Company Summary

| Ichiyoshi Securities Review Summary | |

| Founded | 1950 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Product | Securities |

| Trading Platform | / |

| Customer Support | Tel: 03-4346-4500 |

Ichiyoshi Securities Information

Ichiyoshi Securities Co., Ltd., founded in Japan in 1950 and regulated by the FSA, operates with a triangular pyramid management structure and prioritizes individual customer interests through its “Seven Ichiyoshi Standards,” focusing on trustworthy and less complex products.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Ichiyoshi Securities Legit?

Ichiyoshi Securities has a Retail Forex License regulated by the Financial Services Agency (FSA) in Japan with a license number of 関東財務局長(金商)第24号.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | Japan | Retail Forex License | 関東財務局長(金商)第24号 |

Ichiyoshi Securities Strength

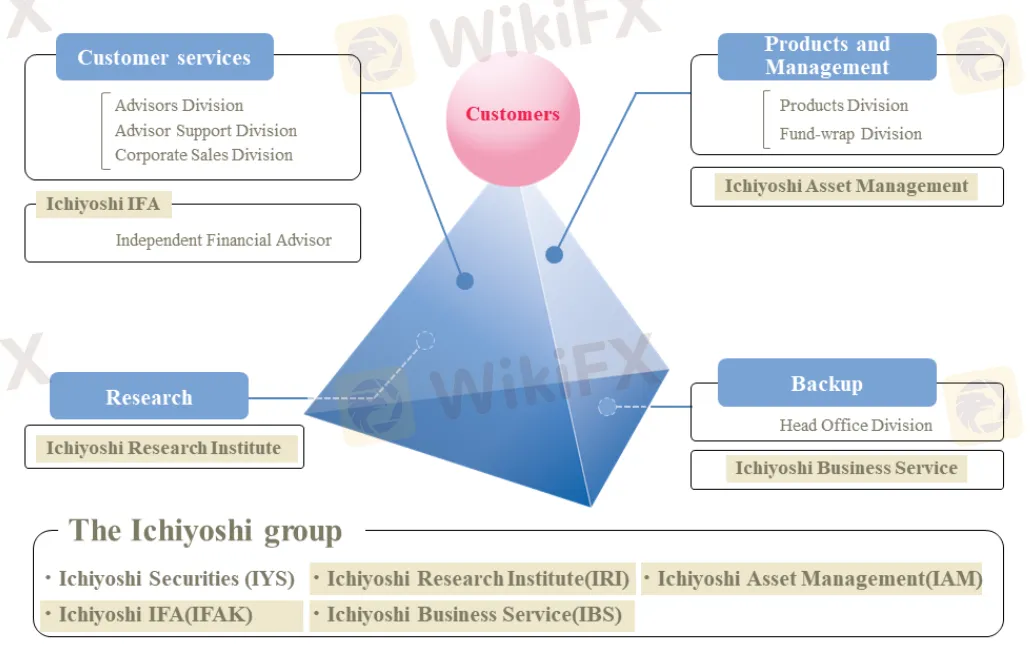

- Triangular Pyramid Management: Ichiyoshi Securities' strength lies in its triangular pyramid management structure with interconnected divisions (Customer Services, Products & Management, Research, Backup) fostering synergy to maximize each division's function, ultimately aiming to provide superior services, products, and information for customer asset and business management.

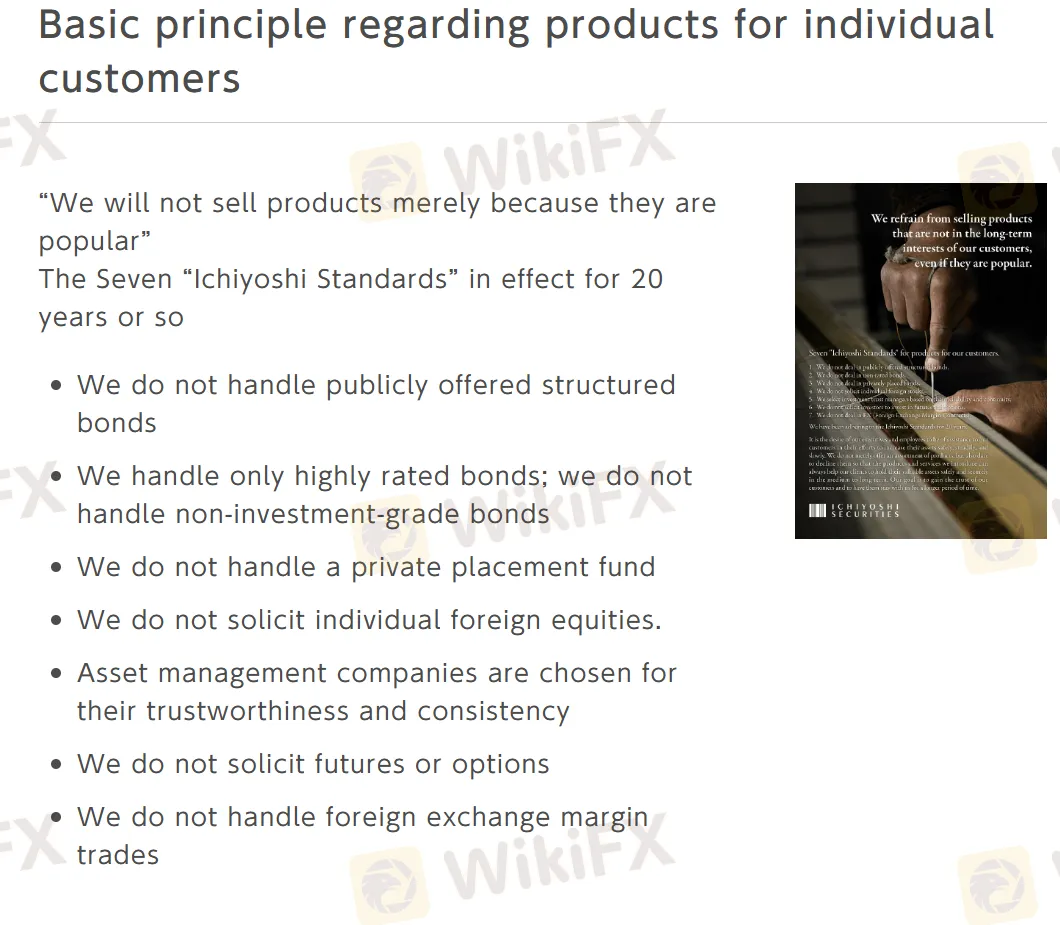

- Basic principles regarding products for individual customers: Ichiyoshi Securities prioritizes individual customer interests by adhering to “The Seven Ichiyoshi Standards” for about 20 years, focusing on high-quality, trustworthy products and avoiding complex or high-risk offerings like structured bonds, non-investment grade bonds, private placements, foreign equities, futures/options, and foreign exchange margin trades.

Important Statistic Figures

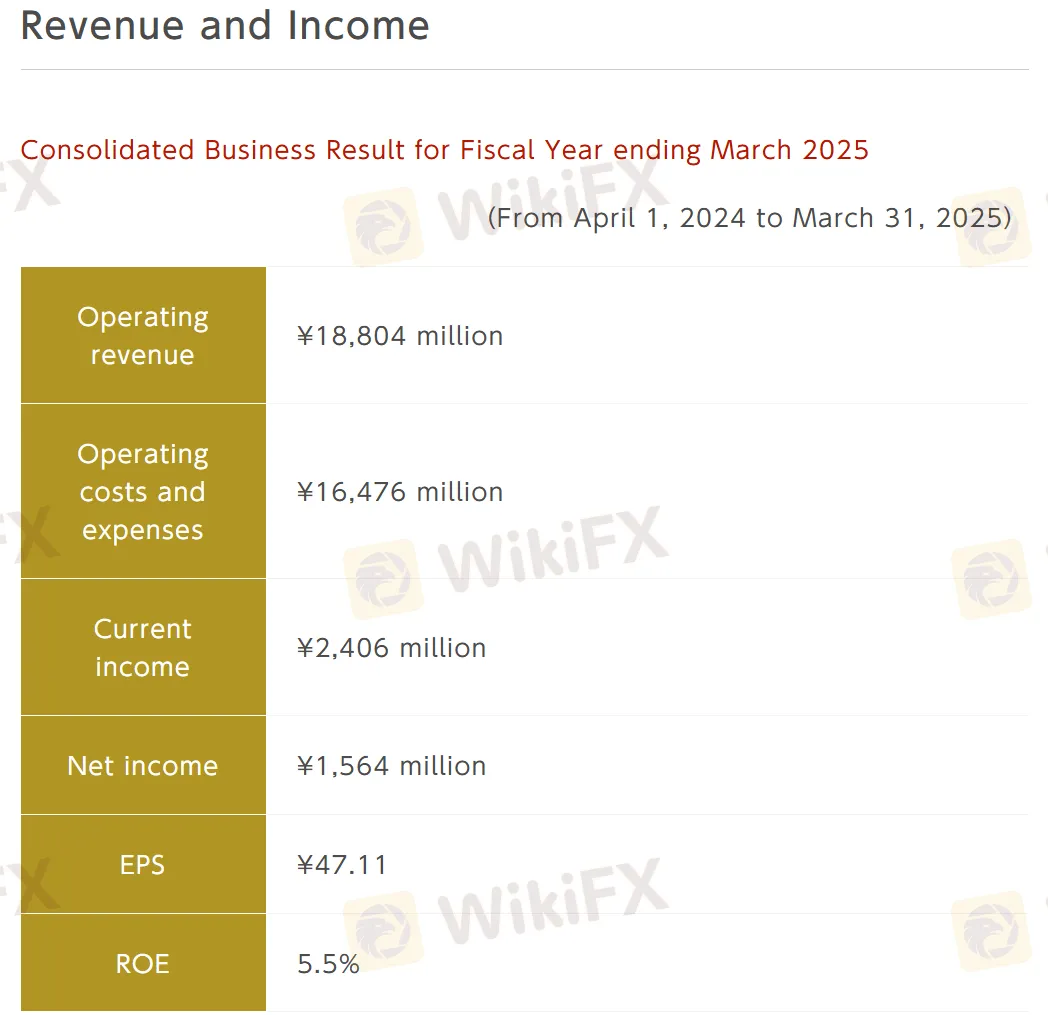

- Revenue and Income: From April 1, 2024, to March 31, 2025

| Metric | Value |

| Operating Revenue | ¥18,804 million |

| Operating Costs and Expenses | ¥16,476 million |

| Current Income | ¥2,406 million |

| Net Income | ¥1,564 million |

| EPS | ¥47.11 |

| ROE | 5.5% |

- Financial Summary: As of March 31, 2025

| Metric | Value |

| Total Assets | ¥41,900 million |

| Net Worth | ¥27,461 million |

| Equity Ratio | 65.4% |

| Net Assets per Share | ¥861.85 |

| Capital Adequacy Ratio | 448.0% |