Abstract:Among the various account management options available, MAM accounts (Multi-Account Manager) have gained increasing popularity these days. These accounts allow money managers to trade on behalf of multiple clients, while investors can benefit from professional trading expertise. In this article, we’ll explore the top 10 forex MAM brokers for 2025, along with their key features, advantages, and considerations.

Among the various account management options available, MAM accounts (Multi-Account Manager) have gained increasing popularity these days. These accounts allow money managers to trade on behalf of multiple clients, while investors can benefit from professional trading expertise. In this article, well explore the top 10 forex MAM brokers for 2025, along with their key features, advantages, and considerations.

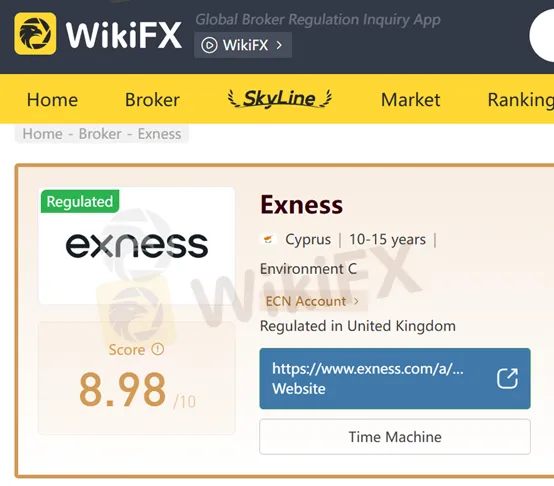

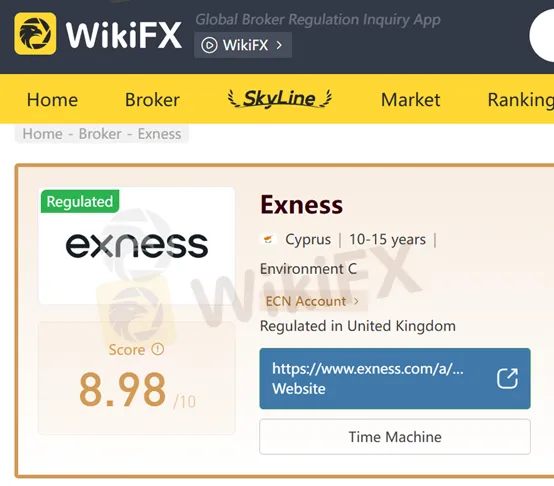

If you are evaluating brokers, apart from spreads, platforms, regulation, etc., checking a brokers WikiFX score can help gauge reliability, exposure, and safety from independent reviews. Here are 10 good brokers for MAM in 2025 + their WikiFX scores, strengths, and what to watch out for.

What Are Forex MAM Brokers?

A forex MAM broker provides a platform where professional traders or money managers can handle multiple accounts simultaneously. The broker‘s MAM software allows trades to be allocated proportionally to investors’ accounts based on their investment size.

Key Benefits of MAM Accounts:

- Professional money management for investors

- Real-time trade allocation across multiple accounts

- Flexible lot size allocation

- Transparency and performance tracking

- Ability for managers to handle unlimited clients

Top 5 Forex MAM Brokers for 2025

Disclaimer: The following list is for informational purposes only. Always verify regulatory status and terms before opening an account.

XM

- WikiFX Score: 9.31/10

- Regulation: ASIC, CySEC, IFSC

- MAM Features: Supports multiple account types under one MAM, transparent performance tracking

- Why It Stands Out: Popular worldwide for reliability and strong educational resources

IC Markets

- WikiFX Score: 9.25/10

- Regulation: ASIC, CySEC, SCB

- MAM Features: Up to 64 trading accounts per master account, supports EA trading

- Why It Stands Out: Deep liquidity and ultra-low spreads, ideal for scalpers and MAM managers

Axi

- WikiFX Score: 9.07/10

- Regulation: FCA, ASIC

- MAM Features: MT4-integrated MAM software, allocation by equity, balance, or lots

- Why It Stands Out: Reliable infrastructure and excellent for professional money managers

Exness

- WikiFX Score: 8.98/10

- Regulation: FCA, CySEC, FSCA

- MAM Features: Instant trade execution, low spreads, flexible commission structures

- Why It Stands Out: High transparency and strong reputation among professional traders

Pepperstone

- WikiFX Score: 8.98/10

- Regulation: FCA, ASIC, DFSA

- MAM Features: Supports MT4/MT5 MAM, lightning-fast execution, multiple allocation methods

- Why It Stands Out: Trusted by fund managers due to tight spreads and low latency

How to Choose the Best Forex MAM Broker

When selecting a forex MAM broker, consider the following factors:

- Regulation: Ensure the broker is licensed by recognized authorities (FCA, ASIC, CySEC, etc.).

- Trading Costs: Look for tight spreads and low commissions.

- Execution Speed: Essential for scalpers and high-frequency trading.

- Platform Compatibility: Most brokers offer MT4/MT5 MAM solutions.

- Reputation & Transparency: Choose brokers with strong industry reputations and client protection.

Conclusion

Forex MAM brokers offer a powerful solution for both investors seeking professional account management and money managers handling multiple clients. The top forex MAM brokers for 2025 listed above provide a mix of regulation, technology, and transparency, making them attractive choices for serious traders.

Before opening an account, always conduct due diligence and ensure the broker aligns with your trading or investment goals.