公司简介

| M&G 评论摘要 | |

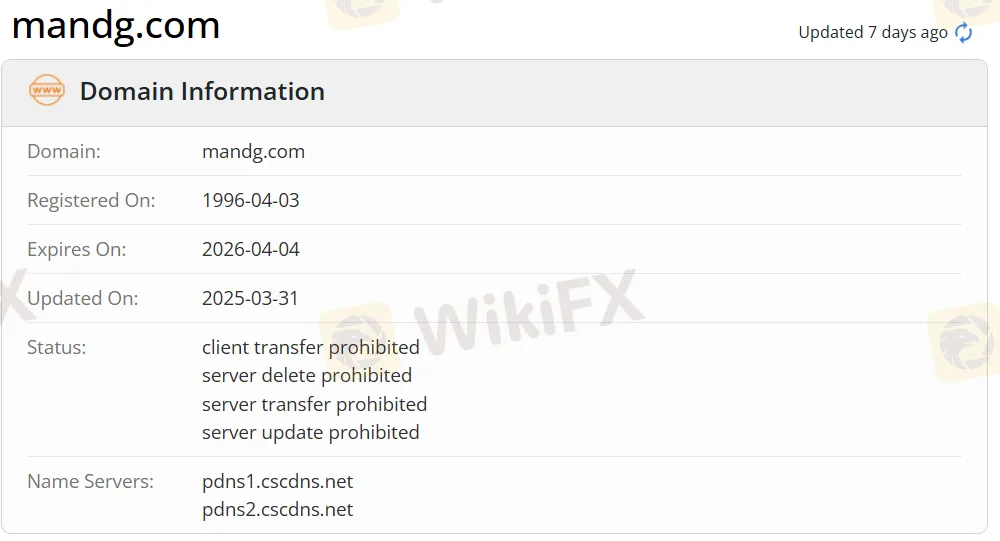

| 成立时间 | 1996 |

| 注册国家/地区 | 爱尔兰 |

| 监管 | FCA(已超出) |

| 服务 | 资产管理、投资和长期储蓄 |

| 交易平台 | myM&G web |

| 最低存款 | £1 |

| 客户支持 | 电话:+44 (0)207 626 4588 |

| 邮箱:info@mandg.co.uk | |

| 地址:10 Fenchurch Avenue LondonEC3M 5AG 英国 | |

| Instagram、LinkedIn | |

| 区域限制 | 资产管理规模低于£50m的市场,以及英国海外领土、王室属地和欧洲微型国家(马耳他除外)已被排除 |

M&G 信息

M&G 是一家提供高级经纪和金融服务的服务提供商,于1996年在爱尔兰成立。它提供资产管理、投资和长期储蓄产品和服务。此外,资产管理规模低于£50m的市场,以及英国海外领土、王室属地和欧洲微型国家(马耳他除外)均不允许。此外,值得注意的是,M&G 的FCA许可已超出,这意味着可能存在潜在风险。

优缺点

| 优点 | 缺点 |

| 运营时间长 | FCA许可超出 |

| 多种联系渠道 | 区域限制 |

| 最低存款低 | 收取佣金手续费 |

| 多种支付选项 |

M&G 是否合法?

M&G 是由英国金融行为监管局授权提供服务,但当前状态已超出。其许可证号码为119328。英国金融行为监管局(FCA)是英国的金融监管机构,但独立于英国政府运作,并通过向金融服务行业成员收取费用来融资。

| 受监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 英国金融行为监管局(FCA) | 已超出 | M&G 投资管理有限公司 | 投资咨询许可证 | 119328 |

M&G 服务

| 服务 | 支持 |

| 资产管理 | ✔ |

| 投资 | ✔ |

| 长期储蓄 | ✔ |

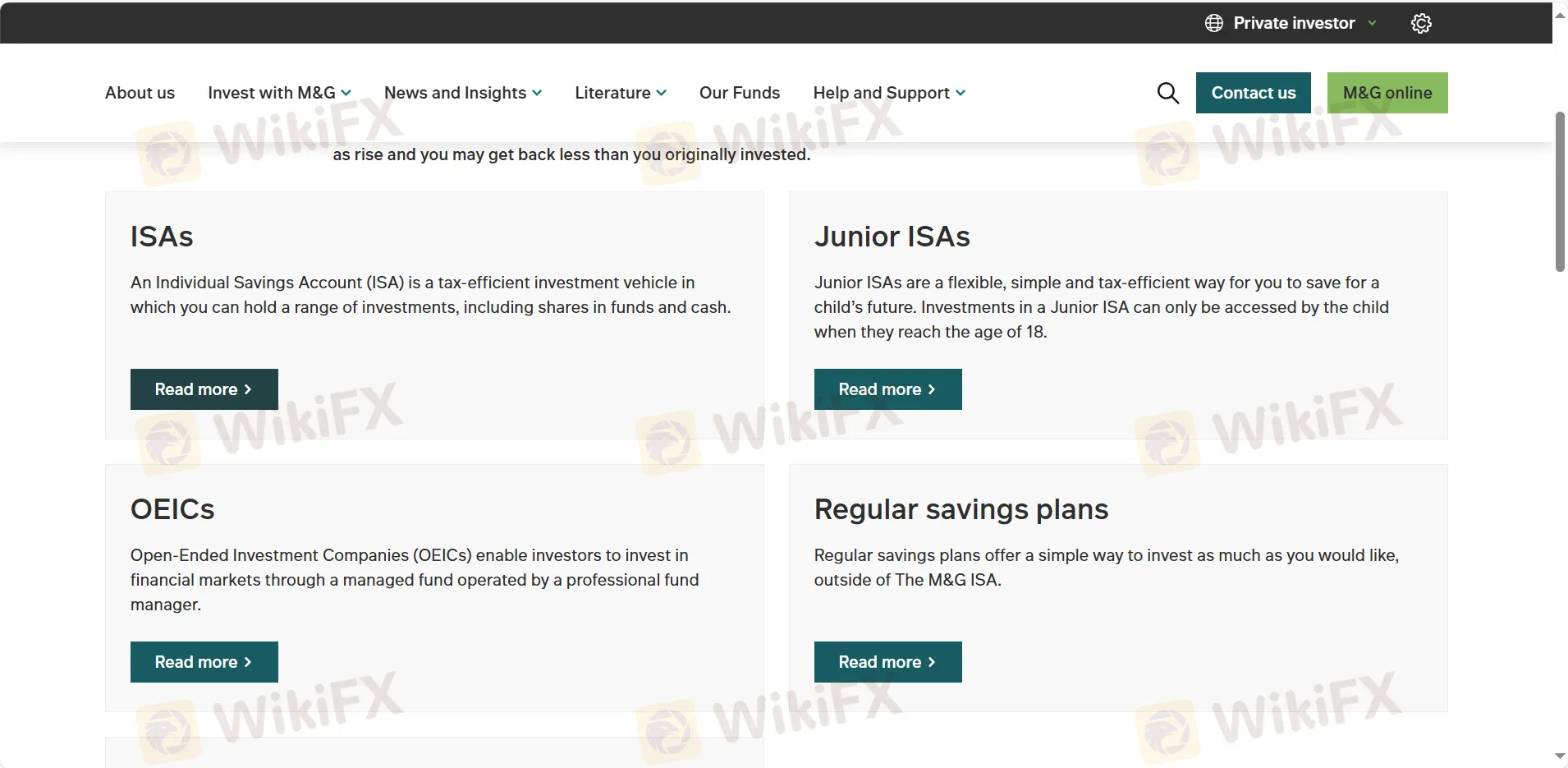

账户类型

| 账户类型 | 最低存款 |

| ISA | £1 |

| Junior ISA | £1 |

| OEIC | £1 |

M&G 费用

费用与投资价值有关,因此将取决于基金表现。费用按年计算,每日扣除。未提及详细信息。

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| myM&G web | ✔ | PC、笔记本电脑、平板电脑 | / |

存款和取款

该经纪商接受通过Maestro、MasterCard借记卡、Visa借记卡和Visa Delta借记卡进行的付款。最低存款金额为£1。未定义最低取款金额,也未指定任何手续费或费用。

FX7068259962

台湾

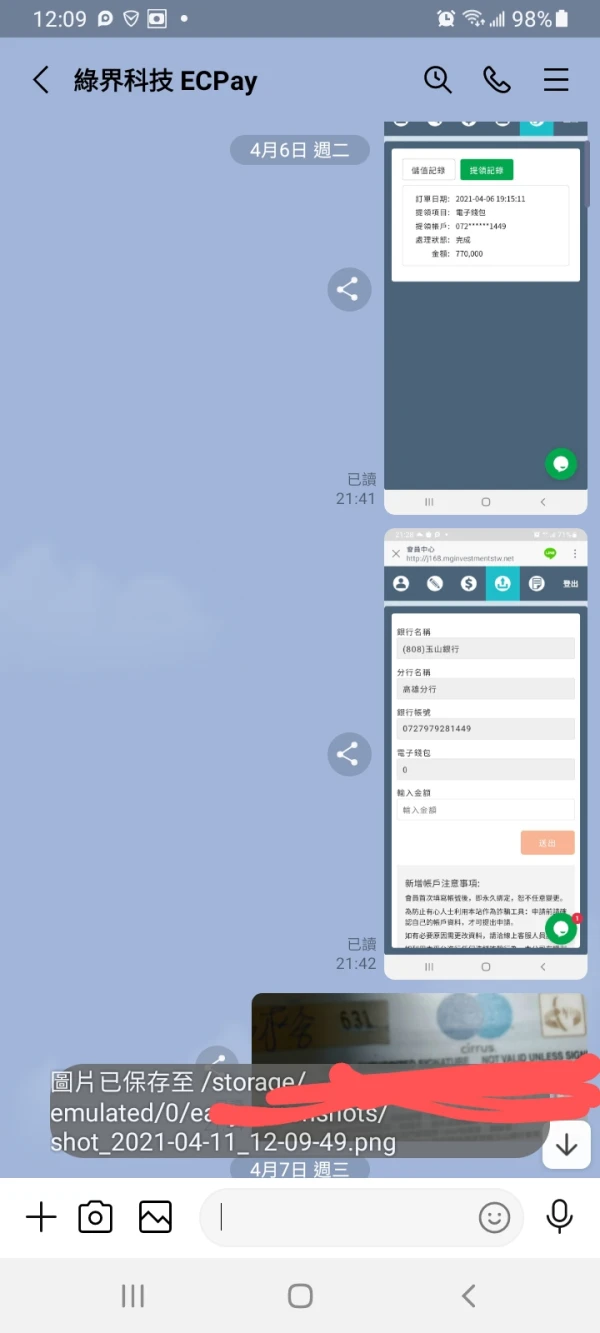

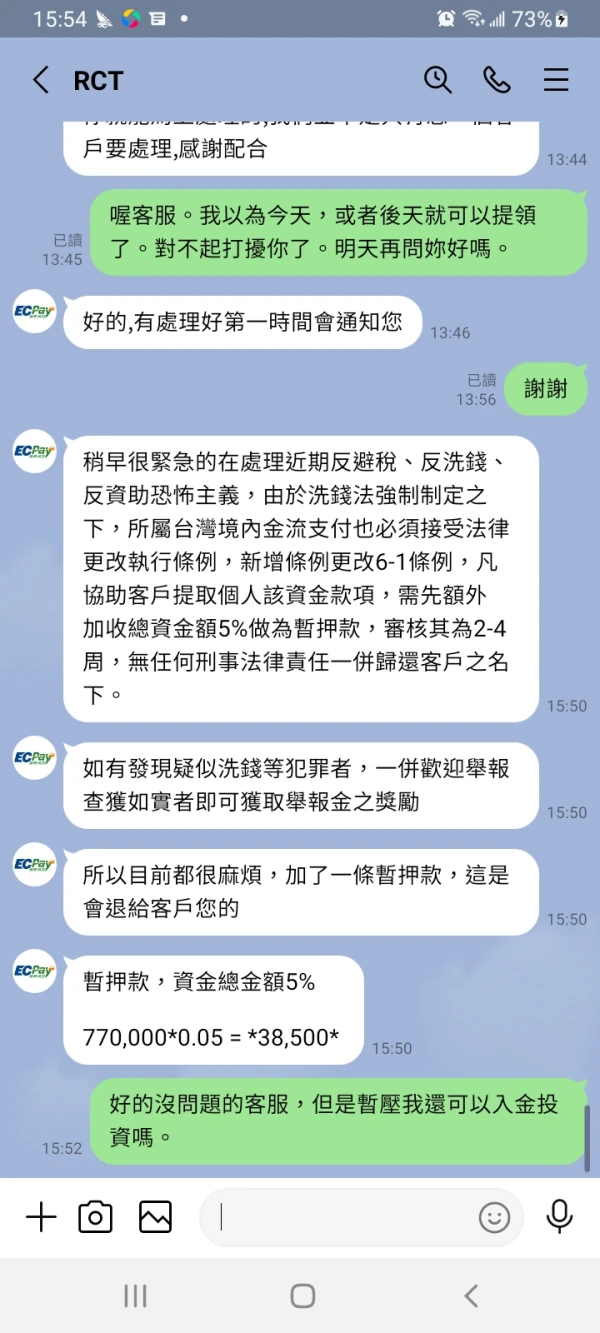

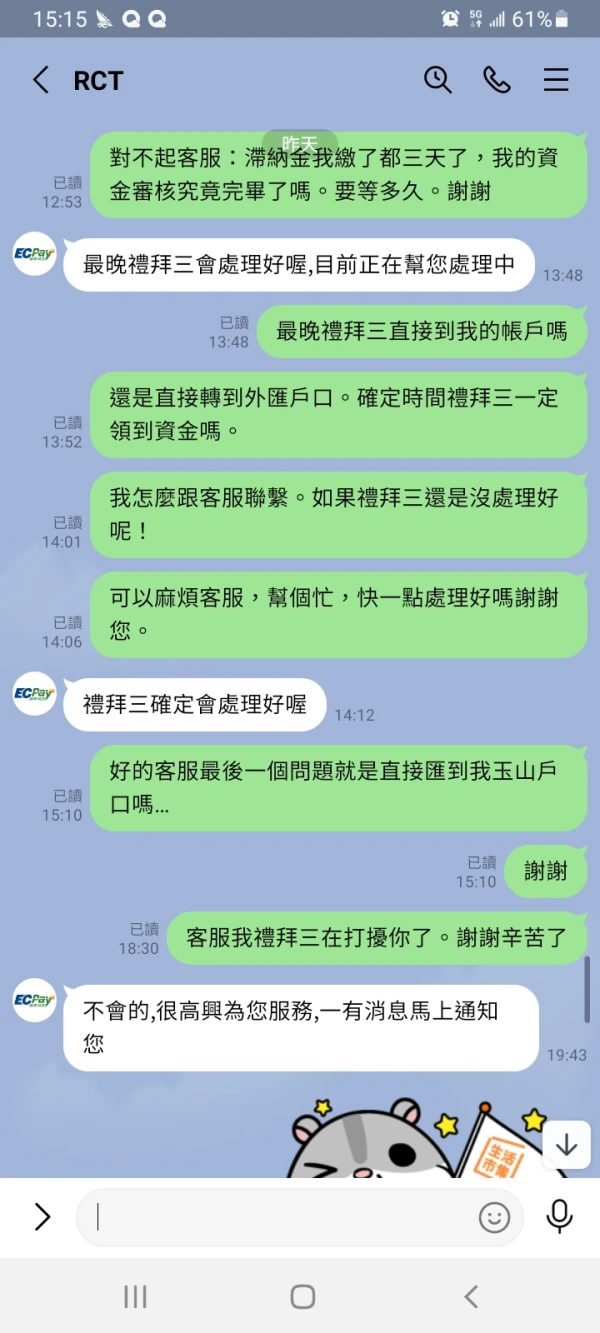

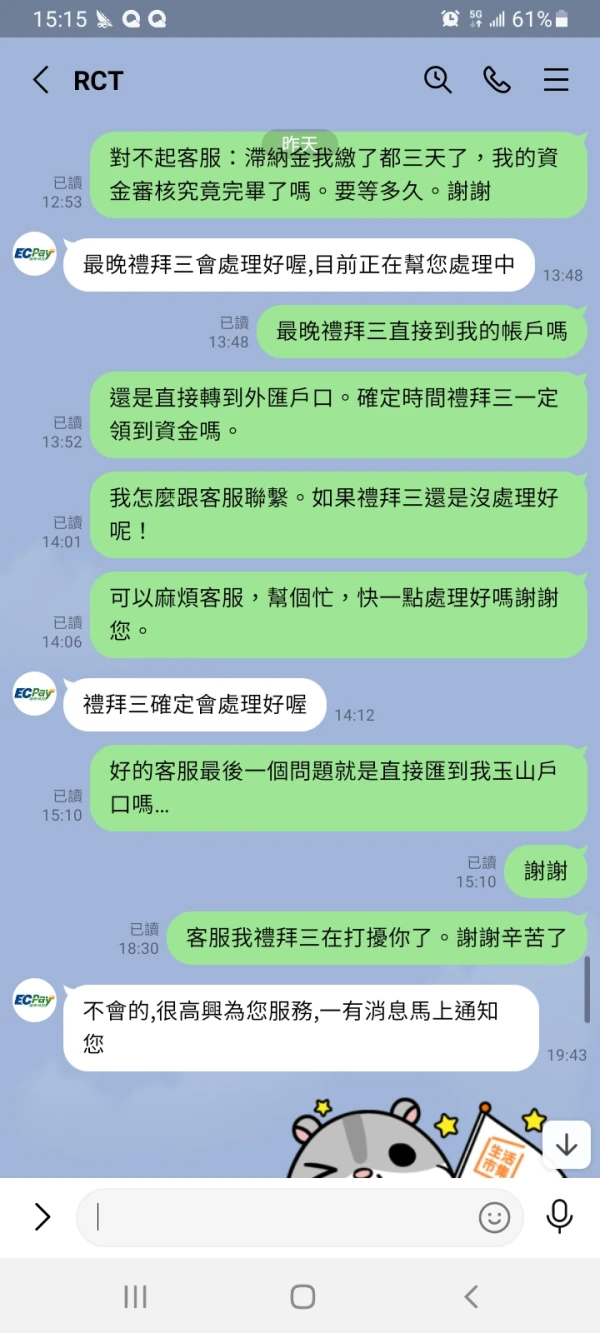

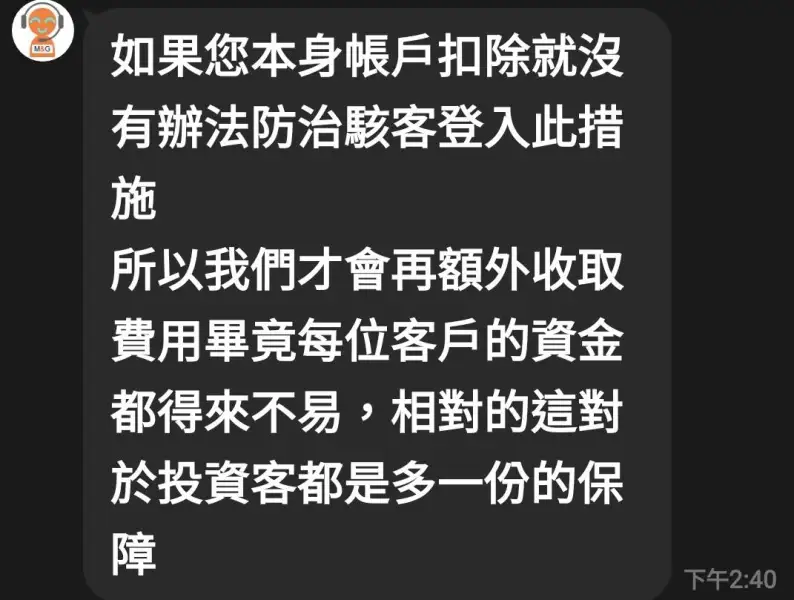

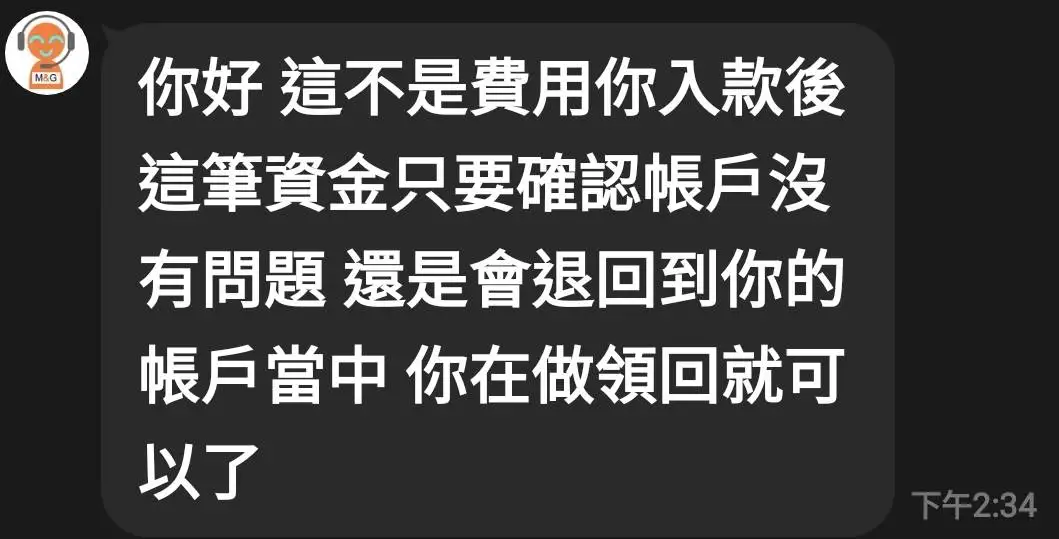

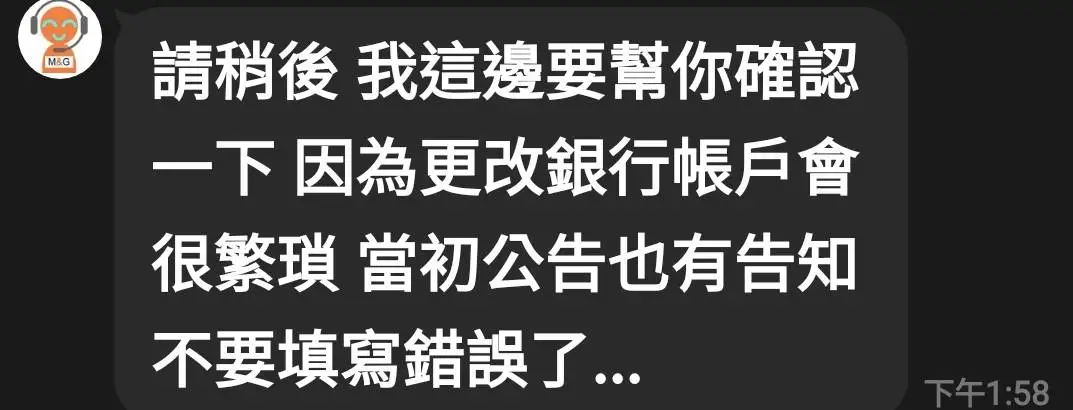

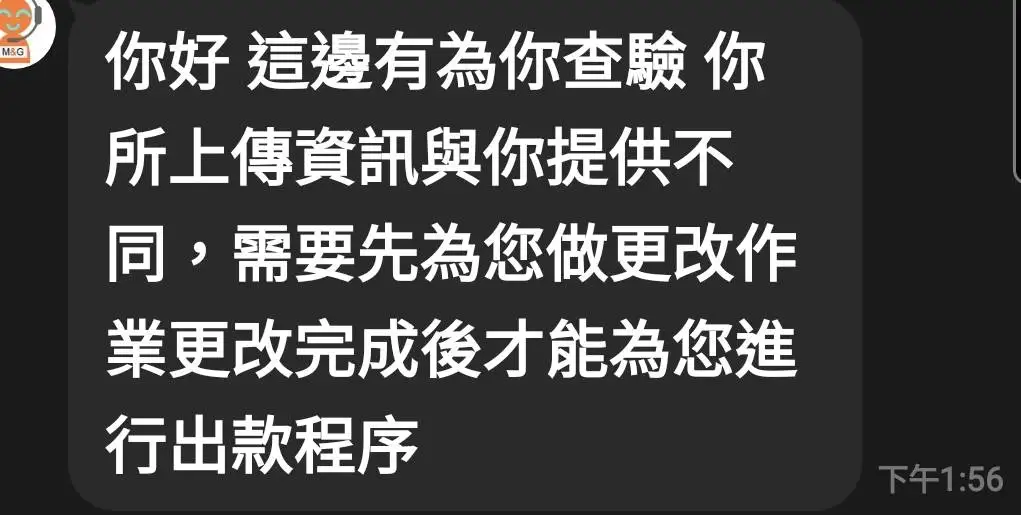

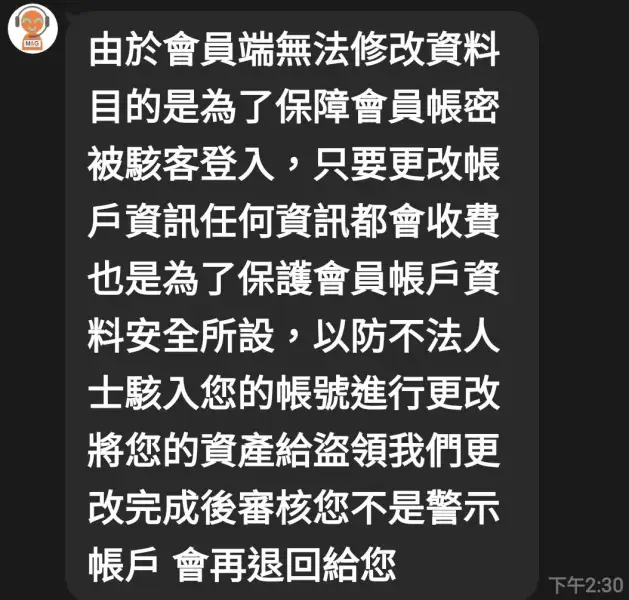

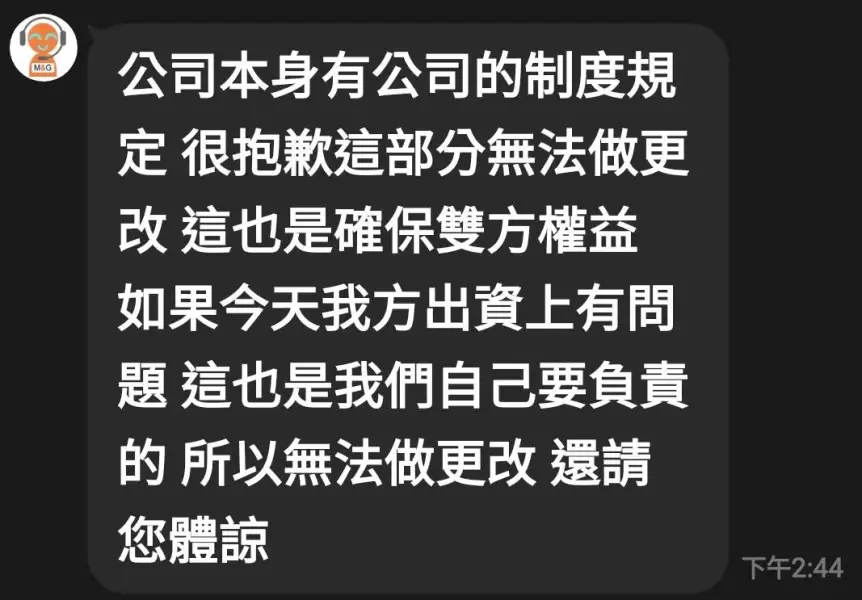

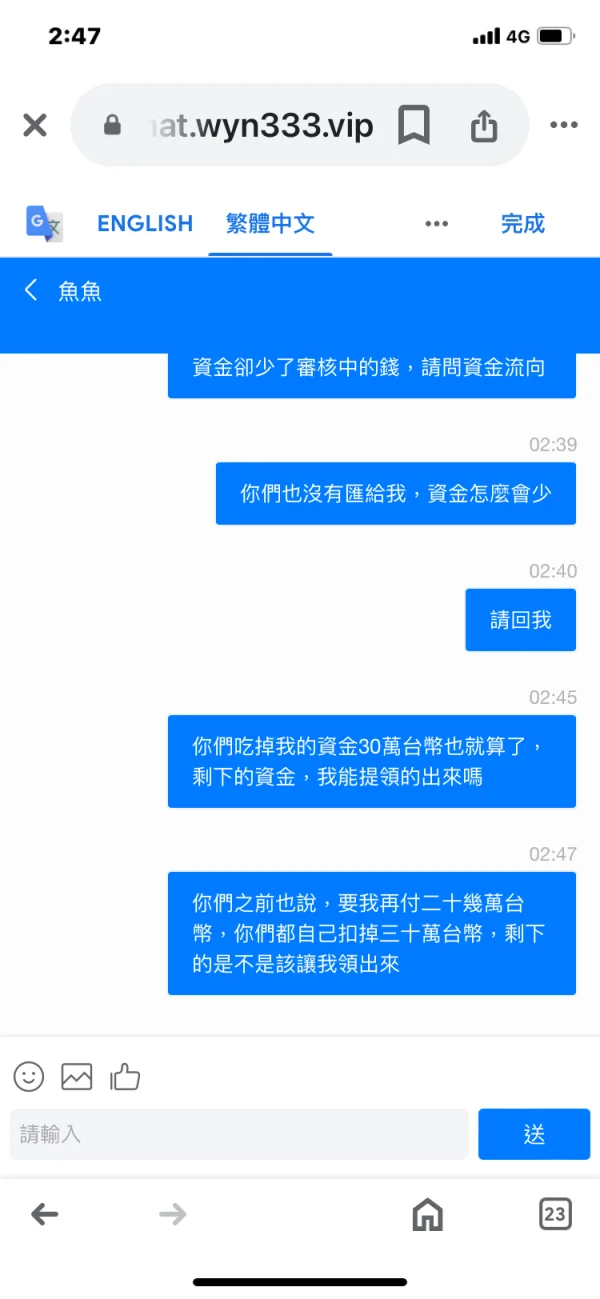

收了滯納金十多萬沒出金黑平台大家要小心不要被偷改帳號又要滯納金要保證金又要改帳號的錢加起多花一二十萬喔黑平台大家不要下單

曝光

Hsuan天天

台湾

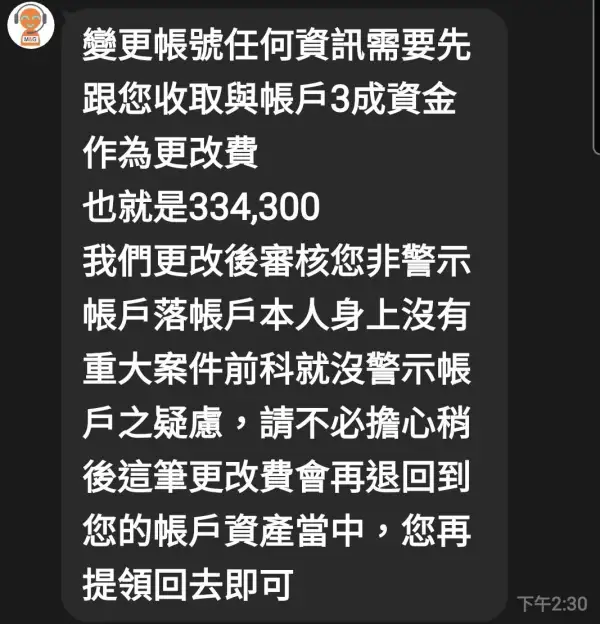

只要看到這網頁mginvestmentstw.net/ 不管前面有啥英文 他們都是一樣的網頁都是可以登入 一樣明明輸入對的銀行帳戶 但網頁顯示錯的 跟改還要是資金的3成才能更變 感覺一受騙 呼籲大家只要看到以上這網頁 基本不要去做投資 有入沒有出

曝光

FX4102010959

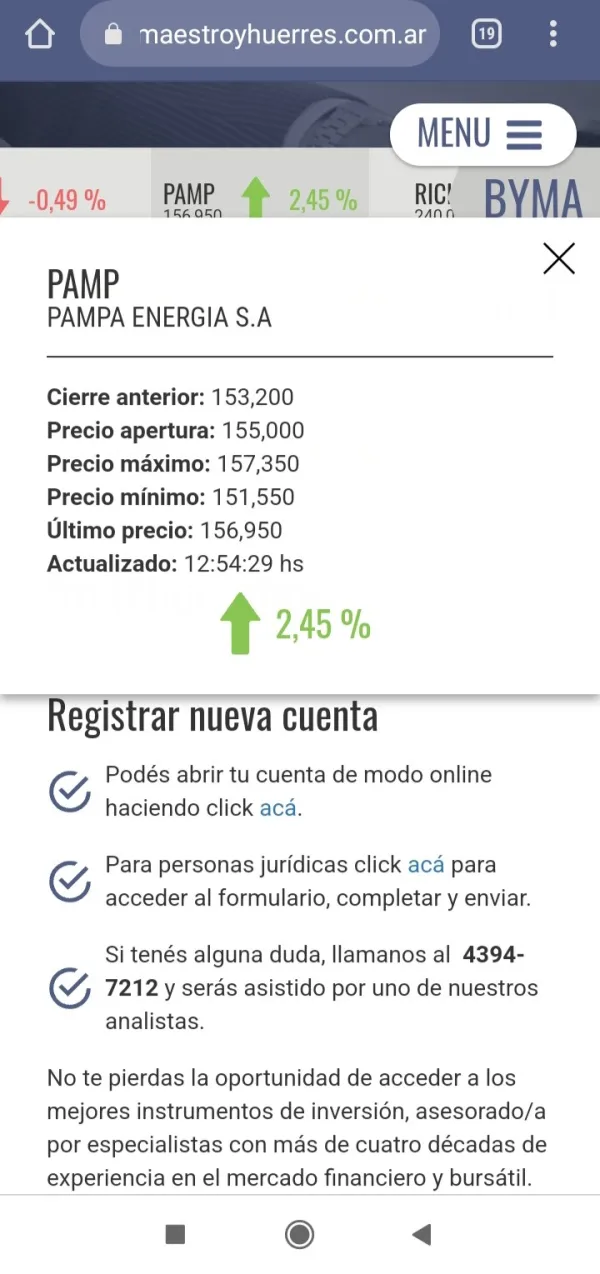

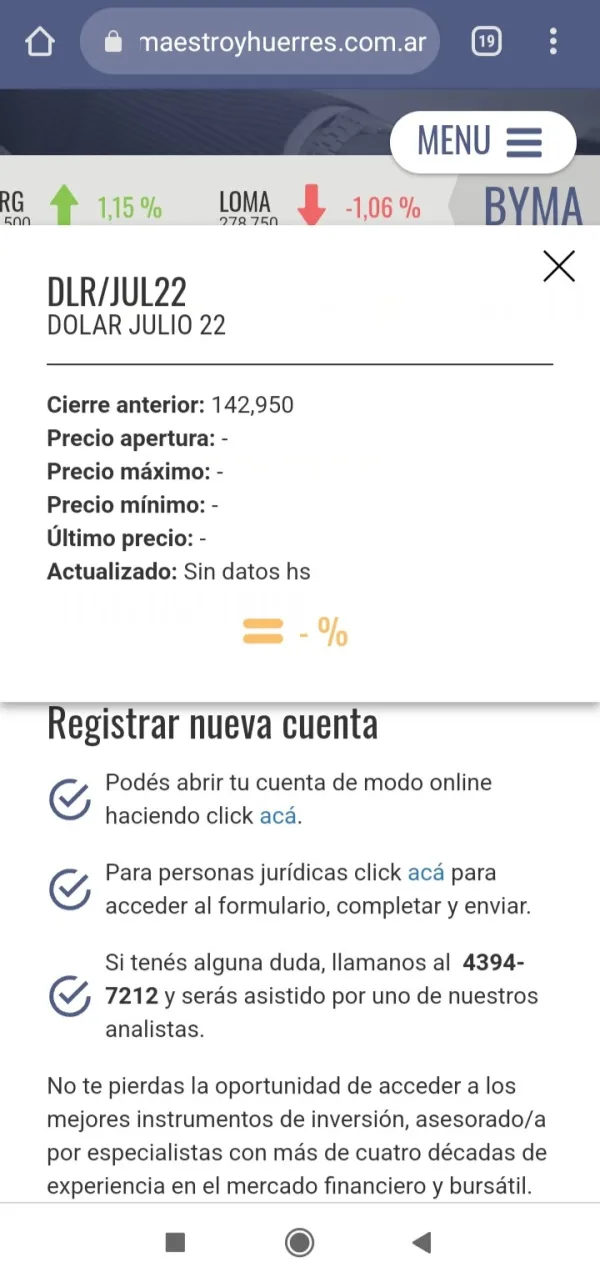

阿根廷

这些人或所谓的公司,致力于不断改变不同金融市场的图表,从而将您的资本减少到 0 美元,我投资了 66,215 比索,一切都失去了

曝光

FX3308363627

台湾

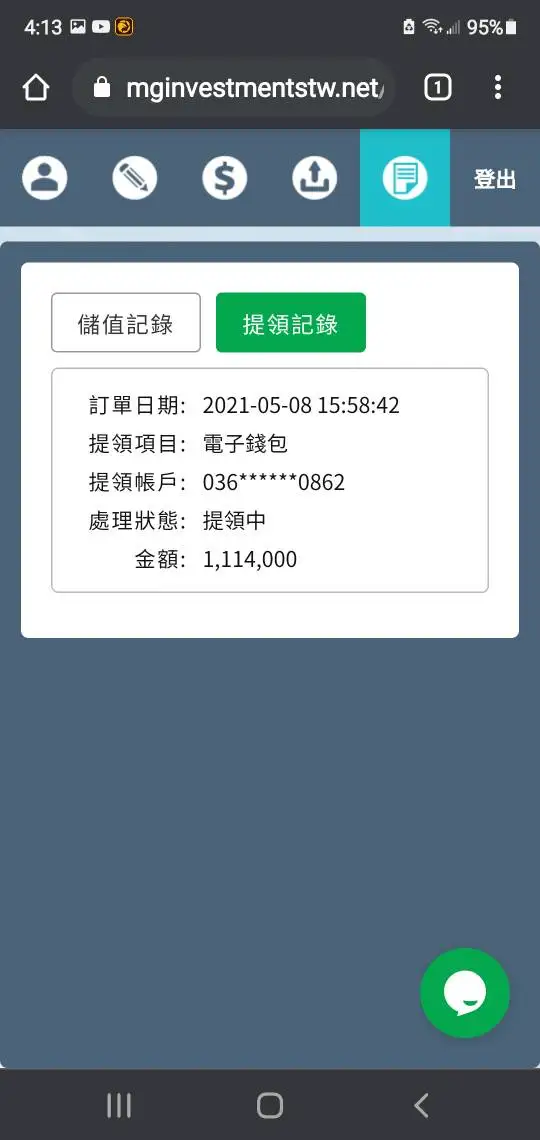

我在互联网上看到这个可以赚钱的应用程序后,下载了它。客服还提供在线汇款服务。我汇款了钱。当我想要提取钱时,它仍在审核中。我提取了三次,每次提取10万元新台币,但我没有收到任何钱。我多次向客服询问,但他们没有回应。当我再次登录这个平台时,我发现我提取的钱不见了。原本是超过190万元,但现在只剩下150万元左右。这显然是一个骗取我的钱的骗局。

曝光

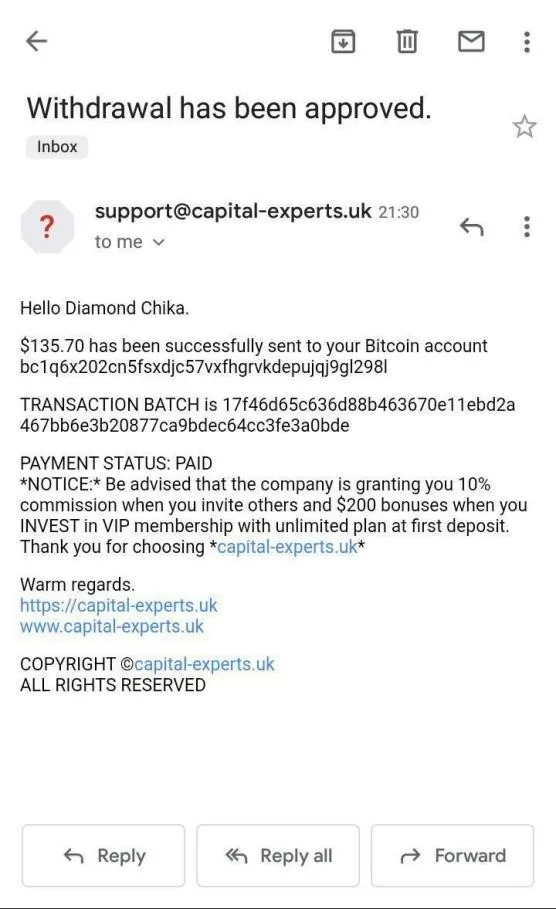

วิทยา ประธานทรง

圣巴泰勒米岛

你好,Witthaya Prathantrong 或 M 企业家。

好评

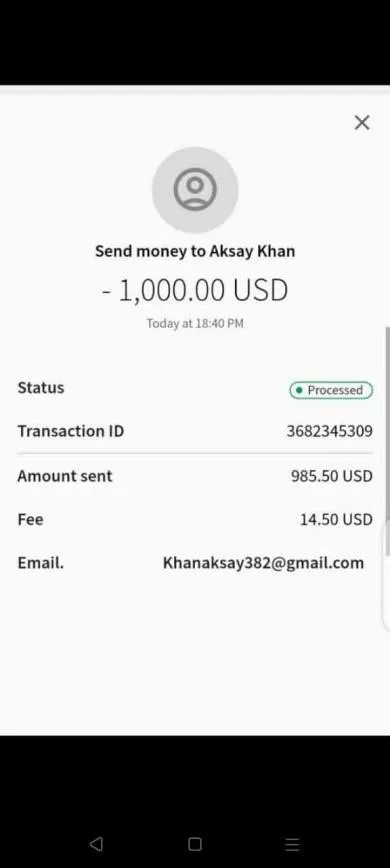

FX1828697794

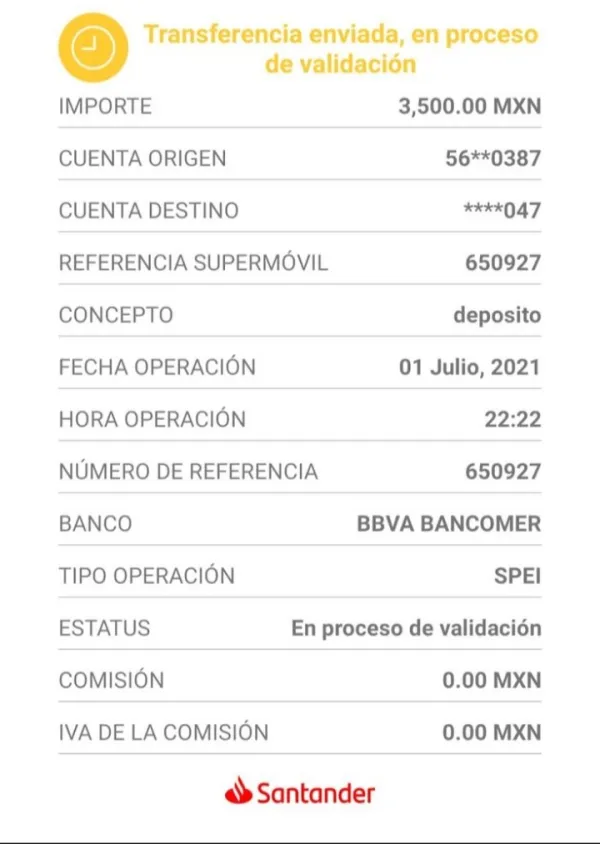

墨西哥

存入了 3,500 美元的比索,那天我提取了 2,300 多美元,我的董事会上出现了一张图片,说他们错了,这些操作很糟糕,所有的钱都不是我的,这有什么不道德的? ,最坏的真相

曝光

FX2046354843

菲律宾

避免投资M&G,我太蠢了居然相信他们承诺的投资回报率,我借了5000英镑的贷款。我什至记不清他们广告上说的投资回报率是多少了,大约是每月5%-7%(确实很可观)刚开始两周,表现非常积极(我从2021年8月开始与他们合作),然后就开始走下坡路。如果你制定一个我账户余额的图表,图标会看起来像一组下降的楼梯。我现在设定在2900英镑(5000英镑中),未平仓交易的浮动利润为-600英镑。因此,如果要提取剩余余额我会不得不关闭所有的未平仓交易,并且失去600英镑。不过他们确实提供了有帮助的,大体上也响应迅速的客户支持。他们似乎也真的很努力。

曝光