Abstract:Multibank (Europe) Ltd, part of the wider MultiBank Group, has recently caught our eye. Public complaint trackers and field reports show a spike in user grievances (withdrawal blocks, unresponsive support, account freezes).

Multibank (Europe) Ltd, part of the wider MultiBank Group, has recently caught our eye. Public complaint trackers and field reports show a spike in user grievances (withdrawal blocks, unresponsive support, account freezes).

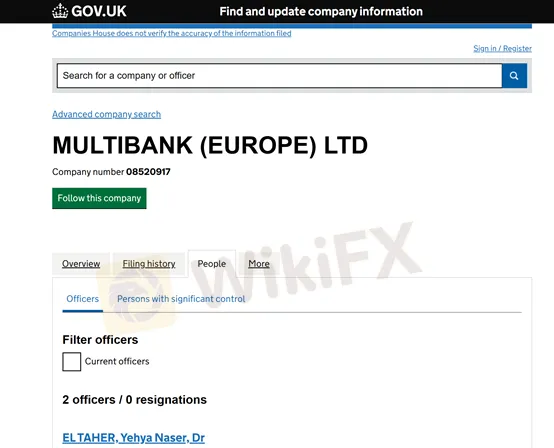

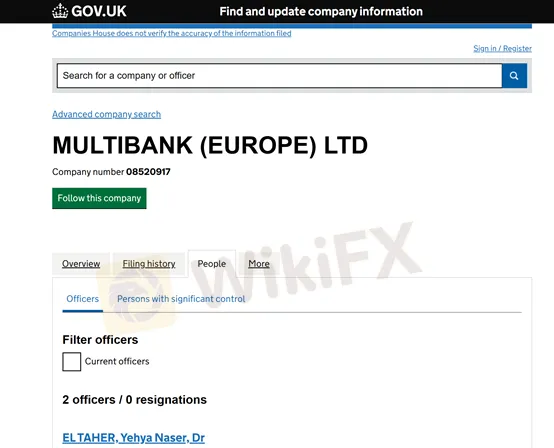

1. What Companies House records show about Multibank (Europe) Ltd

A current search of UK Companies House shows two registered officers for MULTIBANK (EUROPE) LTD (company number 08520917), both appointed on 9 May 2013 and both listed with the same correspondence address at Kemp House, 152 City Road, London, EC1V 2NX. The two officers are:

- Dr. Yehya Naser EL TAHER — listed as Director; nationality: British; country of residence: China; date of birth: April 1981.

- Naser TAHER — listed as Director; nationality: Jordanian; country of residence: China; date of birth: November 1952.

The Companies House filing history also shows registered-office changes and director detail updates over time, which is normal for active groups. However, both directors share the same London correspondence address, and overseas residence details are worth noting when cross-checking local operations.

2) Who are these two people

According to the report, Naser Taher is widely presented in MultiBank Group materials and business profiles as the groups founder and chairman; he appears frequently in corporate press releases and industry profiles highlighting awards and expansion strategy. MultiBank Group company pages and press releases) emphasize long industry experience and a public-facing leadership role for the Group.

This person appears on Companies House as an officer for the European entity (DOB April 1981). Beyond Companies House, the public footprint for this exact name is smaller in mainstream press compared with the founder profile for Naser Taher.

Publicly available corporate materials present Naser Taher as the Groups founder and chairman; official UK filings show two directors tied to the European company, but open-source background on the lesser-known director is limited. That gap should encourage extra verification by regulators, journalists, and affected clients.

3) Other Main Charaters of MultiBank Group

According to MultiBank Group, Public company pages and profiles show that Naser Taher is the founder and chairman of MultiBank Group. He is frequently quoted in company press releases and industry profiles. However, there are other main characters that we cannot ignore.

in this company.

1. Sophie Squillacioti

Head of China Sales; Advisor to the Chairman

According to the reports, Sophie Squillacioti joined MultiBank as Head of China Sales and Advisor to the Chairman.

2. Abdelrahman Wafi

Head of Human Resources and Administration

3. Cristin Francisco

Country Manager, MultiBank Philippines

Cristin Francisco is the Country Manager for MultiBank Group Philippines, based on the information on event pages, social posts, and conference speaker lists. Local country managers are important because they often serve as the primary point of contact for clients during onboarding and local marketing efforts.

4. Kristina Pei

Chief Financial Officer at MultiBank Group

5. Taha Daraji

Multibank executive

Commercial directories, such as Datanyze, list Taha Daraji with a Multibank executive title. However, since these third-party directories sometimes lag or conflate roles, treat them as leads to verify rather than proof of current authority.

4) Complaints, exposures, and red flags reported in the public domain

Independent complaint trackers and watchdog-style sites show multiple user reports of withdrawal problems, frozen accounts, and aggressive collection/upsell practices attributed to MultiBank Group-branded platforms in recent years. WikiFX has published a special report and dozens of user exposures describing: inability to withdraw funds, required “top-up” payments to process withdrawals, inaccessible account managers, and broken customer support. These are user complaints and platform exposures rather than legal judgments, but their volume and consistency across markets are signals that merit caution.

Some of those coverage points to complex disputes that in past cases have involved allegations against related counterparties. That context doesnt prove wrongdoing by the Group itself, but it means there have been public financial conflicts and litigation in the extended corporate orbit.

5) Concrete steps for traders and victims

If you have used Multibank-branded services and suspect misconduct, take these actions immediately:

- Document everything — transaction IDs, deposit/withdrawal screenshots, email/chat logs, account statements, KYC documents, names of account managers, and timestamps.

- File formal complaints — first with the platforms support (email/case number), then with local financial regulators (the regulator in your country or region), and with WikiFX. When possible, attach the documentation above.

- Preserve evidence of communication — dont delete emails or messages even if they contain threatening language. These records help investigators.

- Coordinate with other victims — crowd-sourced complaints (on WikiFX and social media) often produce corroborating evidence and can accelerate regulator attention.

- Speak to legal counsel or a local consumer protection office if the amounts are material. Many jurisdictions offer specialist financial-complaint services or ombudsmen.

- Report suspicious recruitment or “recovery” offers. Scammers often re-target victims, offering to “recover” funds for an up-front fee.

5) Conclusion

Withdrawal denials, repeated requests for “processing fees,” or frozen accounts without a clear cause a recognized red flags in retail brokerage oversight. Those facts justify further independent investigation and regulatory scrutiny.

If you have been directly affected by Multibank-branded services, please preserve your records and share them with WikiFX.