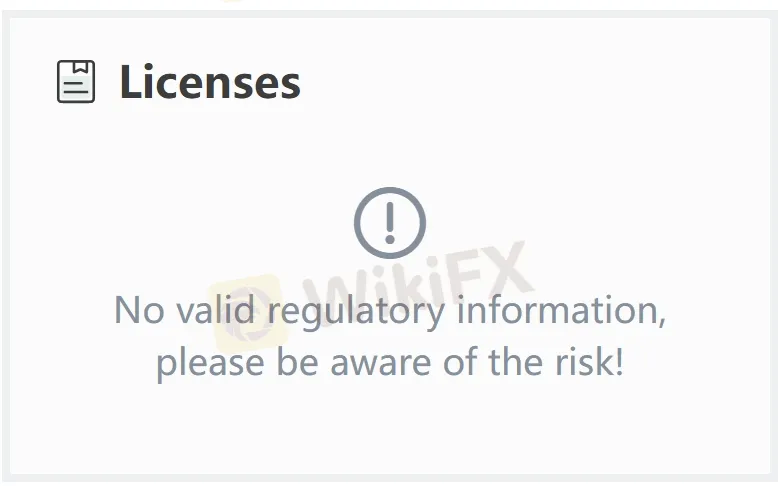

Furthermore, the broker is not being well-regulated by any official authorities so far, which further degrades its credibility and trustworthiness.

Pros and Cons

| Pros | Cons |

| Demo accounts available | No regulation |

| Tiered accounts | Inactivity fees charged |

| 24/7 multilingual support | No MT4/5 platforms |

| Fund segregation | High minimum deposit |

Is Mirrox Legit?

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. Mirrox is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose Mirrox with caution.

What Can I Trade on Mirrox?

Mirrox offers 160+ trading instruments:

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type & Spread

To start with Mirrox, you are suggested to start with a free demo account with virtual money to practice and get familiar with the platform first due to high minimum deposit at USD 250 with live accounts.

There are 5 tiered accounts with varying starting spreads, namely Classic, Silver, Gold, Platinum and VIP. The higher level the account is, the tighter the spread will be.

| Account Type | Minimum Deposit | Spread from |

| Classic | USD 250 | 2.5 pips |

| Silver | ||

| Gold | 1.8 pips | |

| Platinum | 1.4 pips | |

| VIP | 0.9 pips |

Leverage

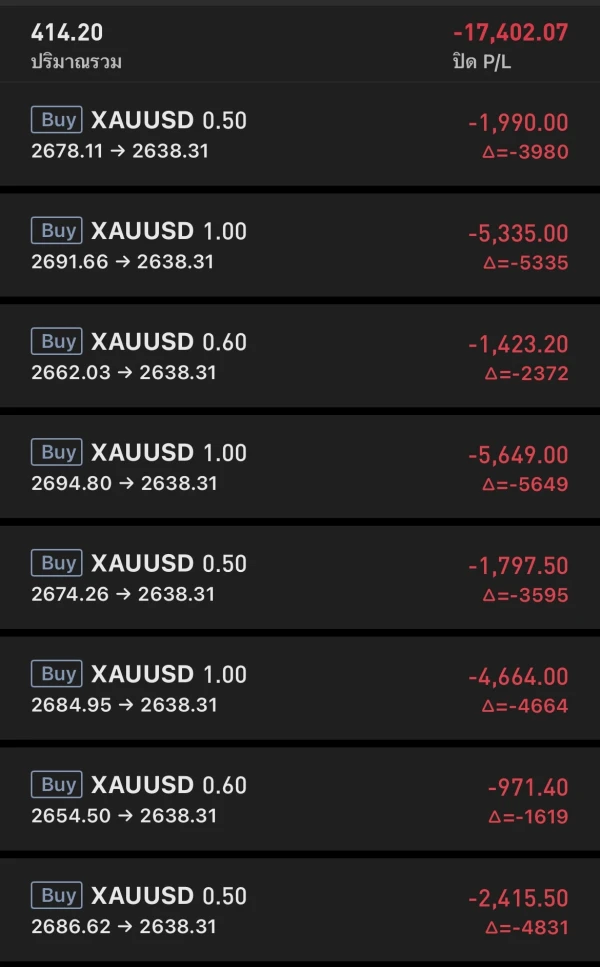

Mirrox offers leverage up to 1:400 for all account types.It's always wise to be cautious with leverage since it's a double-edge word which signifies your profits as well as losses at the same level.

Trading Platform

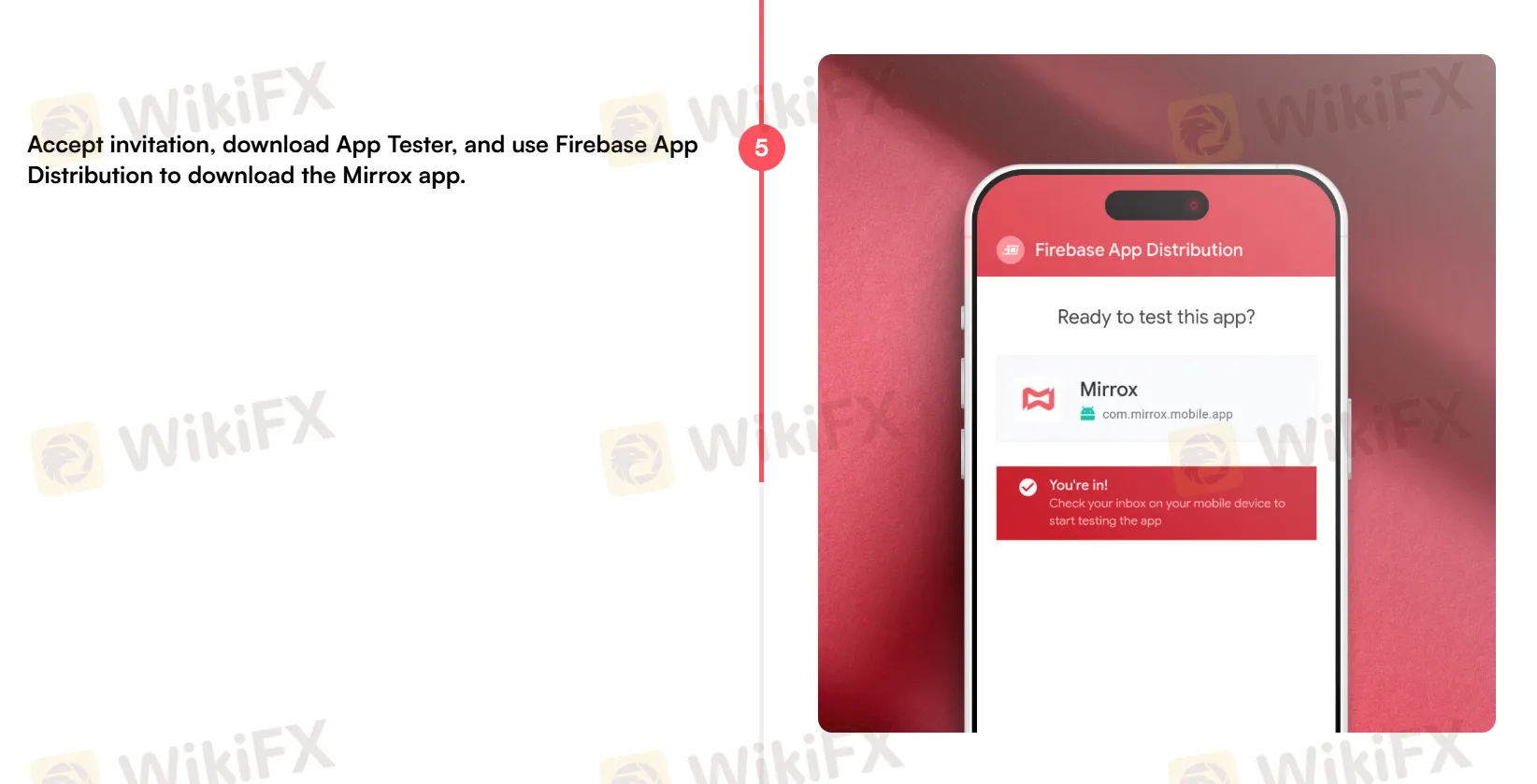

Mirrox offers a proprietary trading platform which can be downloaded on mobile phones via Firebase App Distribution.

Traders can also access the platform via web, which has no limitation for devices to traders.

The platform is said to have customizable interface, as well as precise visual analytics and extensive trading tools to enable traders to make data-driven decisions.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mirrox | ✔ | Mobile/Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

You can deposit funds via credit/debit cards, wire transfers, and various alternative payment methods with this broker.

For deposits, you need to transfer at least USD 250 into your accounts, while for withdrawals, the minimum amount is 10 USD for credit cards and 100 USD for wire transfers. For e-wallets, any amount covering the fee is acceptable.

Withdrawals typically take 8 to 10 business days, depending on your banks processing time.

| Fee | Condition | Fee/Details |

| Withdrawal Fee | First withdrawal (fully verified + at least one trade opened) | ❌ |

| First withdrawal (Not fully verified OR no trades opened) | 10 USD (or equivalent) | |

| Subsequent withdrawals (Credit Card, Debit Card, Prepaid Card, E-wallets) | 3.5% of the amount | |

| Subsequent withdrawals (Wire Transfer) | 30 USD (or equivalent) |

Fees

To ensure you understand your trading costs in advance, communicate with the broker for all the details or visit https://ww0.mirrox.com/wp-content/uploads/2024/06/General-Fees.pdf

| Fee | Condition | Fee |

| Inactivity/Dormancy Fee | 0–1 month | ❌ |

| 1–2 months | 100 USD (or equivalent) per month | |

| 2–6 months | 250 USD (or equivalent) per month | |

| 6–12 months | 500 USD (or equivalent) per month | |

| Over 12 months | Account classified as dormant and archived | |

| Maintenance Fee | Monthly maintenance fee | 10 USD (or equivalent) |

| Financing Fee | Any financing | ❌ |