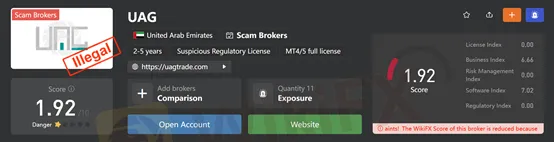

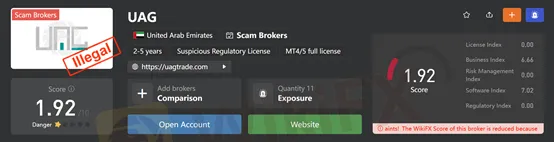

Abstract:Founded in 2016, UAG is an online forex broker based in the United Arab Emirates. However, WikiFX has listed this broker as a scam broker. Why?

About UAG

Founded in 2016, UAG is an online forex broker based in the United Arab Emirates. UAG offers investors a series of financial instruments, such as Forex, precious metals, energy, and index CFDs. However, WikiFX has listed this broker as a Ponzi Scheme. The WikiFX score of this broker gets is 1.92/10. You need to be aware of the potential risk.

Accounts Types

UAG has two regular account types for investors to choose from, namely the Standard Account (the minimum deposit of $100) and the ECN Account (the minimum deposit of $500). In addition, UAG offers swap-free accounts to Muslim traders.

Leverage & Spreads

Both Standard and ECN accounts have a maximum leverage of 1:200, but UAG offers differing spreads for different clients. The spreads for standard accounts range from 1.6 pips, while ECN accounts enjoy a higher discount from 0.1 pips.

Commissions

The various account types are designed to meet the needs of different traders, and of course the benefits of their accounts vary slightly. 2 USD per lot for ECN accounts and 12 USD per lot for standard accounts with real-time cashback.

Trading Platforms

UAGTrade offers its clients two trading platforms, the well-known MetaTrader 4 (MT4) platform and the UAG APP developed by the trader itself. Among them, MT4 supports both PC and mobile use.

Deposit & Withdrawal

UAGTrade supports multiple payment methods for deposits/withdrawals, including bank transfers (only USD/MYR accepted), PayPal, and Bitcoin wallets. It should be noted that the trader emphasizes that deposits and withdrawals cannot be made to/from third-party accounts.

Regulation

This broker is not a regulated broker. Investing in an unregulated broker is dangerous for your funds safety.

Exposure

As of March 17, 2023, UAG has received 11 complaints against this broker. The problem that people complained about the most is the withdrawal rejection.

Conclusion

Since WikiFX has considered UAG a Ponzi Scheme, we advise you to avoid trading with this broker. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.