公司簡介

| TradeSmart評論摘要 | |

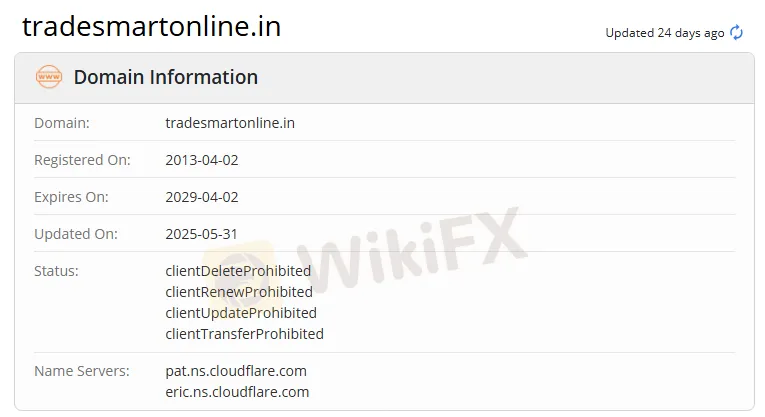

| 成立年份 | 2013 |

| 註冊國家/地區 | 印度 |

| 監管 | 無監管 |

| 交易工具 | 股票、期貨、期權、貨幣和商品 |

| 產品 | TradeSmart 手機應用程式、TradeSmart 桌面版、TradeSmart 網頁版、TradeSmart API、BOX、TradeSmart MF、Instaoption 和整合 |

| 槓桿 | 最高達1:5 |

| 點差 | / |

| 交易平台 | TraderSmart APP |

| 最低存款 | / |

| 客戶支援 | 電話:+91 022-61208000 |

| 電郵:contactus@vnsfin. com | |

| 社交媒體:Facebook、Twitter、Instagram、LinkedIn、YouTube、Telegram | |

| 地址:印度孟買安德烈里東馬洛A-401,郵編400059 | |

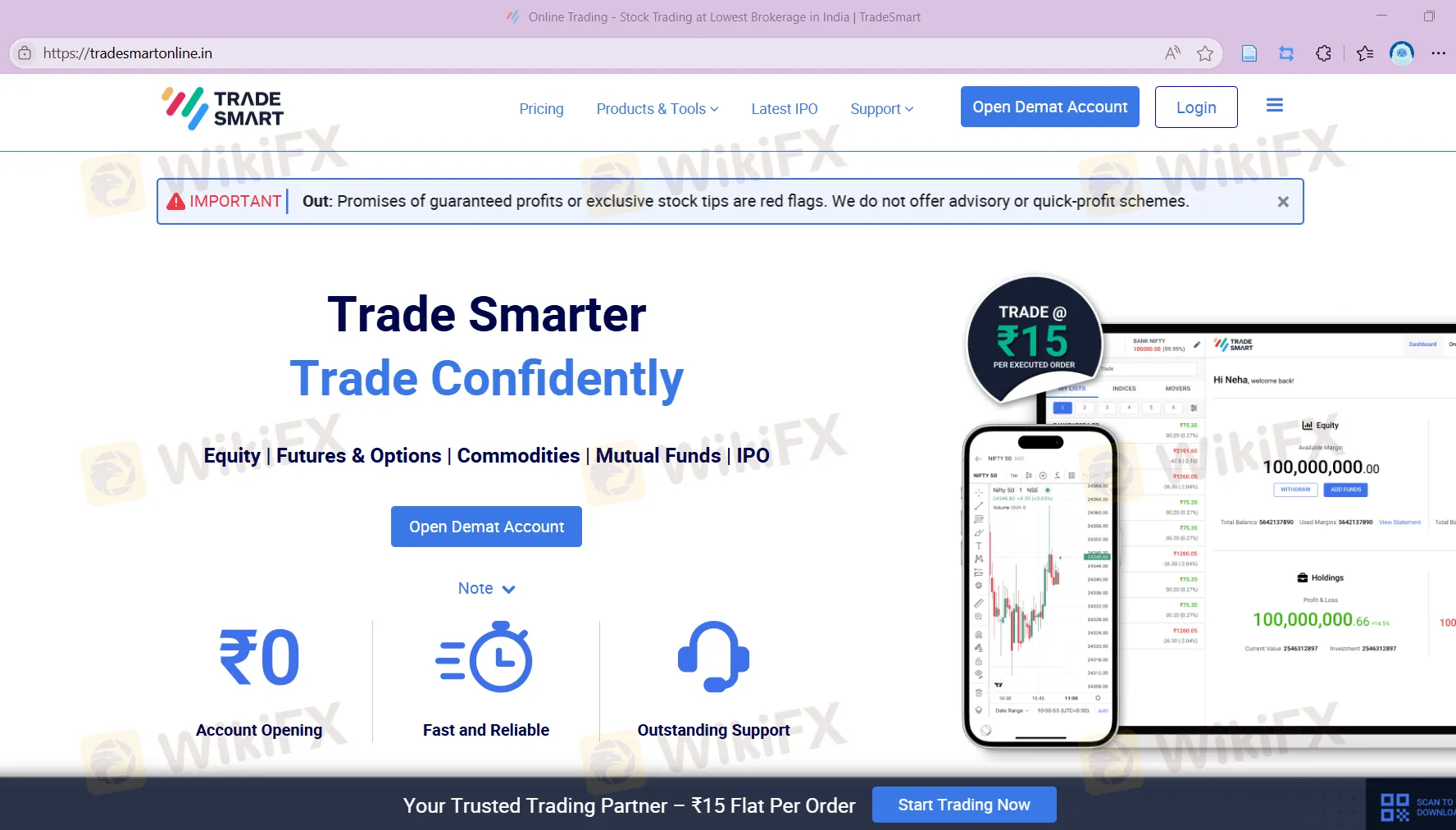

TradeSmart 資訊

成立於2013年,總部設於印度的TradeSmart是一家金融服務提供商。該公司提供多樣化的交易工具和平台,包括TradeSmart手機應用程式、TradeSmart桌面版、TradeSmart網頁版、TradeSmart API、BOX、TradeSmart MF、Instaoption 和整合。為了滿足不同客戶的需求,該公司設有兩種帳戶類型:價值帳戶適用於低頻率和小型交易者,而權力帳戶適用於高頻率和高交易量的交易者。

然而,TradeSmart目前沒有受到監管,其合法性令人擔憂。

優缺點

| 優點 | 缺點 |

| 提供多樣化產品 | 無監管 |

| 帳戶功能資訊有限 | |

| 費用結構不清晰 | |

| 存款和提款資訊有限 |

TradeSmart 是否合法?

編號 TradeSmart 未受監管,交易者在交易時必須小心。

TraderSmart 可以交易什麼?

| 交易工具 | 支援 |

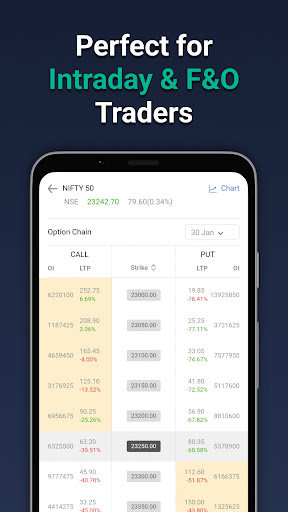

| 股票 | ✔ |

| 期貨 | ✔ |

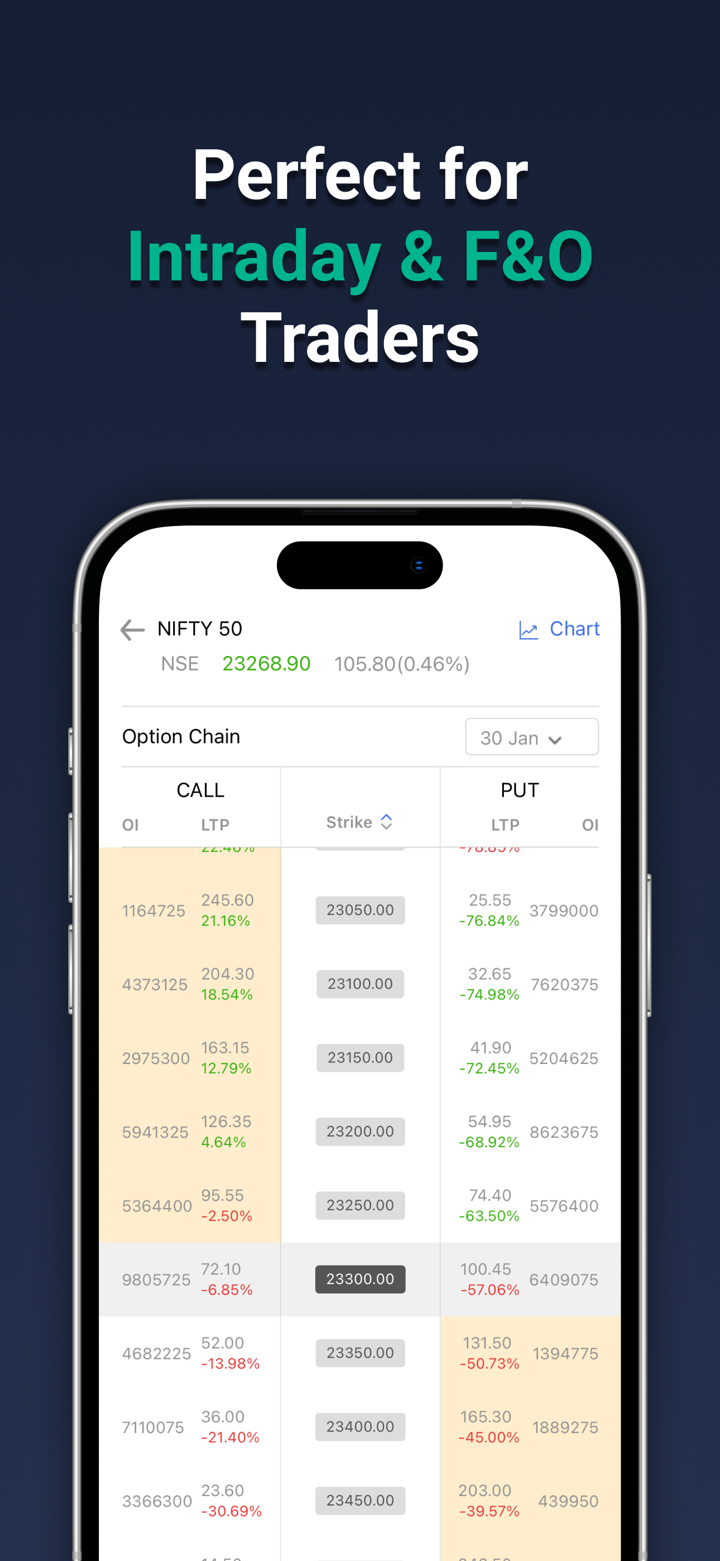

| 期權 | ✔ |

| 貨幣 | ✔ |

| 大宗商品 | ✔ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 交易基金 | ❌ |

產品

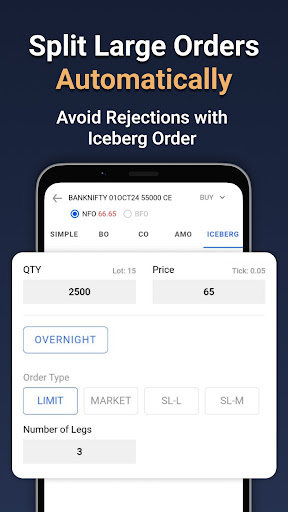

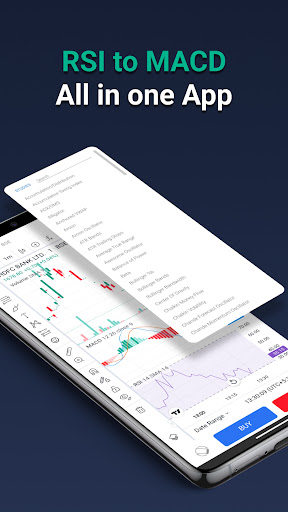

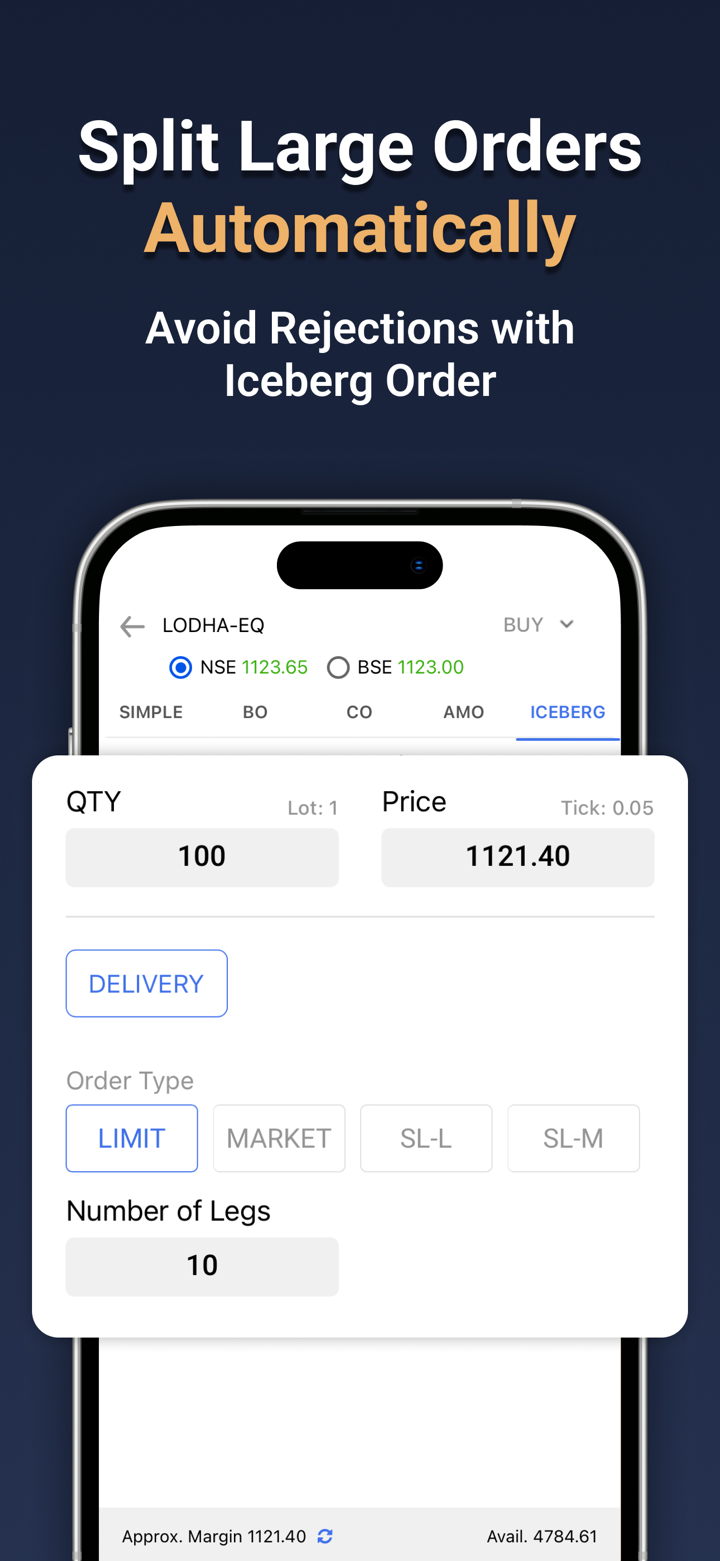

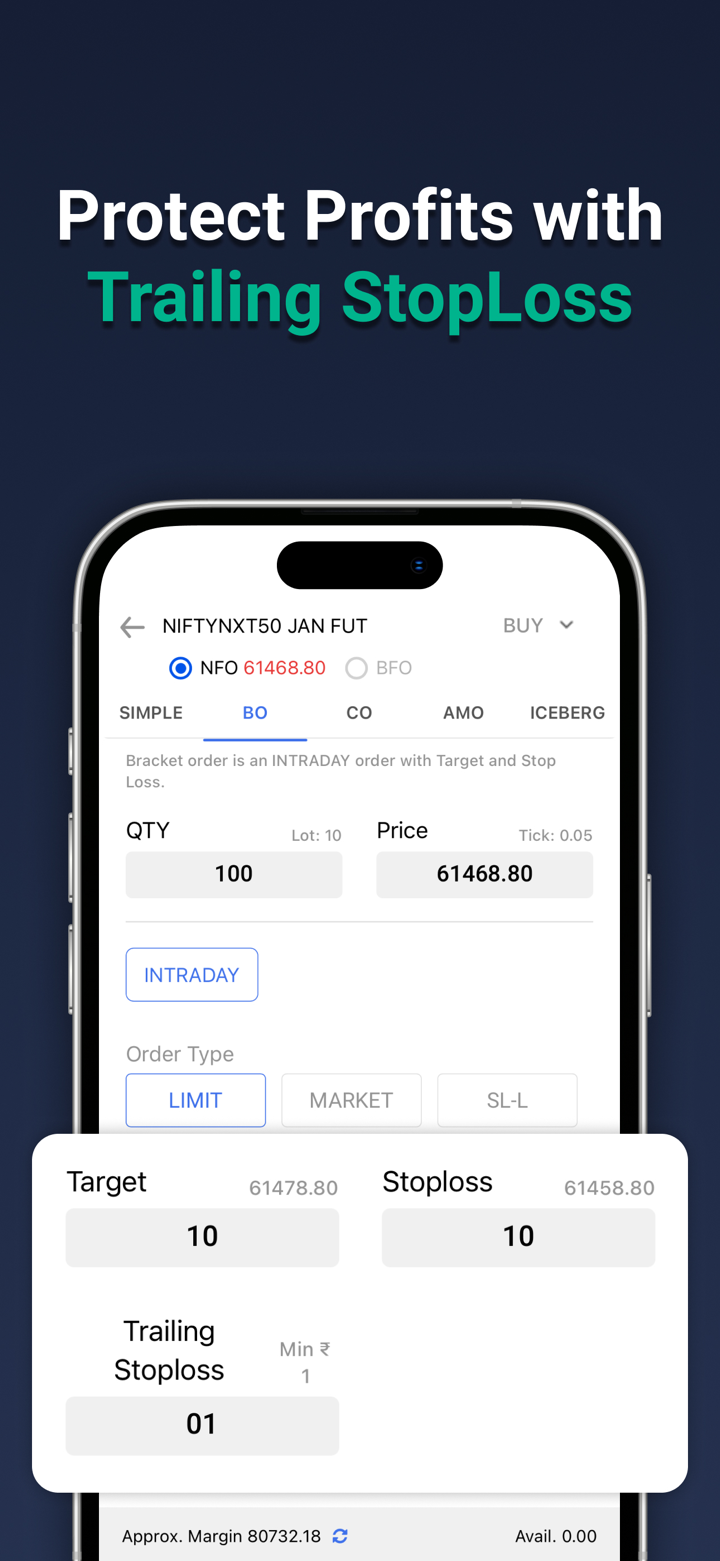

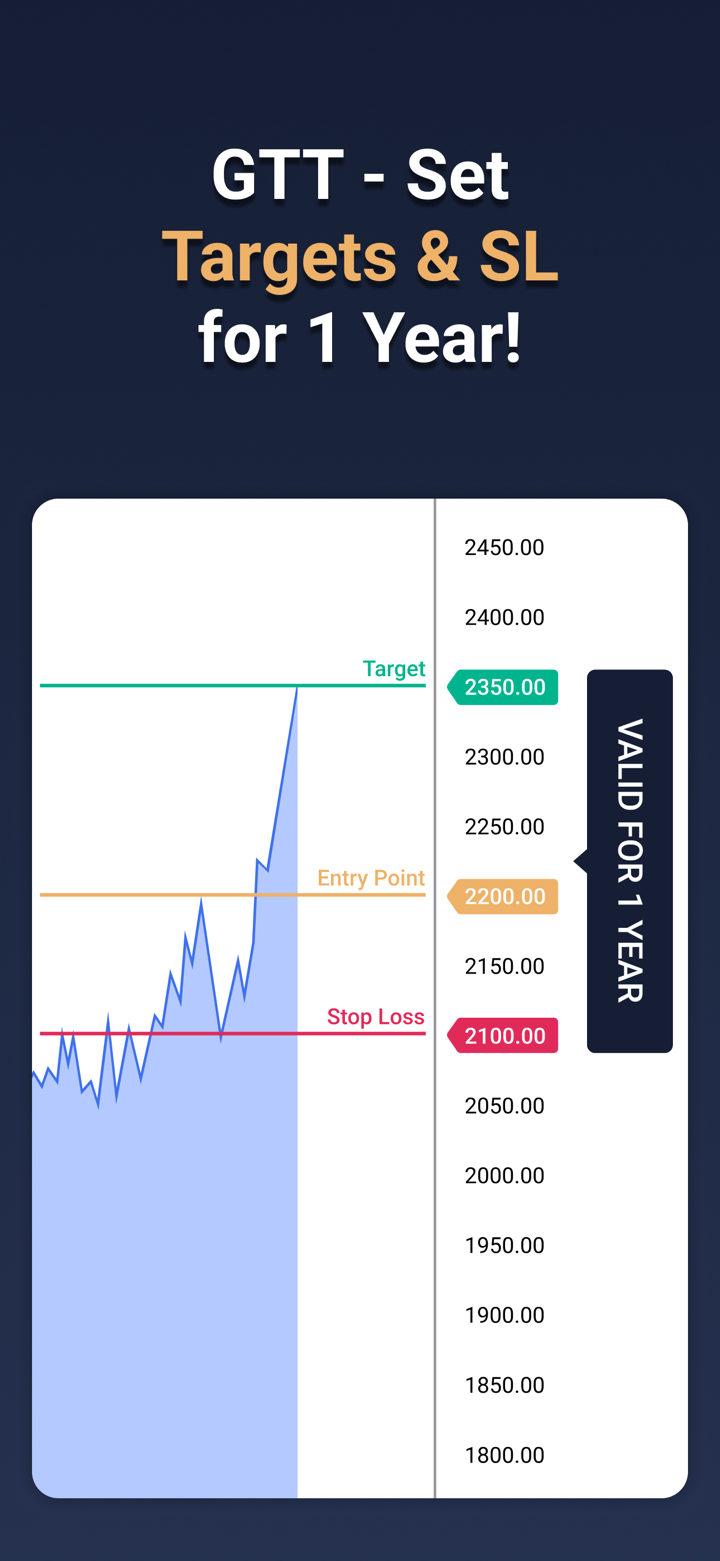

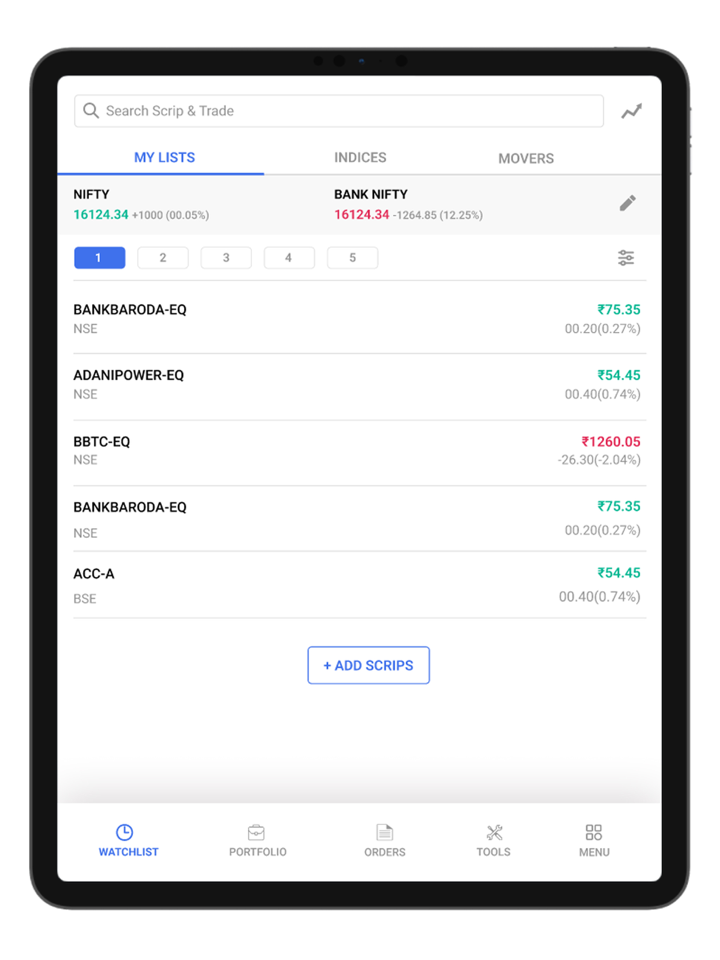

TraderSmart 的產品包括各種交易工具:TradeSmart 手機應用程式、TradeSmart 桌面版、TradeSmart 網頁版、TradeSmart API、BOX、TradeSmart MF、Instaoption 和整合。

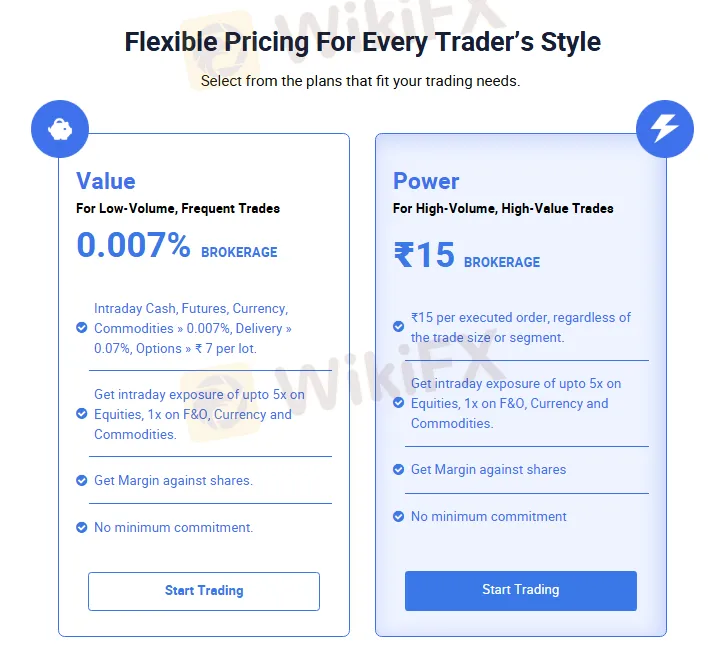

帳戶類型與費用

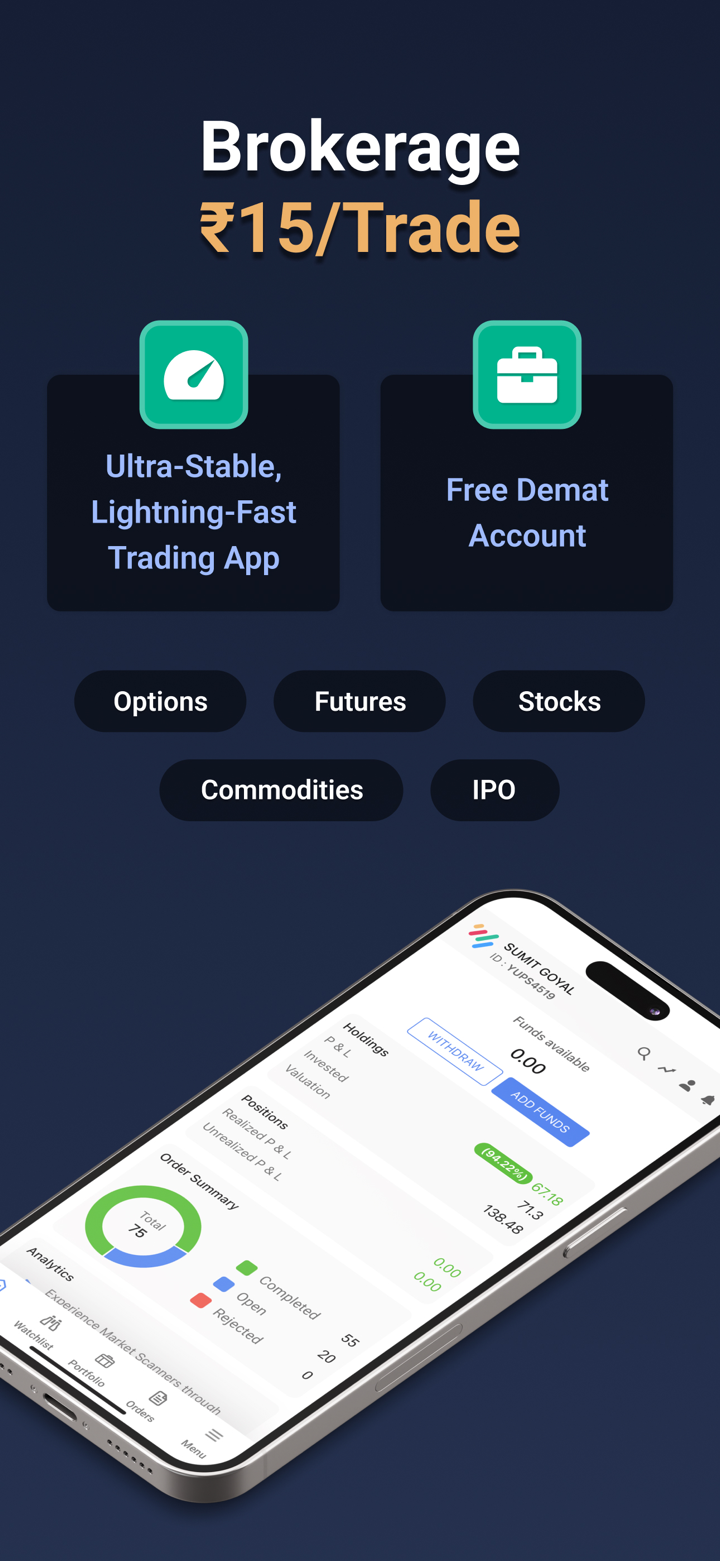

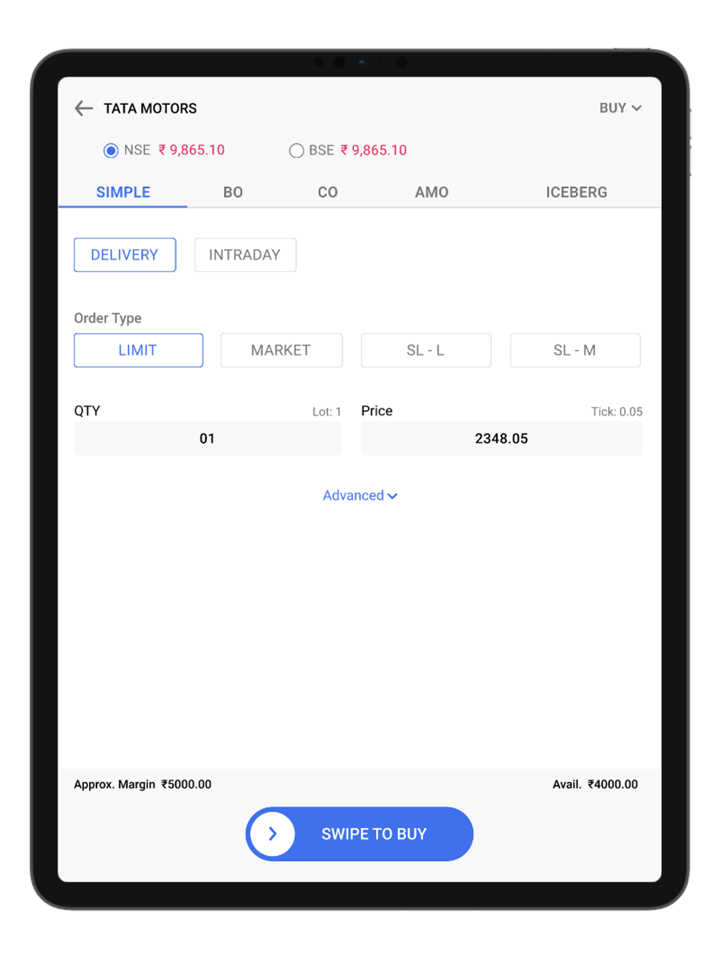

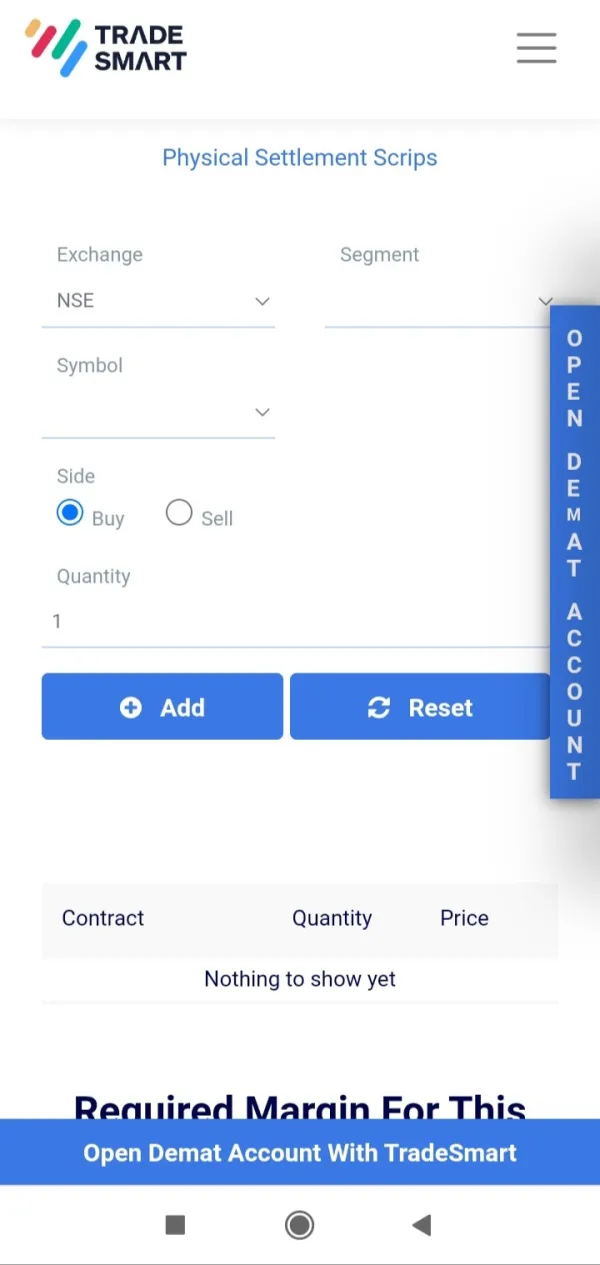

TradeSmart 為交易者提供 Demat 帳戶 進行交易。有兩種不同的方案可供選擇:Value 和 Power。

Demat 帳戶的主要作用是將證券的存儲、管理和交易數位化,為投資者提供高效、安全和透明的投資體驗。

以下是兩種帳戶方案的資訊:

| Value 帳戶 | Power 帳戶 | |

| 目標交易者 | 低交易量、高頻率交易者 | 高交易量、高價值交易者 |

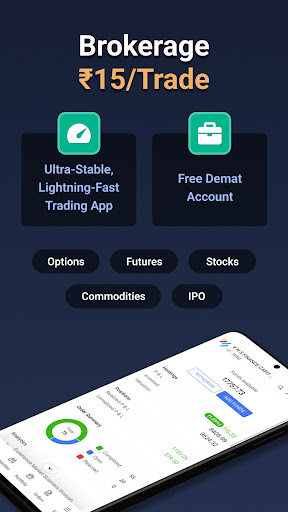

| 佣金費用 | 0.007% | ₹15 每筆訂單(不論交易大小或類型) |

| 當日現金、期貨、貨幣 | 適合低交易量、高頻率交易 | 適合高交易量、高價值交易 |

| 大宗商品 > 0.007%、交割 > 0.07%、期權 > ₹7 每手 | 支持低成本大宗商品和期權交易 | 支持高成本大宗商品和期權交易 |

| 槓桿 | 最高 1:5(股票、F&O、貨幣和大宗商品) | 最高 1:5(股票、F&O、貨幣和大宗商品) |

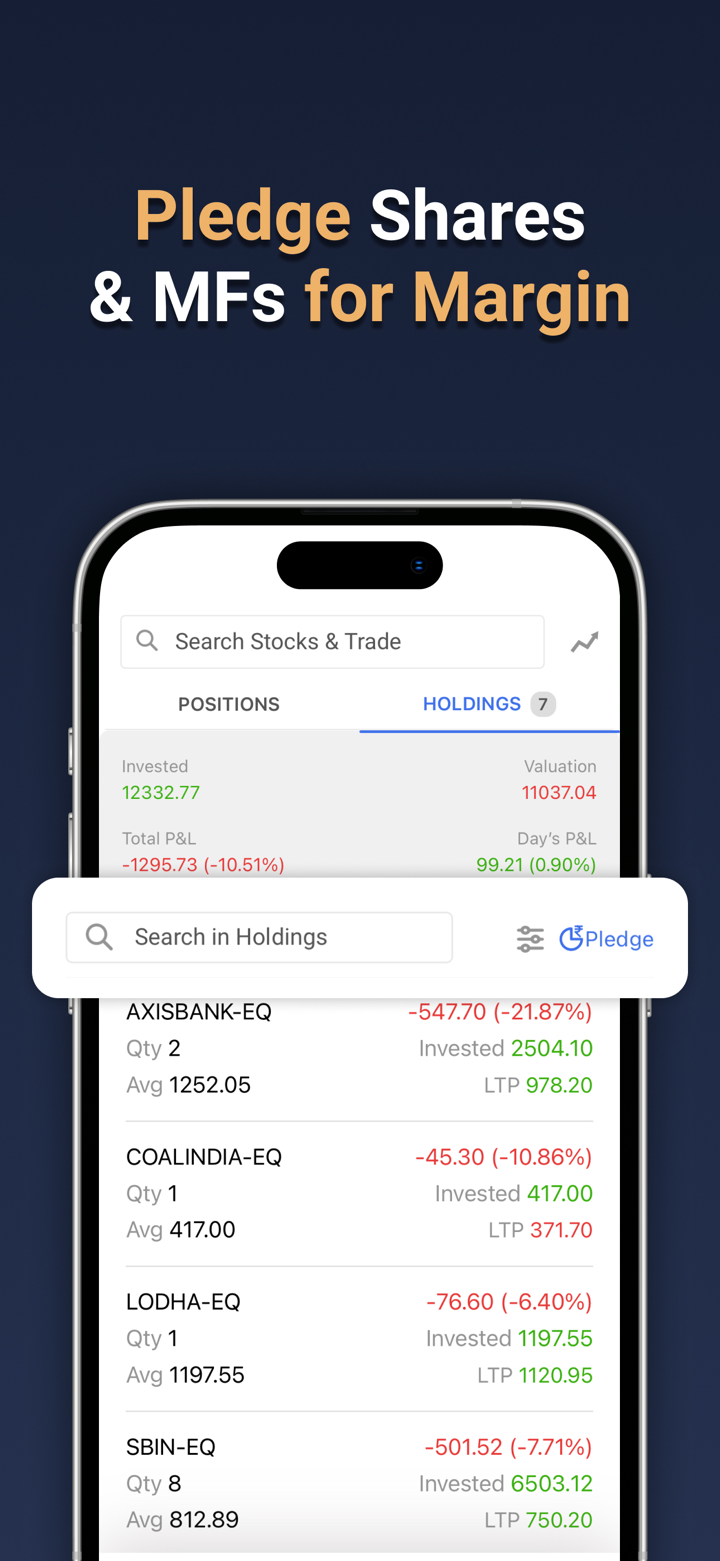

| 股票抵押支援 | 是 | 是 |

| 最低承諾 | 否 | 否 |

槓桿

TradeSmart 在股票、期權、貨幣和大宗商品上擁有 1:5 的槓桿。請注意,高槓桿不僅可以放大利潤,還可能放大損失。

交易平台

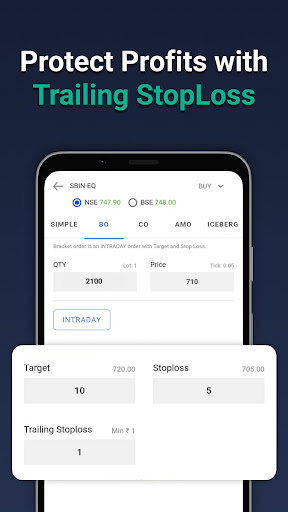

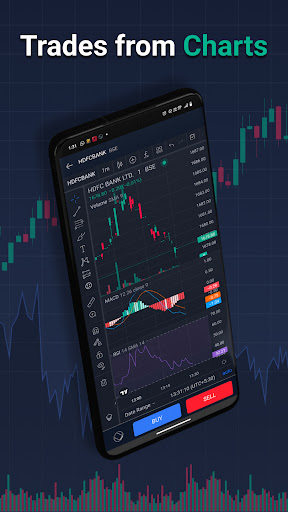

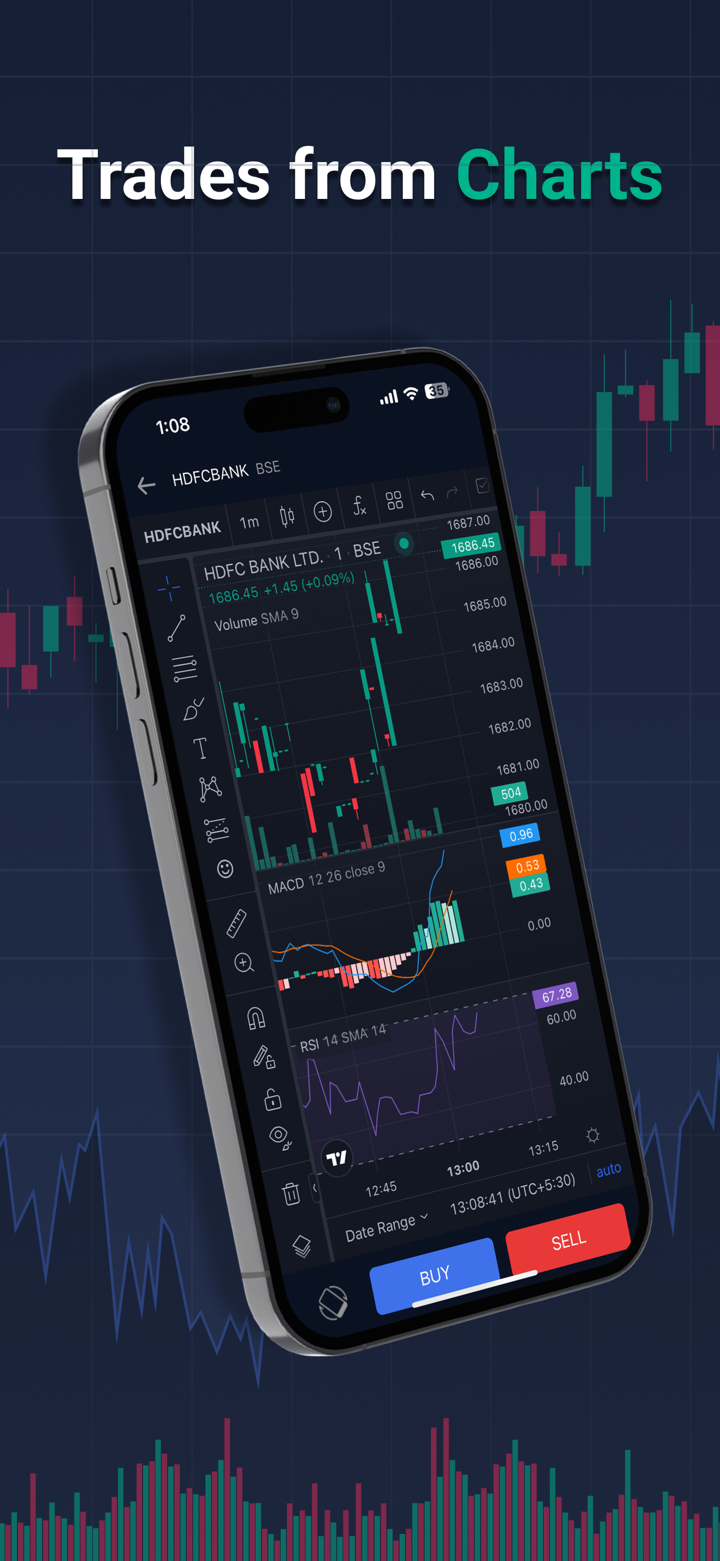

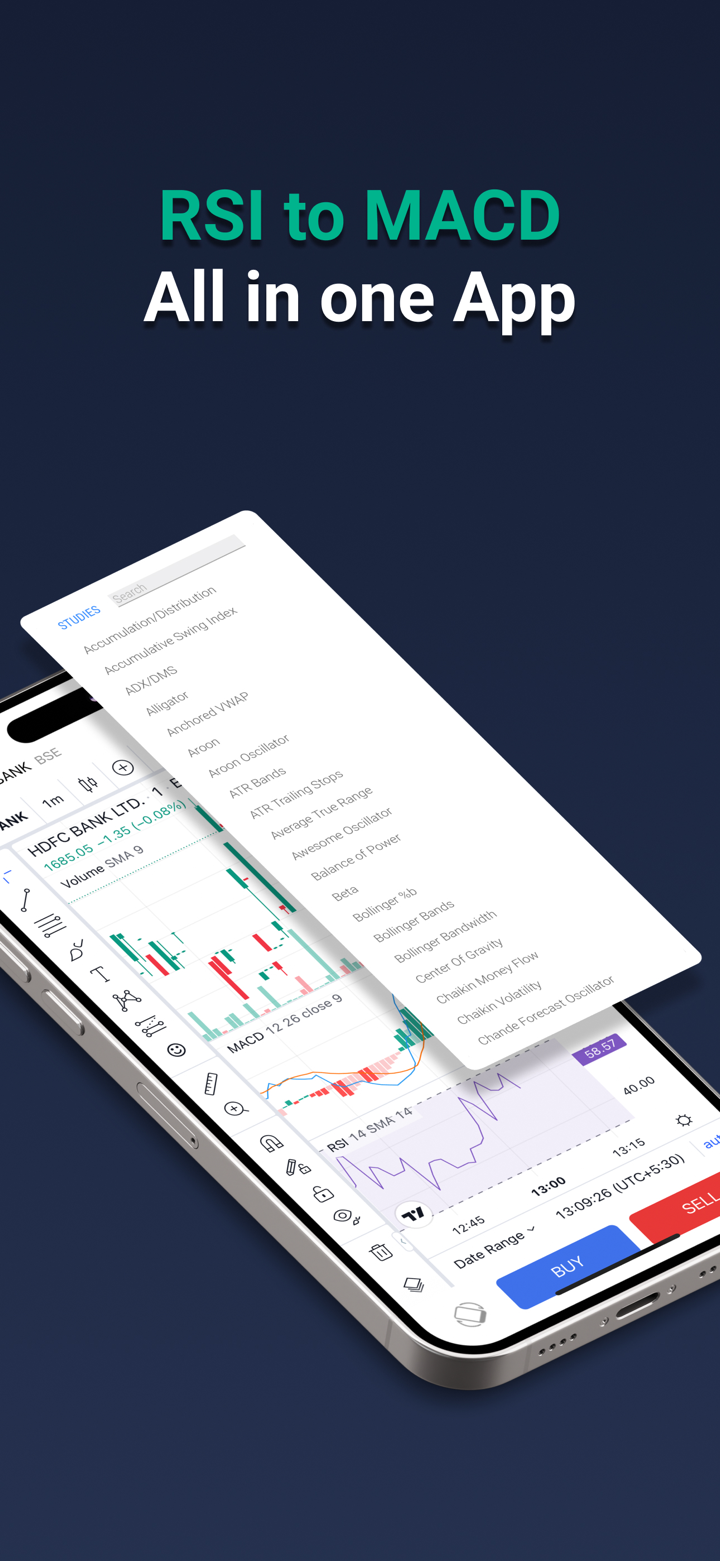

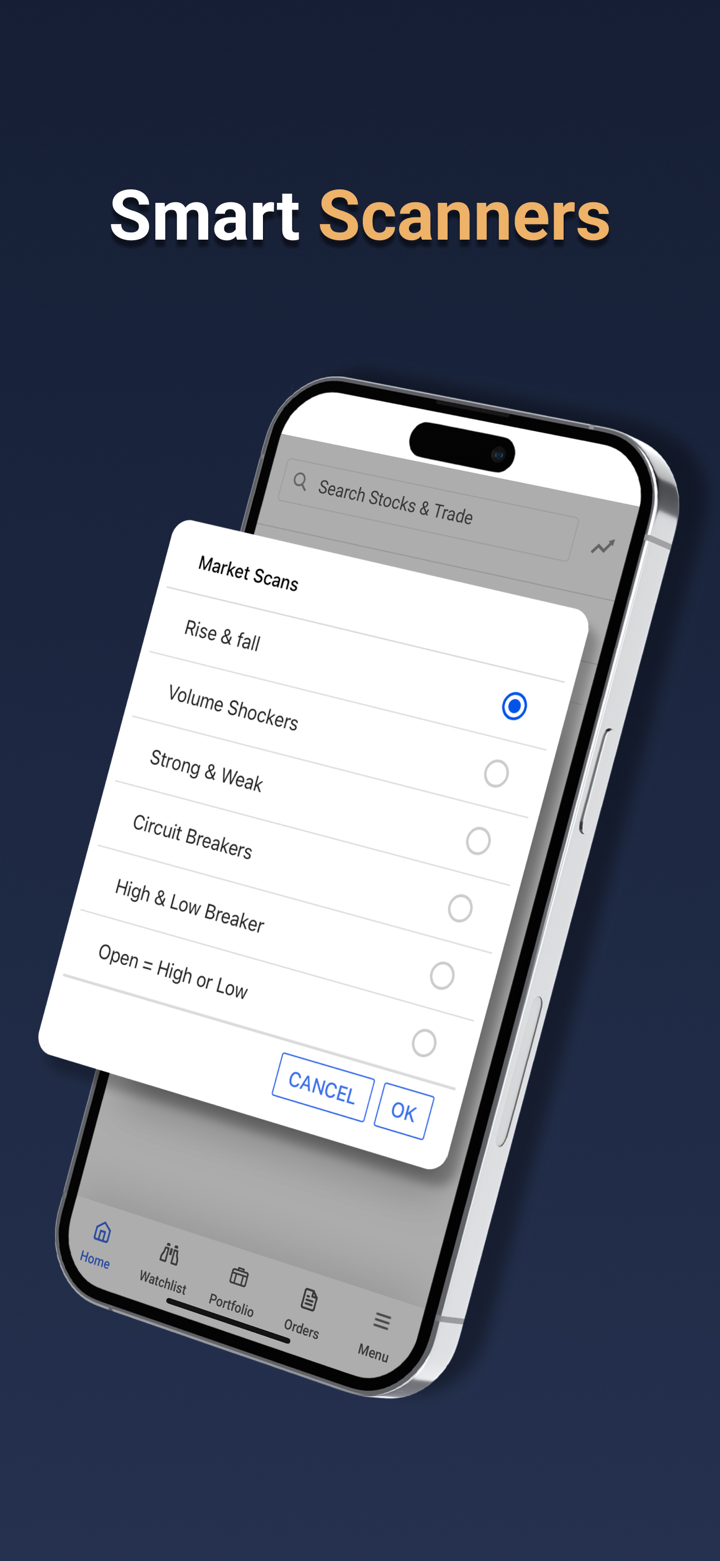

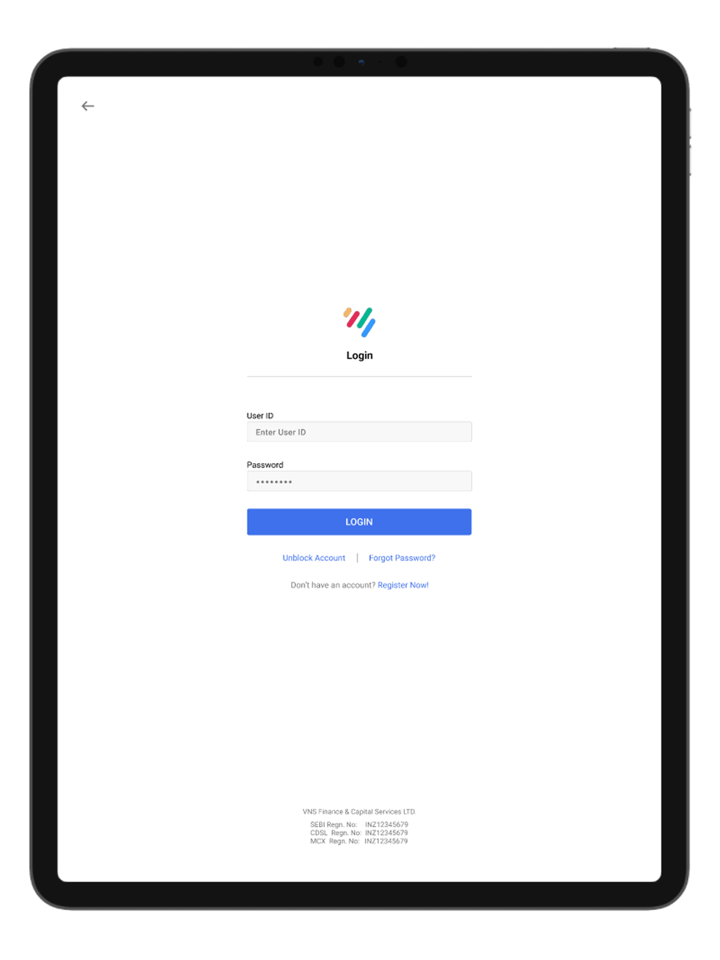

TradeSmart 支持使用專有的 TraderSmart APP 進行交易。在該平台上進行交易只收取每筆 Rs. 15 作為佣金。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| TraderSmart | ✔ | 桌面、手機、網頁 | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

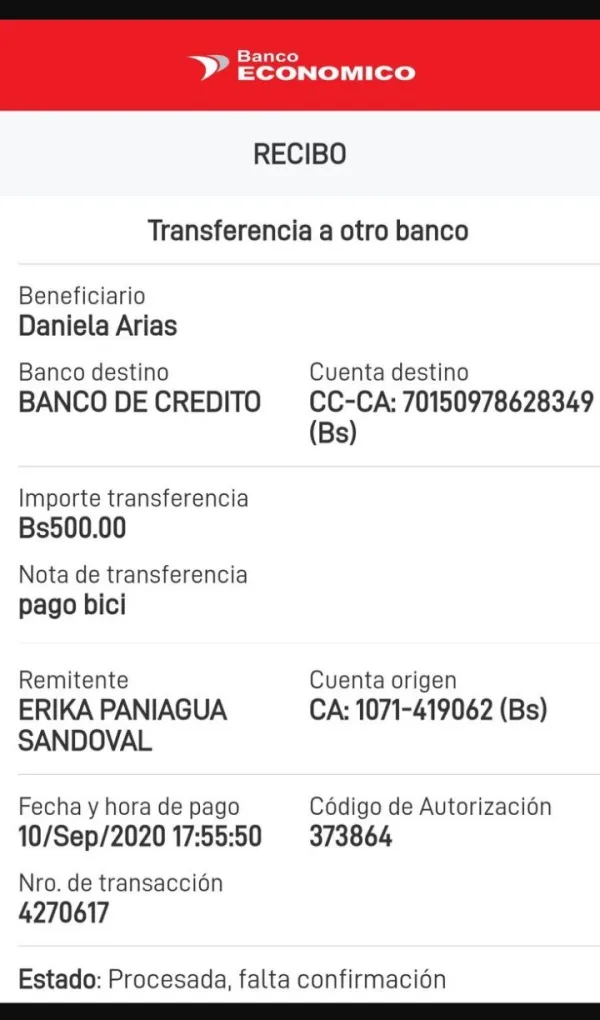

存款和提款

TraderSmart 接受通過 銀行電匯和 NEFT 轉帳 進行付款。

以下列出支援的共有 29 間銀行:

Axis Bank、Bank of Baroda、Bank of India、Bank of Maharashtra、Capital Small Financec Bank、Catholic Syrian Bank、City Union Bank、Deutsche Bank、Dhanlaxmi Bank、Federal Bank、HDFC Bank、IDFC First Bank、ICICI Bank、Indian Bank、Indian Overseas Bank、Indusined Bank、Jammu and Kashmir Bank、Karnataka Bank、Karur Vysya Bank、Kotak Mahindra Bank、Lakshmi Vilas Bank、Punjab National Bank、Saraswat Bank、State Bank of India、Tamilnad Mercantile Bank、Union Bank of India、YES Bank 和 AU Small Finance Bank。