Abstract:EMAR MARKETS (FSCA 53070, exceeded) lures with $1 deposits & MT5 but traps funds in "data verification" scams & fake fees—avoid! Report & recover losses.

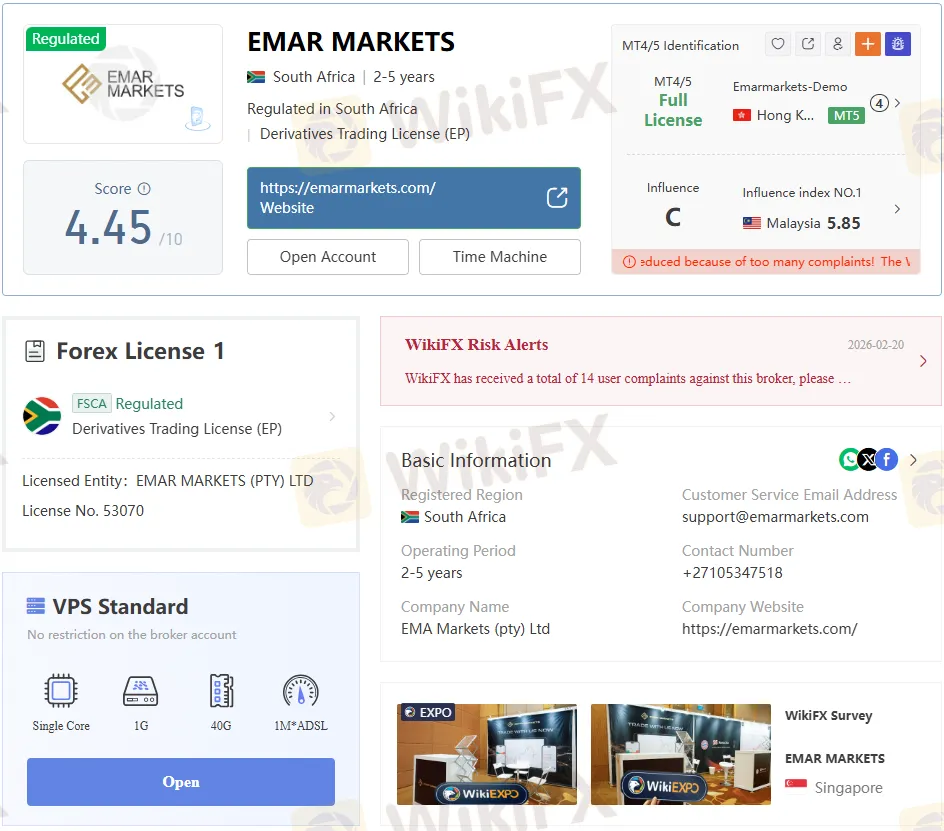

EMAR MARKETS hooks forex traders with slick promises of effortless profits and instant market access, masking a dangerous reality beneath its polished surface. This South Africa-registered broker touts FSCA regulation under license 53070, but its “Exceeded” status screams oversight failures and unreliability that trap users in endless nightmares. With just a $1 minimum deposit, razor-thin 0.1-pip spreads, and user-friendly MT5 or cTrader platforms supporting forex pairs, commodities, indices, and cryptos, it reels in beginners who dream of quick wins—only to slam the door shut on withdrawals through fabricated “data verification” delays and predatory fee demands.

EMAR MARKETS runs Cent, Standard, and Pro accounts for different skill levels, boasting 1:3000 leverage, zero commissions, and a $50 welcome bonus to lure deposits even deeper. Live chat, phone support at +27105347518, email options, and a Cape Town address create a facade of professionalism, but vague deposit and withdrawal specifics, combined with no demo account for practice, reveal the setup‘s true intent early. Multi-asset trading across forex, commodities, indices, and cryptos attracts crowds at first, yet the broker’s real focus sharpens when traders try to pull profits out, turning appeal into outright entrapment.

Trader Lures and Early Traps

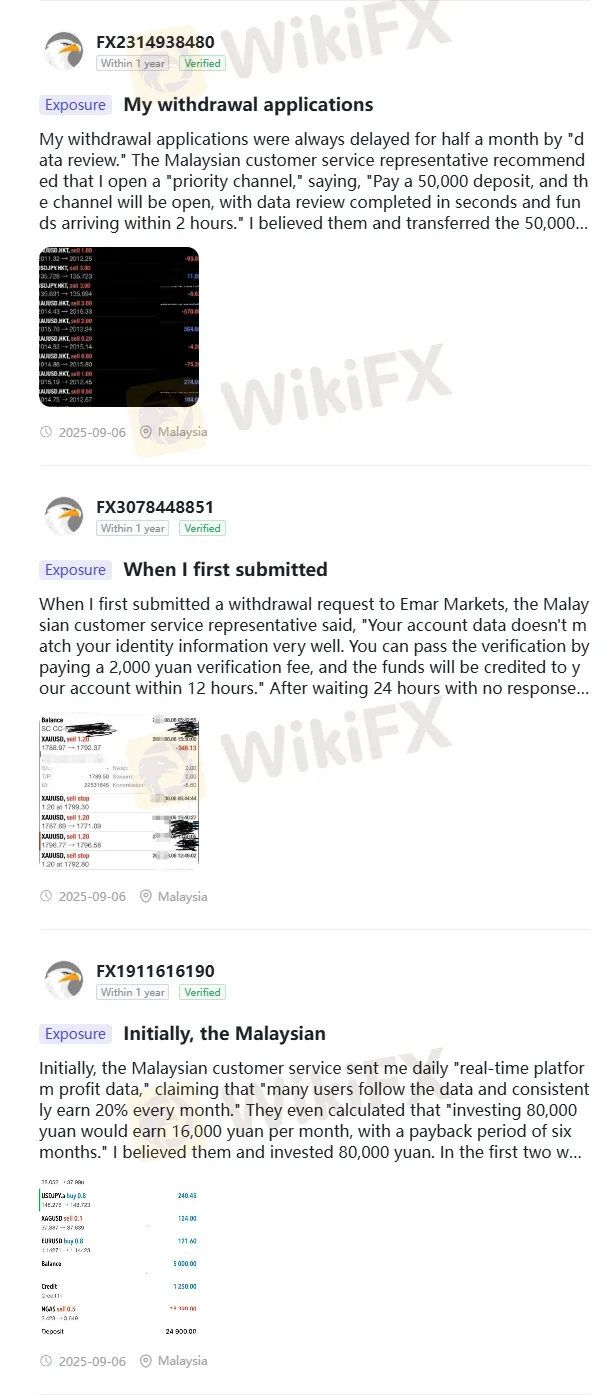

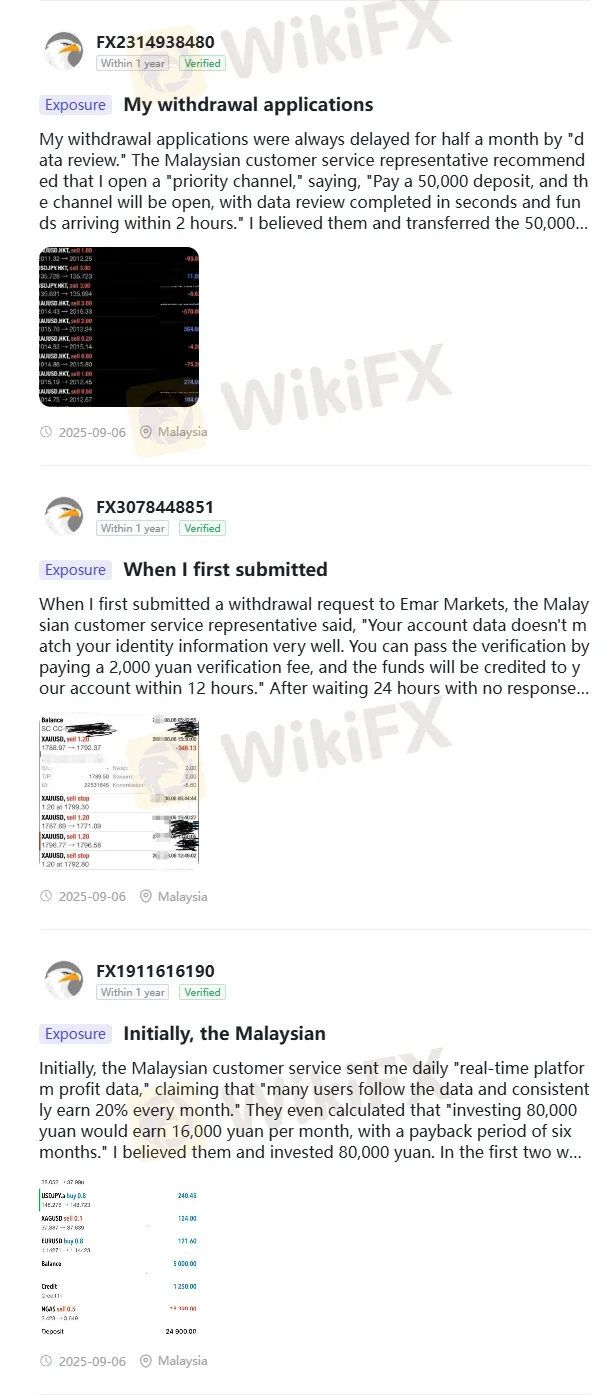

Traders initially fall hard for EMAR MARKETS low-entry hype and Malaysian reps' push of “data-driven” magic with daily “real-time profit data” that flaunts 20% monthly returns. They crunch numbers like 80,000 yuan investments yielding 16,000 monthly profits within six months, making big deposits feel like smart bets. Smooth inflows build ironclad trust fast, but the forex scam mask rips off at the first withdrawal request, unleashing a storm of excuses from “insufficient data correlation” to endless “risk reviews” that leave Pakistanis and Malaysians alike screaming into void support chats.

A Pakistani traders hell unfolded by February 19, 2026, as his -236.87 USD withdrawal request from February 2 moldered pending after nine long days and four unanswered tickets—EMAR MARKETS support evaporated without a trace. Malaysian victims got hammered right away with demands for linked assets valued at 1.5 times the withdrawal sum or a sketchy 100,000 yuan dump into an “asset custody account” complete with flimsy refund vows that never materialized. Resistance met brutal rejection, accounts were slapped with “high risk,” and principal sums were frozen solid within three days, showcasing the data-correlation ploy as a one-way cash vacuum.

Escalating Scam Tactics

One desperate Malaysian handed over 50,000 yuan from mortgage savings chasing a “priority channel” that swore data reviews were done in seconds with funds landing in two hours, only to drown in “deposit sync delay” fabrications stretching days into dead air. Blocks hit messages, complaint lines rang empty, and the promised channel proved a total phantom—pure bait engineered to suck more money before the inevitable ghosting in this ruthless investment scam. Verification fees snowballed even worse, kicking off at 2,000 yuan for basic identity alignment, surging to 3,000 for phantom “system upgrades,” then exploding to 5,000 yuan over invented “cross-border data traces,” every penny labeled non-refundable amid threats of eternal account freezes.

Early account profits dazzle before demolition, with one 80,000 yuan deposit flashing 3,000 yuan gains that overnight morphed into a bogus 50,000 yuan crater—no losing trades placed, just support finger-pointing at “user errors” while stonewalling access to internal records that screamed manipulation. Withdrawals crossing $5,000 thresholds trigger “risk reviews,” clamping trading shut amid savage market volatility; one case sat rotting for 17 days in robotic “processing” loops as verification docs were repeatedly bounced for being “unclear.” Losses piled without a dime compensated, markets churning losses freely while demands for more proof looped endlessly, exposing manual overrides dressed as automated safeguards.

Paid extras flop catastrophically too—a 2023 real-time data-monitoring subscription bled 30,000 yuan from 15-point mismatches, only to be shrugged off overnight despite ironclad hourly response guarantees in sales pitches. “After-sales staff off duty” became the go-to dodge, followed by curt “normal deviations” dismissals that buried massive hits from deliberately shoddy feeds, turning promised “data foundation” into a fee-fueled farce. Trusting bogus reports for “real-time analysis guaranteeing profits” torched another 50,000 yuan down to scraps of 2,000 in mere days, then locked the remains, labeling complaints as “risky user behavior”—Malaysian handlers flipped scripts from hype to full denial, erasing every boast.

Withdrawal Hell and Slippage Horror

Month-long marathons mocked “data-based guaranteed withdrawals in 3 days,” as “five business days” for checks bloated into weeks of “financial integration errors” pierced by rare “still verifying” teases that dangled false hope. “Seven-day data verification” stretched further amid integration delays, leading to full-month shutdowns in which messages and calls went unanswered, mortgage dreams crushed under the weight of pocketed cash. Slippage struck like a sledgehammer: a serene EUR/USD long order at 1.0920 somehow filled 48 pips uglier at 1.0968, while GBP/JPY stop-loss set firm at 152.30 detonated 85 pips early at 153.15 amid Fed hike chaos, vaporizing RM4,100 in one blow—leagues beyond standard 6-12 pip tolerances, rigged to hemorrhage trader capital relentlessly.

EMAR MARKETS Red Flags and Warnings

EMAR MARKETS Malay-led operations trumpet data prowess yet churn fakes, stall payouts indefinitely behind excuse walls, and punish high profits with clamps and cash grabs. Post-deposit support degrades into bots or black holes, tickets rot, chats are severed, leaving fury in the wake of seamless deposits and ironclad lockouts. Review EMAR MARKETS regulation peels back the FSCA-regulated veneer to expose scam guts—escalating fees, slippage nightmares, and vanishing acts form the glaring forex broker scams signature, urging every trader to spot these traps early and bolt from Broker EMAR MARKETS before funds vanish forever.