Company Summary

| TradeSmartReview Summary | |

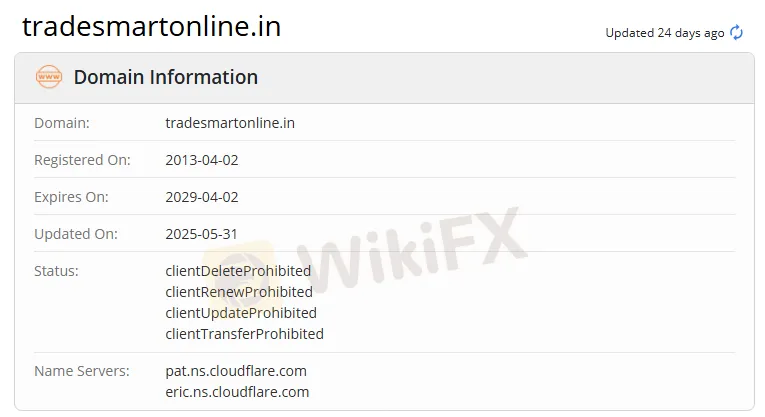

| Founded | 2013 |

| Registered Country/Region | India |

| Regulation | No Regulation |

| Trading Instruments | Stocks, futures, options, currencies, and commodities |

| Products | TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, and Integrations |

| Leverage | Up to 1:5 |

| Spread | / |

| Trading Platform | TraderSmart APP |

| Minimum Deposit | / |

| Customer Support | Phone: +91 022-61208000 |

| Email: contactus@vnsfin. com | |

| Social Media: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | |

| Address: A-401, Mangalya, Marol, Andheri East, Mumbai - 400059 | |

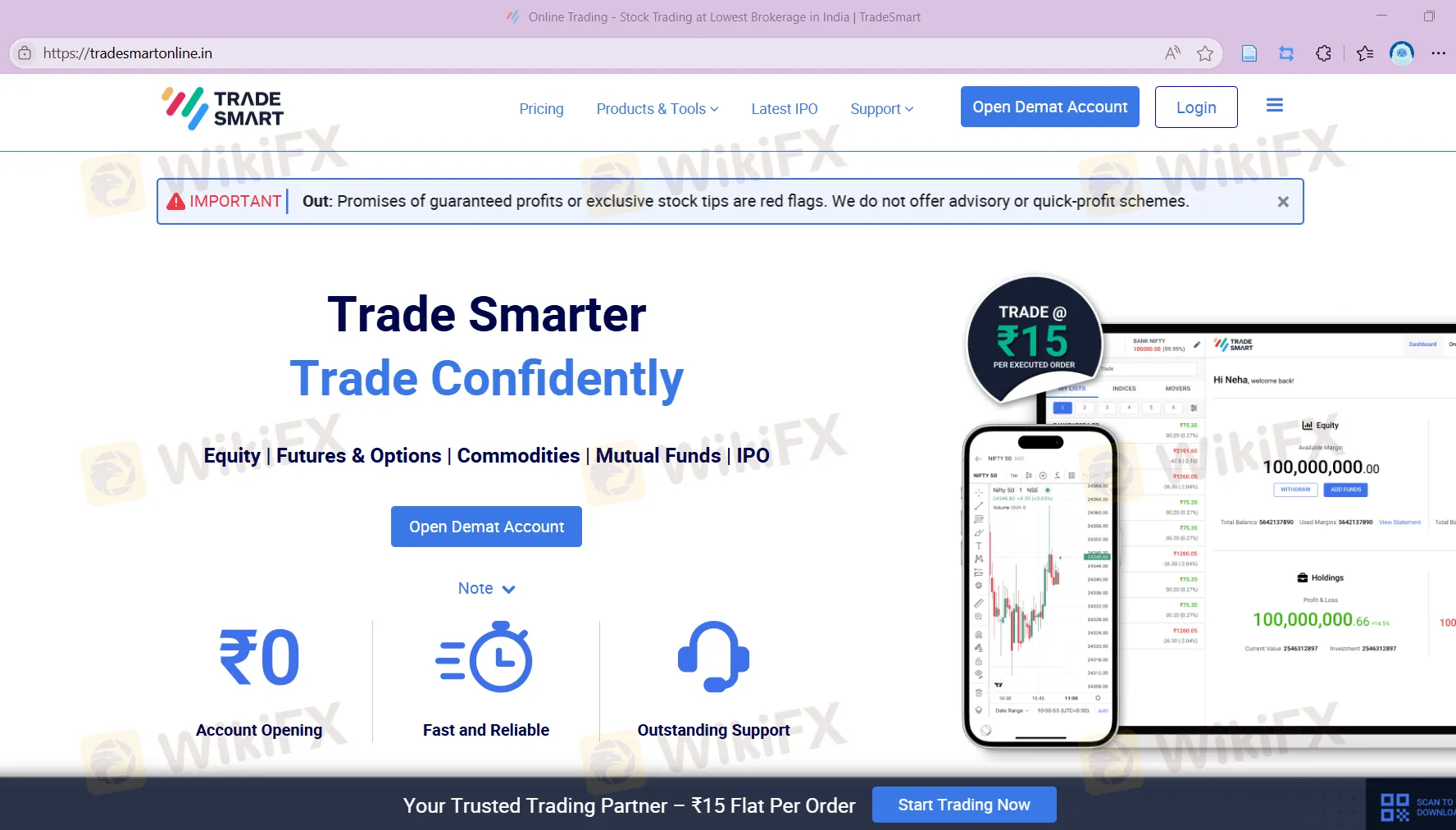

TradeSmart Information

Founded in 2013 and headquartered in India, TradeSmart is a financial services provider. It offers a diverse range of trading tools and platforms, including the TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, and Integrations. In order to meet the needs of different clients, the company has two types of accounts: Value accounts for low-frequency and small traders, and Power accounts for high-frequency and high-volume traders.

However, TradeSmart is currently unregulated and its legitimacy is a cause for concern.

Pros and Cons

| Pros | Cons |

| Various products offered | No regulation |

| Limited info on account features | |

| Unclear fee structure | |

| Limited info on deposit and withdrawal |

Is TradeSmart Legit?

No. TradeSmart is not regulated, and traders must exercise caution when trading.

What Can I Trade on TraderSmart?

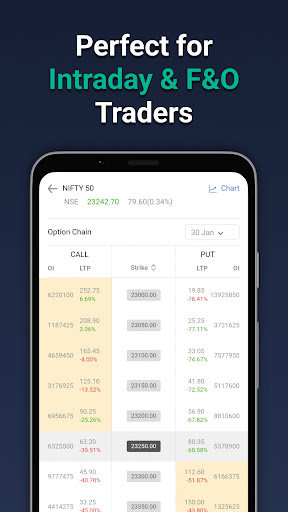

| Trading Instruments | Supported |

| Stocks | ✔ |

| Futures | ✔ |

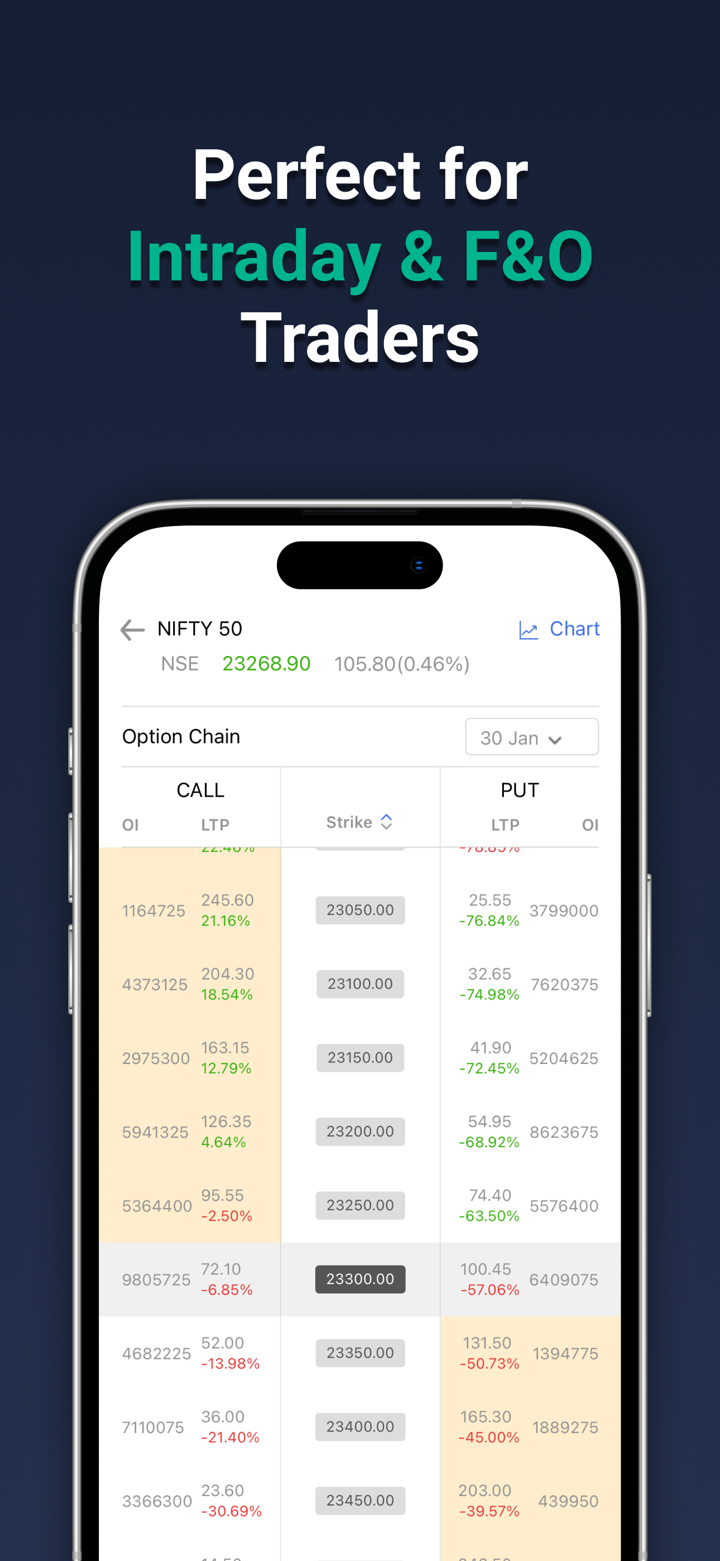

| Options | ✔ |

| Currencies | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Products

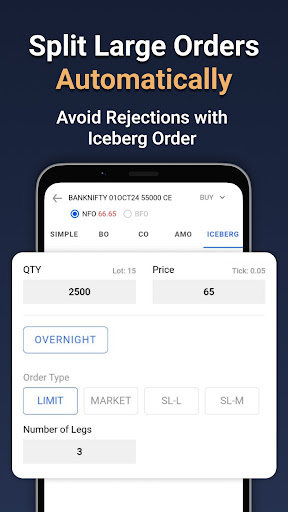

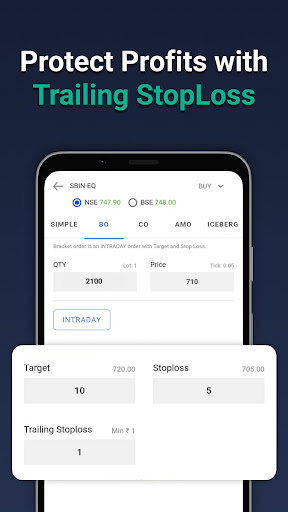

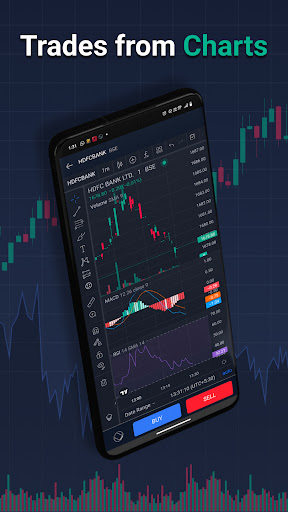

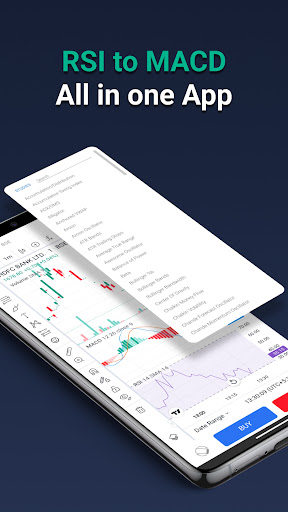

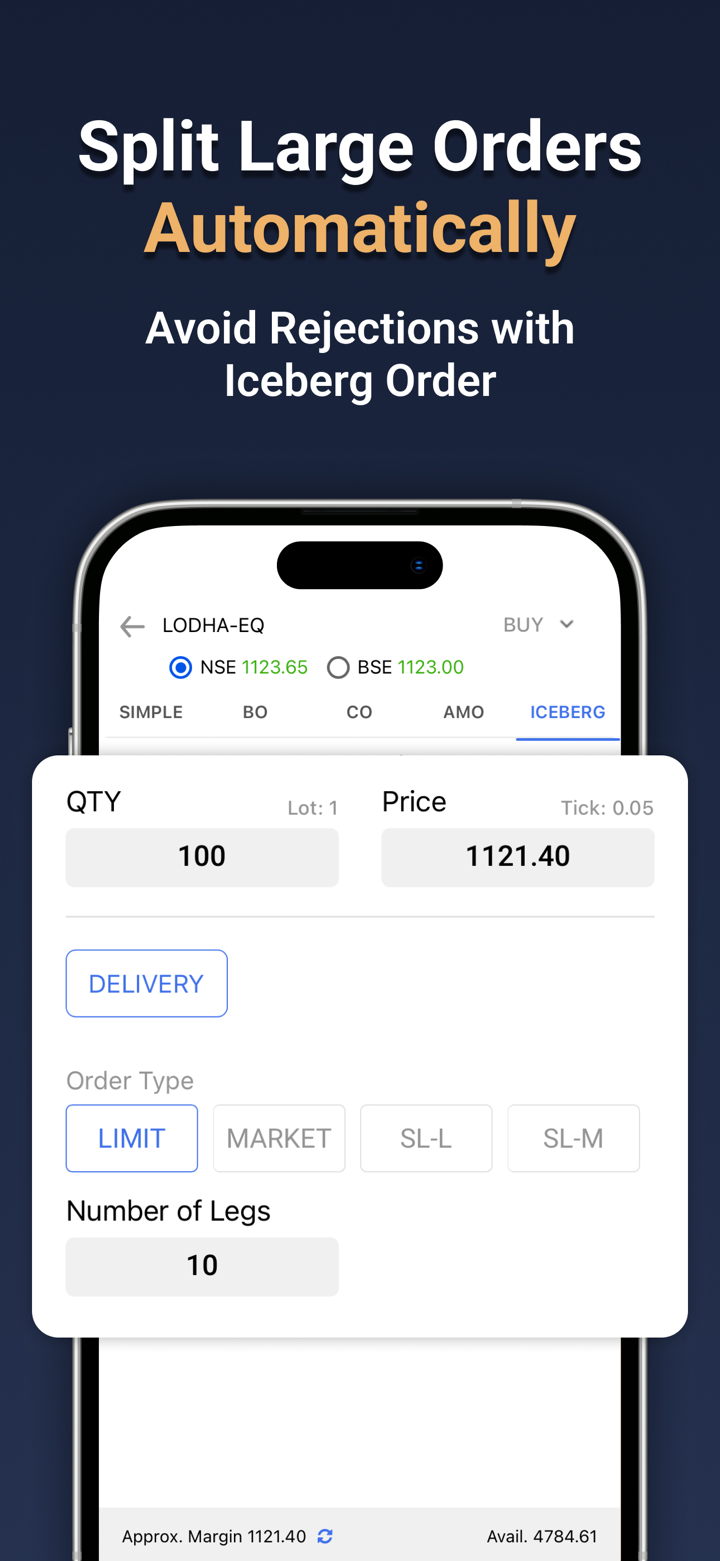

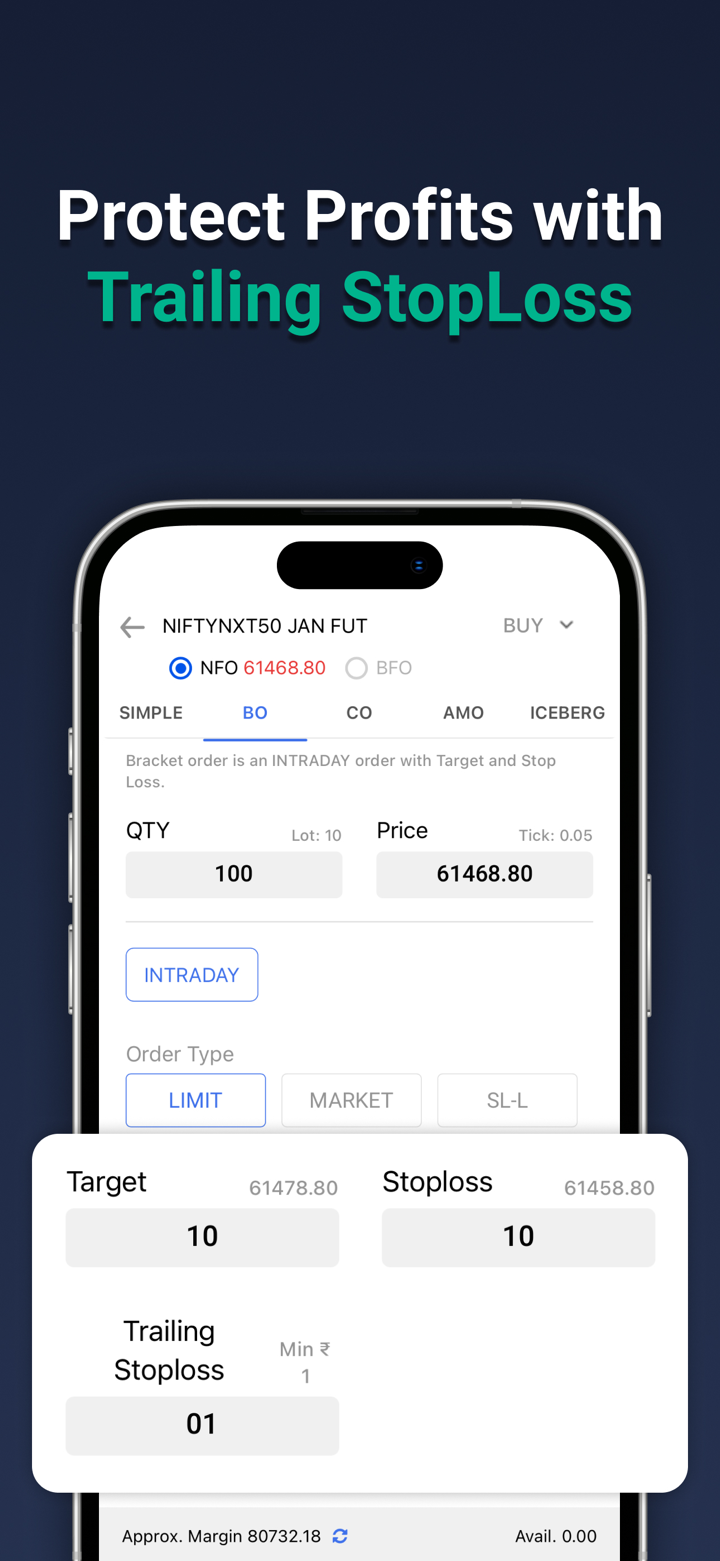

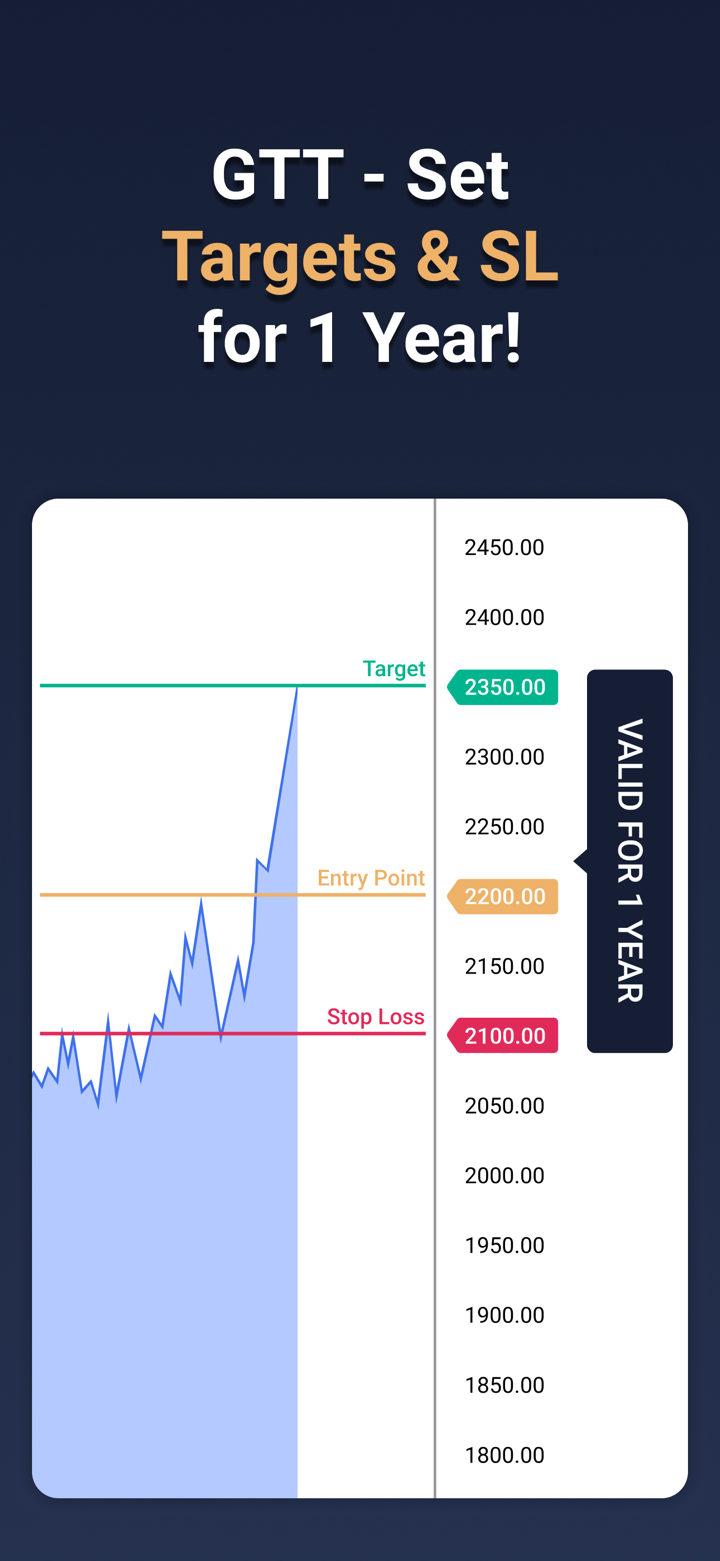

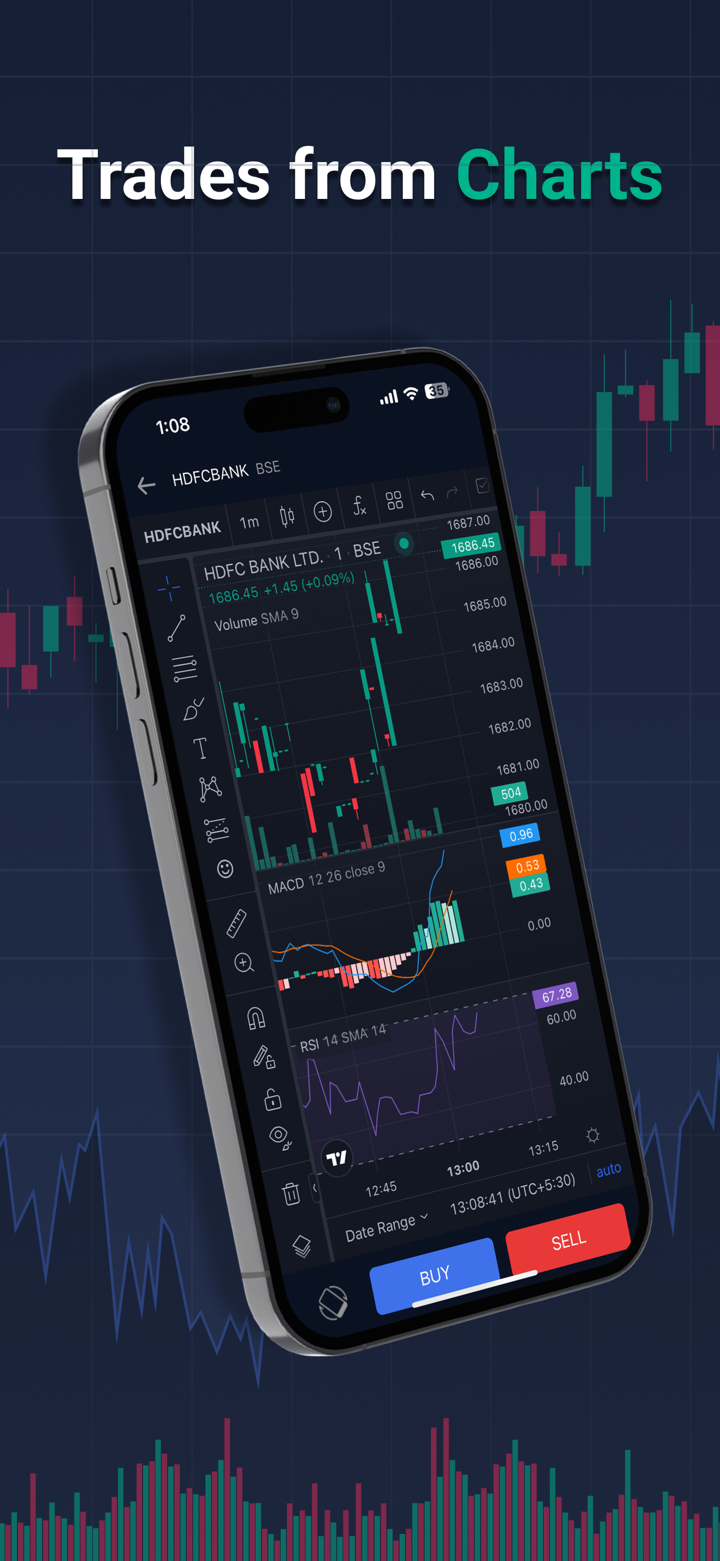

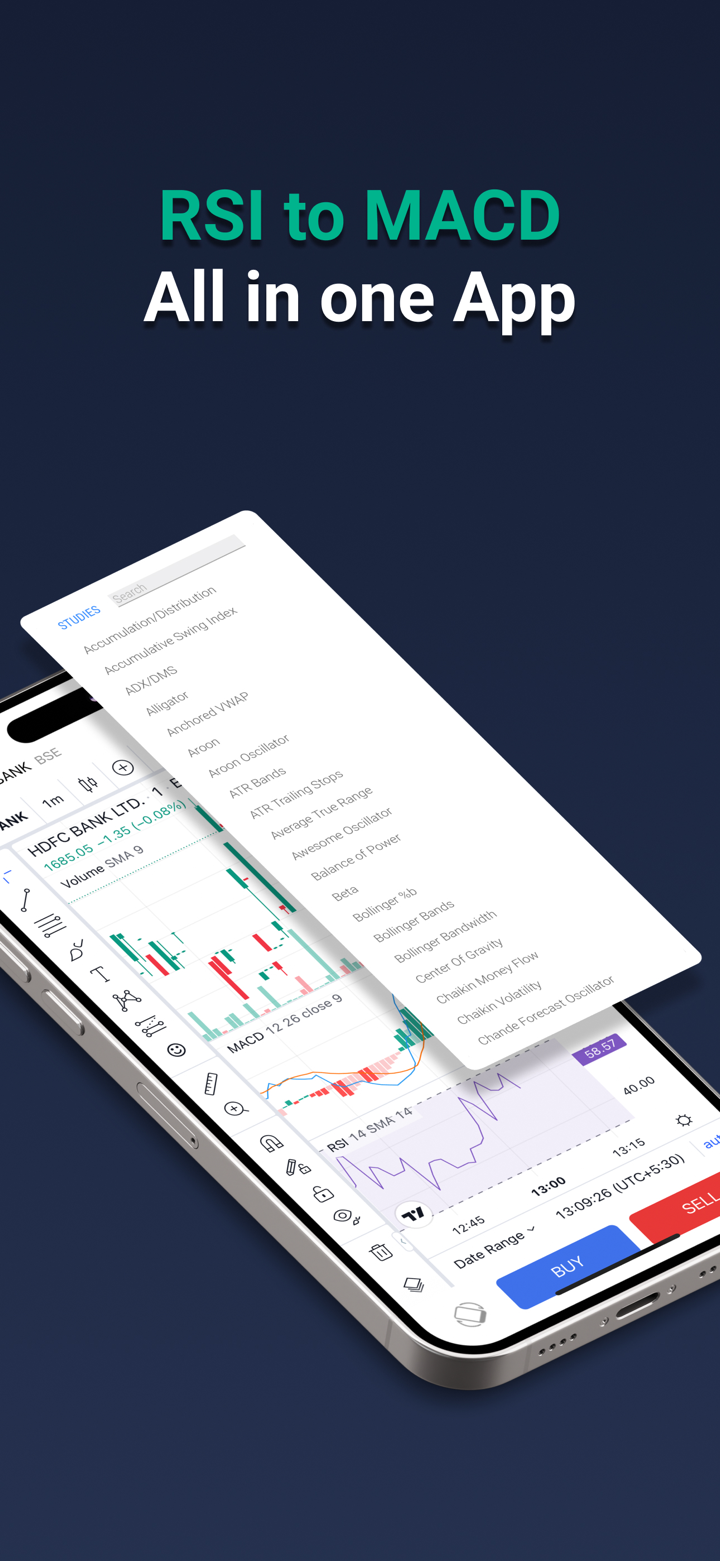

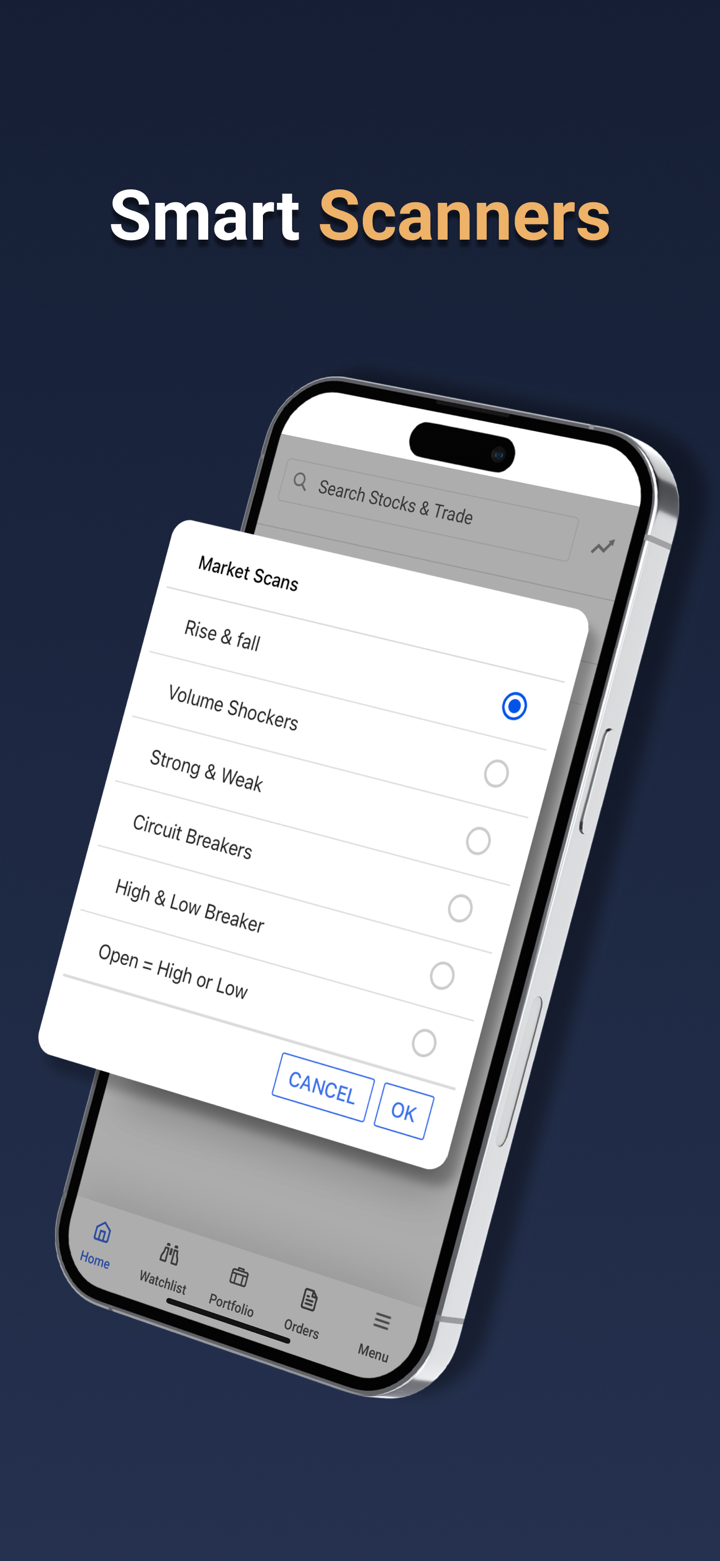

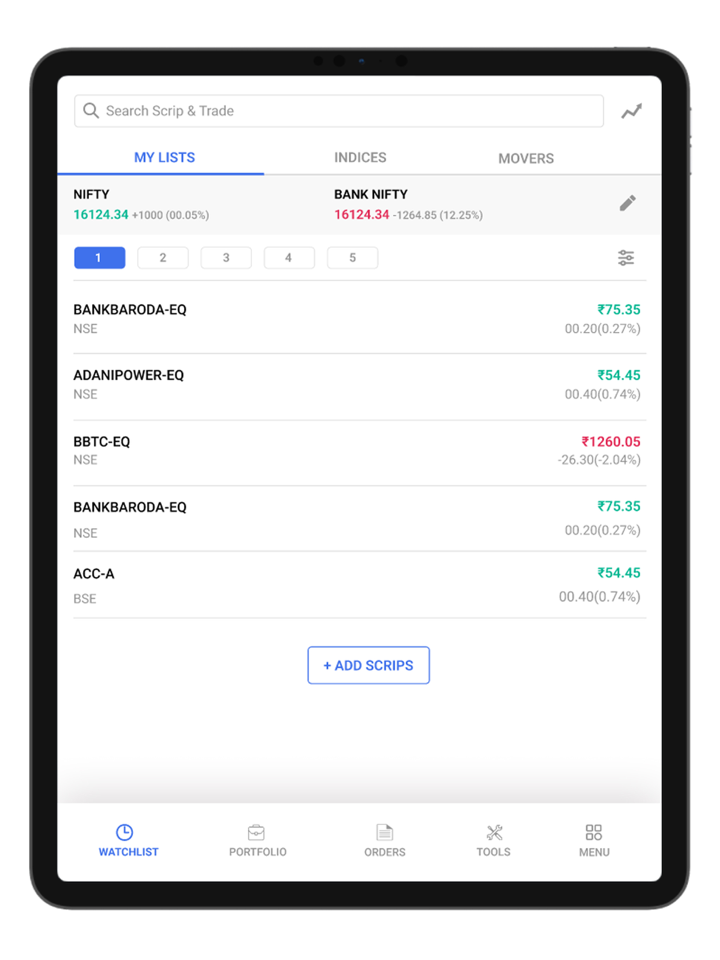

TraderSmart's products include a variety of trading tools: TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, and Integrations.

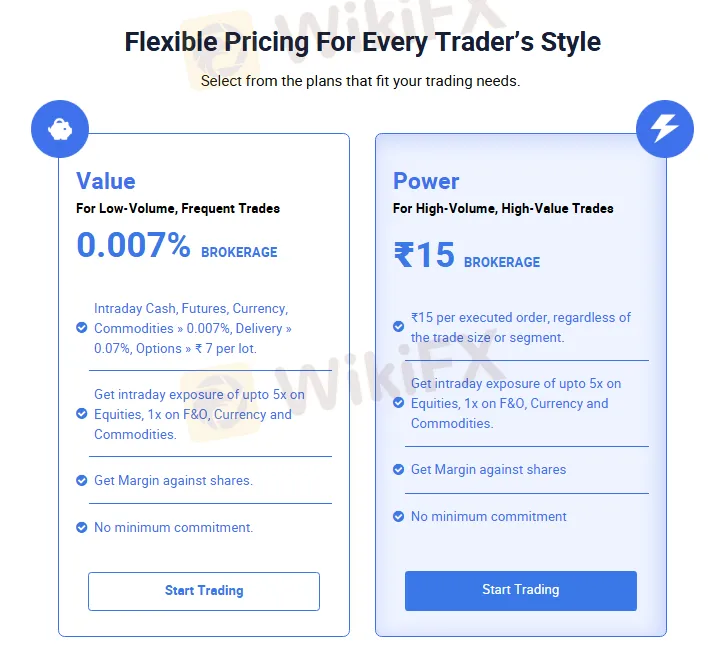

Account Types & Fees

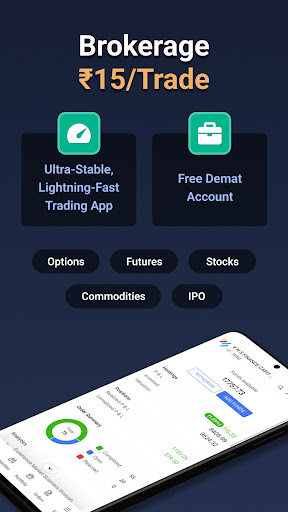

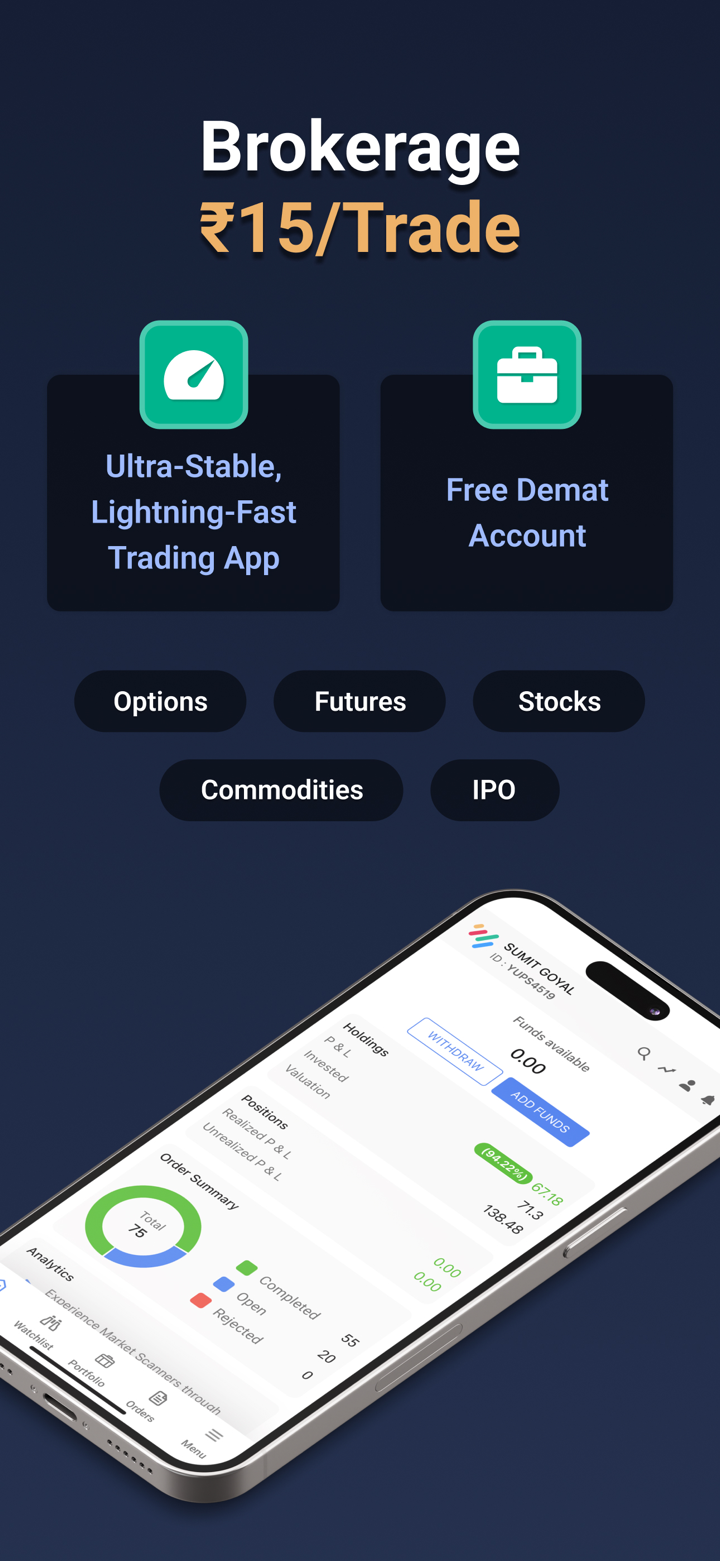

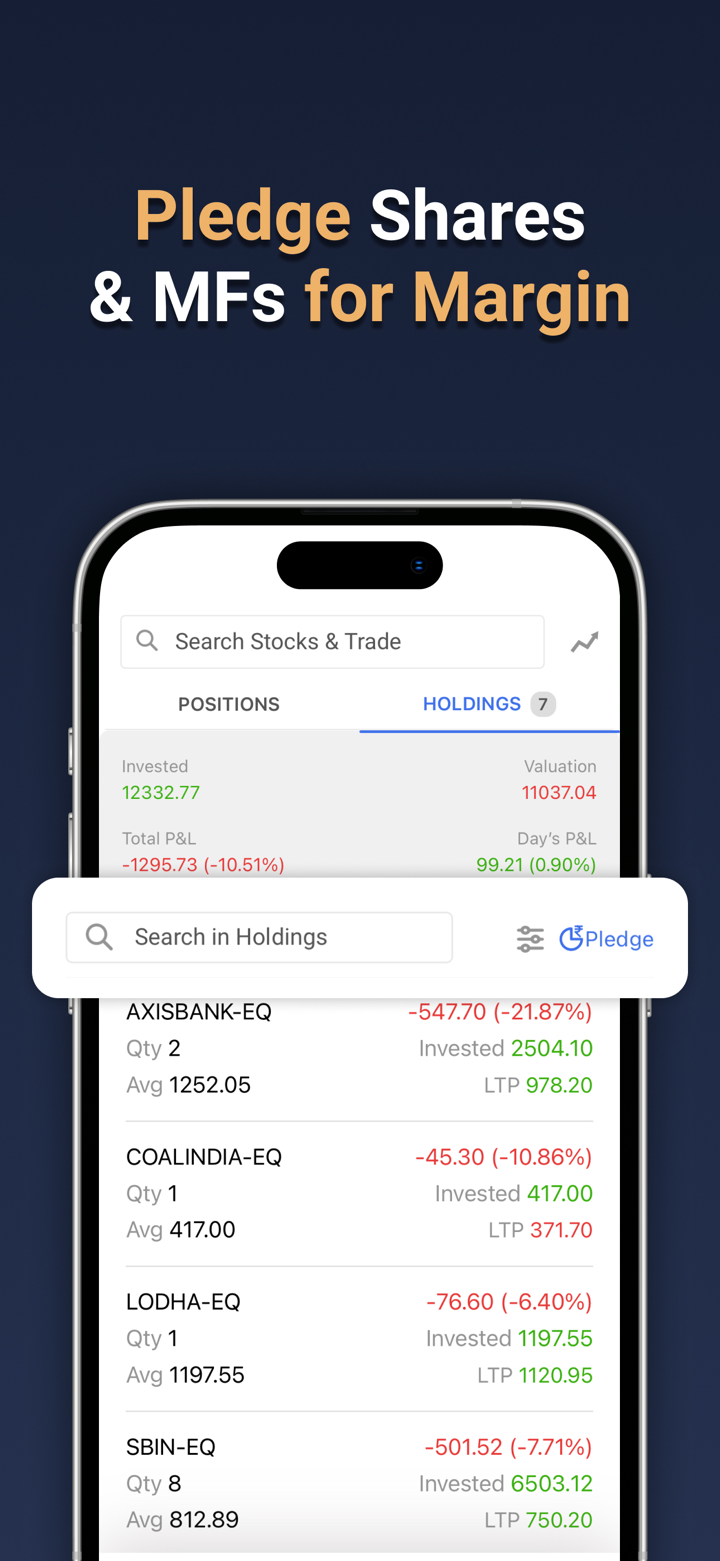

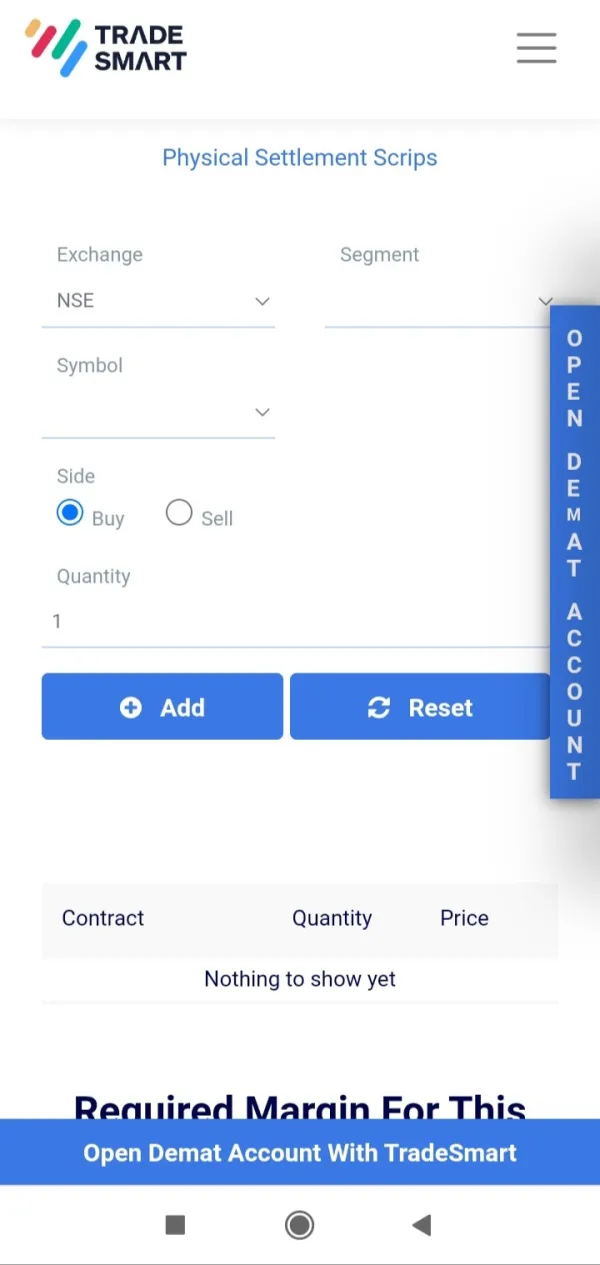

TradeSmart offers traders with Demat accounts for trading. There are two different programs available: Value and Power, for traders to choose from.

The primary role of a Demat account is to digitize the storage, management, and trading of securities, providing investors with an efficient, secure, and transparent investment experience.

Below is information on the two account plans:

| Value Account | Power Account | |

| Target Traders | Low-volume, high-frequency traders | High-volume, high-value traders |

| Brokerage Fee | 0.007% | ₹15 per order (regardless of trade size or type) |

| Intraday Cash, Futures, Currency | Suitable for low-volume, high-frequency trading | Suitable for high-volume, high-value trading |

| Commodities > 0.007%, Delivery > 0.07%, Options > ₹7 per lot | Supports low-cost commodities and options trading | Supports higher-cost commodities and options trading |

| Leverage | Up to 1:5 (Equity, F&O, Currency, and Commodities) | Up to 1:5 (Equity, F&O, Currency, and Commodities) |

| Margin Against Shares Support | Yes | Yes |

| Minimum Commitment | No | No |

Leverage

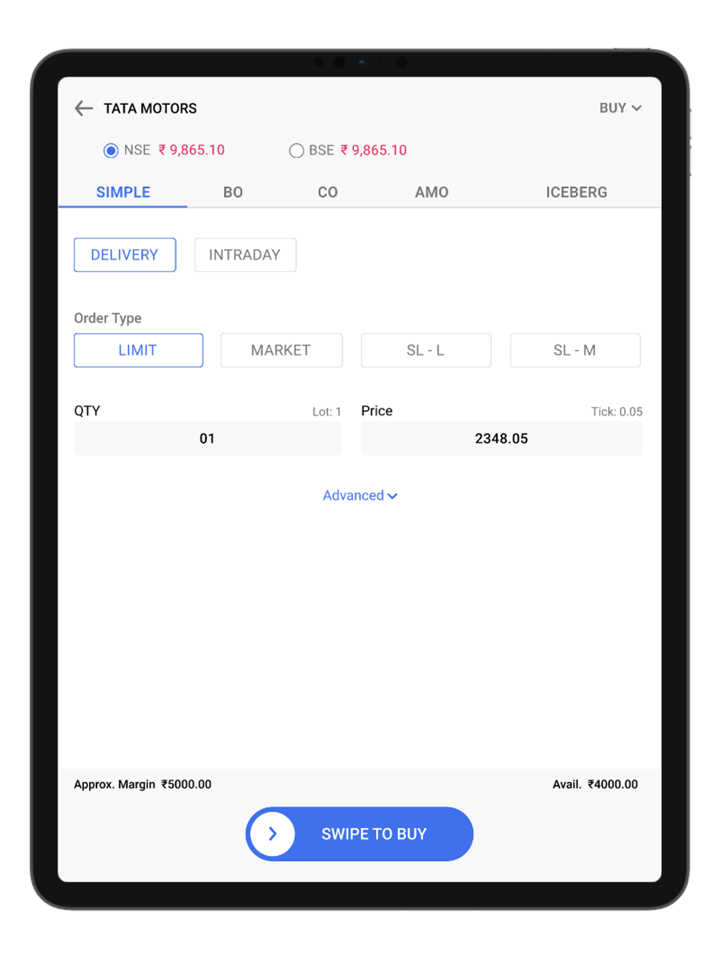

TradeSmart has 1:5 leverage on stocks, F&O, currencies, and commodities. Please note that high leverage can amplify not only profits but also losses.

Trading Platform

TradeSmart supports trading using the proprietary TraderSmart APP. Only Rs. 15 per trade is charged as commission for trading on this platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| TraderSmart | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

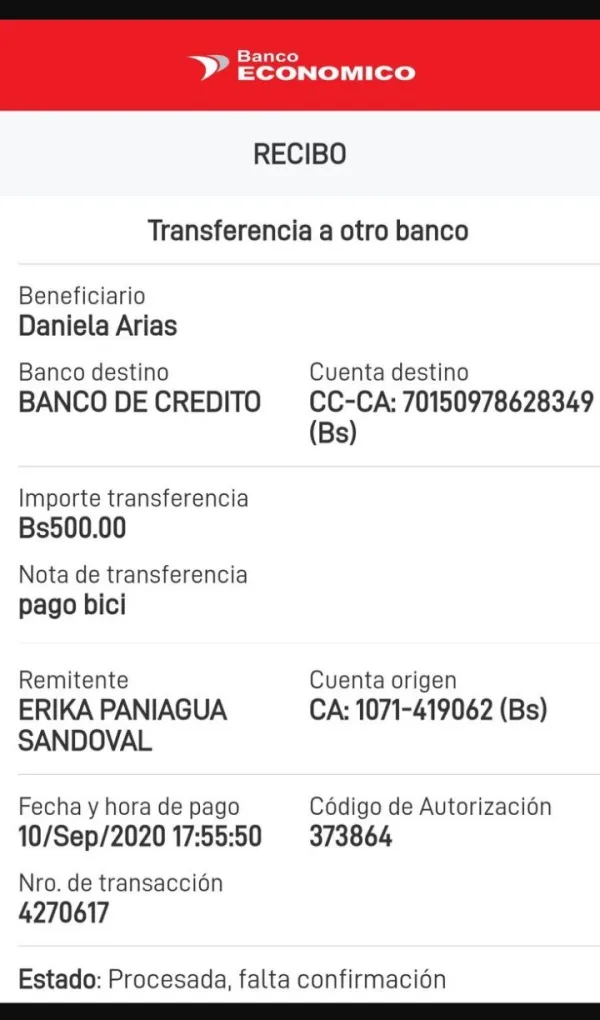

Deposit and Withdrawal

TraderSmart accepts payments via bank wire transfer and NEFT transfer.

A total of 29 banks are supported as listed below:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank, and AU Small Finance Bank.