Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about CBCX and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. CBCX is a broker that holds recognized financial licenses in two different jurisdictions.

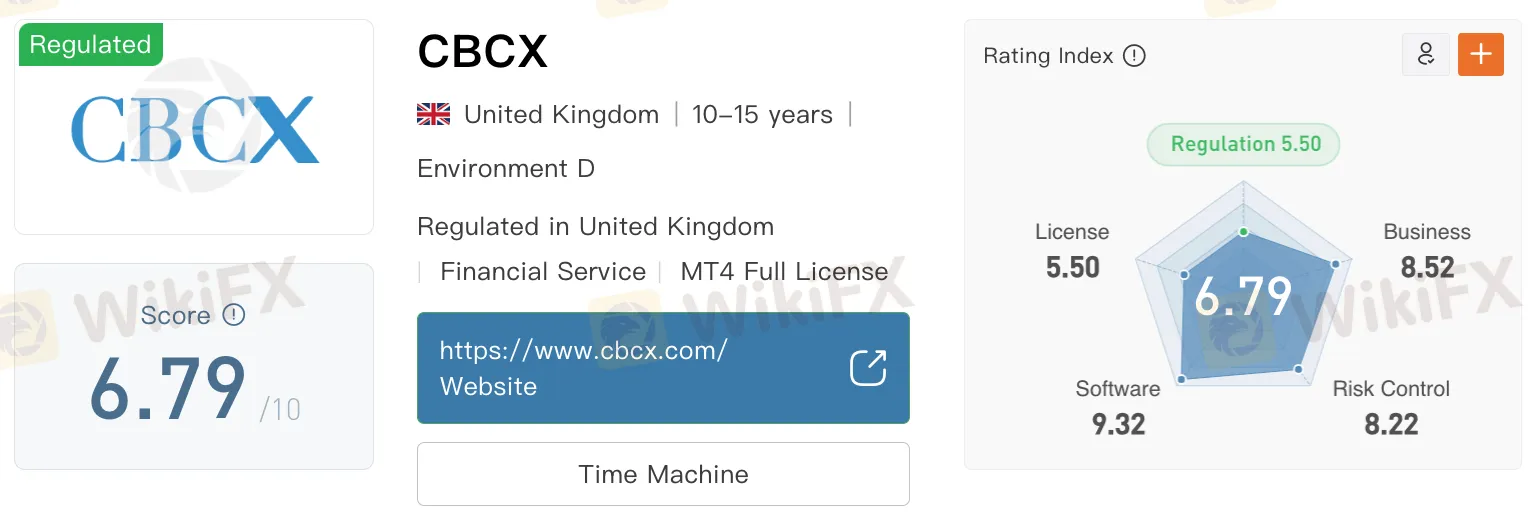

On WikiFX, CBCX holds a score of 6.79 out of 10. This rating reflects a generally stable regulatory framework and active operations, while also noting areas that may require closer review, particularly where a broker operates across multiple jurisdictions with different scopes of regulatory coverage.

CBCX is currently licensed by the Financial Conduct Authority (FCA) in the United Kingdom under license number 572911. The FCA is an independent financial regulatory body responsible for overseeing firms that provide financial services to consumers. FCA-regulated firms are required to comply with strict standards related to transparency, client fund protection, and operational conduct.

In addition to its FCA license, CBCX is also registered with South Africas Financial Sector Conduct Authority (FSCA) under license number 49700. The FSCA is responsible for regulating market conduct among financial institutions and aims to promote fair treatment for financial customers. However, it is noted that CBCX operates beyond the business scope permitted under its FSCA license, which is categorised as a non-forex financial services license. This means that while the broker is listed with the FSCA, it may be offering services not fully covered under its South African authorization.

In summary, CBCX has formal licenses from both the UK‘s FCA and South Africa’s FSCA, which indicates a certain level of regulatory presence. However, the brokers activities exceeding the scope of one of its licenses suggests that traders should take time to understand the specific services being offered and where they fall under regulatory supervision. As always, traders are encouraged to perform due diligence before engaging with any broker, especially when services are offered across multiple regions with varying rules and oversight levels.

Conducting due diligence before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.