简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

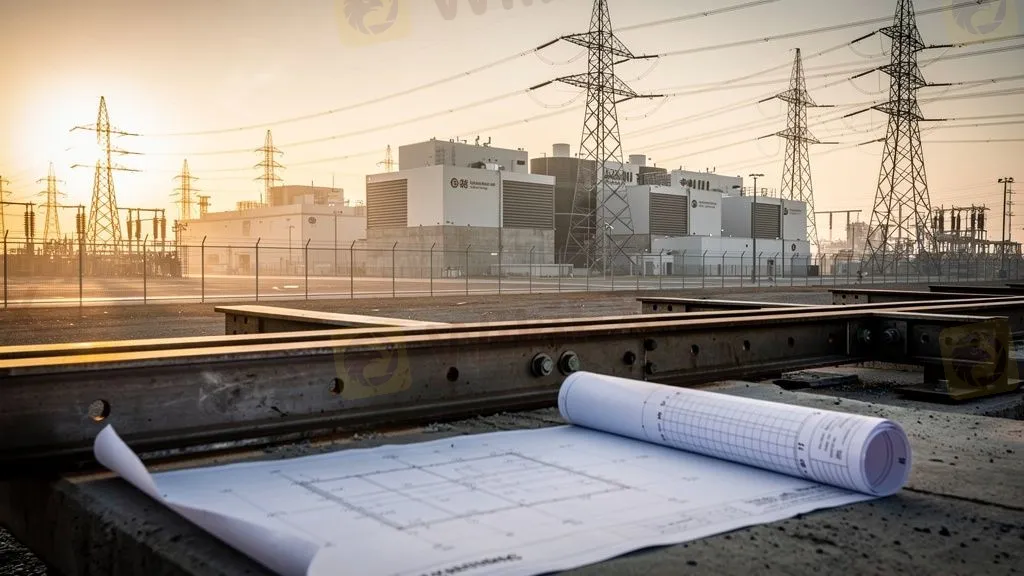

Japan Commits $550B to US Energy as Trade War Fears Cool

Abstract:In a massive strategic maneuver intended to stabilize trade relations, Japan is initiating a $550 billion investment plan in the United States, focusing heavily on energy and infrastructure. This capital injection comes as fears of a global trade war begin to recede, with major US banking leaders suggesting tariff regimes are stabilizing.

In a massive strategic maneuver intended to stabilize trade relations, Japan is initiating a $550 billion investment plan in the United States, focusing heavily on energy and infrastructure. This capital injection comes as fears of a global trade war begin to recede, with major US banking leaders suggesting tariff regimes are stabilizing.

The ‘Capital Shield’

The investment, facilitated by the Japan Bank for International Cooperation (JBIC), involves 7.18 trillion yen in low-interest loans and guarantees. Key projects include a $100 billion nuclear partnership (SMRs) involving Mitsubishi and US firms, and grid modernization efforts.

- Forex Impact: This massive commitment effectively acts as a corporate buying spree for USD, potentially putting a floor under USD/JPY despite recent hawkish signals from the Bank of Japan. It also serves as a geopolitical hedge, likely exempting Japan from the harshest of US protectionist measures.

Tariffs Stabilizing?

Simultaneously, Bank of America CEO Brian Moynihan stated that the trade conflict appears to be “cooling,” with global operational tariffs likely settling around a 15% baseline.

- Market Relief: The shift from erratic 10-100% threat ranges to a predictable 15% baseline is reducing uncertainty for corporates. Moynihan noted that companies are now more concerned with labor shortages and immigration policy than tariff rates.

The Euro/Yen Dynamic

While the US-Japan axis strengthens, the Euro remains vulnerable. EUR/JPY traded lower near 183.80, pressured by the divergent paths of a stabilizing BOJ and a fragile European economic outlook. If the US investment deal secures Japan a “safe harbor” status in US trade policy, the Yen could see flows return from cross-pairs like EUR and GBP.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator