简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IG: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about IG and its licenses.

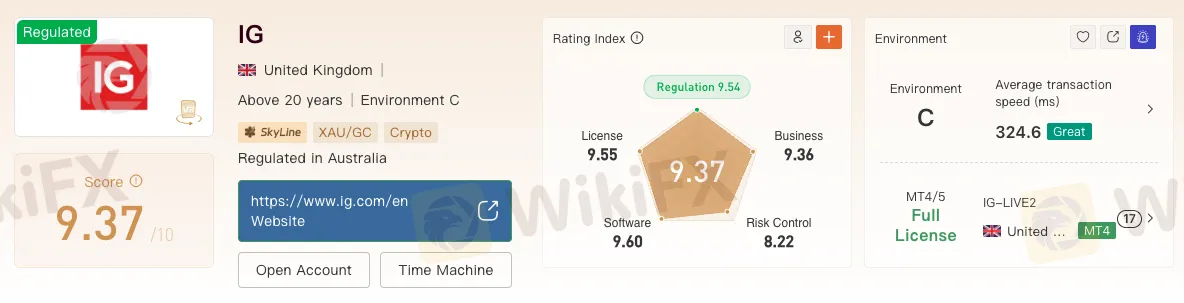

With a strong reputation built over decades in the financial markets, IG stands among the most recognized and trusted brokerage institutions in the world. According to WikiFX, the broker holds an impressive WikiScore of 9.37 out of 10, reflecting its high level of regulatory compliance, transparency, and stability. IGs operations are supported by multiple licenses issued by respected financial authorities across several jurisdictions. This extensive regulatory coverage not only allows IG to serve a global client base but also reinforces its standing as a reliable and well-supervised financial institution.

Global Regulatory Overview

IG‘s regulatory footprint spans several continents, encompassing major financial centers in Europe, Asia, the Middle East, Oceania, and Africa. Each license obtained by IG corresponds to a specific regional authority, ensuring that the broker’s operations comply with local financial laws, capital requirements, and consumer protection frameworks.

View WikiFXs full review on IG here: https://www.wikifx.com/en/dealer/0001473583.html

This multi-licensing approach provides clients with a high degree of security, as it places IG under the continuous oversight of some of the worlds most respected regulators. Each regulatory body enforces its own standards on issues such as fund segregation, transparency in pricing, and fair execution practices.

United Kingdom: Financial Conduct Authority (FCA)

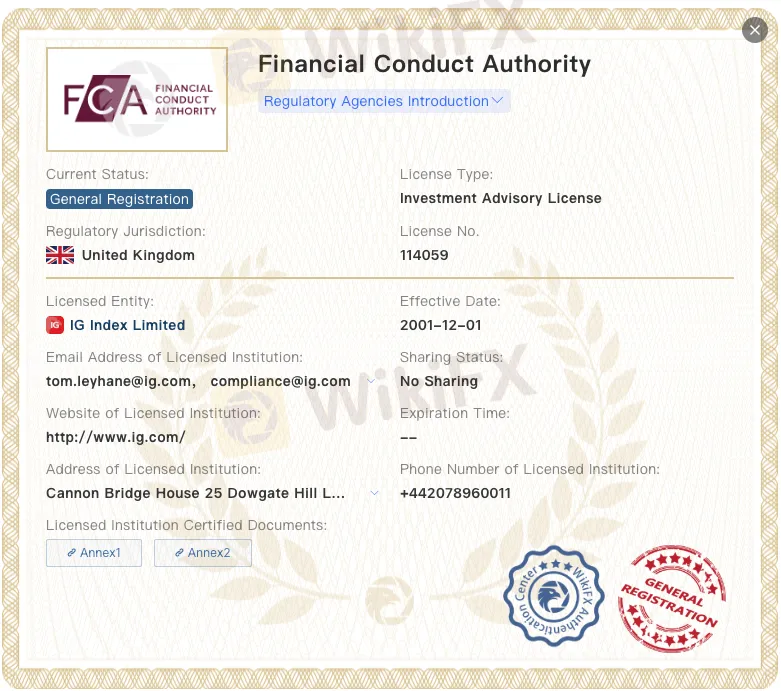

The United Kingdom serves as IGs home market and primary regulatory base. IG Markets Ltd is licensed and regulated by the Financial Conduct Authority (FCA) under a Market Maker (MM) license. The FCA is widely regarded as one of the most stringent financial regulators globally, known for its comprehensive oversight of brokers and investment firms.

Under this license, IG must comply with the Financial Services and Markets Act (FSMA) and related FCA rules that govern financial conduct. This includes maintaining adequate capital reserves, segregating client funds from company assets, and submitting regular audit reports. The FCA license also requires firms to provide clear and accurate marketing materials and to ensure that all client communications meet the regulators standards of fairness and transparency.

In addition to its Market Maker license, IG also holds an Investment Advisory License from the FCA. This registration allows the firm to offer investment-related guidance and information services in the UK market. It demonstrates IGs ability to operate both as a trading service provider and as a regulated entity authorized to offer financial insights within the boundaries set by the FCA.

Australia: Australian Securities and Investments Commission (ASIC)

In Australia, IG operates under the supervision of the Australian Securities and Investments Commission (ASIC) as a Market Maker (MM). ASIC is considered a top-tier financial regulator, enforcing strict standards for operational integrity and client protection.

The ASIC license authorizes IG to provide trading services in derivatives and foreign exchange products to retail and institutional clients. ASIC requires licensed brokers to maintain sufficient financial resources, adopt transparent pricing mechanisms, and comply with the Corporations Act 2001. Moreover, ASIC mandates that brokers maintain segregated client accounts with authorized Australian banks, ensuring that client funds are safeguarded even in the unlikely event of corporate insolvency.

Japan: Financial Services Agency (FSA)

IG holds a Retail Forex License from the Financial Services Agency (FSA) in Japan, one of the most tightly regulated financial markets in the world. The FSA enforces high standards of conduct for brokers operating within Japan, focusing on consumer protection and financial stability.

Through this license, IG is permitted to offer leveraged trading services to Japanese clients. The FSA restricts maximum leverage levels to ensure responsible risk management and requires brokers to provide detailed risk disclosures. It also mandates frequent financial reporting and compliance with cybersecurity and anti-money laundering (AML) measures.

Germany: Federal Financial Supervisory Authority (BaFin)

In Germany, IG operates under the oversight of the Federal Financial Supervisory Authority (BaFin) with a Retail Forex License. BaFin is known for its robust regulatory framework, particularly regarding financial transparency and investor protection.

The BaFin license enables IG to provide its services within the German market and across the broader European Union under the European Economic Area (EEA) passporting mechanism. This authorization ensures that IG adheres to European directives such as MiFID II (Markets in Financial Instruments Directive), which promotes fair competition and standardization across the EUs financial markets.

New Zealand: Financial Markets Authority (FMA)

IG is licensed by the Financial Markets Authority (FMA) in New Zealand under a Straight Through Processing (STP) authorization. The FMA plays a key role in maintaining market integrity within New Zealands growing financial sector.

Under this license, IG operates as an intermediary that executes trades directly through liquidity providers rather than acting as the counterparty. This STP model enhances pricing transparency and ensures that clients receive market-driven execution. The FMA requires ongoing reporting and compliance audits to confirm that IG maintains proper operational standards and client fund protections.

Singapore: Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore (MAS) regulates IG under a Retail Forex License. MAS is internationally recognized for its comprehensive and rigorous approach to financial regulation. It combines central banking functions with market supervision, ensuring the overall soundness of Singapores financial system.

Under MAS regulation, IG must comply with strict standards concerning risk disclosure, transaction reporting, and cybersecurity. The license permits IG to offer forex and derivatives trading services to both retail and professional investors in Singapore. MAS also enforces rules on data protection and ethical marketing, further ensuring the transparency of services offered.

United Arab Emirates: Dubai Financial Services Authority (DFSA)

In the United Arab Emirates, IG operates under the Dubai Financial Services Authority (DFSA) with a Retail Forex License. The DFSA is the regulatory body for financial firms operating in the Dubai International Financial Centre (DIFC).

The DFSA license allows IG to provide leveraged trading services to clients in the Middle East. The authority emphasizes financial soundness, governance standards, and fair treatment of clients. DFSAs framework aligns closely with international norms and ensures that licensed entities like IG uphold high ethical and operational standards.

South Africa: Financial Sector Conduct Authority (FSCA)

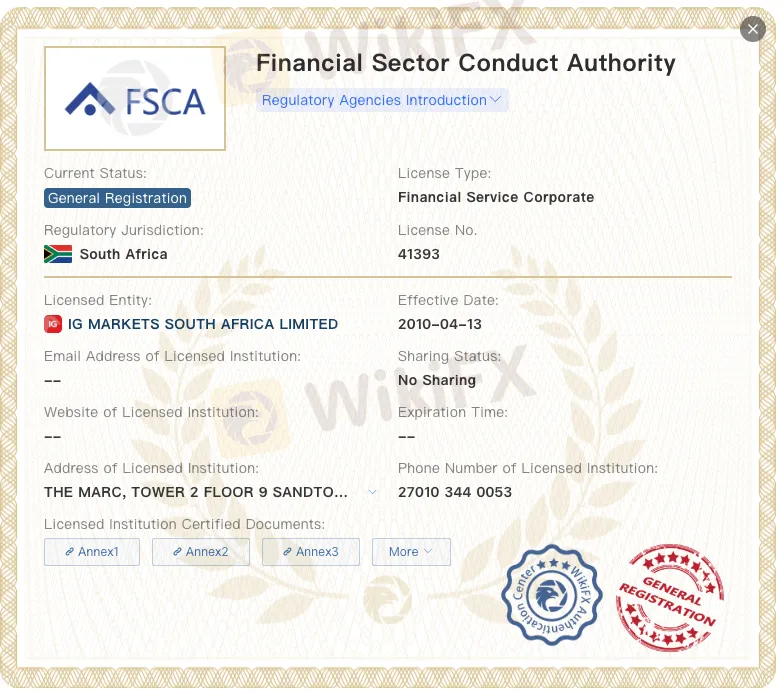

IG is also registered with the Financial Sector Conduct Authority (FSCA) in South Africa under a Financial Service Corporate registration. The FSCA serves as South Africas primary financial watchdog, responsible for regulating market conduct and promoting transparency in financial services.

Through this general registration, IG is recognized as a financial services provider authorized to operate in the South African market. The FSCAs focus is on ensuring that firms communicate transparently with clients and uphold fair business practices.

Why Regulation Matters for Traders

Choosing a regulated broker is one of the most important decisions a trader can make. Regulation provides a framework that protects investors from fraud, misconduct, and mismanagement. Licensed brokers are required to meet capital adequacy standards, keep client funds in segregated accounts, and submit to regular audits by independent authorities. This oversight reduces the likelihood of malpractice and ensures that clients can trade in a transparent and accountable environment.

In contrast, unregulated brokers operate without external supervision, meaning there are no guarantees that client funds are handled responsibly or that trading practices are fair. Trading with a regulated broker such as IG allows investors to focus on strategy and performance, knowing that their capital is protected under internationally recognized legal frameworks.

Using the WikiFX Mobile App to Verify Brokers

Traders can easily verify a broker‘s regulatory status using the free WikiFX mobile application, available on both iOS and Android. The app provides access to detailed profiles of over 70,000 brokers worldwide, including licensing information, regulatory status, and user feedback. By searching for a broker’s name on WikiFX, users can instantly view its WikiScore, official licenses, and the regulatory authorities that oversee it.

This tool helps traders make informed decisions and avoid unregulated entities that could pose financial risks. For those new to online trading, WikiFX serves as a valuable first step in identifying reliable, legally compliant brokers like IG before opening an account or investing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Currency Calculator