简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group Dubai: A 2025 Deep Dive into Its UAE Regulation and Regional Presence

Abstract:When picking a broker in a major financial center like Dubai, two things matter most for peace of mind and successful trading: strong regulation and a real local presence. These elements separate well-known global brokers from temporary online companies. For traders looking at multibank group Dubai, the main question is about its legitimacy and commitment to the region. The answer is straightforward: MultiBank Group is fully regulated by the UAE's top authority and has a major operational headquarters in Dubai, strengthening its position in the multibank group UAE landscape. This guide gives you a complete analysis of MultiBank Group's SCA regulation, what this regulation means for keeping your money safe, the real benefits of their physical offices in Dubai, and how the group specifically serves Arab traders' needs.

When picking a broker in a major financial center like Dubai, two things matter most for peace of mind and successful trading: strong regulation and a real local presence. These elements separate well-known global brokers from temporary online companies. For traders looking at multibank group Dubai, the main question is about its legitimacy and commitment to the region. The answer is straightforward: MultiBank Group is fully regulated by the UAE's top authority and has a major operational headquarters in Dubai, strengthening its position in the multibank group UAE landscape. This guide gives you a complete analysis of MultiBank Group's SCA regulation, what this regulation means for keeping your money safe, the real benefits of their physical offices in Dubai, and how the group specifically serves Arab traders' needs.

Understanding the Regulatory Protection

The United Arab Emirates financial system is watched over by several organizations, but for onshore operations, one stands above the rest. The Securities and Commodities Authority (SCA) is the UAE's federal financial regulator, responsible for supervising and monitoring the nation's capital markets. Its main job is to ensure fairness, efficiency, and transparency, protecting investors and promoting a stable economic environment.

It's important to understand the difference between the SCA and regulators operating within financial free zones, such as the Dubai Financial Services Authority (DFSA) in the DIFC. While free-zone regulators are highly respected, the SCA's authority covers the entire onshore UAE market. Getting an SCA license is a tough process, reserved for companies that can show the highest levels of financial stability, operational integrity, and commitment to following rules. For a broker, holding an SCA license clearly shows its dedication to operating within the highest levels of the UAE's legal and financial framework. This federal-level oversight provides consistent and powerful protection for clients regardless of their specific emirate.

MultiBank Group's SCA Status

MultiBank Group's commitment to the UAE is officially established through its regulatory status. The group operates in the UAE under the licensed entity MEX Global Financial Services LLC, which is fully authorized and regulated by the Securities and Commodities Authority (SCA). This is not a simple registration; it is a top-tier license that subjects the broker to the full scope of the UAE's strict federal financial laws.

Achieving this status requires a substantial investment in compliance infrastructure, significant paid-up capital, and a transparent operational model that can withstand intense scrutiny. By securing this license, MultiBank Group has placed itself among an elite group of brokers permitted to operate onshore in the UAE. This official standing can be verified on the SCA's public register, providing traders with undeniable confirmation of the broker's legitimacy. It moves the conversation beyond marketing claims to a foundation of verifiable, government-backed oversight, a critical factor for any serious trader in the multibank group UAE market.

What SCA Protection Means

A license is more than a logo on a website; it is a framework of specific protections designed to safeguard your capital and ensure fair treatment. For clients of MultiBank Group in Dubai, the SCA regulation provides several concrete, enforceable benefits that form a critical safety net for your trading activities. Understanding these protections is key to appreciating the value of choosing a federally regulated broker.

Here are the core protections you receive under the SCA's regulatory umbrella:

· Segregated Client Funds: This is arguably the most important protection. The SCA requires that brokers must hold all client money in accounts that are completely separate from the company's own operational funds. These segregated accounts are typically held with reputable banks. This means that in the unlikely event the broker faces financial difficulties, your capital is not considered an asset of the company and remains protected from creditors. Your funds are your funds, period.

· Strict Compliance and Auditing: SCA-regulated brokers are not left to their own devices. They must follow a strict code of conduct covering everything from marketing practices and trade execution to risk management and data privacy. The SCA conducts regular, rigorous audits to ensure these rules are being followed consistently. This ongoing supervision ensures the broker maintains high standards of transparency and operational integrity at all times.

· Capital Adequacy Requirements: To ensure a broker can withstand market volatility and meet all its financial obligations to clients, the SCA requires it to maintain a significant level of liquid capital. This capital acts as a financial buffer, guaranteeing that the firm has the resources to cover all client withdrawal requests and other liabilities promptly. It is a key measure of the broker's financial health and stability.

· Formal Dispute Resolution: While every trader hopes for a smooth experience, disputes can occasionally arise. With an SCA-regulated broker, you are not left to rely solely on the company's internal customer support. The SCA provides a formal, impartial, and regulated channel for grievance and dispute resolution. This gives you a powerful recourse if you feel an issue has not been resolved fairly, adding an essential layer of accountability.

MENA Operations Hub

MultiBank Group's commitment to the region extends far beyond a regulatory license. The multibank group dubai office is not a satellite branch or a virtual mailbox; it is the group's strategic headquarters for the entire Middle East and North Africa (MENA) region. Located in the prominent Business Bay district, a core financial area of Dubai, this physical presence is a powerful statement of intent.

Establishing a regional headquarters in a global business hub like Dubai signifies a deep, long-term investment. It requires substantial resources to staff a full-service office with teams dedicated to operations, client support, compliance, and business development. This office acts as the central nervous system for the broker's activities across the Arab world, ensuring that decisions are made with a direct understanding of the local market dynamics. For traders evaluating the multibank group uae offering, the existence of this substantial, physical headquarters provides tangible proof that the company is fully invested in the region's success and is here to stay. It transforms the broker from a remote, faceless entity into a local, accessible partner.

Benefits of a Local Office

A physical office in Dubai offers traders a range of practical advantages that a purely online broker simply cannot match. This local infrastructure is designed to enhance the trading experience, provide peace of mind, and build a stronger client-broker relationship. The benefits are tangible, directly impacting everything from problem resolution to account management.

| Benefit | How It Helps You as a Trader |

| In-Person Support | The ability to schedule a meeting or visit the office for complex account issues provides ultimate peace of mind and clarity that email or chat cannot always offer. |

| Localized Expertise | You gain access to a support team that inherently understands local market hours, regional economic news, banking holidays, and cultural nuances, leading to more relevant and effective support. |

| Enhanced Communication | You can speak directly with Arabic-speaking staff for clear, effective problem-solving without the risk of misunderstandings caused by language barriers. |

| Community & Education | A local presence creates opportunities for the broker to host local seminars, educational workshops, and networking events, fostering a trading community. |

| Faster Administration | Local teams can often streamline and expedite administrative processes like Know Your Customer (KYC) verification and the handling of high-value fund transfers. |

To Read “Your Complete MultiBank Group Crypto Trading Guide (2025)” Click on this Link - www.wikifx.com/en/newsdetail/202510306304997894.html

Global Network, Local Focus

The significance of the Dubai headquarters is amplified when viewed within the context of the company's global footprint. The Dubai office is a key node in a vast international network of MultiBank Group regional offices, with major operational centers in key financial districts across Europe, Asia, and Australia. This global structure provides a powerful assurance of the group's scale, stability, and adherence to international standards.

For a trader in the UAE, this means you are partnering with a major global institution that has the resources, technology, and experience of a worldwide leader. However, a key distinction is that this global power is delivered through a local lens. You are not just a number in a global database; you are a client served by a dedicated regional team. This model combines the best of both worlds: the financial strength and security of a large, multinational corporation with the personalized service and accessibility of a local business. The network of MultiBank Group regional offices demonstrates a proven track record of successfully establishing and maintaining a physical presence in regulated markets worldwide, and its Dubai hub is a prime example of this strategy in action.

Sharia-Compliant Trading

A critical consideration for many investors in the region is adherence to Islamic finance principles. Recognizing this, the offering for MultiBank Group arab traders includes the provision of Sharia-compliant Islamic accounts. These accounts are specifically structured to operate in accordance with the principles of Islamic law, which prohibits the charging or earning of interest.

In the context of forex and CFD trading, this is primarily achieved through a “swap-free” model. A standard trading account incurs or earns a “swap” or “rollover” fee for positions held overnight, which is considered a form of interest (Riba). An Islamic account eliminates these overnight fees entirely. Instead, the broker may charge a fixed administration fee for positions held open for an extended period, ensuring the structure remains free of interest-based charges. This feature is not an afterthought; it is a core product offering that demonstrates a deep understanding of and respect for the financial and cultural requirements of MultiBank Group arab traders, allowing them to participate in global markets without compromising their faith-based principles.

Support for Your Market

Effective communication is the cornerstone of a successful client-broker relationship. For traders in the MENA region, the ability to communicate in their native language is essential for clarity, comfort, and efficient problem-solving. MultiBank Group has invested significantly in creating a fully Arabic-language experience, ensuring that language is never a barrier to accessing their services or receiving support. This commitment goes beyond a simple website translation and is integrated across multiple client touchpoints.

This localized support infrastructure includes several key features:

· Arabic-Speaking Support Team: Clients have access to a dedicated customer service team fluent in Arabic. This support is available through multiple channels, including phone, email, and live chat, ensuring that any query, from a technical issue to an account question, can be handled clearly and efficiently.

· Arabic Website & Platform: The entire user experience, from the main website to the client portal and even the trading platforms themselves, can be navigated in Arabic. This allows for a seamless and intuitive journey, from account opening to trade execution.

· Region-Specific Market Analysis: The broker provides market commentary, news, and analysis that is relevant to the MENA region. This includes insights on local indices, currency pairs involving regional currencies, and the impact of global events on Middle Eastern economies, providing traders with information that is directly applicable to their interests.

Convenient Banking Options

The logistics of funding and withdrawing from a trading account can often be a point of friction, especially when dealing with international brokers. Cross-border wire transfers can be slow, costly, and subject to intermediary bank fees. To address this, MultiBank Group facilitates localized banking options for its clients in the UAE and the broader region.

This includes the ability to fund accounts and process withdrawals using local bank transfers, often in local currencies like the AED. This method drastically simplifies the transaction process. It is typically much faster than an international wire, with funds often reflecting within one business day. Furthermore, it can significantly reduce or even eliminate the transaction fees associated with currency conversion and international banking protocols. By providing these convenient and cost-effective local payment solutions, the broker removes a significant operational hurdle, making the process of managing trading capital as smooth and efficient as possible for its regional client base.

The Verdict: Trust Through Action

In conclusion, the trust and credibility of multibank group dubai are not built on a single factor but on the powerful and complementary combination of two core pillars: regulatory assurance and tangible commitment. These elements work in tandem to create a secure and supportive environment for traders.

The first pillar is Regulatory Assurance. The full license from the UAE's federal Securities and Commodities Authority (SCA) provides a non-negotiable foundation of safety. It is a legal guarantee of segregated funds, operational oversight, capital adequacy, and fair dispute resolution. This is the bedrock of client protection.

The second pillar is Tangible Commitment. The establishment of a major regional headquarters in Dubai, backed by a global network of MultiBank Group regional offices, proves a deep, long-term investment in the region and its traders. This physical presence translates into accessible support, local expertise, and a level of accountability that a remote broker cannot offer.

The Final Takeaway

For traders in Dubai and across the UAE, the evidence is compelling. MultiBank Group is not merely an international broker with a regional website; it is a globally recognized institution with a firm, regulated, and fully operational footing in the heart of the Middle East's financial center. The combination of world-class, onshore regulation and a dedicated, physical presence makes it a highly credible and accessible partner for navigating the financial markets. This dual commitment to both compliance and service provides the assurance and support necessary for traders to pursue their financial goals with confidence.

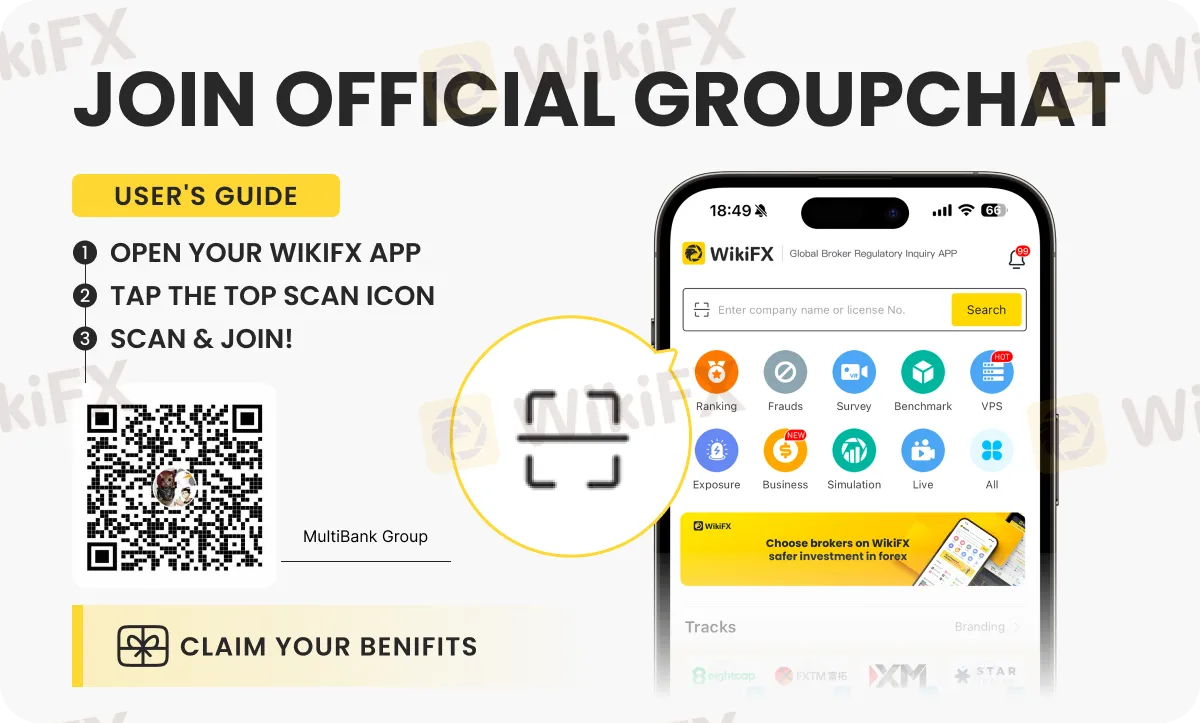

We have created an official MultibankGroup Broker community! Join it Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator