Company Summary

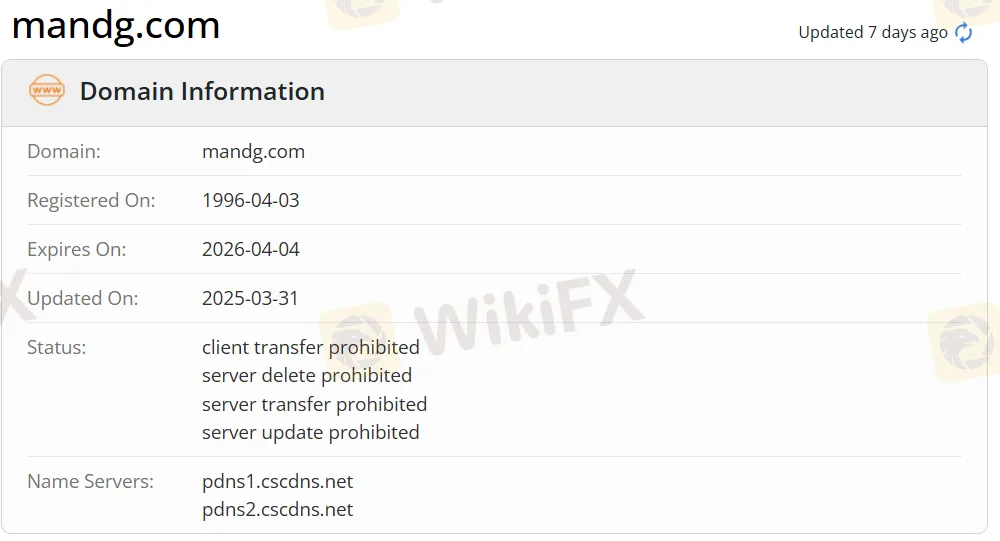

| M&G Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Ireland |

| Regulation | FCA (Exceeded) |

| Services | Asset management, investments and long-term savings |

| Trading Platform | myM&G web |

| Minimum Deposit | £1 |

| Customer Support | Tel: +44 (0)207 626 4588 |

| Email: info@mandg.co.uk | |

| Address: 10 Fenchurch Avenue LondonEC3M 5AG United Kingdom | |

| Instagram, LinkedIn | |

| Regional Restrictions | Markets with AUM less than £50m, and British overseas territories, crown dependencies and European microstates (except Malta) have been excluded |

M&G Information

M&G is a service provider of premier brokerage and financial services, which was founded in Ireland in 1996. It offers products and services for asset management, investments and long-term savings. Besides, markets with AUM less than £50m, and British overseas territories, crown dependencies and European microstates (except Malta) are not allowed. What's more, it should be noted that M&G's FCA license was exceeded, which means potential risks may exist.

Pros and Cons

| Pros | Cons |

| Long operation time | Exceeded FCA license |

| Various contact channels | Regional restrictions |

| Low minimum deposit | Commission fees charged |

| Various payment options |

Is M&G Legit?

M&G is licensed by the Financial Conduct Authority to offer services but the current status is exceeded. Its license number is 119328. The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Financial Conduct Authority (FCA) | Exceeded | M&G Investment Management Limited | Investment Advisory License | 119328 |

M&G Services

| Services | Supported |

| Asset management | ✔ |

| Investments | ✔ |

| Long-term savings | ✔ |

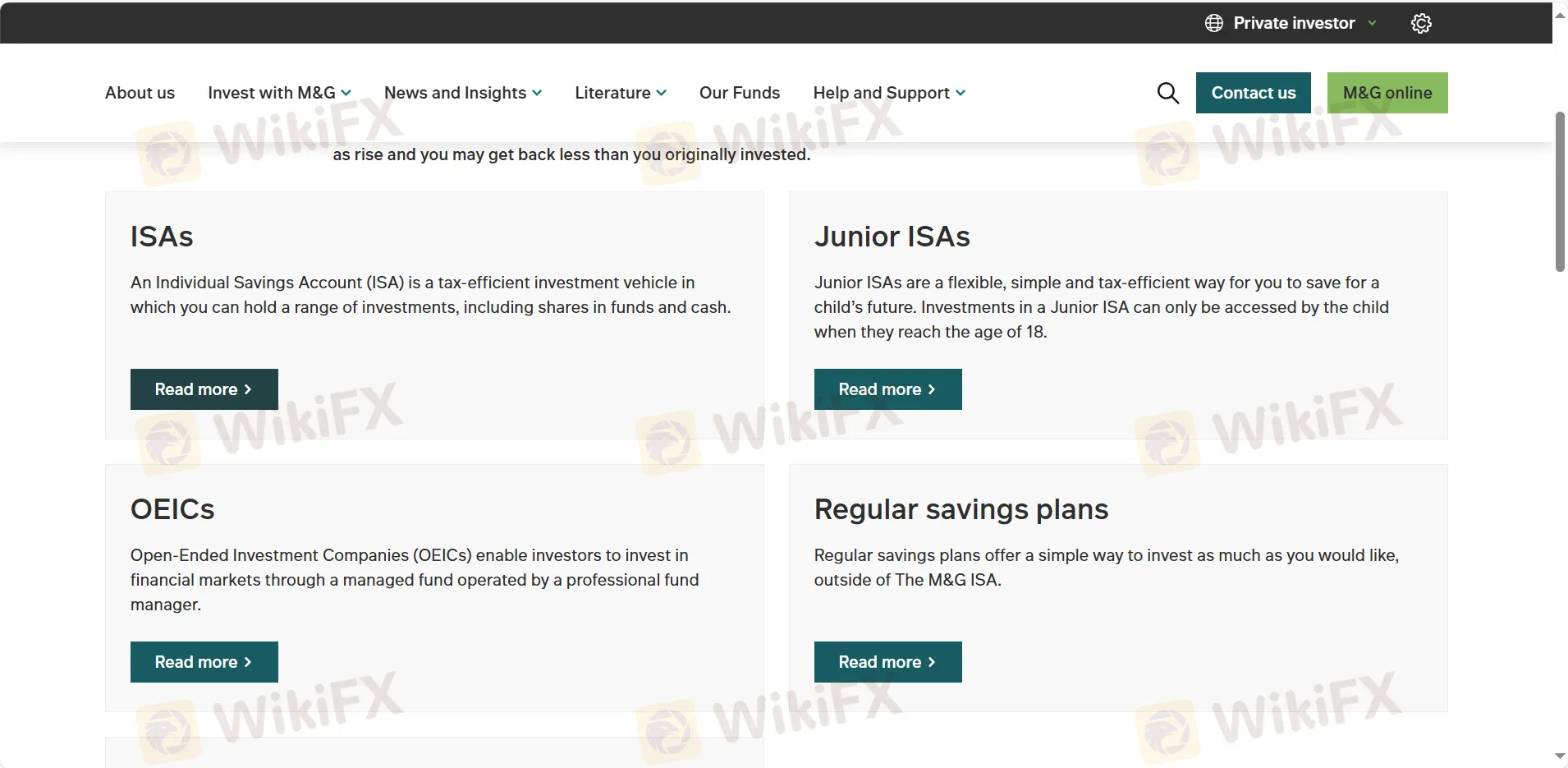

Account Type

| Account Type | Minimum Deposit |

| ISAs | £1 |

| Junior ISAs | £1 |

| OEIC | £1 |

M&G Fees

Fees relate to the value of investment and so will depend on fund performance. Charges are calculated annually and taken daily. Details are not mentioned.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| myM&G web | ✔ | PC, laptop, tablet | / |

Deposit and Withdrawal

The broker accepts payments done via Maestro, MasterCard Debit, Visa Debit & Visa Delta debit cards. The minimum deposit is £1. No minimum withdrawal amount defined and no fees or charges specified.

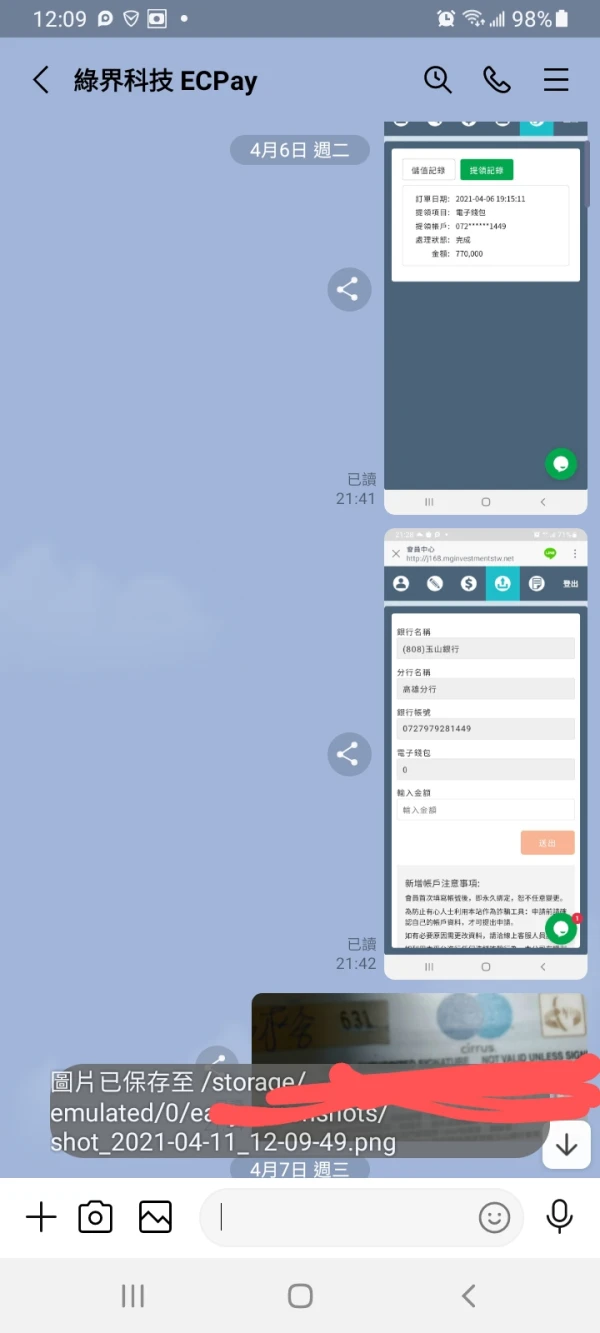

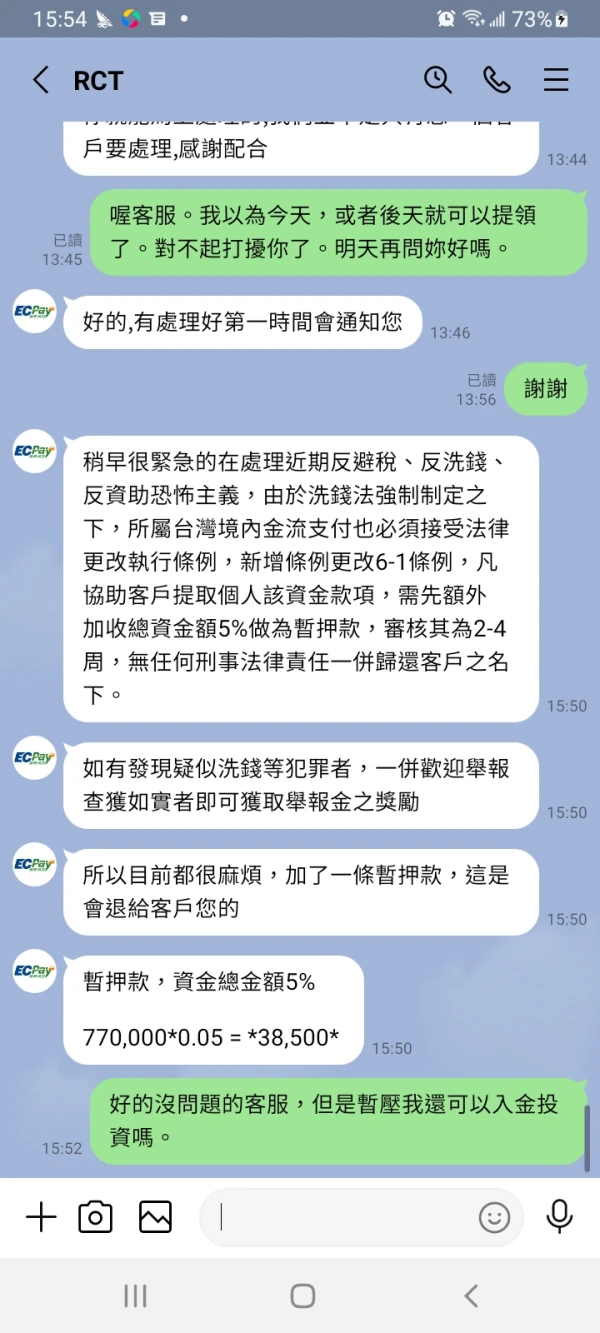

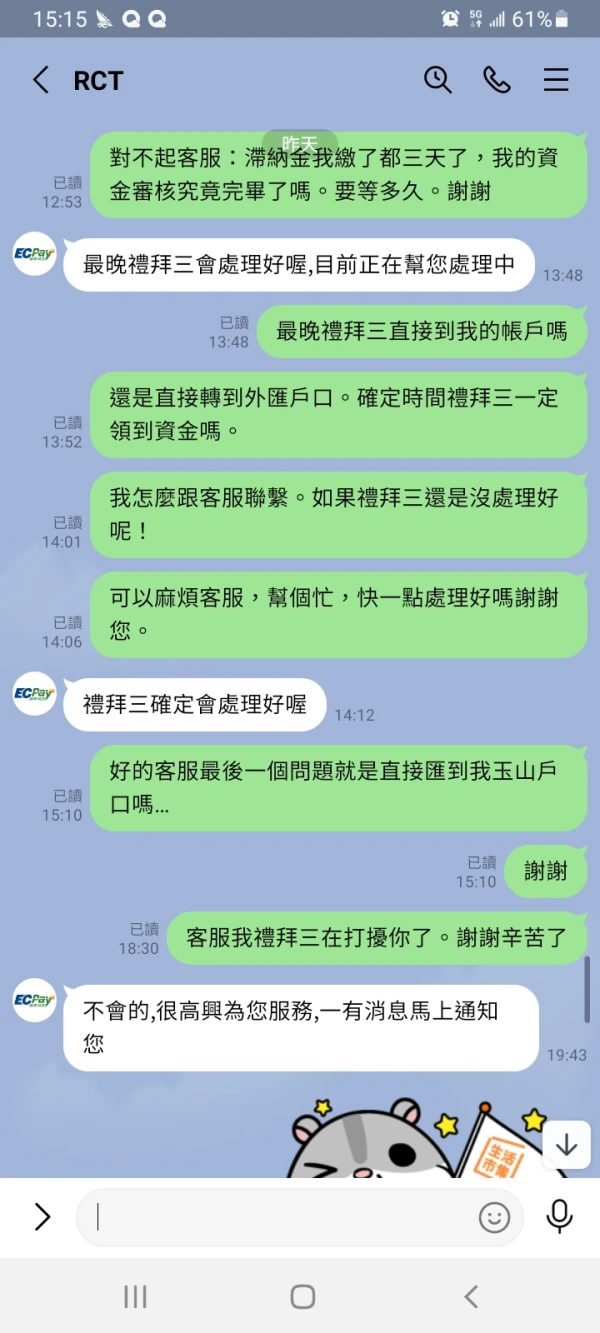

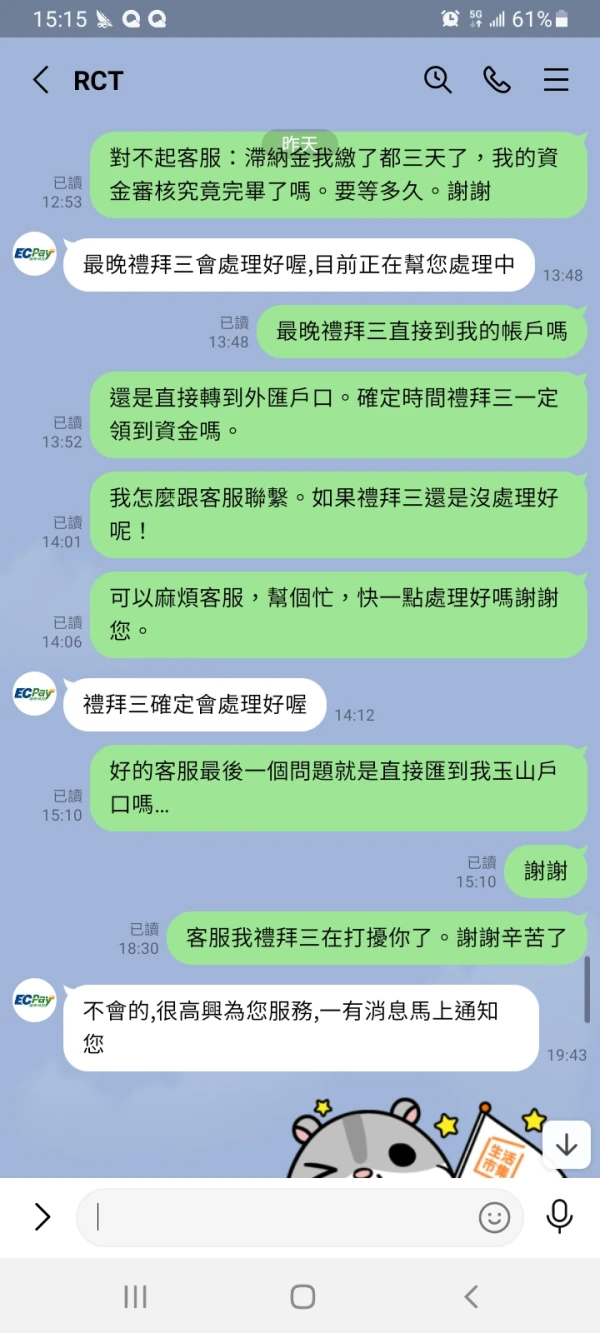

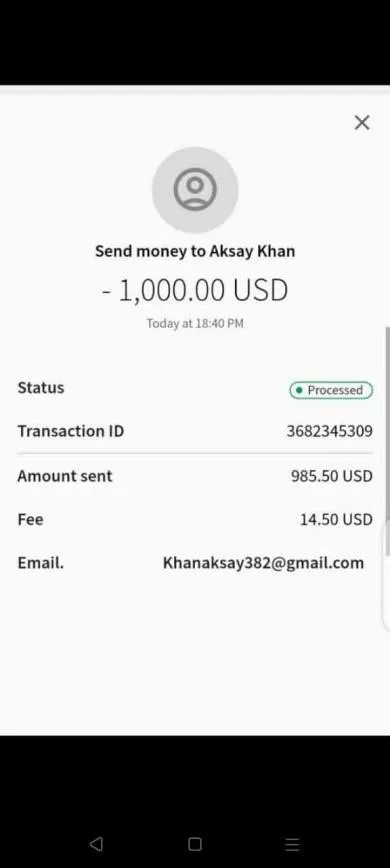

FX7068259962

Taiwan

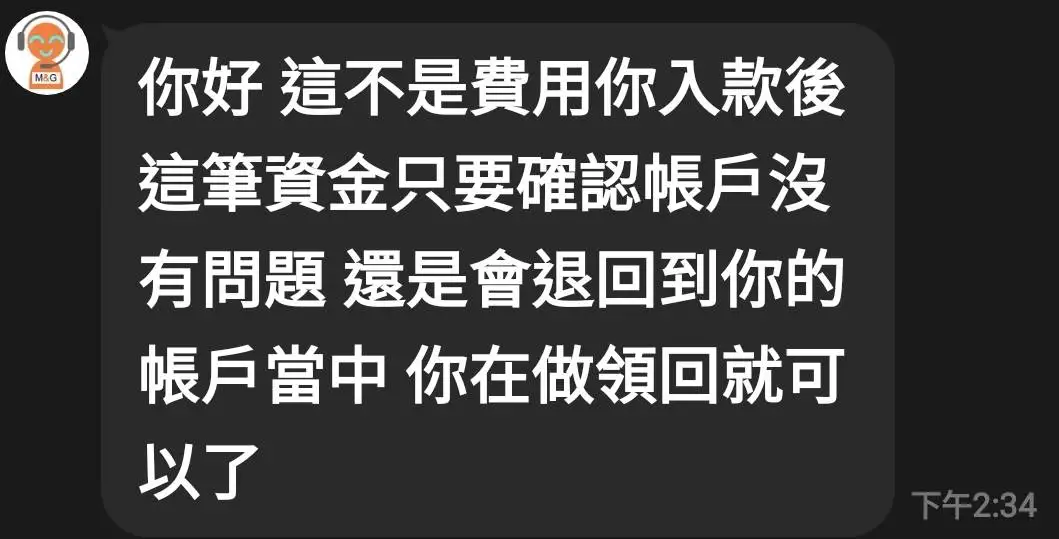

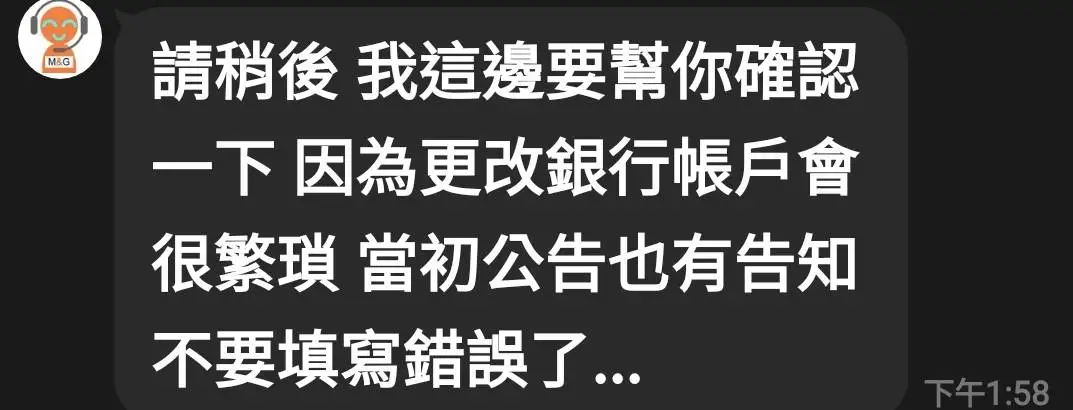

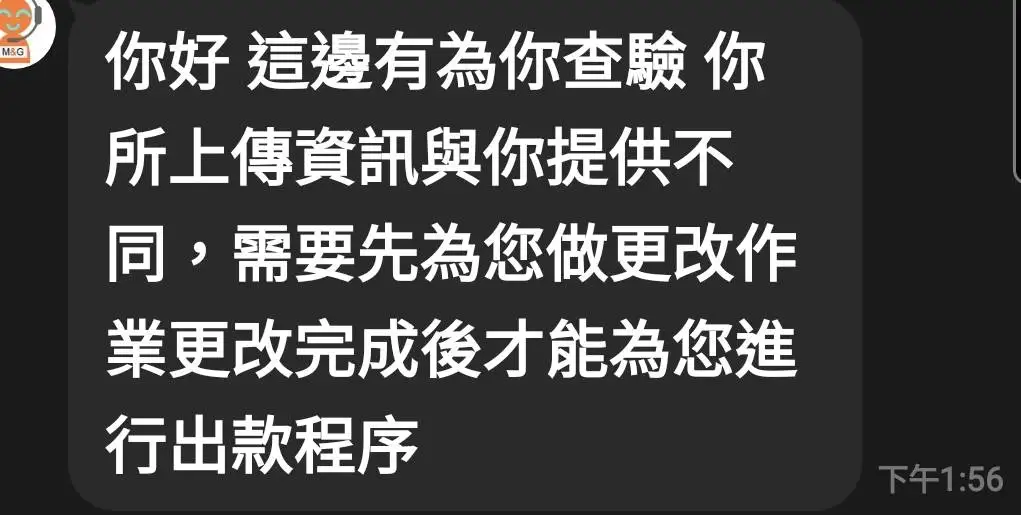

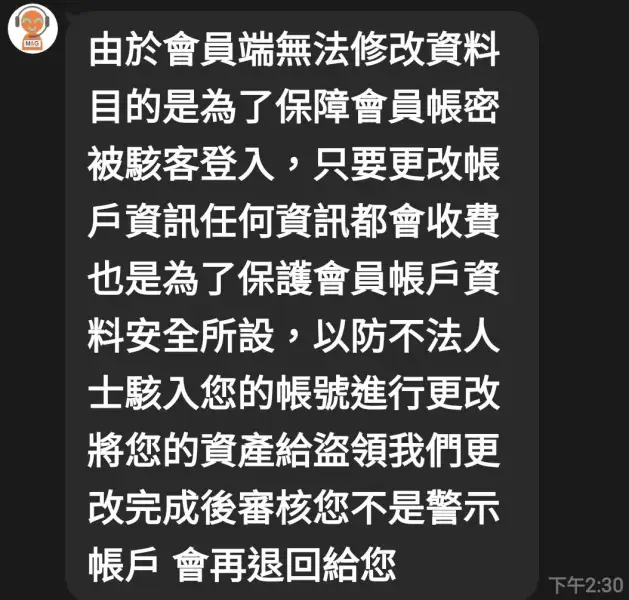

I've paid over 100,000 of all the fees

Exposure

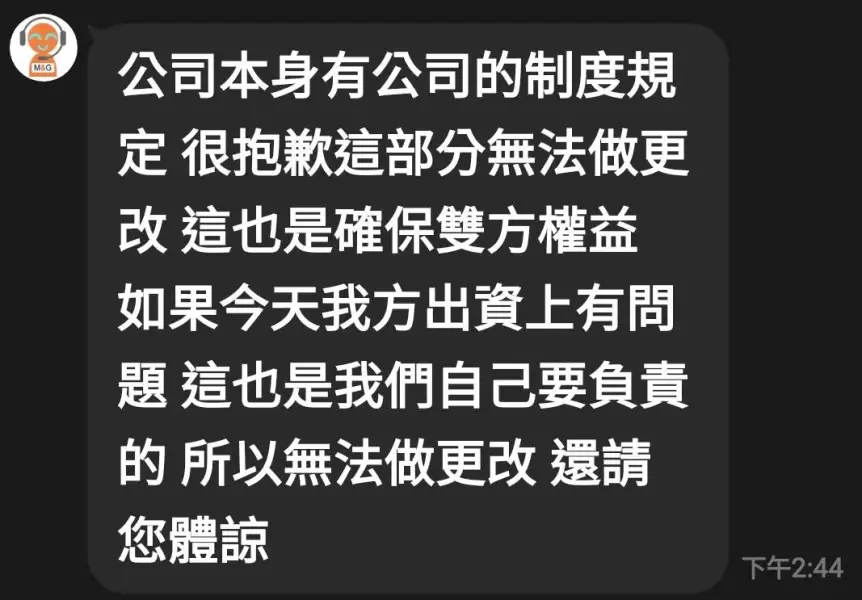

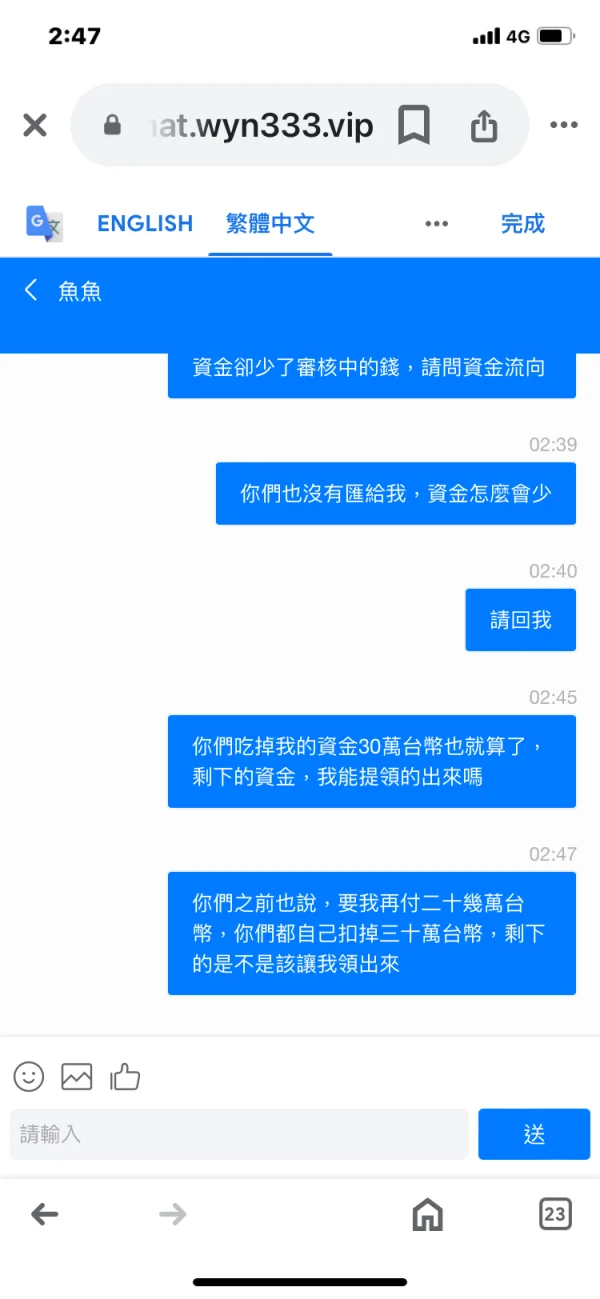

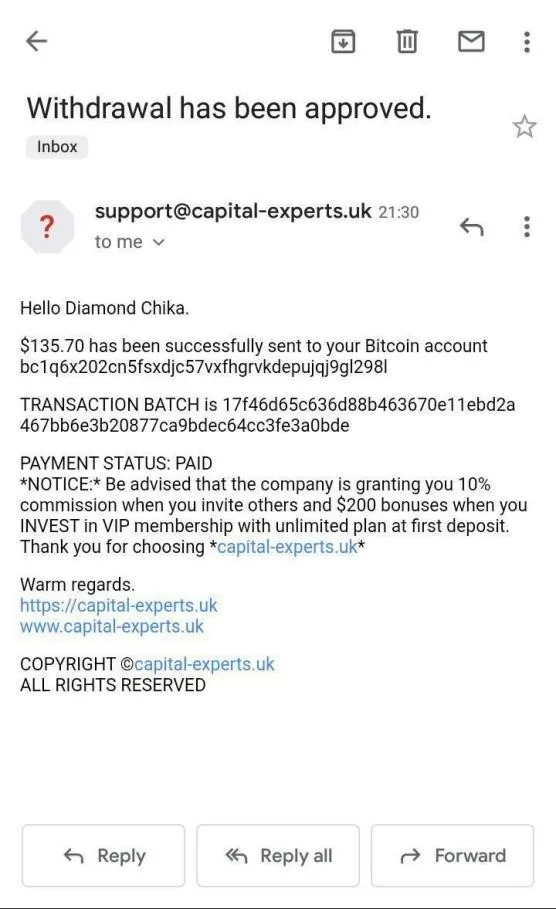

Hsuan天天

Taiwan

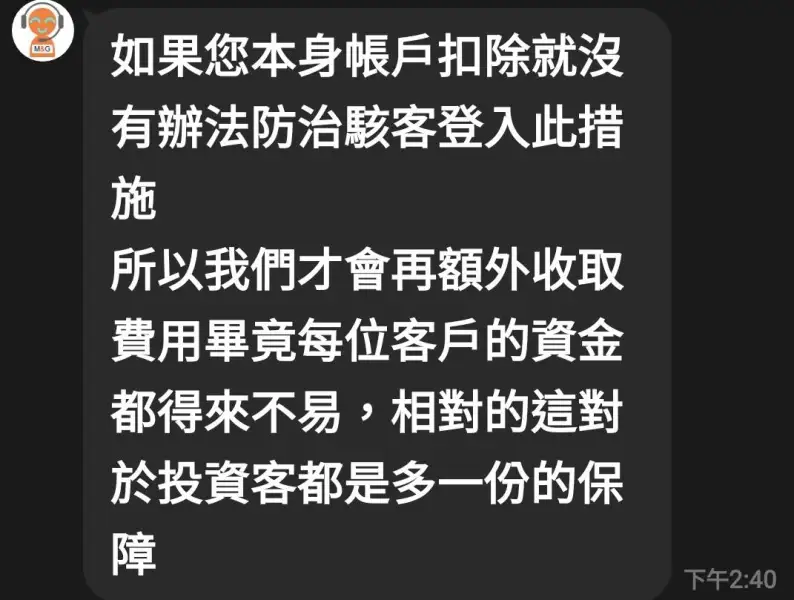

mginvestmentstw.net/ . If you input the true bank account, it will show you that it is wrong. If you wanna change the info, you should pay 30% of your assets. If you see the website, do not invest

Exposure

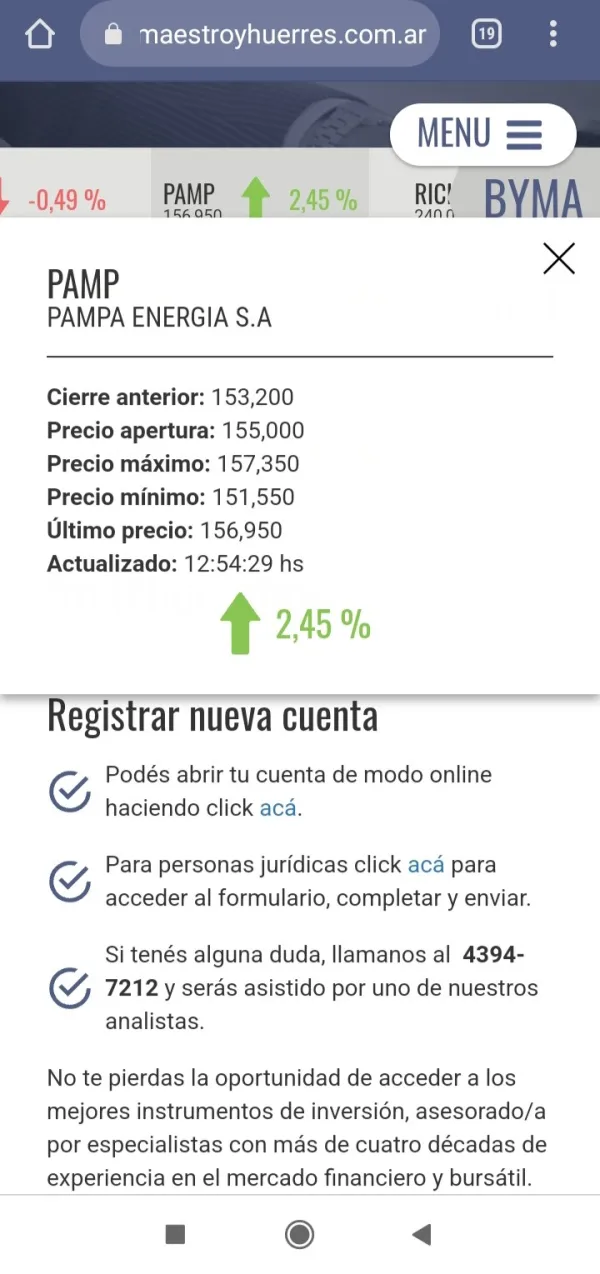

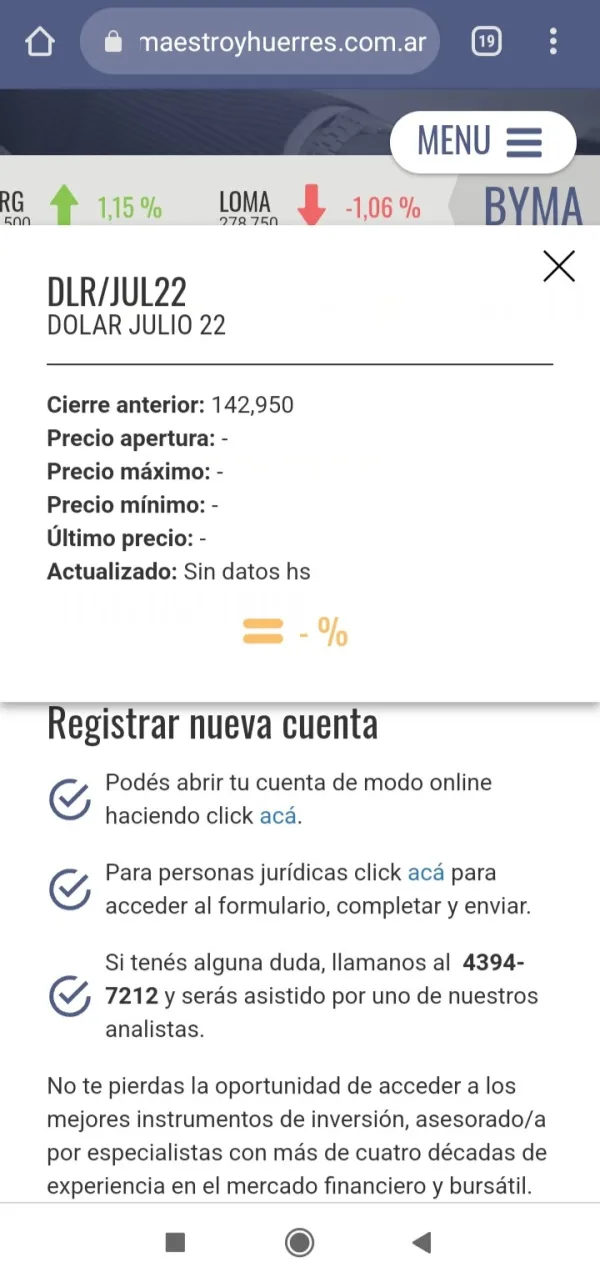

FX4102010959

Argentina

They changed the market information. I deposited 66,215 pesos and lost all the investment.

Exposure

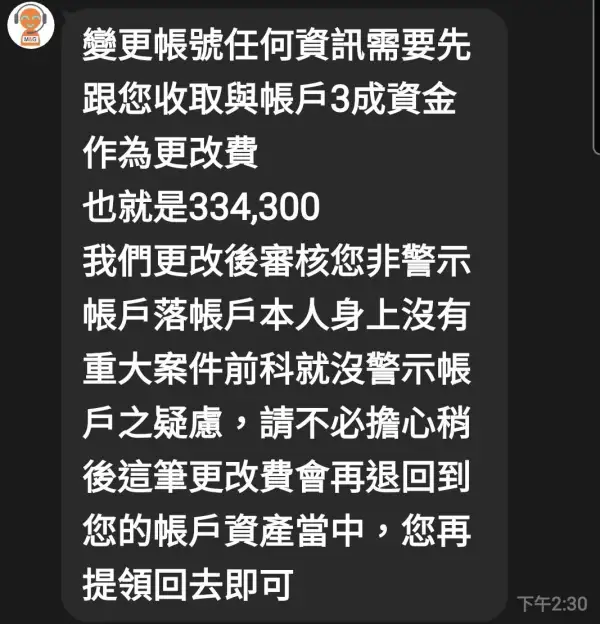

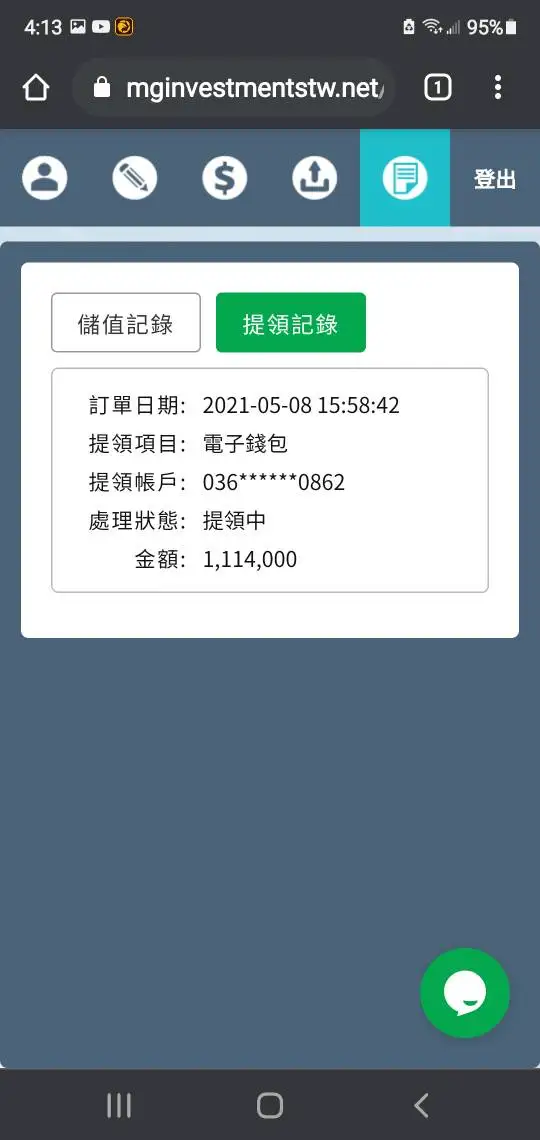

FX3308363627

Taiwan

I downloaded this app when I saw it on the internet that can make money. The customer service also provides online remittance. I remitted the money. When I wanted to withdraw the money, it was still under review. I withdrew three times, each time withdrawing 100,000 New Taiwan Dollars, but I did not receive any. I asked the customer service many times, but they did not respond. When I logged into this platform again, I found that the money I withdrew was gone. Originally, it was over 1.9 million, but now it has become just over 1.5 million. This is clearly a scam to cheat my money.

Exposure

วิทยา ประธานทรง

St. Barthelemy

Hello, Witthaya Prathantrong or M entrepreneur.

Positive

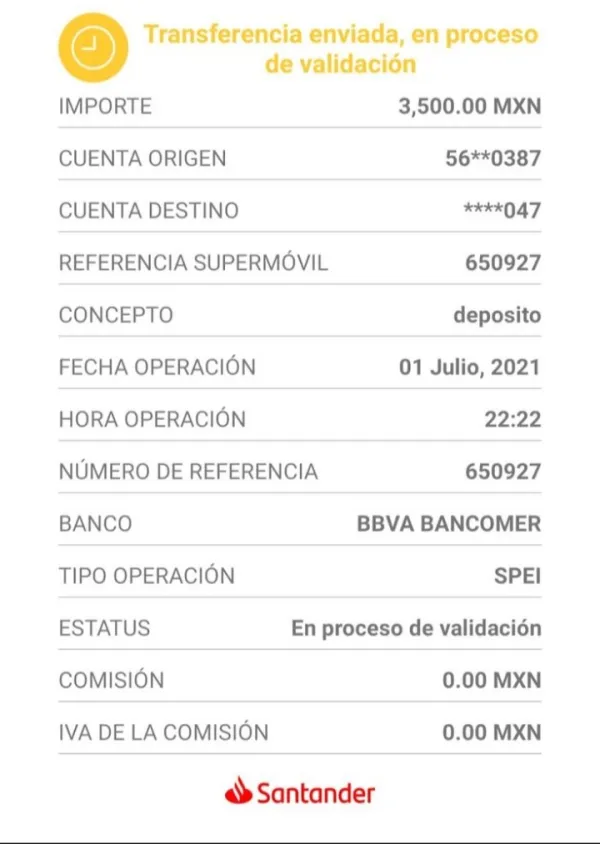

FX1828697794

Mexico

I deposited $3500 and withdrew $2300. My board showed a picture and they said something went wrong. The money did not belong to me. It was the worst truth.

Exposure

FX2046354843

Philippines

Avoid their M&V Investments. Took out a £5000 loan as I was daft enough to believe their promised ROI. I can't even remember the Advertised ROI, but it was somewhere in the range of 5-7% per month. ( Which is of course good.) For the first two weeks it was very positive (I have been with them since August 2021) then it all went down hill from there. If you formulated a graph of my account balance it would look like a decending set of stairs. I am now setting around the £2900 mark (out of £5000) with a floating profit in the open trades of -£600. So to withdraw the remaining balance I would have to close all the open trades and loose that £600 as well. They do however have a helpful and generally responsive customer support. They also seem to be genuinely trying hard.

Exposure